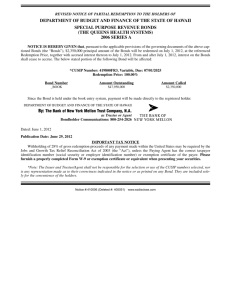

N I R (Book-Entry Only)

advertisement