Document 11949937

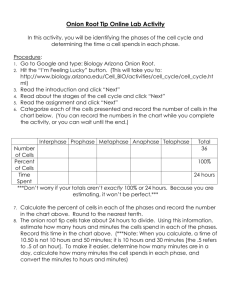

advertisement

COl"" March 1991 A.E. Ext. 91-3 The National Dry Onion Market: A Monthly Analysis of New York State's Competitive Position in Eastern Markets Enrique E. Figueroa Department of Agricultural Economics New York State College of Agriculture and Life Sciences A Statuatory College of the State University Comell University, Ithaca, New York, 14853-7801 • It is the policy of Cornell University actively to support equality of educational and employment opportunity. No person shall be denied admission to any educational program or activity or be denied employment on the basis of any legally prohibited dis­ crimination involving, but not limited to, such factors as race, color, creed, religion, national or ethnic origin, sex, age or handicap. The University is committed to the maintenance of affirmative action programs which will assure the continuation of such equality of opportunity. ... THE NATIONAL DRY ONION MARKET: A MONTHLY ANALYSIS OF NEW YORK STATE'S COMPETITIVE POSITION IN EASTERN MARKETS by Enrique E. Figueroa • Assistant Professor of Agricultural Economics Cornell University, Ithaca, N.Y. 14853 ACKNOWLEDGEMENTS I would like to thank the New York state Onion Industry Research and Development Program for financially supporting this research. Mr. Donald Nielson from New York state Agriculture and Markets for his courteous assistance in administering the project as well as for his helpful comments regarding some of the date utilized in the project. However, the author takes sole responsibility for the paper. - TABLE OF CONTENTS .. I. Introduction. II. National Market IIA. Competition lIB. Time Period ... · · · · · · · · · · · .. ... ......... · . . · . . . · Differences . · · · · 1 2 · 8 · · · · · 8 III. Other Eastern Markets • · 16 ·. .. ·...... IV. Eastern Market's Price Analysis IVA. Atlanta IVB. Baltimore • IVC. Boston. • IVD. Buffulo. IVE. New York City IVF. Philadelphia. . • 30 IVG. Pittsburgh. . • 33 IVH. Direct Weekly comparison. • • • 22 • • 24 · 26 • • • • • 26 · 26 30 • • • 33 IVI. Summary and Conclusions . 36 Bibliography . . • . . . . • 39 - , THE NATIONAL DRY ONION MARKET: A MONTHLY ANALYSIS OF NEW YORK STATE'S COMPETITIVE POSITION IN EASTERN MARKETS I. Introduction Between 1982 and 1988 dry storage onion production in New York averaged 3,432,000 cwt with a high of 4,550,000 cwt in 1982 and a low of 2,793,000 cwt in 1983. However, the year-to-year changes in production have declined, on average, 5.5%. Over the same time period, national dry storage-onion production has averaged nearly 34,000,000 cwt and the average annual change in production has been a 5.6% increase. New York's share of the national market has been 10.1%, but New York onion producers have not benefitted from the expansion of the national market. Why? In this report, an attempt is made to shed light on the answer. ha~ within the vegetables category, the value of production of onions in New York ranks second only to potatoes. The value of production in 1988 was nearly $40 million and has averaged nearly $41 million over the past five years. It is a significant industry in Orange county with Genessee, Madison, Orleans, and Oswego as other producing counties. These five counties grow more than 90% of all onions produced in the state. Producers in these counties have recognized that their share of the national market has been eroding and that something needs to be done before their presence in the market is no longer a significant factor. In an earlier report which utilized weekly data between February 1987 and March 1988, the author presents a similar analysis to this report. Among the findings of the previous report were: New York had 6% of the national storage onion market; the first and fourth quarters of the year are New York's primary marketing periods; Idaho and Oregon onions were New York's main head-to-head competitors; the Boston and Baltimore markets were New York's strongest and most stable markets; and that New York suppliers did not have a large share of the New York City market. One limitation of the previous report was the rather short time period used as a basis for the report. Though a weekly analysis provides far more seasonal detail, the year chosen for the analysis may not be representative of the structure of the market. Also, the previous report did not utilize prices--it was strictly a market share approach. This report expands on the previous report in two significant ways: 1.) the time period of the analysis is monthly rather than weekly and therefore the total time period is enlarged to seven years rather than one and 2.) prices as well as volumes are analyzed. It uses the same data sources as the previous report and is presented in a similar format. The specific objectives are to describe and analyze the competitive position of New York onions in the national "Shipments" market as well as its' position in various eastern u.S. "Arrival" markets. The report first describes the national market; New York's competitive position in the national market as well as in specific eastern u.S. terminal markets; and ­ 2 then onion prices for various suppliers to eastern markets are analyzed. II. ~he u.s. terminal Bationa1 Market _.As mentioned earlier, the data sources for the analysis are the same utilized by Figueroa [1] in the previous report. Shipment data are from the USDA [4] as are arrival data [3]. Table I presents average monthly shipments during the year and by quarter by the major dry onion suppliers in the country as well as Canada & Mexico. According to the USDA, shipment data captures approximately 90% of all shipments. To verify the USDA's assertion, a comparison was made between total U.S. storage onion production data and total U.S. shipment data for the seven years--1982 to 1988. Given that the industry operates under the assumption of 13.5% shrinkage and waste between harvest and pack-out, then the shipment data used in this study reflects 95% of production. Indeed, a better figure than what the USDA asserts. Compared to average monthly shipments for the entire year, New York shipments in the first and last quarters are 47.8% greater while second quarter shipments are 72.2% less and third quarter shipments are 23.4% less. Alternatively, quarterly New York and competitor dry onion shipments as percent of total annual shipments are: _______________ , SHIPPING STATE I , I I 1 II I 1 III I 1 IV I ---------------I--------I--------!--------!--------I NEW YORK 37.0% 7.0% 19.1% 36.9% COLORADO 23.2 1.0 32.5 43.3 IDAHO 35.1 1.1 16.2 47.7 MICHIGAN 39.9 1.5 15.5 43.1 OREGON 38.6 2.5 17.7 41.1 WASHINGTON 25.5 6.5 36.4 31.6 --------------------------------------------------- Michigan and Oregon have the most similar annual shipment distribution to New York's. New York is the fifth largest supplier included in Table I and the third largest supplier when California and Texas (primarily II and III quarter suppliers) are excluded. Total shipments during each of the last three quarters are about 2.45 million cwt, while first quarter shipments are 1.96 million cwt. • Table I ... AVERAGE MONTHLY U.S. DRY ONION SHIPMENTS--JANUARY 1982-DECEMBER 1988 SHIPPING STATE YEAR JANUARY­ MARCH TIME PERIOD APRIL­ JUNE JULY­ SEPTEMBER OCTOBER­ DECEMBER --1,000 CWT.