Is the U.S. Losing Its Manufacturing Base? William Strauss Rocky Mountain Economic Summit

advertisement

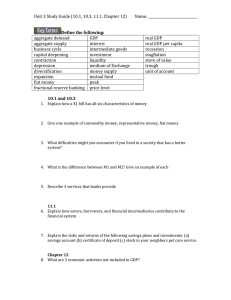

Is the U.S. Losing Its Manufacturing Base? Rocky Mountain Economic Summit Afton, WY July 10, 2014 William Strauss Senior Economist and Economic Advisor Federal Reserve Bank of Chicago The Setup 2 Manufacturing output peaked in December 2007 and fell 20.8% over the following 18 months Industrial production ‐ manufacturing Index 2007 = 100 110 100 90 80 70 60 50 1990 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 3 Manufacturing capacity utilization collapsed to the lowest rate in 70 years Capacity utilization ‐ manufacturing percent 86 84 82 80 78 76 74 72 70 68 66 64 62 1990 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 4 Job declines in the manufacturing sector were significant, with over 2.0 million jobs lost over that same period Manufacturing employment percent 5 0 ‐5 Percent change from a year earlier ‐10 ‐15 Quarterly change (saar) ‐20 1990'91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 5 Is the U.S. Losing Its Manufacturing Base? 6 Manufacturing employment as a share of national employment has been declining for over 60 years Manufacturing employment as a share of total nonfarm employment percent 40 35 30 25 20 15 10 5 0 1940 7 '50 '60 '70 '80 '90 '00 '10 The number of jobs in manufacturing has been relatively stable over this period, edging lower on average by -0.3% per year since 1947 Manufacturing employment mi l lions 20 18 16 14 12 10 8 6 4 2 0 1940 8 '50 '60 '70 '80 '90 '00 '10 Not to make a mountain out of a molehill, but manufacturing employment was increasing up until 1979 and has been moving lower over the past 30 years Manufacturing employment mi l lions 20 18 0.8% 16 ‐1.3% 14 12 10 1940 9 '50 '60 '70 '80 '90 '00 '10 However, service sector employment has grown more than fourfold over this period, averaging growth of 2.3% per year since 1947 Employment mi l lions 120 100 s ervi ce 80 60 40 20 ma nufacturing 0 1940 10 '50 '60 '70 '80 '90 '00 '10 While manufacturing employment has been edging lower over the past 63 years, manufacturing output increased by 3.2% per year Manufacturing output Index 2007=100 120 100 80 60 40 20 0 1940 11 '50 '60 '70 '80 '90 '00 '10 This translated into an almost 600 percent increase in manufacturing output over this time period Manufacturing Index 2007=100 mi l lions 120 120 100 100 output ‐ l eft scale 80 80 60 60 40 40 20 20 empl oyment ‐ ri ght s cale 0 0 1940 12 '50 '60 '70 '80 '90 '00 '10 The increase in output can be attributed to strong productivity growth experienced by the manufacturing sector Manufacturing productivity Index 1950=100 600 500 400 300 200 100 0 1950 13 '60 '70 '80 '90 '00 '10 What took 1,000 workers to produce in 1950 takes 167 workers today Manufacturing sector: Number of workers needed to do the work of 1,000 workers in 1950 Number of workers 1,000 900 800 700 600 500 400 300 200 100 0 1,000 813 627 485 377 253 1950 14 1960 1970 1980 1990 2000 183 175 2010 2013 Manufacturing productivity has been growing faster over the past 40 years Productivity Avera ge annual percent change 5 Nonfa rm business Ma nufacturing 4.1 4 3.3 2.8 3 2.6 2.6 2.6 2.2 2.1 2.6 2.2 1.7 2 1.7 1.5 0.7 1 0 1950s 15 1960s 1970s 1980s 1990s 2000s 2010‐2013 The divergence in productivity appears to have occurred around the mid-1970s Productivity Index 1975=100 350 300 ma nufacturing 250 200 150 nonfarm business 100 50 0 1950 16 '60 '70 '80 '90 '00 '10 This divergence is especially apparent in durable manufacturing Productivity Index 1975=100 450 400 dura ble manufacturing 350 300 250 200 nondurable ma nufacturing 150 100 50 0 1950 17 '60 '70 '80 '90 '00 '10 Strong productivity growth had allowed the manufacturing sector to grow faster than the overall economy Output Index 1947=100 900 800 i ndustrial production ‐ ma nufacturing 700 600 rea l GDP 500 400 300 200 100 0 1947 18 '52 '57 '62 '67 '72 '77 '82 '87 '92 '97 '02 '07 '12 However, lower relative prices in the manufacturing sector has lead to manufacturing comprising a smaller share of GDP over time Manufacturing share of GDP percent 30 25 20 