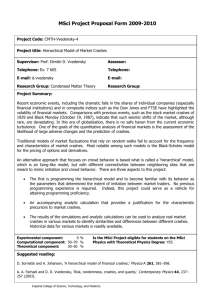

Market fragility and international market crashes Abstract Dave Berger

advertisement