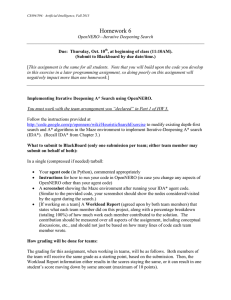

I D A

advertisement