Behaviour of the Norwegian exchange rate Farooq Akram October 14, 2003 ∗

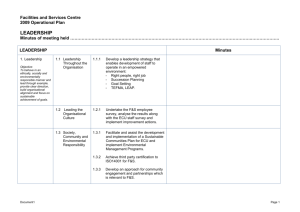

advertisement

Behaviour of the Norwegian exchange rate Farooq Akram∗ October 14, 2003 ∗ The views and opinions expressed in this note and during the lecture are personal. 1 Exchange rate determination • Supply of net foreign assets determined by: • Risk premium: r = i − (i∗ + ∆ee) • Current account surplus: D ≡ Tradesurplus (R, Y , Y f ,Commodity prices) + income from assets abroad + Transfers + − + — R ≡ E×P f /P • Shape of the demand curve depends on the exchange rate regime: — Vertical when floating exchange rate regime — Horisontal when fixed exchange rate regime • The effect of r and D on E depends on the exchange rate regime • What is the equilibrium level of the nominal exchange rate (E)? — In a fixed regime: At what level should the govt. fix the exchange rate? — In a floating regime: To which level will the nominal exch. rate revert to? • Purchasing Power Parity: E ∗ = P f /P — R∗ = 1, which can imply D = 0, under some conditions. — Assume that r converges to a value, say 0, at which the supply of net foreign assets is at rest. • Large shifts in the supply curve may lead to currency crises in a fixed regime. May occur: — When E 6= E ∗, i.e. when there is a misalignment. In which case R≷ R∗ and D ≷ 0 persistently — If |D| becomes extremely large, due to jumps in commodity prices — If r takes on extreme values, e.g. when ∆ee becomes large • Govt. may shift to a floating exch. rate if the defence of the fixed exch. rate becomes costly — Command too high/low domestic interest rates to reverse the shift in the supply curve — Are likely to run out of foreign reserves (Fg ) if defend the exch. rate Table 1: Norwegian exchange rate policy in the period 1972—2001 Exchange rate regimes Period Vis-a-vis Fixed: Smithsonian Agreement Fixed: European ”snake” Fixed: European ”snake” 1971:12—73:3 1972:5—73:3 1973:3—78:12 US dollar Euro. currencies Euro. currencies Fixed: Currency basket Fixed: EMS 1978:12—90:10 1990:10—92:12 Trade weighted ECU Float (Managed) Stable without bands 1992:12—94:5 1994:5—97:1 ECU ECU Stable without bands 1997:1—98:12 ECU Stable without bands 1999:1—01:3 Euro Major fluctuations 5% reval., 16 Nov., 1973 5% deval., 29 Aug., 1977 8% deval., 2 Feb., 1978 12% deval., 5 May, 1986 6% depr., 10 Dec., 1992; temporary switch to float 7% appr., 1996:1—97:1; defence abandoned on 10 January, 1997. 5% appr. 5 Feb., 1997. 6% depr. 24 Aug., 1998; and defence abandoned. 14% depr. 28 Aug., 1998 .05 E (RB - RB f) 1.1 1.0 0.00 .9 .8 1972 1975 1978 1.10 1981 1984 1987 1990 1993 1996 1999 E (RB - RB f) 1.05 -.05 .01 1.00 0.00 .95 1991 2002 -.01 1993 1995 1997 1999 2001 2003 Figure 1: The interest rate difference and the nominal exchange rate during fixed and floating periods. Stronger in the floating period: after 2001:1? OILPRICE Period: 1. January 1986--12 August 1998 110 32 115 38 ECU 26 105 20 100 14 95 8 90 85 0 288 576 864 1152 1440 1728 2016 2304 2592 2880 3168 3456 3744 4032 4320 4608 Figure 2: Daily observations of the oil prices in USD and the ECU index. corr = -0.88 104.5 corr = -0.35 (10) (12) 105 104 103.5 8 14 20 26 (10) 19 8 20 26 (12) 19 18 18 17 17 16 14 16 15 2600 2650 2700 2750 2800 2850 3200 3250 3300 3350 3400 3450 Figure 3: The correlation between oil prices and the exch. rate depends on whether oil prices are falling or rising. 108 106 ECU × OILP RICE No vemb er 1, 1990 - August 12, 1998 104 102 100 98 96 108 8 10 12 14 16 18 20 22 24 26 106 28 30 32 34 36 ECU × OILP RICE January 1, 1993 - August 12, 1998 104 102 100 98 96 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 Figure 4: The correlation becomes weaker at higher level of oil prices. 1.20 E P f/P R = E× P f/P 1.15 1.10 1.05 1.00 0.95 0.90 0.85 0.80 1972 1975 1978 1981 1984 1987 1990 1993 1996 1999 2002 Figure 5: Changes in E tend to coincide with changes in P f /P . R is relatively stable over the period 1972:1—2003:2. PPP seems valid in the long run. 2 Variables • x = ln(X); ∆x = 1. difference of x : relative change over a quarter • [e − (cpi−cpi f )] : difference between the actual and the PPP value of the nominal exchange rate (cpi − cpif ). • RS = 3. Month market rate • RB − RB f : Difference between Norwegian and foreign interest rates • FLow (OILPt < 14.21) : When oil prices are below 14 USD; FF all (OILPt < OILPt−1) : When oil prices are falling • id97q1 : Dummy variable to capture unexplained appreciation in 1997:1 3 Econometric Model ∆ebt = − 0.09 [e − (cpi−cpi f )]t−1 + 0.17 ∆et−1 − 0.22 ∆cpi f t (−3.46) (2.34) (−2.42) − 0.21 ∆RS t − 0.26 ∆(RB t−1 − ∆cpi t−2) − 0.037 id97q1 (−2.62) (−2.39) (−4.39) [− 0.14 ∆oilpt − 0.026 ∆oilpt−2] × FLow (OILPt < 14) (−2.89) (−5.52) − 0.02 ∆oilpt−1× FF all (OILPt < OILPt−1) (−2.15) − 1.30 (RB−RB f )t | t >2001:1; Inflation Targeting (−4.15) Sample: 1972:2-2002:4 , T = 123, k = 10. Method: OLS R2 = 0.53; • Econometric model required to estimate the partial effects of the variables • Convergence towards the PPP level • Interest rate effects depends on the exchange rate regime. Stronger in the floating period • Oil price effects strong when oil prices are relatively low and are likely to fall