Boston University FE 810: Finance 2 Module 4: SPRING 2016 Class Schedule

advertisement

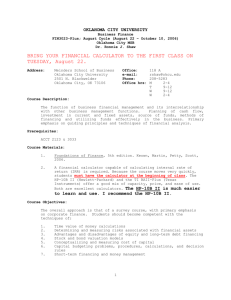

BU BostonUniversitySchoolofManagement BostonUniversityQuestromSchoolofBusiness FE810:Finance2 Module4:SPRING2016ClassSchedule Session Date Day Topic UNIT1:FINANCIALPOLICYUNIT 1 3/14 M • Introduction,Overview,andReview 2 3/16 W • CapitalStructureinaPerfectMarket 3 3/21 M • DebtandTaxes 4 3/23 W • FinancialDistress 5 3/28 M • PayoutPolicy 6 3/30 W • Exam1 UNIT2:FIRMVALUATIONUNIT • ValuationwithLeverage 7 4/4 M • BBBYandUST(TeamCases) • ValuationandFinancialModeling 8 4/6 W • InfineonandIntel(TeamCases) UNIT3:OPTIONSUNIT 9 4/11 M • FinancialOptions 10 4/13 W • FinancialandRealOptions • RealOptions 11 4/20 W • ArundelandLauraMartin(TeamCases) • ReviewandWrap-Up 12 4/25 M • MWPetroleumandMerck(TeamCases) 13 4/27 W Exam2 Readings (bookchapters) Assignments (duepriortoclass) • 14 • 15 • 16 • 17 • Chapter14DataCase • PracticeProblems1 • Chapter15DataCase • PracticeProblems2 • 18 • Chapter17DataCase • 19 • PracticeProblems3 • 20,21 • 21,22 • Chapter18DataCase • 22 • PracticeProblems4 BU BostonUniversityQuestromSchoolofBusiness BostonUniversitySchoolofManagement FE810:Finance2 Instructor: DirkHackbarth Office: Room564 OfficePhone: (617) 358-4206 e-mail: dhackbar@bu.edu OfficeHours: 2-3pm on Tuesdays o r by appointment We will have plenty of TA office hours, which are completely voluntary. Their aim is to help students who strugglewithsomeofthetheoreticalandpracticalconceptsdiscussedinclass.Thedetailsaregivenbelow. Teaching Assistant Email BenCourtney blc11@bu.edu TAOfficeHours Tu11.00-12.30 (Room518L) W15.30-17.00 COURSEDESCRIPTION Thecoursecanbedividedintothefollowingthreebuildingblocks. 1. FinancialPolicy We consider first how the choice of debt and equity affects firm value in a perfect capital market. ThereweapplytheLawofOnePricetoshowthataslongasthecashflowsgeneratedbythefirm’s assets are unchanged, then the value of the firm—which is the total value of its outstanding securities—doesnotdependonitscapitalstructure.Therefore,ifcapitalstructurehasaneffecton firmvalue,itmustcomefromchangestothefirm’scashflowsthatresultfrommarketimperfections, suchasbankruptcycostsandtaxes.Henceweanalyzetheroleofdebtinreducingthetaxesafirmor itsinvestorswillpay,andconsiderthecostsoffinancialdistressandchangestomanagerialincentives thatresultfromleverage.Finally,weconsiderthefirm’schoiceofpayoutpolicyandask:Whichisthe bestmethodforthefirmtoreturncapitaltoitsinvestors? 2. FirmValuation Weintegrateourunderstandingofrisk,return,andthefirm’schoiceofcapitalstructure.Wedevelop the three main methods for capital budgeting with leverage and market imperfections: weighted averagecostofcapital(WACC)method,adjustedpresentvalue(APV)method,andflow-to-equity(FTE) method.Wewillidentifyconditionsthatcanmakeonemethodeasiertoapply.Wethenvalueafirm (Ideko)inthecontextofaleveragedacquisition,whichservesasacapstonecasethatillustrateshowall theconceptsdevelopedthusfarareusedtomakecomplexreal-worldfinancialdecisions. 3. Options Weturntosettingsinwhichafirmoraninvestorhasanoptionbutnotanobligationtobuyorsellan assetinthefuture.Financialoptionsareanimportanttoolforcorporatefinancialmanagersseeking to manage or evaluate risk. The growth of derivatives markets can be traced to the discovery of methodsforvaluingoptions,whichwederiveinusingtheLawofOnePrice.Animportantcorporate applicationofoptiontheoryisintheareaofrealinvestmentdecision-making(orrealoptions). COURSEOBJECTIVES • Buildingonconceptscoveredinthefinancemoduleofthecorecurriculum(Module2),this courseextendsfundamentalconceptsofcorporatefinance,capitalmarketsandassetpricing introducedinthecore.ThecoursepreparesfinanceconcentratorsforthespecializedMBA financeelectivesofferedinthesecondyear.Thecoursewillprovideskillsrelevantforallfinance electivesandisrequiredforallfinanceconcentratorsinthefulltimeMBAprogram.Itwillhelp studentstoacquirenecessaryknowledgeforasuccessfulsummerinternship. • Thiscoursecoversthecoreoffinancewithanemphasisonapplicationsthatarevitalfor corporate,riskandportfoliomanagers.Wewilldiscussmanyofthemajorfinancialdecisions madebymanagersbothwithinthefirmandininteractionswithothermarketparticipants.We