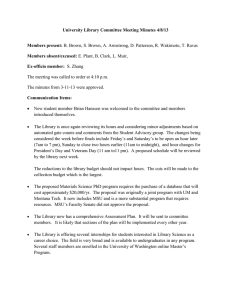

University of Montana For the Fiscal Year Ended June 30, 2014 J

advertisement