-­ CALIFORNIA 390.35 72.19 748.86 571.33 169.0 COLORADO 255.44 237.19 10.14 331. 57 442.86 IDAHO 212.32 297.76 9.14 137.48 404.90 MICHIGAN 122.33 195.05 7.57 75.91 210.81 NEW YORK 250.42 370.19 69.71 191. 71 370.05 OREGON 303.15 468.10 30.00 216.62 497.90 TEXAS 350.12 71. 43 1,000.29 328.67 0.10 WASHINGTON 122.21 124.62 32.00 177.90 154.33 CANADA AND MEXICO 142.45 336.29 164.00 20.19 49.33 OTHER U.S. 324.12 121.29 525.86 415.81 233.52 2,330.46 1,957.81 2,433.57 2,447.00 2,483.48 TOTALS I w 4 Table II presents total u.s. arrival data. Arrivals represent approximately 42% of total shipments and the comparable quarterly figures are: 1=45.5%, 11=41.6%, 111=42.6%, and IV=38.9%. In short, the 22 cities reported by the USDA receive less than half of all onions shipped within the U.S. Because arrival data includes arrivals from countries other than Canada and Mexico and because shipment data only reports U.S. shipments (Florida and Texas only report interstate shipments), it is therefore difficult to derive a precise relationship (percent) between arrivals and shipments. However, for comparisons of shares and/or changes in sources of supply, arrival data can be used more justifiably than absolute volume comparisons. Of the eastern markets, New York City is the largest terminal market receiving onions. It is followed by Boston, Atlanta, Philadelphia, and Baltimore. Buffalo is the smallest while Pittsburgh is the next smallest. Except for Atlanta and New York City, very little differences exist between quarters of the year for any of the markets. As pointed out by some New York growers, Atlanta is considered a "dump" market and as such one would expect a larger variation in arrivals. New York City is not necessarily a "dump" market, but since it is the largest, many growers send product to the market as "rollers" and/or consignment when there is oversupply. The seven eastern cities in Table II represent 43.3% of all U.s. arrivals and New York City alone represents 13.1%. Given the figures in Tables I & II, what can be said about the share distributions of suppliers and receivers? Tables III and IV present shipper and arrival shares, respectively. Over the entire year, the eight states and Canada & Mexico ship 87% of all onions in the U.S. During the II and III quarters, the percentage drops to 80% and 83%, respectively. New York onions maintain the second largest national share in the first quarter and the fourth largest share in the fourth quarter. New York is not a major supplier in the other two quarters. Based on the widest distribution of shares, the first quarter is the most competitive quarter while the second quarter is the least competitive. Since average shipments during the fourth quarter are 526,000 cwt more than during the first, an implication may be that storage capacity and/or storage costs preclude longer storage (the major states supplying during the IV and I quarters harvest during the fall). Alternatively, if growers know that the first quarter is the most competitive quarter, then they may choose to move more product during the less competitive fourth quarter. The reason for shipping more product during the fourth quarter, as compared to the first, is an important research theme for the future. The shares presented in Table IV depict stable markets over the entire year. The seven cities vary in size, income, demographics, are geographically dispersed and therefore represent a broad consumer profile and one that most likely is representative of national demand for dry storage onions. • Table II ... AVERAGE MONTHLY U.S. DRY ONION ARRIVALS--JANUARY 1982-DECEMBER 1988 ARRIVAL MARKET YEAR JANUARY­ MARCH TIME PERIOD APRIL­ JUNE JULY­ SEPTEMBER OCTOBER­ DECEMBER --1,000 CWT-­ ATLANTA 70.30 60.95 78.86 77.38 64.00 BALTIMORE 49.36 47.67 50.90 52.48 46.38 BOSTON 81. 67 76.67 79.71 89.19 81.10 9.98 9.38 9.57 10.29 10.67 128.23 128.10 118.24 130.90 135.67 PHILADELPHIA 56.98 58.29 54.29 59.76 60.57 PITTSBURGH 26.44 25.19 26.33 27.62 26.62 555.44 490.52 594.29 595.62 541. 33 978.38 891.76 1,012.19 1,043.24 966.33 BUFFALO NEW YORK CITY OTHER CITIES TOTALS I U1 Table III ••• AVERAGE MONTHLY DRY ONION S-,-H_I_PPE_'_R_t1ARKET SHARES OF TOTAL U.S. IDRY ORIOK MARKET--JANUARY 1982--DOCEMBER 1988 TIME PERIOD SHIPPING YEAR JANUARY­ APRIL­ MARCH JUNE JULY­ SEPTEMBER OCTOBER­ DECEMBER --PERCENT-­ CALIFORNIA 15.3 3.1 27.9 23.4 6.9 COLORADO 10.3 10.5 0.5 13.1 17.3 IDAHO 8.6 12.9 0.4 5.4 15.9 MICHIGAN 5.1 8.7 0.3 3.0 8.5 NEW YORK 10.6 . 16.6 3.0 7.7 15.0 OREGON 12.4 20.2 1.3 8.5 19.6 TEXAS 14.0 3.1 39.0 13.8 0.0 WASHINGTON 5.0 5.4 1.3 7.2 6.0 CANADA & MEXICO 6.0 14.4 6.6 0.8 2.0 OTHER U.S. 12.7 5.1 19.7 17.0 8.9 TOTALS 100.ot 100.0' 99.9' I 100.0t 100.1' 0\ Table IV ... AVERAGE MONTHLY DRY ONION ARRIVAL SHARES AS PERCENT OF TOTAL U.S. ARRIVALS--JANUARY 1982-DECEMBER 1988 ARRIVAL MARKET YEAR JANUARY­ MARCH TIME PERIOD APRIL­ JUNE JULY­ SEPTEMBER OCTOBER­ DECEMBER --PERCENT-­ ATLANTA 7.2 6.8 7.8 7.4 6.6 BALTIMORE 5.1 5.3 5.0 5.0 4.8 BOSTON 8.4 8.6 7.9 8.6 8.4 BUFFALO 1.0 1.1 0.9 1.0 1.1 13.1 14.4 11. 6 12.5 13.8 PHILADELPHIA 5.9 6.0 5.4 5.7 6.3 PITTSBURGH 2.7 2.8 2.6 2.7 2.8 56.7 54.9 58.7 57.0 56.1 99.9% 99.9% 99.9% 99.9% NEW YORK CITY OTHER TOTALS I 100.2% ....J 8 XX.A. Competition A total of eighty-four (84) months are included in the data series. With this size number of observations, it is appropriate to use "correlation coefficients" (c.c.'s) to estimate the degree of correlation between two variables. For example, if shipments from New York and Idaho move in the same pattern from one-month-to-another, then the correlation is positive and high--close to 1.0--and Idaho and New York are said to be competitors. If on the other hand, shipments are not correlated--do not show a pattern--then the c.c. is equal to zero. Lastly, if the shipments move in different directions--Idaho is decreasing shipments while New York is increasing them--then the c.c. is close to -1.0 and they are not competitors. Table V presents the c.c.'s between the shipping states and Canada & Mexico. The selection of a value of the c.c. which indicates a high correlation is somewhat arbitrary and a function of the variables which one is comparing. For national onion shipments, a figure greater than 10.801 would indicate a strong correlation. As might be expected, the highest positive correlation is between Idaho and Oregon onion shipments--O.93. One could say that they are competitors, but since a federal market order exists for Idaho and Oregon (Mulheur County) onions, then they really are not. The strongest competitor to New York is Michigan with a c.c. of 0.84 and the strongest competitor to Michigan is Idaho--c.c. equal to 0.87. The table makes it very evident that both California and Texas are not competitors with the fall and winter supply states--negative c.c.'s. California's major competitor is "Other States"--0.82. Table VI also presents a c.c. matrix, but these coefficients represent arrivals at New York City from the various sourcing regions. One would not expect c.c.'s of the magnitude of shipment c.c.'s because both bi-lateral supply and bi-lateral demand factors influence these correlations. The shipment c.c.'s are primarily influenced by supply forces. Therefore, a c.c. of 10.65\ or greater is considered a value indicating strong correlation. As such, only Oregon and Idaho arrivals are positively correlated--0.78--while the other significant c.c. 