Investment, consumption, and hedging under incomplete markets ARTICLE IN PRESS Jianjun Miao

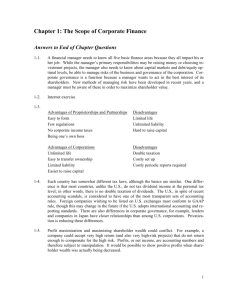

advertisement