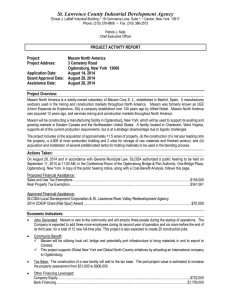

ST. LAWRENCE COUNTY INDUSTRIAL DEVELOPMENT AGENCY Resolution No. IDA-14-09-21 September 25, 2014

advertisement

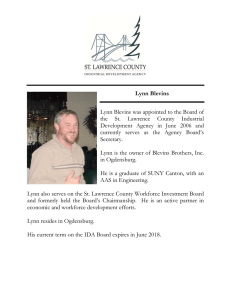

ST. LAWRENCE COUNTY INDUSTRIAL DEVELOPMENT AGENCY Resolution No. IDA-14-09-21 September 25, 2014 AUTHORIZING RESOLUTION (Maxam North America, Inc. – Ogdensburg Project A meeting of St. Lawrence County Industrial Development Agency (the “SLCIDA”) was convened on September 25, 2014, at 8:30 a.m., local time, in the Main Conference Room of the Ernest J. LaBaff Industrial Building, 19 Commerce Lane, Canton, New York. The meeting was called to order by the Vice-Chairman and, upon roll being called, the following members of the SLCIDA were: MEMBER Blevins, Lynn Hall, Mark C. LaBaff, Ernest McMahon, Andrew J. Peck, Donald Staples, Brian W. Weekes, Jr., R. Joseph PRESENT X ABSENT X X X X X X The following persons were ALSO PRESENT: SLCIDA Staff: Patrick J. Kelly, Thomas A. Plastino, Richard A. Williams, Natalie A. Sweatland; Andrew Silver, Esq., Legal Counsel. On motion duly made by Mr. Weekes and seconded by Mr. Blevins, the following resolution was placed before the members of the St. Lawrence County Industrial Development Agency: (i)ACKNOWLEDGING THE PUBLIC HEARING HELD WITH RESPECT TO THE MAXAM NORTH AMERICA, INC. OGDENSBURG PROJECT (AS MORE FULLY DESCRIBED BELOW); (ii) REAFFIRMING THE FINDINGS OF THE CITY OF OGDENSBURG WITH RESPECT TO THE PROJECT PURSUANT TO SEQRA; (iii) AUTHORIZING FINANCIAL ASSISTANCE TO MAXAM NORTH AMERICA, INC. IN EXCESS OF $100,000 IN THE FORM OF A SALES AND USE TAX EXEMPTION AND A PARTIAL REAL PROPERTY TAX ABATEMENT THROUGH A PAYMENT IN LIEU OF TAXES AGREEMENT (PILOT) (iv) AUTHORIZING EXECUTION AND DELIVERY BY SLCIDA OF A LEASE AGREEMENT, LEASEBACK AGREEMENT, PILOT AGREEMENT AND RELATED DOCUMENTS WITH RESPECT TO THE PROJECT WHEREAS, the ST. LAWRENCE COUNTY INDUSTRIAL DEVELOPMENT AGENCY (the "SLCIDA") is authorized and empowered by Title 1 of Article 18-A of the General Municipal Law of the State of New York (the "State") as amended, and Chapter 358 of the Laws of 1971 of the State, as amended (collectively, the "Act") to promote, develop, encourage and assist in the acquiring, constructing, reconstructing, improving, maintaining, equipping and furnishing of industrial, manufacturing, warehousing, commercial, research, and recreation facilities, including industrial pollution control facilities, railroad facilities and certain horse racing facilities, for the purpose of promoting, attracting, encouraging and developing recreation and economically sound commerce and industry to advance the job opportunities, health, general prosperity and economic welfare of the people of the State, to improve their recreation opportunities, prosperity and standard of living, and to prevent unemployment and economic deterioration; and WHEREAS, MAXAM NORTH AMERICA, INC., (the “Company”), submitted an application (the “Application”) to the SLCIDA requesting the SLCIDA’s assistance with a certain project (the “Project”) consisting of: (i) the acquisition by the SLCIDA of a leasehold interest to approximately 11.5 acres of real property located at 3 Cemetery Drive , City of Ogdensburg, St. Lawrence County, New York (the “City”), such real property being more particularly described as TMID No 48.002-1-20.15 (herein, the “Land”), (ii) the construction and operation on the Land of a rail spur leading onto the property; construction of a 4,800 sq. ft. main production building, construction of two silos for storage of raw materials and finished product, and acquisition and installation of several prefabricated tanks as part of the project for holding materials to be used in the blending process, and additional improvements such as driveway, parking, curbage and infrastructure (the “Improvements”), (iii) the acquisition in and around the Land and Improvements and of certain items of equipment and other tangible personal property and equipment (the “Equipment” and, collectively with the Land and the Improvements, the “Facility”), and (iv) the lease of the Facility to the Company pursuant to a straight-lease transaction as defined within the Act; WHEREAS, by resolution adopted by the SLCIDA on August 28, 2014 (the “Initial Resolution”), the SLCIDA accepted the Application as submitted by the Company and, among other things, (i) authorized the scheduling and conduct of a public hearing with respect to the project; (ii) described the forms of financial assistance being contemplated by the SLCIDA with respect to the Project; (iii) authorized financial assistance to the Company in the form of a Sales