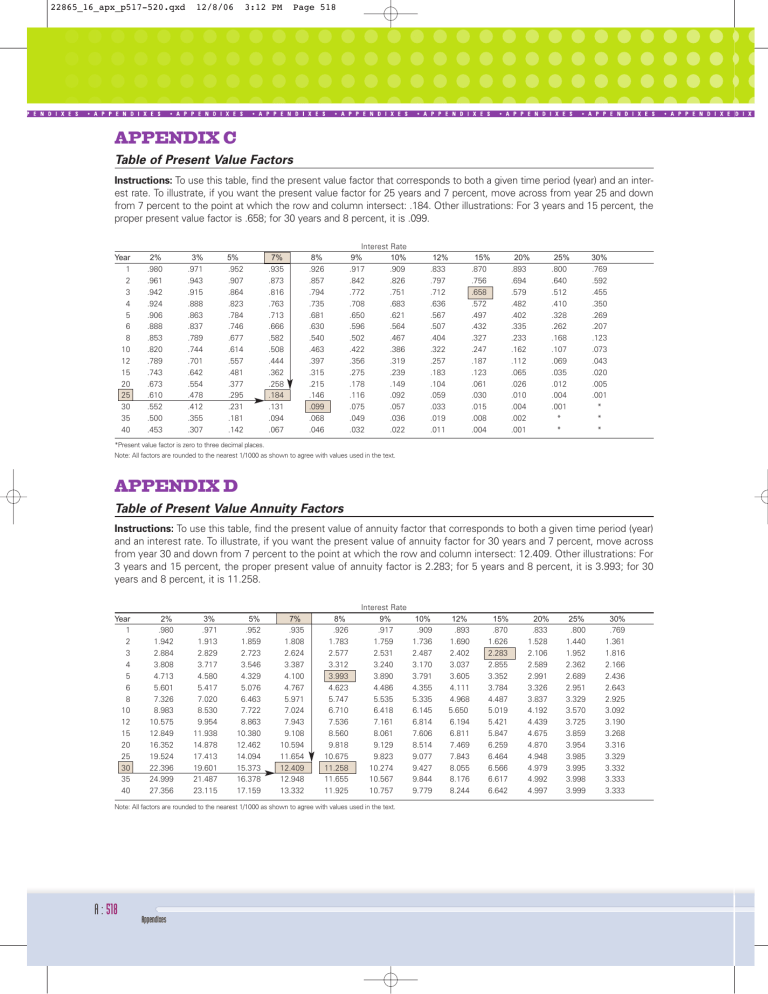

APPENDIX C Table of Present Value Factors

22865_16_apx_p517-520.qxd 12/8/06 3:12 PM Page 518

A : 518

APPENDIX C

Table of Present Value Factors

Instructions: To use this table, find the present value factor that corresponds to both a given time period (year) and an interest rate. To illustrate, if you want the present value factor for 25 years and 7 percent, move across from year 25 and down from 7 percent to the point at which the row and column intersect: .184. Other illustrations: For 3 years and 15 percent, the proper present value factor is .658; for 30 years and 8 percent, it is .099.

20

25

30

35

40

8

10

12

15

Interest Rate

Year 2% 3% 5% 7% 8% 9% 10% 12% 15% 20% 25% 30%

1

2

.980

.961

.971

.943

.952

.907

.935

.873

.926

.857

.917

.842

.909

.826

.833

.797

.870

.756

.893

.694

.800

.640

.769

.592

5

6

3

4

.942

.924

.906

.888

.915

.888

.863

.837

.864

.823

.784

.746

.816

.763

.713

.666

.794

.735

.681

.630

.772

.708

.650

.596

.751

.683

.621

.564

.712

.636

.567

.507

.658

.572

.497

.432

.579

.482

.402

.335

.512

.410

.328

.262

.455

.350

.269

.207

.853

.820

.789

.743

.673

.610

.552

.500

.453

.789

.744

.701

.642

.554

.478

.412

.355

.307

.677

.614

.557

.481

.377

.295

.231

.181

.142

.582

.508

.444

.362

.258

.184

.131

.094

.067

.540

.463

.397

.315

.215

.146

.099

.068

.046

.502

.422

.356

.275

.178

.116

.075

.049

.032

.467

.386

.319

.239

.149

.092

.057

.036

.022

.404

.322

.257

.183

.104

.059

.033

.019

.011

.327

.247

.187

.123

.061

.030

.015

.008

.004

.233

.162

.112

.065

.026

.010

.004

.002

.001

.168

.107

.069

.035

.012

.004

.001

*

*

.123

.073

.043

.020

.005

.001

*

*

*

*Present value factor is zero to three decimal places.

Note: All factors are rounded to the nearest 1/1000 as shown to agree with values used in the text.

APPENDIX D

Table of Present Value Annuity Factors

Instructions: To use this table, find the present value of annuity factor that corresponds to both a given time period (year) and an interest rate. To illustrate, if you want the present value of annuity factor for 30 years and 7 percent, move across from year 30 and down from 7 percent to the point at which the row and column intersect: 12.409. Other illustrations: For

3 years and 15 percent, the proper present value of annuity factor is 2.283; for 5 years and 8 percent, it is 3.993; for 30 years and 8 percent, it is 11.258.

20

25

30

35

40

8

10

12

15

Interest Rate

Year 2% 3% 5% 7% 8% 9% 10% 12% 15% 20% 25% 30%

1

2

.980

1.942

.971

1.913

.952

1.859

.935

1.808

.926

1.783

.917

1.759

.909

1.736

.893

1.690

.870

1.626

.833

1.528

.800

1.440

.769

1.361

5

6

3

4

2.884

3.808

4.713

5.601

2.829

3.717

4.580

5.417

2.723

3.546

4.329

5.076

2.624

3.387

4.100

4.767

2.577

3.312

3.993

4.623

2.531

3.240

3.890

4.486

2.487

3.170

3.791

4.355

2.402

3.037

3.605

4.111

2.283

2.855

3.352

3.784

2.106

2.589

2.991

3.326

1.952

2.362

2.689

2.951

1.816

2.166

2.436

2.643

7.326

8.983

10.575

12.849

16.352

19.524

22.396

24.999

27.356

7.020

8.530

9.954

11.938

14.878

17.413

19.601

21.487

23.115

6.463

7.722

8.863

10.380

12.462

14.094

15.373

16.378

17.159

5.971

7.024

7.943

9.108

10.594

11.654

12.409

12.948

13.332

5.747

6.710

7.536

8.560

9.818

10.675

11.258

11.655

11.925

5.535

6.418

7.161

8.061

9.129

9.823

10.274

10.567

10.757

5.335

6.145

6.814

7.606

8.514

9.077

9.427

9.844

9.779

4.968

5.650

6.194

6.811

7.469

7.843

8.055

8.176

8.244

4.487

5.019

5.421

5.847

6.259

6.464

6.566

6.617

6.642

3.837

4.192

4.439

4.675

4.870

4.948

4.979

4.992

4.997

3.329

3.570

3.725

3.859

3.954

3.985

3.995

3.998

3.999

2.925

3.092

3.190

3.268

3.316

3.329

3.332

3.333

3.333

Note: All factors are rounded to the nearest 1/1000 as shown to agree with values used in the text.