's are negative. The negative correlations all make intuitive sense: California arrivals are negatively correlated with Colorado, New York, and Oregon arrivals; and Texas arrivals are negatively correlated with Idaho and Oregon arrivals. New York arrivals in New York City are not strongly positively correlated (i.e. competitor) with any other sourcing region. XI.B. Time Period Differences Between January 1982 and December 1988, the national market position held by New York onion producers changed. Figure 1 presents a graphical illustration of New York onion shipments during 1982-1983 and 1987-1988. Although it is not very obvious, total shipments did decrease between the beginning of the time period and ­ Table V... CORRELATION COEFFICIENT MATRIX FOR TOTAL U.S. MONTHLY DRY ONION SHIPMENTS-­ JANUARY , 82-DECEMBER '88 CALIF. COLO. IDAHO MICH. N.Y. OREG. TEXAS WASH. CANADA & MEXICO OTHER STATES CALIFORNIA COLORADO -.58 IDAHO -.75 .77 MICHIGAN -.71 .67 .87 NEW YORK -.79 .59 .75 .84 OREGON -.80 .72 .93 .81 .78 .32 -.70 -.77 -.71 -.54 -.75 WASHINGTON -.09 .32 .32 .17 .10 -.36 -.47 CANADA & MEXICO -.41 -.30 -.01 .06 .22 .17 .14 -.16 .82 -.36 -.57 -.60 -.77 -.65 .13 .10 TEXAS OTHER STATES ~ .48 Table VI ••• CORRELATION COEFFICIENT MATRIX FOR MONTHLY DRY ONION ARRIVAIS IN JANUARY 1982-DECEMBER 1988 CALIF. COLO. IDAHO MICH. N.Y. OREG. TEXAS WASH. JEW YORK CANADA , MEXICO CITY-­ OTHER STATES CALIFORNIA COLORADO -.70 IDAHO -.61 .00 MICHIGAN -.43 -.05 .36 NEW YORK -.65 .26 .13 .40 OREGON -.65 -.07 .78 .28 .27 ~ 0 TEXAS .40 -.22 -.67 -.33 -.37 -.65 WASHINGTON .01 .16 .02 .02 .10 -.03 -.10 -.24 -.03 .22 .60 .25 .03 -.16 -.06 .40 -.16 -.42 -.33 -.48 -.45 .15 .18 CANADA , MEXICO OTHER STATES I -.21 11 the end. Mean monthly New York shipments during the first 24-months were 283,000 cwt while during the last 24-months they were only 209,000 cwt--a 26% decline. Figure 2 illustrates the national market shipment shares maintained by New York shipments during 1982 to 1983 and 1987 to 1988. As compared to Figure 1, the time period differences are more evident. During the first two years, New York's mean national market share was 13.4% while during the last two years it was only 7.8%--a 41.8% decline! Since the percent decrease in market share is greater than the percent decrease in shipments, one can conclude that the growth in the national onion market was captured by states other than New York. Figures 3 and 4 illustrate the New York city onion terminal market. Figure 3 shows the shipment market share New York City represents of total New York shipments. Again, graphically it is not very evident how the two time periods differ, but the mean share during the first two years was 17.5% while during the latter two years it was only 5.6%. However, the first time period is skewed by the August 1983 share--87%. If one does not include that month, then the mean for the first time period is 14.4%. Using the mean which excludes August 1983, then the mean market share New York City represents of total New York shipments declined by 17.7% between 1982-1983 to 1987-1988. Figure 4 illustrates the market share New York suppliers maintain in the New York City market. Graphically, it is very evident how the shares changed over time. During the first two years the mean share was 40.7% while during the last two years it was only 12.8%--a 68.5% decline! The New York City market was "lost" by New York suppliers over a relatively short time period--1982-83 to 1987-88. Why did New York suppliers lose such a large market share? Was it the competition or was it that New York producers chose to move to different markets? This outcome is particularly troubling because the New York City market is the largest market. One should note, however, that the arrival data most likely does not provide the whole picture with regards to how many New York produced onions are actually consumed within the state. Nonetheless, there is nothing that indicates that New York City arrival data would progressively report less arrivals from New York State. Therefore, the decline in market share is indicative of a structural change in market position. The answer to why the loss in market share took place begs for further research--for it may shed light in protecting and/or maintaining current market shares. The national onion market grew from an average of 2,178,400 cwt per month during 1982 to a monthly average 2,768,000 cwt during 1988--a 27% increase. Over the entire 84-months, the average monthly change in national onion shipments was +1.69%. Conversely, New York's average monthly onion shipments during 1982 were 317,300 cwt while during 1988 they were 200,250 cwt--a 36.7% decrease. One cannot properly generate an average monthly change in New York onion shipments because during a number of months (18) shipments were • 12 PIGURB 1. 'l'OTAL SHIPMENTS OP nw YOU DRY OBIOBS MONTH 1.QQQ CWT. 1982:1 1982: 2 1982:3 1982:4 1982:5 1982:6 1982:7 1982:8 1982:9 1982:10 1982:11 1982:12 1983:1 1983:2 1983:3 1983:4 1983:5 1983:6 1983:7 1983:8 1983:9 1983:10 1983:11 1983:12 1987:1 1987:2 1987:3 1987:4 1987:5 1987:6 1987:7 1987:8 1987:9 1987:10 1987:11 1987:12 1988:1 1988:2 1988:3 1988:4 1988:5 1988:6 1988:7 1988:8 1988:9 1988:10 1988:11 1988:12 • • • • • • • • • • • • • / / I I I I I I • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 560 403 433 177 0 0 0 249 553 496 471 466 520 447 435 251 0 0 0 68 231 304 379 364 367 290 343 140 0 0 31 179 367 317 315 296 336 250 372 180 0 0 0 130 279 277 293 286 • 13 I'IGURB 2. 52. YORK'S SHARE OF TOTAL DTIOHAL DRY OHIOH SHIPMENTS MONTH PERCENT 1982:1 1982:2 1982:3 1982:4 1982:5 1982:6 1982:7 1982:8 1982:9 1982:10 1982:11 1982:12 1983:1 1983:2 1983:3 1983:4 1983:5 1983:6 1983:7 1983:8 1983:9 1983:10 1983:11 1983:12 1987:1 1987:2 1987:3 1987:4 1987:5 1987:6 1987:7 1987:8 1987:9 1987:10 1987:11 1987:12 1988:1 1988:2 1988:3 1988:4 1988:5 1988:6 1988:7 1988:8 1988:9 1988:10 1988:11 1988:12 * * * * * * * * * * * * * * * * * * / / * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * 0.27 0.26 0.20 0.08 0 0 0 0.12 0.23 0.24 0.23 0.23 0.24 0.24 0.20 0.11 0 0 0 0.03 0.09 0.12 0.16 0.16 0.13 0.14 0.14 0.06 0 0 0.00 0.07 0.13 0.11 0.12 0.10 0.11 0.11 0.13 0.06 0 0 0 0.05 0.09 0.10 0.11 0.10 • 14 I'IGtJU 3. lID YOU CITY'S SHARB OJ' nw YOU'S IfOTAL DRY 0111011 8BIPKENTS MONTH PERCENT 1982:1 1982:2 1982:3 1982:4 1982:5 1982:6 1982:7 1982:8 1982:9 1982:10 1982:11 1982:12 1983:1 1983:2 1983:3 1983:4 1983:5 1983:6 1983:7 1983:8 1983:9 1983:10 1983:11 1983:12 1987:1 1987:2 1987:3 1987:4 1987:5 1987:6 1987:7 1987:8 1987:9 1987:10 1987:11 1987:12 1988:1 1988:2 1988:3 1988:4 1988:5 1988:6 1988:7 1988:8 1988:9 1988:10 1988:11 1988:12 * * * * * * * * * * * * * * * * * * / / * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * 0.13 0.19 0.18 0.27 0 0 0 0.25 0.16 0.17 0.18 0.20 0.16 0.15 0.19 0.26 0 0 0 0.87 0.32 0.19 0.16 0.16 0.07 0.08 0.06 0.11 0 0 0 0.06 0.08 0.08 0.11 0.10 0.07 0.10 0.05 0.18 0 0 0 0.02 0.02 0.05 0.05 0.06 .. 