The road ahead Gaining momentum from energy transformation

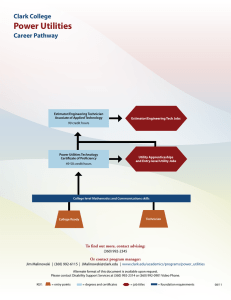

advertisement