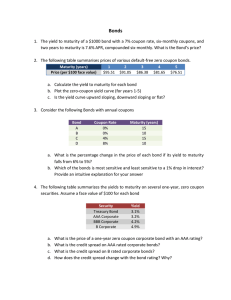

Bonds 1 Introduction

advertisement

1 Bonds Slides for 28 Oct 2003 lecture Ragnar Nymoen University of Oslo, Department of Economics Introduction In the portfolio model, the interest bearing asset is labelled “bonds”. However little “bond specificity” in the formal model. Bonds are like ordinary (short) bank deposits. OK simplification for many purposes, e.g., for understanding the relationship between domestic money market and market for foreign exchange. But in practice loans and credits have different maturities (short and long), and the long maturities are important for decisions that affect consumption, employment and investments in real capital. Reference: B&W 19.3.1. October 27, 2003 2 1 2 Role of bonds in the economy 3 Bond price and yield Bonds are stores of wealth (like deposits, money, residential and productive capital). If you buy a bond. you hold a piece of paper that gives you the right to receive a cash flows (payments) at specified dates in the future, and for a specified period of rime. Unlike a bank deposit, bonds are fixed income assets–the return (yield) is variable. The periodic payments are called coupons , C below. In addition you will get a final payment of the face value, F , in the period when the bond matures. Bond yields are therefore responsive to changes in money-market interest rates (the interest rate most directly controlled by economic policy). If the yield on a bond is y and there are n periods (left) maturity, the price, P , of the bond is defined by: Market equilibrium in asset markets secures transmission of changes in yields on to other interest rates (not necessary equalization, because of different risk characteristics, market “inefficiencies etc.). Bonds markets are important to the operation of monetary policy–transforms changes in short interest rates to changes in long interest rates (mortgages, and business credits). 3 P = C F C C + ... + + + 2 n 1 + y (1 + y) (1 + y) (1 + y)n (1) where we assume that the fist coupon is paid exactly one year (12 months) from now. y is thus yield per year. (1) defines P as the present value of all future fixed payments. Bonds can be sold and resold (a market for the stock of outstanding bond debt) 4 4 Conversely, if P is determined by supply and demand, (1) defines the yield as the average rate of return that you get from owing the bond from “today” and to maturity (therefore expressions like “yields to maturity” or “redemption yield” are often heard). P and y are negatively related. The yield curve The fact that there are markets for bonds with different years to maturity means that there is a functional relationship between (annualized) yields and years to maturity: yn = f (years to maturity) The relationship is nonlinear where yn is the yield of the a bond with maturity n (1 month, 3months, 1 year, ....,90 years). The graphs of of this function is called the yield curve. Special case (a consol): F = 0 and long maturity (n → ∞), The markets change rapidly, so it only makes sense to talk about a yield curve on any specific day. 1 P = . y (Hint: Use result for infinte sum with geometric weights, and correct for the fact that “the first term of the sum” is missing from (1). They are also reported daily by (business) newspapers, and their shape is given a lot of attention by economics. The reason is that the yield curve is believed to embody the markets response to policy-changes (and other shocks), and even anticipations of future policychanges. 6 5 Illustrating the expectations theory of the yield curve Current and expected Bond maturity money market interest rate: % today 1 year ahead 3 4 12-months 1-year 2 years ahead 5 2-year 3 years ahead 6 3-year 4 years ahead .... Many years ahead 6 6 4-year ... Long 7 yield Upward sloping yield curve: Expectations of interest rate increases in the future. Downward sloping: Expectations of interest rate cuts. 3 (3+4) 2 (3.5+ 4+5 2 ) 2 (3.5+4.5+ 5+6 2 ) 3 (3.5+4.5+5.5+ 6+6 2 ) 4 = 3 3.5 = 4 = 4.5 = 4.9 ... 6 ... ≈ For an example of how expectations about future interest rates are “backed out” of observed yield curves, see Norwegian National Budget 2004. But such procedures hinges on a strong ceteris paribus clause, since yield curves also depend on other factors than just expectations about short-term interest rates. For example inflation, which is not 1-1 with interest rate setting and the possibility that risk is linked to maturity. 8 5 Behaviour of bond rates over time The theory of the yield curve suggests that, even though the yields curve changes from day to day, there will also be a positive relationship between short terms interest rates and average bond yields over a longer period of time. Such a relationship is what transmits policy motivated changes in short interest rates on to interest rates on mortgages and business credit. Regressions on Norwegian data for the period 1990(1)-2001(4) confirm that a relationship exists: 1 pp increase in money market rate increases 6-month average bond yield by 0.34 pp However: Foreign bond yields even more important, see copy of PcGive out-file. Over the same period, the empirical relationship between bond yield and average interest on bank loan is very strong, almost 1 to 1. 9