16 zero. It is expansion of addition, in country--New clear that other supply states benefitted from the the national onion market and New York did not. In the New York City market--the largest in the York suppliers lost significant market share. __ - In the following section, a closer look at the other eastern markets is presented and how New York and its competitors fared in those markets. III. other Bastern Markets Table VII presents the arrival market shares, monthly averages based on the entire year as well as per quarter, held by New York arrivals in the seven eastern cities. The shares indicate the market penetration of New York onions in each of the markets. The reader should refer back to Table IV and recognize that the seven markets only represent, on average, 43.3% of total U.S. onion arrivals. Over the entire time period, New York maintains relatively large market share positions in all the cities except Atlanta and Pittsburgh--2.8% and 19.2%, respectively. The largest position is held in Buffalo--32.6%--followed by Boston and New York CitY--27%--and Baltimore and Philadelphia--24.9% and 23.4%, respectively. In fact, during the first quarter of the year, New York has 50% of the arrival market in Buffalo! Unfortunately, the market position deteriorates over the time period of the study. The following presents the same information as does Table VII, except the monthly averages are calculated for only 1982, 1988, and the percentage change between the two years. Even if one argues that 1982 was a very good year for New York shippers and that 1988 was a very bad year, the market share losses are startling given the relatively short time period--six years. What happened? ____________________ I, CITY I ATLANTA BALTIMORE BOSTON BUFFALO NEW YORK CITY PHILADELPHIA PITTSBURGH 1982 1988 1I I . --Percent-­ 9.4% 0.4% 36.1 15.4 34.5 0.2 48.6 0.0 42.9 11.2 34.2 18.3 24.8 15.6 1I % CHANGE _ I -95.7% -57.3 -99.4 -100 -73.9 -46.5 -37.1 The Boston, BUffalo, and New York City markets are the three markets in which New York shippers lost the largest percentage market shares (the loss in Atlanta was large, but the Atlanta market is rather insignificant as far as New York shippers are concerned). TABLE VII ... AVERAGE MONTHLY DRY ONION ARRIVAL MARKET SHARES HELD BY NEW YORK STATE ARRIVALS--JANUARY 1982-DECEMBER 1988 ARRIVAL CITY YEAR JANUARY­ MARCH TIME PERIOD APRIL­ JUNE JULY­ SEPTEMBER OCTOBER­ DECEMBER --PERCENT-­ ATLANTA 2.8 4.8 0.2 3.3 2.8 BALTIMORE 24.9 36.7 8.1 18.4 36.4 BOSTON 27.3 40.5 9.5 20.6 38.6 BUFFALO 32.6 50.1 23.1 16.9 40.3 NEW YORK CITY 27.8 37.2 19.7 20.8 33.7 PHILADELPHIA 23.4 34.2 12.5 19.1 27.8 PITTSBURGH 19.2 25.0 17.4 12.7 21.9 9.0 16.1 1.8 5.7 12.4 OTHER CITIES I-' -..J 18 In the Boston market, New York lost 34.3 (34.5% - 0.2%) share points between 1982 and 1988. What states gained in market share? Idaho increased its market share position from 14.2% to 21.5' and "Other states" increased their position from 6.7% to 32.6%. In essence, these two suppliers increased their share position by 33.2 points--what New York lost. Although it is difficult to pinpoint, but most likely Georgia "Vidalia" onions captured a significant share between 1982 and 1988. Though terminal market reports indicate zero New York arrivals in Buffalo, the author considers this a suspect figure. Nonetheless in the Buffalo market, New York lost 48.6% (went to zero) share points between 1982 and 1988. The gainers in descending order were: "Other States" -= 24.1, Idaho = 10.9, Colorado = 6.0, California = 5.1, and Oregon = 4.3. Since California generally does not compete with New York during the same months, then the other sourcing regions were the beneficiaries of New York's losses. Lastly, in the New York City market, New York lost 31.7 share points between 1982 and 1988. A much different picture develops in this market. For example, "Other states" also lost market share--2.0 points--whereas in the Boston and BUffalo markets the "Other states" were the largest gainers. California is the second largest gainer--9.5 points--and therefore indicates that it competed directly with New York. This is an odd outcome because historically the two states have supplied the market during different parts of the year. The largest gainer in New York City was Idaho--18.5 points--followed by Oregon--6.1 points. What can be said about the suppliers that took over the market shares that New York lost? First, other sourcing states entered the market--particularly Georgia. Idaho and Oregon generally supply a "jumbo ll sweet-spanish onion and therefore one can surmise that the demand for this type of product lead to the gains at the expense of New York's "large" or "medium-repacker" yellow-globe onions. At this point, it is difficult to speculate why the Boston and Buffalo markets were different than the New York City market in terms of what sourcing states ended up with the market shares New York lost. Further study on this particular question would assist New York producers in formulating their strategies for future market maintenance and/or penetration. The preceding indicated how important New York onions were in particular eastern markets. An ancillary question is how important are these markets to New York suppliers. That is, which markets buy relatively more/less onions shipped by New York. Table VIII presents the average monthly shipment shares received by the various eastern markets. The reader should remember that "arrival" data on average represents 42% of II shipment II data. Therefore the figures in Table VIII appear to be small, but if they add up to 42%, then the seven cities received 'all' of New York's shipments. The average monthly arrival shares for the seven cities Table VIII ... AVERAGE MONTHLY DRY ONION ARRIVAL SHARES AS PERCENT OF TOTAL NEW YORK STATE SHIPMENTS--JANUARY 1982-DECEMBER 1988 . ARRIVAL CITY YEAR JANUARY­ MARCH TIME PERIOD APRIL­ JUNE JULY­ SEPTEMBER OCTOBER­ DECEMBER --PERCENT-­ ATLANTA 0.5 0.7 0.1 0.8 0.4 BALTIMORE 3.5 4.6 1.5 3.6 4.4 BOSTON 6.7 8.3 3.1 7.4 8.1 BUFFALO 1.3 1.2 0.7 2.1 1.1 NEW YORK CITY 11.2 12.4 6.5 14.5 11.3 PHILADELPHIA 5.1 4.9 2.2 8.8 4.5 PITTSBURGH 1.5 1.7 .L...1 .LJi 1.6 29.6% 33.8% 15.2% 39.0% 31. 4% TOTAL f-' \0 20 for the entire year is 29.6% of all New York shipments. During the third quarter the figure is 39.0%--i.e., almost all of the 'reported' arrivals from New York are to the seven cities! Even though New York has deteriorated its market position in New city, the city is still the most important market for New York suppliers. It is important because it represents such a large volume--a monthly average of 128,226 cwt. The other market's average monthly arrivals are (in descending order): Boston = 81,667 cwt, Atlanta = 70,298 cwt, Philadelphia = 56,976 cwt, Baltimore = 49,357 cwt, Pittsburgh = 26,440 cwt, and Buffalo = 9,976 cwt. The fourth and first quarters of the year are when New York primarily markets its onions and there is no discernable difference in share allocation between the two quarters. Within the year, the seven cities represent stable markets for New York shippers and they represent the markets where 71% of New York onions arrived. Yo~ Table IX presents a somewhat different market share approach. Contrary to the figures in Table VIII, the figures in Table IX are all a function of arrivals. That is, of all the arrivals in New York City, what percent came from each supplying region? Between 1982 and 1988, New York onions have the largest average monthly share--27.8%. The most surprising figures are the shares maintained by New York during the second and third quarters--19.7% and 20.7%, respectively. No doubt, most sales in the second quarter are in April while most sales in the third quarter are in September. However, an important question is how the figures in Table IX changed between 1982 and 1988. What follows are the average monthly shares for each year: SUPPLY STATE I 1982 I 1988 I % CHANGE --------------------!