Document 11949824

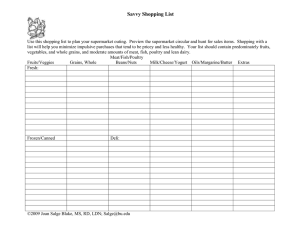

advertisement