St. Lawrence County Industrial Development Agency

advertisement

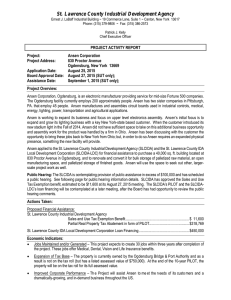

St. Lawrence County Industrial Development Agency Ernest J. LaBaff Industrial Building ~ 19 Commerce Lane, Suite 1 ~ Canton, New York 13617 Phone: (315) 379-9806 ~ Fax: (315) 386-2573 Patrick J. Kelly Chief Executive Officer PROJECT ACTIVITY REPORT Project: Project Address: Beamko, LP 802 Proctor Avenue Ogdensburg, New York 13669 Application Date: August 25, 2015 Board Approval Date: August 27, 2015 Assistance Date: September 1, 2015 Project Overview: Beamko, LP is a partnership created in 2013 with Milpada, LLC as general partner. In 2014, the Company received financial assistance from the SLCIDA as part of its project to demolish an existing building located at 800 Proctor Avenue and construct a new building. Beamko, LP then leased the space to DeFelsko Corporation. DeFelsko is a leading US manufacturer of coating thickness gages and inspection instruments, and has been delivering gages since 1965. Beamko, LP applied for financial assistance from the SLCIDA in the form of exemption from New York and local sales and use tax on the purchase of goods and services needed to assist the Company in modernization and energy efficiency improvements to its facility at 802 Proctor Avenue, Ogdensburg, and to transition the building to be used for research and development, repairs department, purchasing, production/machine shop and employee cafeteria. Actions Taken: Proposed Financial Assistance: St. Lawrence County Industrial Development Agency (Sales and Use Tax Exemption Benefit) ........................ $28,800 Economic Indicators: Jobs Maintained and/or Generated – This project will assist in the retention of 77 full-time equivalent jobs at DeFelsko. These jobs offer Medical, Dental, Life Insurance and Profit Sharing benefits. Improved Corporate Performance – This project will assist DeFelsko to strengthen its investment in its Company and maintain its significant presence in St. Lawrence County. Renovation and Modernization of Existing Property – This project will assist DeFelsko to modernize and incorporate energy efficient improvements in the facility. ***FOR AGENCY USE ONLY*** COST/BENEFIT ANALYSIS (As required by Section 869-A3 of New York General Municipal Law) Project Applicant: Beamko, LP Estimated COST of Agency Assistance ESTIMATED EXEMPTIONS: Double click chart to enter data 1. Sales and Use Tax Exemption a. Amount of Project Cost Subject to Tax: [Sales and Use Tax Rate] b. Estimated Exemption: $360,000 8% $28,800 2. Mortgage Recording Tax Exemption a. Projected Amount of Mortgage: [Mortgage Recording Tax Rate] b. Estimated Exemption: $0 0.75% $0 3. Real Property Tax Exemption Property Location: a. Investment in Real Property [Total Project Cost] b. Pre-project assessment: c. Projected post-project assessment d. Equalization Rate [for reference only] e. Increase in Assessed Value of Property f. Total Applicable Tax Rates per $1,000 g. Ten Year Total Taxes [e X f X 10] h. PILOT Payments with Standard IDA PILOT [g X .25] i. Net Exemption Amount [g - h] 4. Interest Exemption [Bond Only] a. Total Estimated Interest Expense [assuming taxable interest] b. Total Estimated Interest Expense [assuming tax exempt interest rate] c. Interest Exemption [a – b] TOTAL ESTIMATED EXEMPTIONS $425,000 $425,000 $0 $0 $0 $0 $0 $0 $0 $28,800 Comments: Interior renovations to the facility are not expected to increase assessed value of the property. For assistance please contact the St. Lawrence County Industrial Development Agency at (315) 379-9806 / TDD Number: 711. Estimated BENEFIT of Agency Assistance EMPLOYMENT COMPARISON: Do not include construction jobs relating to the Project. Double click on chart to enter data Current Jobs Created Year 2 Created Year 3 Post-Project Employment Created Year 1 Pre-Project Employment 0 0 0 0 Full Time Part Time Seasonal Total: Total New Jobs 0 0 0 0 PAYROLL COMPARISON: Double click on chart to enter data Total Payroll 1st Total Payroll 2nd Total Payroll 3rd Year after Year after Year after Project Project Project Completion Completion Completion Total Payroll Before Project $2,521,750 $2,521,750 $2,521,750 $2,521,750 ESTIMATED OTHER BENEFITS: Sales Tax Revenue (New Product) This project will result in the manufacturing or selling of a new product, and the estimated amount of annual sales taxes that will be generated on retail sales of the new project is $ . Sales Tax Revenue (Existing Product) This project will result in increased production or sales of an existing product, and the estimated amount of annual sales tax that will be generated on the retail sales of the increased production is $ . Real Property Taxes The amount of annual real property taxes that will be payable on the project at the end of the PILOT Agreement is $N/A, but the project will modernize a building currently assessed at $425,000, upgrading its interior finishes and extending its useful life. Construction Jobs This project will help generate approximately 5 construction jobs. Community and Regional Benefit Beamko is the property owner of 802 Proctor Avenue, a related company, Defelsko, employs 77 people at the facilty and an adjoining facilty constructed in 2014-2015 as part of previous IDA project. As a result of that project, Defelsko, a leading US manufacturer of coating thickness gages, has recently increased its employee count from 60 to 77 (exceeding their job creation goal of 15). This proposed project for Beamko will bring the original facilty, constructed over 20 years ago, up to the same quality and standards of the facility constructed in 2014-2015, supporting Defelsko's 77 person workforce. For assistance please contact the St. Lawrence County Industrial Development Agency at (315) 379-9806 / TDD Number: 711.