------------!------------I-----------­ --Percent-­ CALIFORNIA COLORADO IDAHO MICHIGAN NEW YORK OREGON TEXAS WASHINGTON CANADA & MEXICO OTHER U.S. 10.5% 1.9 10.1 0.7 42.9 11.3 14.5 0.1 0.1 7.8 20.0% 1.1 28.6 0.1 11.2 17.4 16.2 0.1 0.0 5.8 +90.5% -42.1 +183.2 -85.7 -73.9 +54.0 +11.7 -25.6 Table IX ... AVERAGE MONTHLY DRY ONION ARRIVAL MARKET SHARES HELD BY VARIOUS SHIPPERS IN NEW YORK CITY--JANUARY 1982-DECEMBER 1988 ARRIVAL SOURCE YEAR JANUARY­ MARCH TIME PERIOD APRIL­ JUNE JULY­ SEPTEMBER OCTOBER­ DECEMBER --PERCENT-­ CALIFORNIA 14.3 0.8 20.4 34.2 1.7 2.3 0.9 0.2 5.4 2.8 19.7 31.3 3.5 8.3 35.5 MICHIGAN 1.1 2.2 0.5 0.2 1.5 NEW YORK 27.8 37.2 19.7 20.7 33.7 OREGON 14.4 25.2 3.7 6.0 22.8 TEXAS 15.6 0.6 45.4 16.4 0.0 WASHINGTON 0.6 0.3 0.1 1.2 0.7 CANADA AND MEXICO 0.4 0.7 0.2 0.1 0.5 OTHER U.S. 6.0 .L..l 11.8 10.1 0.9 100.3% 105.5% 102.7% COLORADO IDAHO TOTALS 102.2% *--Data inconsistencies and rounding errors lead to figures greater than 100% 100.1% '" i-> 22 New York drops to the fifth--11.2%--position in market share during 1988 whereas it held the number one position in 1982--42.9%. The leading suppliers during 1988 were: Idaho, California, Oregon and Texas. Idaho increased its market position by nearly 185% over the six-year period and most likely all at the expense of New York. Table X presents the shares of total shipments represented by arrivals in the New York City market. The shares are stable over the year with the exception of the following: the third quarter is relatively more important for California and the fourth quarter is the most important for Canadian & Mexican shipments. Only New York relies on New York City for more than 10% of its total shipments. The national dry storage onion shipment market grew at an average rate of 1.7% per month between January 1982 and December 1988. New York producers did not benefit from the expansion of the market and in fact lost significant market share over the time period. The principal beneficiaries from the expansion of the market were Idaho, California, Oregon, and "Other states". In the New York City market, the largest terminal market in the country, New York shippers went from a 43% market share in 1982 to an 11.2% in 1988. It appears that demand for a larger, "jumbo", sweet-spanish-type onion led to the decline of New York's position in the market. xv. Eastern Markets' Price Analysis. Price analysis is the most difficult undertaking of the report. The first problem is identifying the appropriate price series on which to base the analysis. Since the report primarily is concerned with the competitive position of New York onions, an appropriate price would be one which is relevant to New York shippers. Secondly, should the price data be monthly or weekly and if it is monthly, how are the inter-month price variations captured? Should prices be analyzed for all sizes and types of onions--'colossal', 'jumbo's', 'large', 'medium', and/or 'repacker': 'sweet-spanish', 'yellow-globe', 'reds', 'grano', and/or 'granex'? Should grower price, f.o.b. price, terminal market receiving price, or retail price be analyzed? And lastly, which source(s) should be utilized for the analysis? The decisions were not easy to make for arguments could be generated for alternative decisions. The availability of good price data was the fundamental force guiding the decisions. The second guiding principle was the type and size onions that compete with New York onions. The decision between weekly and monthly data was for weekly data. Monthly data would miss some of the significant variations within a month. Since New York mostly markets a 'large' orlmedium/repacker' onion, then this size onion price was used for New York onions. For the western states, california, and Texas the 'jumbo' and 'large' prices were used. For Michigan, the 'large' and 'medium/repacker' price was v . Table X... AVERAGE MONTHLY DRY ONION TOTAL U.S. SHIPMENT MARKET SHARES REPRESENTED BY NEW YORK CITY ARRIVALS-JANUARY 1982-DECEMBER 1988 SOURCE OF SHIPMENT YEAR JANUARY­ MARCH TIME PERIOD APRIL­ JUNE JULY­ SEPTEMBER OCTOBER­ DECEMBER --PERCENT-­ CALIFORNIA 3.3 1.2 2.7 7.2 1.9 COLORADO 0.7 0.3 0.0 1.7 0.8 IDAHO 9.7 14.0 9.2 3.9 11.8 MICHIGAN 0.8 1.3 0.6 0.5 0.8 NEW YORK 11.2 12.4 6.5 14.4 11.3 OREGON 5.1 7.2 4.8 2.0 6.3 TEXAS 4.7 0.7 7.5 10.7 0.0 WASHINGTON 0.5 0.3 0.3 0.9 0.6 CANADA AND MEXICO 6.2 0.3 0.0 5.0 19.6 OTHER U.S. 0.7 2.4 0.0 2.4 0.5 N w 24 used. Lastly, the author felt that the appropriate price for the analysis would be the terminal market prices reported by New York state Agriculture and Markets [3]. Terminal market prices as compared to grower and/or f.o.b. shipping prices are preferable because the weekly variation in these latter prices is minimal compared to terminal market prices. In addition, the demand side of the market, terminal market, is most likely more influential on market shares at each eastern market than the supply side, shipping point. It is assumed that the prices reported by the western and Central New York Fruit and Vegetable Report are reflective of when and where New York onions are sold. The time period for the analysis was somewhat arbitrary and for the sake of convenience. weekly prices between November 3, 1986 and November 20, 1989 are the basis of the analysis. During many weeks New York onion prices are not reported and it is assumed they are not reported because no substantial amounts of New York onions moved through the particular terminal market that particular week. This would also apply to weeks in which prices for other sourcing states are not reported. It is further assumed, that if a particular market (i.e. Pittsburgh) is not reported during one particular week, then New York onion arrivals were not important in that market during that particular week. The price comparisons are only made during weeks when a price is reported. For example, within the time period of the analysis, there are 130-weeks. If prices are only reported for, say 50-weeks, then the mean price for the time period would be computed on the basis of 50-weeks not 130. Lastly, direct weekly competition between New York onions and the principal competitors are utilized for certain analysis (Table XVIII). Only weeks with simUltaneous reporting of competitor and New York price are used in this analysis. What follows is a market-by-market analysis of the terminal market prices for New York onions and their principal competitors. Each table presents the mean price for the weeks the onion