Tax Newsletter February 2015 Audit | Tax | Advisory www.crowehorwath.rs

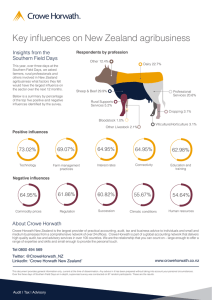

advertisement

Tax Newsletter February 2015 Audit | Tax | Advisory www.crowehorwath.rs The Government of the Republic of Serbia, at the meeting held on 24 February 2015, adopted the Decree on Amendments of the Decree on Criteria for Determining Prevailing Supply of Goods Abroad in Accordance with the VAT Law (hereinafter: the Decree), which will enter into force on the following day after its publication in the Official Gazette of the Republic of Serbia. The most important change in the Decree is the duty of VAT taxpayers which perform export as its prevailing business activity to submit PID VAT form, along with the VAT tax return for the period in a current year in which the financial statements (for the previous FY) have been submitted. Therefore, needed corrections of the PID VAT form were made. Prior to the adoption of before said amendments to the Decree, VAT taxpayers – prevailing exporters, were obliged to submit respected PID VAT form in February of the current year as the same was detemined as period for the submission of annual financial statements. Taking into consideration that the deadline for the submission of the annual financial statements has been moved to the end of June of the current year, changes made to the Decree were necessary as a harmonizing process of legislation. Criteria for qualifying for the prevailing exporter status remain the same. In case you have any questions or doubts, please do not hesitate to contact us. Sincerely yours, Crowe Horwath BDM Contact details: Bogdan Đurić Managing Partner bogdan.djuric@crowehorwath.rs +381 60 60 61 200 Pavle Ristić Tax Manager pavle.ristic@crowehorwath.rs +381 64 803 71 76 Vladimir Deljanin Tax Manager vladimir.deljanin@crowehorwath.rs +381 64 803 71 75 Crowe Horwath BDM d.o.o. Beograd Terazije 5, IV floor, 11000 Belgrade www.crowehorwath.rs Phone: +381 11 65 58 500 Fax: +381 11 65 58 501 E-Mail: office@crowehorwath.rs Crowe Hotrwath BDM is a member of Crowe Horwath International, a Swiss verein (Crowe Horwath). Each member firm of Crowe Horwath is a separate and independent legal entity. Crowe Hotrwath BDM and its affiliates are not responsible or liable for any acts or omissions of Crowe Horwath or any other member of Crowe Horwath and specifically disclaim any and all responsibility or liability for acts or omissions of Crowe Horwath or any other Crowe Horwath member. © 2015 Crowe Horwath BDM Audit | Tax | Advisory www.crowehorwath.rs