St. Lawrence County Industrial Development Agency

advertisement

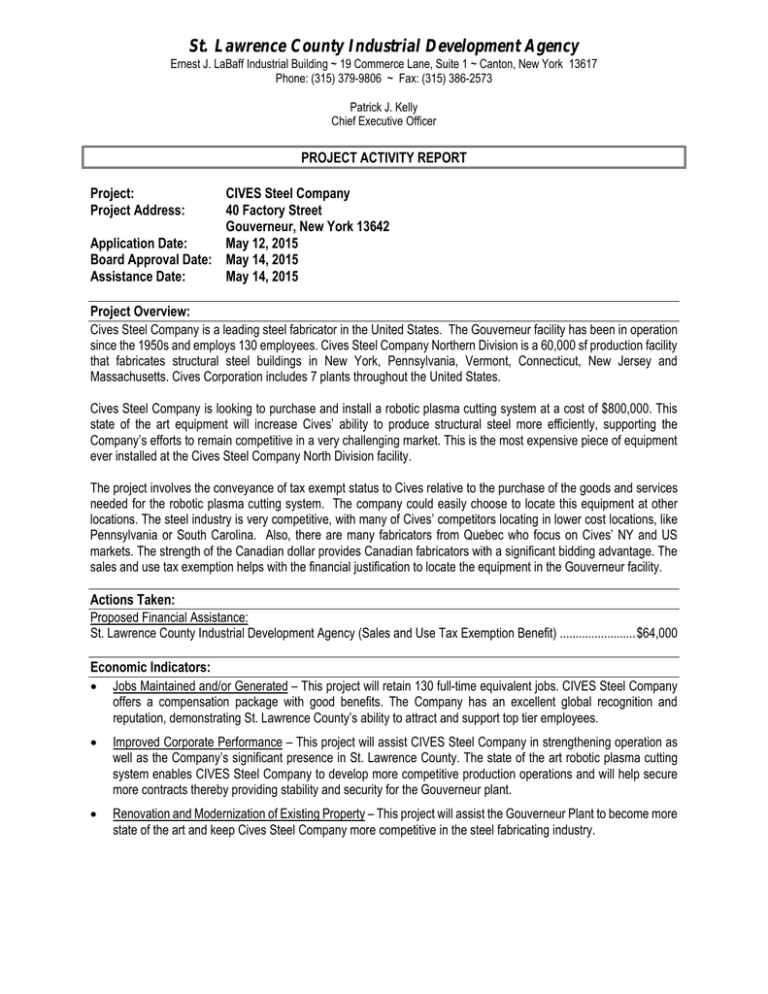

St. Lawrence County Industrial Development Agency Ernest J. LaBaff Industrial Building ~ 19 Commerce Lane, Suite 1 ~ Canton, New York 13617 Phone: (315) 379-9806 ~ Fax: (315) 386-2573 Patrick J. Kelly Chief Executive Officer PROJECT ACTIVITY REPORT Project: Project Address: CIVES Steel Company 40 Factory Street Gouverneur, New York 13642 Application Date: May 12, 2015 Board Approval Date: May 14, 2015 Assistance Date: May 14, 2015 Project Overview: Cives Steel Company is a leading steel fabricator in the United States. The Gouverneur facility has been in operation since the 1950s and employs 130 employees. Cives Steel Company Northern Division is a 60,000 sf production facility that fabricates structural steel buildings in New York, Pennsylvania, Vermont, Connecticut, New Jersey and Massachusetts. Cives Corporation includes 7 plants throughout the United States. Cives Steel Company is looking to purchase and install a robotic plasma cutting system at a cost of $800,000. This state of the art equipment will increase Cives’ ability to produce structural steel more efficiently, supporting the Company’s efforts to remain competitive in a very challenging market. This is the most expensive piece of equipment ever installed at the Cives Steel Company North Division facility. The project involves the conveyance of tax exempt status to Cives relative to the purchase of the goods and services needed for the robotic plasma cutting system. The company could easily choose to locate this equipment at other locations. The steel industry is very competitive, with many of Cives’ competitors locating in lower cost locations, like Pennsylvania or South Carolina. Also, there are many fabricators from Quebec who focus on Cives’ NY and US markets. The strength of the Canadian dollar provides Canadian fabricators with a significant bidding advantage. The sales and use tax exemption helps with the financial justification to locate the equipment in the Gouverneur facility. Actions Taken: Proposed Financial Assistance: St. Lawrence County Industrial Development Agency (Sales and Use Tax Exemption Benefit) ........................ $64,000 Economic Indicators: Jobs Maintained and/or Generated – This project will retain 130 full-time equivalent jobs. CIVES Steel Company offers a compensation package with good benefits. The Company has an excellent global recognition and reputation, demonstrating St. Lawrence County’s ability to attract and support top tier employees. Improved Corporate Performance – This project will assist CIVES Steel Company in strengthening operation as well as the Company’s significant presence in St. Lawrence County. The state of the art robotic plasma cutting system enables CIVES Steel Company to develop more competitive production operations and will help secure more contracts thereby providing stability and security for the Gouverneur plant. Renovation and Modernization of Existing Property – This project will assist the Gouverneur Plant to become more state of the art and keep Cives Steel Company more competitive in the steel fabricating industry. ***FOR AGENCY USE ONLY*** COST/BENEFIT ANALYSIS (As required by Section 869-A3 of New York General Municipal Law) Project Applicant: Cives Steel Company, Northern Division Estimated COST of Agency Assistance ESTIMATED EXEMPTIONS: Double click chart to enter data 1. Sales and Use Tax Exemption a. Amount of Project Cost Subject to Tax: [Sales and Use Tax Rate] b. Estimated Exemption: $800,000 8% $64,000 2. Mortgage Recording Tax Exemption a. Projected Amount of Mortgage: [Mortgage Recording Tax Rate] b. Estimated Exemption: 0.75% $0 