prices are reported, the high and low prices, and the price variation between the weeks the onion price is reported. The price variation is an indicator of the volatility of the market for a particular onion. One cannot infer that a relatively high price variation is a result of unstable markets--for the reason may be the competition. However, high price variability of one onion price versus another indicates that a buyer may be more leery of purchasing a product because of the greater price uncertainty. IV.A. Atlanta Atlanta is not an important market for New York onions. On average, it represents 0.5% of total New York shipments (2% of New York arrivals) between January 1982 and December 1988. Table XI presents the relevant prices identified in the Atlanta market. Surprisingly, New York onion arrivals had the highest average prices. However, only during 5-weeks were New York onions sold in Table.XI ... WEEKLY PRICES OF VARIOUS DRY ONION ARRIVALS IN ATLANTA-­ NOVEMBER 3, 1986 TO NOVEMBER 20, 1989 SOURCING STATE AND ONION SIZE NUMBER OF WEEKS PRICE IS REPORTED MEAN PRICES HIGH LOW COEFFICIENT OF PRICE VARIATION* --$ PER 50 Ibs. BAG-­ COLORADO "jumbo" 12 $8.26 $9.25 $6.25 0.086 IDAHO-OREGON "jumbo" 20 8.87 13.00 6.25 0.485 5 10.37 14.50 5.50 1.135 13 9.46 19.75 5.63 2.652 NEW YORK "medium/repacker" TEXAS "jumbo" *--Price variance divided by price mean N lJ1 26 Atlanta. The inference may be that only during a relatively good market will New Yorkers ship to Atlanta, but the fact that the low price was $5.50 indicates that may not be the only reason. A more plausible reason may be that the competitors sell in Atlanta during periods of over supply. The price variation of New York onions is in-between the highest--Texas--and the lowest--Colorado. XV.B. Baltimore The Baltimore market is a relatively more important market to New York--3.S% of total shipments (10% of arrivals) between 1982 and 1988. Table XII presents findings which indicate New York 'medium/repacker' onions sold in Baltimore during 78-weeks and the 'large' onions for only 2S-weeks. On average, New York 'large' onion prices were 16% higher than 'medium/repacker' prices. Michigan onions are the most similar onions to New York's and their prices were very similar to New York's. The average price of Idaho 'jumbo' onions was only 1.3% higher than New York's 'large' onions and Colorado 'jumbo's' were almost the same price as New York's 'large'. only Texas 'jumbo' (not a New York competitor) prices were significantly higher. The implication is that New York onions compete rather well in the Baltimore market. In addition, since the Baltimore market is important to New York shippers it is therefore imperative that the competitive position in Baltimore be maintained. XV.c. Boston Based on the number of weeks prices are reported for New York onion arrivals, Boston is where the largest number of New York onions are sold. Table XIII presents the results which indicate that Boston represents 7% of total New York shipments (20% of arrivals) between 1982 and 1988. No doubt, the Boston market is very important to New York shippers. New York 'large' onions sell for a price 15% higher than New York 'medium/repacker' onions, but more importantly for only 1.2% less than Idaho 'jumbo' and 7.4% higher than Colorado 'jumbo's'. Unfortunately, most New York onion arrivals in Boston are 'medium/repacker', but these onions obtained a price of $15.00 per SOlbs bag during one week. It appears that if New York could market more 'large' onions they would compete very well in the Boston market. Also, the 'medium/repacker' market is relatively strong and should not be ignored. XV.D. Buffalo Buffalo is now an inconsequential market for New York onions--only 1.3% of total New York shipments (5% of arrivals). Price wise, the $6.89 mean price for New York 'medium/repacker' arrivals is the lowest price in the seven markets analyzed (see Table XIV). However, the prices for the other onions are relatively higher in Buffalo than in the other markets in the east. One implication is that even at relatively low prices New York onions Table XII ... WEEKLY PRICES OF VARIOUS DRY ONION ARRIVALS IN BALTIMORE-­ NOVEMBER 3, 1986 TO NOVEMBER 20, 1989 SOURCING STATE AND ONION SIZE NUMBER OF WEEKS PRICE IS REPORTED MEAN PRICES HIGH LOW COEFFICIENT OF PRICE VARIATION* --$ PER 50 lbs. BAG-­ COLORADO "jumbo's" 18 $8.26 $11.50 $5.88 0.253 IDAHO-OREGON "jumbo's" 93 8.32 18.00 3.75 0.618 MICHIGAN "medium/repacker" 34 7.44 10.00 6.00 0.168 '" --J MICHIGAN "large" 12 8.20 10.00 7.00 0.129 NEW YORK "medium/repacker" 78 7.07 14.50 3.75 0.311 NEW YORK "large" 25 8.21 14.00 6.00 0.582 TEXAS "jumbo's" 14 10.32 20.50 5.75 2.005 *--Price variance divided by price mean TABLE XIII ... WEEKLY PRICES OF VARIOUS DRY ONION ARRIVALS IN BOSTOM-­ NOVEMBER 3, 1986 TO NOVEMBER 20, 1989 '. SOURCING STATE AND ONION SIZE NUMBER OF WEEKS PRICE IS REPORTED MEAN PRICES HIGH LOW COEFFICIENT OF PRICE VARIATION* --$ PER 50 lbs. BAG-­ CALIFORNIA "medium" 29 $9.31 $14.50 $8.00 0.113 COLORADO "jumbo" 31 8.25 10.25 6.00 0.161 IDAHO-OREGON "jumbo" 91 8.91 18.50 5.00 0.641 MICHIGAN "medium" NEW YORK "medium/repacker" NEW YORK "large" CD 4 1.25 1.50 6.50 0.034 104 1.10 15.00 4.25 0.488 10 8.86 15.00 5.50 1.435 12 13.05 20.11 8.00 2.013 TEXAS "jumbo" '" *--Price variance divided by price mean Table XIV ... WEEKLY PRICES OF VARIOUS DRY ONION ARRIVALS IN BUFFALO-­ NOVEMBER 3, 1986 TO NOVEMBER 20, 1989 SOURCING STATE AND ONION SIZE NUMBER OF WEEKS PRICE IS REPORTED MEAN PRICES HIGH LOW COEFFICIENT OF PRICE VARIATION* --$ PER 50 lbs. BAG-­ COLORADO "jumbo" 15 $9.33 $9.75 $7.75 0.031 IDAHO-OREGON "jumbo" 37 9.89 19.50 6.50 0.930 NEW YORK "medium/repacker" 30 6.89 10.50 4.50 0.274 l\J \0 TEXAS "jumbo" 2 9.38 *--Price variance divided by price mean 11. 25 7.50 0.749 30 lost market share in Buffalo. Conversely, one can postulate that the reason New York lost market share in Buffalo was because it was selling the poorest quality onions in the market and the receivers chose to buy other higher quality products. Perhaps the most revealing aspect of Buffalo prices is the relative similarity of the three 'jumbo' mean and low prices, even though a wide gap exists between the high prices. The Idaho high price is nearly twice as high as the other two 'jumbo' prices. IV.B. Bew York City The New York City terminal market represents 11.2% of total New York shipments (25% of arrivals) over the 1982-1988 time period. It is the largest market in the country. There are particular "oddities" in this market (Table XV presents the prices). New York 'medium/repacker' mean price is 6% higher than the New York 'large' price, 13% higher than the Michigan 'medium/repacker' price, 6% higher than the Colorado 'large' price, and 3% higher than the Colorado 'jumbo' price! In no other eastern market is the New York 'medium/repacker' arrival price as good as in New York City. Another anomaly is that the Michigan 'large' mean price is the highest price during the fall and winter (Texas supplies spring/summer). Why would these price differentials exist? First, as mentioned in section III.B., Idaho was the sourcing state that captured the largest market share gains in New York City. Since the Idaho 