15 10 1947 19 '52 '57 '62 '67 '72 '77 '82 '87 '92 '97 '02 '07 '12 However, the US still makes over 70% of what it consumes % of US manufactured goods consumed in 20101 by source 100 Made in: 80 China 60 Other lowcost countries 40 Rest of the World 20 Net US 0 Food and Beverages Petroleum and Coal Fabricated ChemicalsPrimary metal Transportation goods Machinery Computers Apparel, Wood Products Plastics and Rubber Furniture Textiles and Fabrics metals & electronics footwear, & Paper Products Glass, Stone, and Minerals Miscellaneous accessories Appliances & Electrical equipment Value of US manufactured goods consumed by category (Billion USD) From the Boston Consulting Group 20 How profitable is manufacturing? 21 While more cyclical, profits in manufacturing have out-performed returns in nonfinancial corporate businesses Profits ‐ as a percent of value added percent 30 25 ma nufacturing 20 15 10 nonfinancial corporate business 5 0 1950 22 '55 '60 '65 '70 '75 '80 '85 '90 '95 '00 '05 '10 The Manufacturing Sector Continues to Re-invent Itself 23 Over the last twenty years the fastest growing sector, not surprisingly, has been computer and electronic components Industrial output: 1990 ‐ 2013 percent change (annual ra te) ‐10 Manufacturing Durable Goods Wood Products Nonmetallic Mineral Products Primary Metals Fabricated Metal Products Machinery Computer and Electronic Components Electrical Eqpt, Appliances & Components Motor Vehicles and Parts Aerospace & Miscellaneous Transport Equip Furniture and Related Products Miscellaneous Durable Goods Nondurable Manufacturing Food, Beverages, and Tobacco Textile and Product Mills Apparel and Leather Goods Paper Printing and Related Support Activities Chemicals Petroleum and Coal Products Plastics and Rubber Products Other Manufacturing 24 ‐5 0 5 10 15 There has been a large number of industrial sectors that have risen and fallen over the past twenty years Industrial output: 1990 ‐ 2013 percent change (annual ra te) ‐8 Manufacturing Durable Goods Wood Products Nonmetallic Mineral Products Primary Metals Fabricated Metal Products Machinery Electrical Eqpt, Appliances & Components Motor Vehicles and Parts Aerospace & Miscellaneous Transport Equip Furniture and Related Products Miscellaneous Durable Goods Nondurable Manufacturing Food, Beverages, and Tobacco Textile and Product Mills Apparel and Leather Goods Paper Printing and Related Support Activities Chemicals Petroleum and Coal Products Plastics and Rubber Products Other Manufacturing 25 ‐6 ‐4 ‐2 0 2 4 6 The collapse in manufacturing experienced in 2008-2009 was closely linked with the economic recession 26 Declines in manufacturing output were broad-based during the Great Recession – especially in vehicle and primary metals manufacturing Industrial output: December 2007 ‐ June 2009 percent change ‐60 Manufacturing Durable Goods Wood Products Nonmetallic Mineral Products Primary Metals Fabricated Metal Products Machinery Computer and Electronic Components Electrical Eqpt, Appliances & Components Motor Vehicles and Parts Aerospace & Miscellaneous Transport Equip Furniture and Related Products Miscellaneous Durable Goods Nondurable Manufacturing Food, Beverages, and Tobacco Textile and Product Mills Apparel and Leather Goods Paper Printing and Related Support Activities Chemicals Petroleum and Coal Products Plastics and Rubber Products Other Manufacturing 27 ‐50 ‐40 ‐30 ‐20 ‐10 0 The recovery has also been broad-based with motor vehicles and primary metals manufacturing leading the way Industrial output: June 2009 ‐ May 2014 percent change ‐20 Manufacturing Durable Goods Wood Products Nonmetallic Mineral Products Primary Metals Fabricated Metal Products Machinery Computer and Electronic Components Electrical Eqpt, Appliances & Components Motor Vehicles and Parts Aerospace & Miscellaneous Transport Equip Furniture and Related Products Miscellaneous Durable Goods Nondurable Manufacturing Food, Beverages, and Tobacco Textile and Product Mills Apparel and Leather Goods Paper Printing and Related Support Activities Chemicals Petroleum and Coal Products Plastics and Rubber Products Other Manufacturing 28 0 20 40 60 80 100 