3. Real Property Tax Exemption Property Location: a. Investment in Real Property [Total Project Cost] b. Pre-project assessment: c. Projected post-project assessment d. Equalization Rate [for reference only] e. Increase in Assessed Value of Property f. Total Applicable Tax Rates per $1,000 g. Ten Year Total Taxes [e X f X 10] h. PILOT Payments with Standard IDA PILOT [g X .25] i. Net Exemption Amount [g - h] 4. Interest Exemption [Bond Only] a. Total Estimated Interest Expense [assuming taxable interest] b. Total Estimated Interest Expense [assuming tax exempt interest rate] c. Interest Exemption [a – b] TOTAL ESTIMATED EXEMPTIONS $0 $0 $0 $0 $0 $0 $0 $64,000 Comments: Sales and Use Tax Exemption is estimated based on non-manufacturing equipment purchase and installation expense related to this project. Actual exemption amount needed could vary from $60,000 to $64,000 based on amount of materials subject to tax relating to the installation of the equipment. For assistance please contact the St. Lawrence County Industrial Development Agency at (315) 379-9806 / TDD Number: 711. Estimated BENEFIT of Agency Assistance EMPLOYMENT COMPARISON: Do not include construction jobs relating to the Project. Double click on chart to enter data Created Year 2 Created Year 3 Full Time Part Time Seasonal Total: Current Jobs 130 Post-Project Employment Created Year 1 Pre-Project Employment 0 0 0 130 Total New Jobs 0 0 0 0 PAYROLL COMPARISON: Double click on chart to enter data Total Payroll 1st Total Payroll 2nd Total Payroll 3rd Year after Year after Year after Project Project Project Completion Completion Completion Total Payroll Before Project $5,200,000 $5,200,000 $5,200,000 $5,200,000 ESTIMATED OTHER BENEFITS: Sales Tax Revenue (New Product) This project will result in the manufacturing or selling of a new product, and the estimated amount of annual sales taxes that will be generated on retail sales of the new project is $ . Sales Tax Revenue (Existing Product) This project will result in increased production or sales of an existing product, and the estimated amount of annual sales tax that will be generated on the retail sales of the increased production is $ . Real Property Taxes The amount of annual real property taxes that will be payable on the project at the end of the PILOT Agreement is $Cives bids on projects which result in NYS sales tax being paid. Increases in production and in the successful bidding in these types of projects will result in increased NYS sales tax payments. Construction Jobs This project will help generate approximately 5 construction jobs. Project supports local manufacturing firm with 130 local employees and a 60 year commitment to the region. Company pays competitive wages and offers medical, dental and life insurance as well as a 401 (k) retirement program. Other Benefit The company has numerous options for investment in, and placement of, this equipment, including multiple facilities outside of New York State. The asssitance provided by the IDA for this project assists the Gouvereneur operation in securing the corporate funding to invest in the new equipment. The increased productivity from the new equipment will enable the local facility to more effectively compete with other firms, including those outside of the United States currently benefitting from the strong US dollar and could lead to future development and expansion opportunties for Cives in Gouverneur. For assistance please contact the St. Lawrence County Industrial Development Agency at (315) 379-9806 / TDD Number: 711.

![PROJECT AUTHORIZING RESOLUTION Cives Steel Company, Northern Division [IDA Proj# 4001-05-01]](http://s2.studylib.net/store/data/012049738_1-7b197e9460b24f18c52ad07b2b7686f6-300x300.png)