'jumbo' mean price is only 8% above New York's 'medium/repacker' price and slightly less than the Michigan 'large' price, it is difficult to put forth an argument indicating Idaho onions were undercutting the competition. The preceding coupled with the relatively high price of New York 'medium/repacker' onions infers that onion type rather than size is mostly responsible for the market share deterioration. The price variation coefficients are similar in magnitude for most of the onions. IV.F. Philadelphia This market represents 5.1% of New York shipments (15% of arrivals) between 1982-'88. Of all the eastern markets, this is where Colorado onions have the most market penetration and the only market where the Colorado mean price is higher than the Idaho-Oregon mean price (See Table XVI). This particular outcome is somewhat puzzling--what is it about the Philadelphia market that allows higher prices for Colorado onions? In contrast to New York City, New York 'medium/repacker' prices are the lowest priced and with the next-least priced variation in the market. Also, Idaho-Oregon onions arrive at a price 17% higher than New York onions--the same price differential as in Baltimore and Boston. However, in Buffalo the price differential is 44% while in New York City it is 8% and in pittsburgh it is 13%. New York onion prices are quoted in half the weeks of the time period--69 from a possible 130--weeks. , Table XV ... WEEKLY PRICES OF VARIOUS DRY ONION ARRIVALS IN NEW YORK CITY-­ NOVEMBER 3, 1986 TO NOVEMBER 20, 1989 SOURCING STATE AND ONION SIZE NUMBER OF WEEKS PRICE IS REPORTED MEAN PRICES HIGH LOW COEFFICIENT OF PRICE VARIATION* --$ PER 50 lbs. BAG-­ COLORADO "jumbo" 8 $8.27 $9.75 $7.25 0.141 COLORADO "large" 3 8.00 8.50 7.50 0.031 90 9.16 20.25 5.50 0.727 IDAHO-OREGON "jumbo" w ...... MICHIGAN "medium/repacker" 26 7.52 11.50 4.75 0.408 MICHIGAN "large" 11 9.20 14.25 6.50 0.763 NEW YORK "medium/repacker" 63 8.49 17.00 4.50 0.581 NEW YORK "large" 47 7.99 16.00 5.88 0.622 TEXAS "jumbo" 12 10.72 19.50 5.75 0.947 *--Price variance divided by price mean Table XVI ••. WEEKLY PRICES OF VARIOUS DRY ONION ARRIVALS IN PHILADELPBXA-­ NOVEMBER 3, 1986 TO NOVEMBER 20, 1989 ' SOURCING STATE AND ONION SIZE NUMBER OF WEEKS PRICE IS REPORTED MEAN PRICES HIGH LOW COEFFICIENT OF PRICE VARIATION* --$ PER 50 lbs. BAG-­ COLORADO "jumbo" 34 $8.87 $13.00 $5.88 0.244 77 8.67 12.50 5.50 0.348 8 8.19 10.00 6.88 0.147 69 7.43 11.25 4.25 0.219 14 9.15 13.00 5.75 0.690 IDAHO-OREGON "jumbo" MICHIGAN "large" I\J NEW YORK "medium/repacker" TEXAS "jumbo" *--Price variance divided by price mean w 33 IV.G. Pittsburgh Pittsburgh is similar to Buffalo in importance to New York shippers in both volume and in the number of weeks that New York onion prices are quoted. The most surprising observation is the low Te~as 'jumbo' prices and corresponding price variation. In all other markets, Texas onions generally commanded the highest prices (see Table XVII). The author has very little insight as to why this would be. The other unusual price situation are the low price variation coefficients--the lowest of all the markets. Why? One possible explanation may be the relatively few number of receiving firms in this market as compared to the others. New York arrivals are better priced than Michigan onions--both 'large' and 'medium/repacker'. IV.H. Direct Weekly Price comparisons. The previous city price analysis did not take into account the weeks in which New York onions were quoted as compared to when the competitor prices were quoted. The following analysis only utilizes prices for weeks in which New York onion prices are simultaneously quoted with competitor prices (i.e. 'head-to-head' competition). This is a more direct measure of how price competitive New York onions are. Also, this type of analysis may reveal some pricing opportunities for New York shippers. In some markets, only New York price and its principal competitor price are compared while in others an additional comparison is made with two competitors rather than one. The reader should keep in mind that a total of 130-weeks are available for the price comparisons. The average number of weeks of the comparison is 45 with a high of 90-weeks in Boston for 'medium/repacker' and a low of 23-weeks in Baltimore for 'large'. Table XVIII presents the price comparisons. First, in all the market price comparisons, except New York City arrivals from New York, Idaho-Oregon, and Michigan, the price of New York onions is the lowest. The average percentage price differential for all the comparisons is 13.4% lower for New York onions as compared to competitor prices. As a side note, the Boston market is where New York onion prices are quoted the most number of weeks and the price differential there is 14.5% higher for Idaho-Oregon 'jumbos' as compared to New York 'medium/repacker'. The highest price differential is in Buffalo between New York 'medium/repacker' and Idaho-Oregon 'jumbo' prices and is 30% higher for Idaho-Oregon onions. Buffalo is followed by Pittsburgh--19.3%--and Philadelphia--18%. It is not necessarily true that New York 'large' prices versus New York 'medium/repacker' prices are consistently better. However, what is evident is that the 'large' prices are more volatile than the 'medium/repacker' prices. A striking difference between New York onions and its competitors is found in the high price column. The highest prices for non-New York onions are significantly higher than New York's Table XVII .•. WEEKLY PRICES OF VARIOUS DRY ONION ARRIVALS IN PITTSBURGH-­ NOVEMBER 3, 1986 TO NOVEMBER 20, 1989 I SOURCING STATE AND ONION SIZE NUMBER OF WEEKS PRICE IS REPORTED MEAN PRICES HIGH LOW COEFFICIENT OF PRICE VARIATION* --$ PER 50 lbs. BAG-­ COLORADO "jumbo" 3 $9.04 $10.25 $7.88 0.156 61 9.02 17.50 4.00 0.875 24 7.09 8.50 5.50 0.062 IDAHO-OREGON "jumbo" MICHIGAN "medium/repacker" "large" w ~ MICHIGAN 2 7.50 8.00 7.00 "medium/repacker" 37 7.96 13.00 5.50 0.436 TEXAS "jumbo" 13 7.46 8.63 6.50 0.076 NEW YOU *--Price variance divided by price mean 35 Table XVIII ... COMPARISON OF NEW YORK DRY ONION WEEKLY ARRIVALS PRICES WITH MAJOR COMPETITOR(S) PRICES*-­ NOVEMBER 3, 1986 TO NOVEMBER 20, 1988 ARRIVAL MARKET & COMPETITOR NUMBER OF WEEKS PRICES COMPARED MEAN PRICES HIGH LOW PRICES VARIABILITY --$ PER 50 lbs. BAG-­ BALTIMORE N.Y.- medium" I.O.-"jumbo" 75 75 $7.07 7.97 $14.50 16.00 $3.75 3.75 0.322 0.412 N.Y.-"medium" I.O.-"jumbo" MICH.-"medium 33 33 33 7.19 8.43 7.45 9.62 10.25 10.00 5.37 3.75 6.00 0.186 0.172 0.174 BALTIMORE N.Y.-"large" I.O.-"jumbo" 23 23 8.23 9.69 14.00 18.00 6.00 6.00 0.609 1.109 BOSTON N.Y.-"medium" I.O.-"jumbo" 90 90 7.75 8.87 13.50 18.50 4.25 5.00 0.379 0.557 BUFFALO N.Y.- medium" I.O.-"jumbo" 27 27 6.84 8.88 10.50 14.00 4.50 6.50 0.298 0.292 NEW YORK CITY N.Y.-"medium" I.O.-"jumbo" 53 53 8.63 9.39 14.50 17.50 4.50 5.50 0.402 0.600 N.Y.-"medium" I.O.-"jumbo" MICH.-"medium" 23 23 23 8.27 8.91 7.48 10.63 11. 00 11.50 6.00 6.00 4.75 0.150 0.195 0.398 NEW YORK CITY N.Y.-"large" I.O.-"jumbo" 41 41 8.25 9.50 16.00 20.25 6.12 6.00 0.623 1. 009 PHILADELPHIA N.Y.-"medium" I.O.-"jumbo" 60 60 7.62 8.79 11.25 12.50 4.25 5.50 0.190 0.356 N.Y.-"medium" I.O.- jumbo" COLO.-"jumbo" 33 33 33 7.46 8.79 8.85 9.50 12.50 13.00 6.25 6.00 5.88 0.064 0.160 0.189 PITTSBURGH N.Y.