120 140 Manufacturing workers have suffered steep employment declines over the current cycle Manufacturing employment trough = 100 125 upper and lower bounds around GDP troughs 120 115 110 105 100 current cycle 95 90 85 ‐8 ‐6 ‐4 ‐2 0 2 4 6 8 10 12 14 16 Quarters away from trough of real GDP 29 18 20 22 24 26 28 But the overall economy’s employment growth also struggled Total nonfarm employees trough = 100 130 upper and lower bounds around GDP troughs 125 120 115 110 105 100 current cycle 95 90 ‐8 ‐6 ‐4 ‐2 0 2 4 6 8 10 12 14 16 Quarters away from trough of real GDP 30 18 20 22 24 26 28 When changes in nonfarm employment are considered, the most recent manufacturing employment downturn is not unprecedented Manufacturing employment share percent 10 8 6 4 2 0 ‐2 ‐4 ‐6 ‐8 ‐10 1947 31 '52 '57 '62 '67 '72 '77 '82 '87 '92 '97 '02 '07 '12 The financial crisis and its aftermath has hampered the current economic expansion Real GDP trough = 100 150 upper and lower bounds around GDP troughs 140 130 120 110 current cycle 100 90 ‐8 ‐6 ‐4 ‐2 0 2 4 6 8 10 12 14 16 Quarters away from trough of real GDP 32 18 20 22 24 26 28 The recovery in manufacturing output is in-line with past industrial recoveries Industrial production ‐ manufacturing trough = 100 170 upper and lower bounds around GDP troughs 160 150 140 130 current cycle 120 110 100 90 ‐8 ‐6 ‐4 ‐2 0 2 4 6 8 10 12 14 16 Quarters away from trough of real GDP 33 18 20 22 24 26 28 Productivity in the overall economy has grown at a rate below the low-end of previous expansions Productivity ‐ nonfarm business trough = 100 130 upper and lower bounds around GDP troughs 125 120 115 110 105 current cycle 100 95 90 ‐8 ‐6 ‐4 ‐2 0 2 4 6 8 10 12 14 16 Quarters away from trough of real GDP 34 18 20 22 24 26 28 However, productivity within the manufacturing sector has grown at a somewhat faster pace Productivity ‐ manufacturing trough = 100 135 upper and lower bounds around GDP troughs 130 125 120 115 110 current cycle 105 100 95 90 ‐8 ‐6 ‐4 ‐2 0 2 4 6 8 10 12 14 16 Quarters away from trough of real GDP 35 18 20 22 24 26 28 Manufacturing employment losses have occurred across numerous countries – among 20 big economies, 22 million jobs were lost 36 Is the U.S. positioned to continue its strong productivity gains? 37 U.S. maintaining its commitment to research and development Research and development expenditures as a share of GDP percent 3.0 2.5 2.0 1.5 1.0 1953 38 '58 '63 '68 '73 '78 '83 '88 '93 '98 '03 '08 The vast majority of U.S. research and development is being privately funded Share of research and development that is privately funded percent 80 70 60 50 40 30 1953 39 '58 '63 '68 '73 '78 '83 '88 '93 '98 '03 '08 Lessons from the farm sector 40 We are producing more in our farm sector than at any time in our history Real gross value added: farm business Bi l lions of chained 2005 dollars 140 120 100 80 60 40 20 0 1947 41 '57 '67 '77 '87 '97 '07 And we are accomplished this remarkable feat with less than 2.0% of our employment devoted to farming Share of total employment percent 90 80 services 70 60 50 40 30 manufacturing 20 10 agriculture 0 1870 1880 1890 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 42 Trade with China 43 China has risen to number one in terms of U.S. imports, representing 19.4% of all imports in 2013 Imports (customs value) bi l lions of dollars 2,500 2,000 rest of imports 1,500 UK Korea Germany 1,000 Japan Mexico Canada 500 China 0 1975 44 '80 '85 '90 '95 '00 '05 '10 While China has risen to be our third largest export country, it represents only 7.7% of U.S. exports Exports (f.a.s.) bi l lions of dollars 1,600 1,400 1,200 rest of exports 1,000 Korea 800 Germany 600 400 Japan China Mexico 200 Canada 0 1975 45 UK '80 '85 '90 '95 '00 '05 '10 This difference has led to China having the largest trade deficit with the U.S. Trade balance (customs value) bi l lions of dollars 100 0 ‐100 China ‐200 ‐300 Japan ‐400 ‐500 UK Canada Germany Mexico Korea ‐600 rest of trade deficit ‐700 ‐800 ‐900 1975 46 '80 '85 '90 '95 '00 '05 '10 China has certainly increased the amount of goods flowing into the U.S. Imports (customs value) Index 1990=100 3,000 China 2,500 2,000 