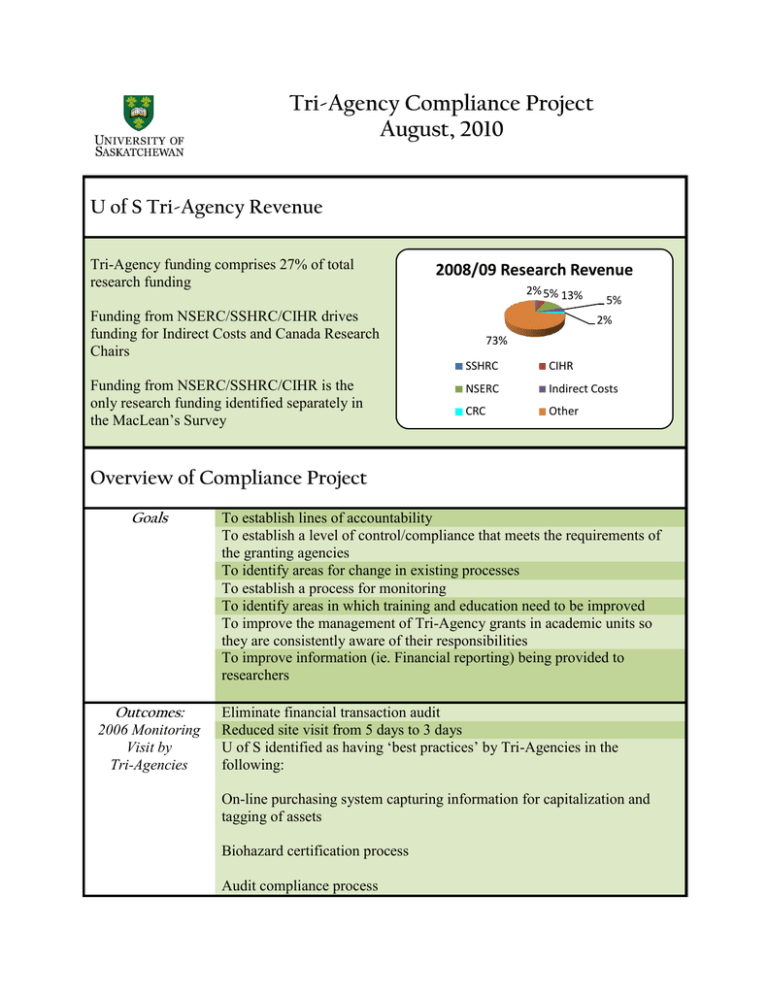

Tri-Agency Compliance Project August, 2010 U of S Tri-Agency Revenue

advertisement

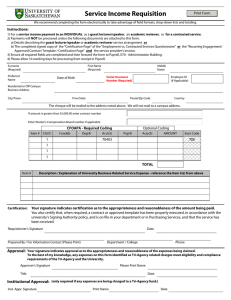

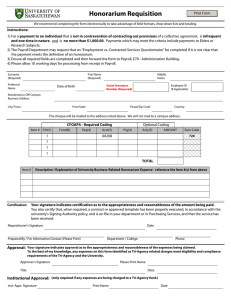

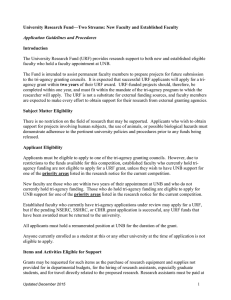

Tri-Agency Compliance Project August, 2010 U of S Tri-Agency Revenue Tri-Agency funding comprises 27% of total research funding 2008/09 Research Revenue 2% 5% 13% Funding from NSERC/SSHRC/CIHR drives funding for Indirect Costs and Canada Research Chairs Funding from NSERC/SSHRC/CIHR is the only research funding identified separately in the MacLean’s Survey 5% 2% 73% SSHRC CIHR NSERC Indirect Costs CRC Other Overview of Compliance Project Goals Outcomes: 2006 Monitoring Visit by Tri-Agencies To establish lines of accountability To establish a level of control/compliance that meets the requirements of the granting agencies To identify areas for change in existing processes To establish a process for monitoring To identify areas in which training and education need to be improved To improve the management of Tri-Agency grants in academic units so they are consistently aware of their responsibilities To improve information (ie. Financial reporting) being provided to researchers Eliminate financial transaction audit Reduced site visit from 5 days to 3 days U of S identified as having ‘best practices’ by Tri-Agencies in the following: On-line purchasing system capturing information for capitalization and tagging of assets Biohazard certification process Audit compliance process Observations For Improvements Delegation of Signing Authority: Authorization of Expenditures Written delegation of signing authority must be on file if anyone other than the grant holder is authorizing expenditures from the grant http://www.usask.ca/fsd/resources/f orms/delegate_signing_authority.pdf 5 5 Equipment & Computers 12 Materials & Supplies 22 Student Salaries 3 37 Travel 0 Reimbursements to the grant holder must be authorized by their supervisor – this responsibility cannot be delegated. 3 10 Properly authorized 20 13 30 40 50 Improperly authorized Eligibility of Expenditures: Supporting information submitted with travel expense claim forms must be improved Attach conference agenda showing meals provided Detailed receipts must be provided rather than credit card receipts A separate claim form must be submitted for each trip Details supporting hospitality expenditures must be provided Alcohol is an ineligible expenditure Rate of Compliance Salaries/stipends paid to students from all Tri-Agency funding must adhere to minimums and maximums as specified by the agency General office supplies are ineligible expenditures as it is the responsibility of the University to provide pens, paper, etc. University Contacts for Further Information Eligibility and Agency Guidelines Research Services 966-8576 Research.services@usask.ca Financial Administration Financial Reporting 966-8303 fsd_accounting_inquiries@usask.ca