-"medium" I.O.-"jumbo" 36 36 8.01 9.56 13.00 17.50 5.50 5.50 0.434 0.811 II II II 36 highest price. The inference being that when the market is short, non-New York onions capture the premium prices much better than New York onions. Conversely, the lowest prices are similar for all shippers--when oversupply (low demand) conditions exist all arrivals are priced similarly. No discernable pattern can be identified for price variability nor its relationship to the pattern of mean prices. v. Summary and Conclusions The preceding analysis paints a rather bleak picture of New York onions' competitive position in both the national shipments market and in particular eastern u.s. cities terminal markets. Though the analysis is only based on a segment of total onion shipments (95%) and total onion arrivals (42%), it nonetheless can serve as an indicator of patterns and/or market share changes in the onion market. Caution should be exercised when attempting to use the analysis for extrapolating absolute volume and price changes in the future. What follows is a synthesis of what was found and possible strategies to ameliorate the erosion of New York's market share(s). During 1982, average monthly national dry storage onion shipments were 2,178,000 cwt. By 1988 the national market had increased by 27% to 2,768,000 cwt. During the same time period, New York onion shipments declined by 36.7%--from 317,300 cwt to 200,250 cwt. In 1982, New York's share of the national onion shipments market was 14.6% while in 1982 it dropped to 7.2%--half the market share was lost over six years. In the New York City market, New York onions maintained a 43% arrival market share during 1982, but by 1988 the share dropped to 11.2%--a decline of 74%1 The corresponding percentage market share declines in the other cities were: Boston--99.4%, Atlanta--95.7%, Baltimore--57.3%, Philadelphia--46.5%, and Pittsburgh--37.1%. Since New York onions lost significant market shares in an expanding market, then what shipping states gained? Between January 1982 and December 1988, average monthly onion arrivals in New York City were 128,226 cwt and this volume represents the largest market. Idaho, California and to a lesser extent Oregon were the primary gainers in market share. Boston arrivals averaged 81,667 cwt and the primary market share gainers were Idaho and "Other States". The "Other states" is most likely Georgia. Atlanta's average monthly arrivals were 70,289 cwt, but it has not been an important market for New York shippers. Philadelphia arrivals averaged 57,000 cwt and the gainers there were Idaho, Colorado and Oregon. Baltimore arrivals averaged nearly 50,000 cwt per month and the 20.7 share points lost by New York were gained by "Other States", Idaho and Colorado. Arrivals in Pittsburgh averaged 26,500 cwt and the market share gainers there were Idaho, Colorado and California. However, in Pittsburgh New 37 York only lost 9.2 share points while Texas lost 12.8 and Michigan lost 5.8 share points. Therefore, the losers and gainers in the Pittsburgh market are not as clear as in the other markets. Lastly, Buffalo arrivals averaged 10,000 cwt and the gainers there were "Other states" and Idaho. Contrary to many individuals' perceptions, Canada & Mexico did not increase their market shares significantly in any of the seven eastern markets. Based on a different analysis--correlation coefficients (c.c.) New York's primary shipment competitor was Michigan. In the New York City market, no strong correlation coefficients were found between New York arrivals and other sourcing states. However, c.c. analysis only measures the pattern of month-to-month shipments and not the quantities. Therefore, what the correlation coefficient analysis indicates is that Michigan's within year pattern of shipments most closely resembles that of New York shipments. The first quarter of the year is the most competitive followed by the fourth, third, and the second is the least competitive. competition is defined by the dispersion of market shares (i.e. the more spread the market shares the more competitive). Unfortunately, New York markets its onion during the two most competitive guarters. Prices were the most difficult to analyze, but some important observations were noted and some inferences deduced. First, in almost all of the seven markets when one compares the average price of New York onions with the competitor price (comparisons based only on weeks in which both New York and competitors are in the market), New York onions were the lowest priced. However, the comparison is primarily between New York 'medium/repacker' onions versus 'large', but primarily 'jumbo' onions. No doubt, the 'jumbo' would command a higher price. The average difference is about 17% higher for 'jumbo' onions versus New York onions. In the Atlanta market, a market where very few New York onions are sold, the average prices received for New York onions during the few weeks in which they sold, were the highest. The Baltimore market is also a market where New York onions receive relatively good prices versus the competition. Buffalo was the worst price market for New York onions. The Philadelphia market was the next worst price market for New York onions. The Boston market was where New York onion prices were quoted the most number of weeks (i.e. longest market presence) and the 'medium/repacker' price was, on average, $1.16 per 50 lbs bag less than the 'large' price. No doubt, more 'large' onions could be sold in Boston. The opposite was true in New York City--the 'medium/repacker' price was higher than the 'large' price. In fact, the New York 'medium/repacker' average price in New York City was higher than the average price for Colorado 'jumbo' and 'large' onions. 38 Another observation applicable to all the markets was that New York onion prices were not as good in "high price" markets as were the competition prices. conversely, in "low price" markets, New York onions did just as poorly as everyone else. Lastly, no patterns were identified between the variations in prices between weeks and relative absolute prices. :. 39 BIBLIOGRAPHY • . 1.)- Figueroa, E.E. "The Competitiveness of New York state Onions During the 1987-1988 Marketing Year" , Department of Agricultural Economics, Cornell University Agricultural Experiment station, New York state College of Agricultural and Life Sciences, Cornell University, Ithaca, N.Y. A.E. Res. 89-1. January 1989. 2. ) New York State Department of Agriculture & Markets, "western and Central New York Fruit and Vegetable Report", Division of Marketing, Rochester, N.Y. Various issues. 3.) united states Department of Agriculture, Fresh Fruit and Vegetable Arrival Totals: For 22 Cities, Agricultural Marketing Service, Fruit and Vegetable Division, Market News Branch. Various Issues. 4.) United states Department of Agriculture, Fresh Fruit and Vegetable Shipments: By Commodities, States, and Months, Agricultural Marketing Service, Fruit and Vegetable Division, Market News Branch. Various Issues. 5.) United States Department of Agricul ture, Vegetables and Special ties: situation and Outlook Yearbook, Economic Research Service, TVS-249. November 1989.