willemphasizetheroleofrisk,howitismanagedandhowrisk,uncertainty,informationand incentivesinteractandcanbeaddressedbydesigningappropriatemechanisms. • The course aims to provide you with a set of analytical tools necessary to answer the most importantquestionsrelatedtofinancialpolicy,firmvaluation,andoptions.Overall,thesecourse objectives contribute towards the MBA learning goals by enabling graduates to deepen their understandingofcoreconceptsoffinance,andbyhelpinggraduatestobeabletosuccessfully applycriticalandanalyticalthinking. COURSEPEDAGOGY • Thecoursewillbeamixof o Lectures o Casestudiesandexamples o PracticeproblemssolvedinExcel o Discussionsofcurrentdevelopments • Studentsshouldalwaysbringanddisplaytheirnamecardsinclass. COURSEMATERIALS • Required textbook: Corporate Finance by Jonathan Berk and Peter DeMarzo, 3rd edition (withoutMyFinanceLab),PrenticeHall,ISBN-13:978-0-13-342415-7. We will discuss a series of cases, which are available electronically for purchase from the HarvardBusinessSchoolwebsite(http://hbsp.harvard.edu/),andcanbefoundasaCoursepack atthefollowingsiteatHBSpublishing:https://cb.hbsp.harvard.edu/cbmp/access/48069115. It is expected that the required readings pertinent to each class will be completed before the lecture. We reserve the right to pose questions to individual students during lectures ("cold calls")inordertostimulateclassparticipation. • Additional materials: Lecture notes and additional content will be available on the course website on QuestromTools (see below). You are required to print out the course materials pertinenttoeachmeetingandbringthemwithyoutoclass(orhavethemavailableonatablet deviceoralaptop). • Coursewebsite:Allclassmaterialswillbepostedonthecoursewebsite.Inadditiontoallclass materials, I will also post practice exams, problems, and repeat important announcements on thewebsite;itisyourresponsibilitytovisititfrequently,anddefinitelybeforeeachclass. 3 PERFORMANCEEVALUATION Thefollowingevidencewillbeusedtodetermineyourgrade: Component Exam1(March30) Exam2(April27) DataCases TeamCases ClassParticipation Weight 20% 30% 20% 15% 15% DetailsonPerformanceEvaluation. • Exams:Theexamswillcoverthematerialofthecourse.Youwillbeallowedtouseuptotwo lettersizepages(oratwo-sidedpage)as“cheatsheet”preparedinadvanceoftheexam. • Data Cases (spreadsheet assignments): Building spreadsheet models helps to achieve one of the main goals of this course – learning the logical relationships among financial variables. Moreover,theabilitytoworkcomfortablywithspreadsheetmodelsisanessentialskillthatcan onlybeacquiredthroughpractice.Therewillbefourspreadsheetassignmentsfromthecourse textbook, which you are to complete and submit throughout the semester. The spreadsheet assignmentsaretobepreparedindividuallyanddueonlineonthedatelistedintheschedule. • TeamCasePresentations:Groupsof3studentspresenttheirsolutionstothecasesonthefirst pageofthesyllabus.Ondatesinwhichcasesaredue,therewillbeatleasttwostudentorteam presentationsofeachcase.Youareencouragedtosign-upassoonaspossible(again,thereisa maximumof3studentsperslot).Thelistoftheavailableslotswillbegiveninclass,andslotsare first-come,first-serve. • ClassParticipation:Iwillexpectactiveparticipationbystudents.“Activeparticipation”doesnot meanthatyouneedtotrytoanswereverysinglequestionposedinclass.Thoughtfulquestions, answers,andremarkswillberewarded.“Thoughtful”doesnothavetocoincidewith“correct”. Thegoalofparticipationistoarrivetogetherattherightanswer. • PracticeProblems:Thoughnotpartoftheperformanceevaluation,studentsshouldindividually workthroughallpracticeproblemsandconsultwiththeTAincasetheyhaveanyquestions. ACADEMICINTEGRITY Wewillabidebytheschool’scodeofacademicintegrity:http://questromworld.bu.edu/acc/.Note thatworkingaspartofagroupimpliesthatyouareanactiveparticipantandfullycontributedto theoutputproducedbythatgroup. ATTENDANCEATEXAMS Nomake-upexamswillbegiven.Unexcusedabsencewillresultinazerobeingenteredfortheexam grade. Excusedabsence(veryrare)willresultinthefinalgradebeingdeterminedbytheother evaluationinputs.An excusedabsencemustbearrangedwiththeinstructorbeforetheexam. Universitylettersallowingspecialexam takingproceduresmustbeprovidedtotheinstructoratleast oneweekpriortotheexam. 4