and Use Tax Exemption for purchases and rentals relating to the project; (iv) accepted and adopted the findings of the City of Ogdensburg with respect to the project pursuant to SEQRA; and (iv) authorized the execution and delivery of an Agent Compliance Agreement and related documents with respect to the sales and use tax exemption; and WHEREAS, pursuant to and in accordance with Section 859-a of the Act, on Thursday, September 11, 2014, at 11:00 AM, local time, at the Ogdensburg Bridge & Port Authority Board Room, One Bridge Plaza, Ogdensburg, St. Lawrence County, New York, the SLCIDA conducted a public hearing (the “Public Hearing”) whereat interested parties were provided a reasonable opportunity, both orally and in writing, to present their views. A copy of the minutes of the Public Hearing, along with the notice of Public Hearing published and forwarded to the affected taxing jurisdictions at least ten (10) days prior to said Public Hearing are attached hereto as Exhibit A; and WHEREAS, following the adoption of the Initial Resolution and pursuant to correspondence from the Company to the SLCIDA, it is determined that the value of goods and services relating to the Project that shall be subject to New York State and local sales and use tax will be in an amount of up to $1,875,000, which will result in New York State and local sales and use tax exemption benefits not to exceed $150,000; and WHEREAS, the SLCIDA desires to adopt a resolution (i) acknowledging that the Public Hearing was held in compliance with the Act; (ii) reaffirming the findings of the City of Ogdensburg with respect to the project pursuant to SEQRA; (iii) authorizing the financial assistance to the Company in the form of a sales and use tax exemption and partial real property tax abatement through a PILOT; and (iv) authorizing execution and delivery by SLCIDA of a lease agreement, leaseback agreement, PILOT agreement and related documents. NOW, THEREFORE, BE IT RESOLVED by the members of the St. Lawrence County Industrial Development Agency as follows: Section 1. The Public Hearing held by the SLCIDA on September 11, 2014, concerning the project and Financial Assistance was duly held in accordance with the Act, including but not limited to the giving of at least ten (10) days’ published notice of the Public Hearing (such notice also provided to the Chief Executive Officer of each affected taxing jurisdiction), affording interested parties a reasonable opportunity, both orally and in writing, to present their views with respect to the Project. Section 2. The SLCIDA hereby reaffirms the determination of the City of Ogdensburg, as Lead Agency that the project will not result in any significant adverse environmental impacts. Section 3. The SLCIDA hereby authorizes provision of Financial Assistance to the Company in an amount in excess of $100,000 and in the form of a sales and use tax exemption and partial real property tax abatement through a PILOT. Section 4. The value of goods and services relating to the Project that shall be subject to New York State and local sales and use tax is authorized in an amount of up to $1,875,000, which will result in New York State and local sales and use tax exemption benefits not to exceed $150,000, and said benefits shall expire on August 28, 2015 unless extended pursuant to the terms of a certain Agent Compliance Agreement, executed by the SLCIDA and the Company. Section 5. The officers, employees and agents of the SLCIDA are hereby authorized and directed for and in the name and on behalf of the SLCIDA to do all acts and things required and to execute and deliver all such certificates, instruments and documents, to pay all such fees, charges and expenses and to do all such further acts and things as may be necessary or, in the opinion of the officer, employee or agent acting, desirable and proper to effect the purposes of the foregoing resolutions and to cause compliance by the SLCIDA with all of the terms, covenants and provisions of the documents executed for and on behalf of the SLCIDA. Section 6. These Resolutions shall take effect immediately. The question of the adoption of the foregoing resolution was duly put to vote on roll call, which resulted as follows: Move: Second: VOTE Blevins Hall LaBaff McMahon Peck Staples Weekes Weekes Blevins AYE X NAY ABSTAIN ABSENT X I HEREBY CERTIFY that I have compared this copy of this Resolution with the original record in this office, and that the same is a correct transcript thereof and of the whole of said original record. X X X /s/ X X The resolution was thereupon declared duly adopted. Natalie A. Sweatland September 25, 2014