1,500 Mexico 1,000 rest of imports Canada 500 Germany UK 0 1975 47 '80 '85 '90 '95 '00 '05 Korea Japan '10 They have also represented the largest gain for exports from the U.S. Exports (f.a.s.) Index 1990=100 3,000 China 2,500 2,000 1,500 1,000 Mexico rest of imports Canada 500 Germany Korea Japan 0 1975 48 '80 '85 '90 '95 '00 '05 '10 UK While China has increased its share of imports to the U.S., the Pacific Rim as a whole has had a declining share since the mid-90s Share of U.S. imports percent 45 40 Pacific Rim 35 30 Pacific Rim excluding China 25 20 15 10 China 5 0 1974 49 '78 '82 '86 '90 '94 '98 '02 '06 '10 U.S. share of world manufacturing steady for last 40 years Manufacturing value added, % of world 100 80 58% 58% 46% Rest of World 60 China 15% 40 Japan 17% ...and remains the biggest in the world in mfg value add by a sizeable margin 20 US 0 1950 1960 25% 1970 1980 1990 From the Boston Consulting Group 50 2000 15% 24% 2010 U.S. share of world manufacturing steady for last 40 years Manufacturing value added, % of world 100 80 58% 58% 46% Rest of World 60 China 15% 40 Japan 17% ...and remains the biggest in the world in mfg value add by a sizeable margin 20 US 0 1950 1960 25% 1970 1980 1990 From the Boston Consulting Group 51 2000 15% 24% 2010 Energy 52 Adjusted for inflation, current oil prices are below the levels that existed thirty years ago Real West Texas Intermediate oil price dol lars per barrel, 2013 dollars 160 140 120 100 80 60 40 20 0 1970 53 '75 '80 '85 '90 '95 '00 '05 '10 Natural gas prices are quite low Real natural gas price dol lars per mmbtu, 2013 dollars 16 14 12 10 8 6 4 2 0 1994 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 54 Due to technology that now allows access to reserves that have been known for quite a few years 55 Between 1994 and 2005 the natural gas to oil price ratio averaged 13.4% - year-to-date it has averaged 4.8% in 2014 Natural gas price to oil price ratio percent (dollars per mmbtu/dollars per barrel West Texas i ntermediate) 35 30 25 20 15 10 5 0 1994 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 56 Implication: The U.S. is one of the world's lowest-cost countries for manufacturing Major exporting nation average manufacturing cost structures relative to U.S. (2015 projections) Manufacturing cost index (U.S. = 100) 140 123 120 115 115 108 38 100 100 110 30 28 2 6 2 7 77 78 21 25 2 5 2 6 US = 100 94 19 80 1 2 78 4 4 15 80 77 2 4 77 74 0 U.S. Germany France Labor (productivity-adjusted) 57 Italy United Kingdom Electricity Natural Gas From the Boston Consulting Group Japan Other China The Current Expansion 58 Beginning in July 2009, manufacturing output in the United States has been increasing at a 4.8% annualized rate and as of May 2014 it finally regained all the output lost during the Great Recession Industrial production ‐ manufacturing Index 2007 = 100 110 100 90 80 70 60 50 1990 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 59 Manufacturing capacity utilization has been rising since June 2009 Capacity utilization ‐ manufacturing percent 86 84 82 80 78 76 74 72 70 68 66 64 62 1990 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 60 And while manufacturing jobs have been rising, they have only recovered 29.1% of the jobs lost during the downturn Manufacturing employment percent 5 0 ‐5 Percent change from a year earlier Percent change from a year earlier ‐10 ‐15 Quarterly change (saar) Quarterly change (saar) ‐20 1990'91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 61 Summary Manufacturing output is in the process of recovering its losses The success of manufacturing has been driven by productivity Manufacturing employment has shown little change over the past 70 years – with a steady decline over the past 30 years The most recent decline in manufacturing was cyclical, not structural Profits in manufacturing have outperformed profits for the rest of the nation The trends that have dominated manufacturing for the past 70 years are suggestive of the future for U.S. manufacturing: ever increasing output with employment representing a smaller share of total employment 62 Chicago Fed Letter - June 2003 www.chicagofed.org 63