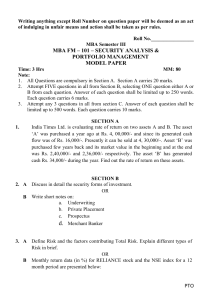

Intertemporal Trades • {

advertisement

Intertemporal Trades

C2

(1 + r )m1 + m2

m2

•E

0

= {m1 , m2 }

A c1 , c2

•

c2

I0

1 r

m1

c1

Borrowing

in period 1

m2

m1 +

(1 + r )

C1

Intertemporal Trades

C2

C2

C1 = C2

C1 = C2

C1

Patient preferences

C1

Impatient preferences

Optimal Holding Period for an Asset

FV(t) = 100 + 6t + 2t2 – 0.1t3

$350

24%

22%

$300

20%

FV t

$250

18%

16%

$200

14%

12%

$150

10%

8%

$100

PV t

$50

0

1

2

Time

3

4

5

6

7

8

t*

9

10

11

12

13

14

15

16

17

18

19

4%

2%

Rate of return from holding asset

$0

6%

0%

20

Asset Markets: Debt

Asset Markets: Debt

Risky Assets: Equities

1800

S&P 500

1600

1400

1200

1000

800

600

400

2007

Return: 3.67%

Volatility: 16.02%

2008

Return: - 38.52%

Volatility: 41.10%

2009

Return: 23.44%

Volatility: 27.27%

200

0

1/3/2007

1/3/2008

1/3/2009

1/3/2010

Risky Assets: Portfolios

140.00

S&P 500 and Malkiel Portfolio

120.00

100.00

80.00

60.00

40.00

20.00

2007

Return: 3.67%

Volatility: 16.02%

2008

Return: - 38.52%

Volatility: 41.10%

2009

Return: 23.44%

Volatility: 27.27%

Return: 17.92%

Volatility: 18.05%

Return: - 35.97%

Volatility: 33.14%

Return: 37.35%

Volatility: 20.81%

0.00

1/3/2007

1/3/2008

Malkiel Portfolio

1/3/2009

S&P 500

1/3/2010

Capital Asset Pricing Model

Capital Market Line

Security Market Line

r = E[return of a portfolio ]

r = E[return of a security ]

rx = rf +

rm - rf

m

rm

ri rf rm - rf i

X

rm

rx

rm - rf

rf

rm - r f

m

rf

x

m

cov(rx , rm )

Beta, ≡

var (rm )

1

i

Beta as a Measure of Relative Risk

1

0.8

0.6

0.4

0.2

0

2004

2005

2006

2007

2008

2009

-0.2

-0.4

-0.6

SP500

FLSAX (Beta = 1.46)

VTI (Beta = 1.03)

NCICX (Beta = 0.75)

FMAGX (Beta = 1.25)

Capital Asset Pricing Model

25

Returns

20

15

ri = 3 + 5i

10

5

0

0.0

0.2

0.4

Mutual Fund Name

American Century Heritage A

Fidelity Advisor Equity Growth T

Fidelity Magellan

Putnam International Growth & Income

Fidelity Diversified International

Templeton Growth A

Vanguard 500 Index

Vanguard Total Stock Market Index

Vanguard PRIMECAP

Janis Growth & Income

Dreyfus Premier Balanced B

Dreyfus Founders Balanced A

0.6

Symbol

ATHAX

FAEGX

FMAGX

PNGAX

FDIVX

TEPLX

VFINX

VTSMX

VPMCX

JAGIX

PRBBX

FRIDX

0.8

Beta

1.0

1.2

1.4

1.6

3-Year

5-Year

10-Year

Beta

Returns Beta

Returns Beta

Returns

1.44

20.50

1.17

19.26

0.96

8.42

1.18

8.31

1.16

11.20

1.16

3.34

1.33

6.88

1.03

10.42

1.04

3.53

1.07

12.55

1.03

20.56

0.96

6.90

1.08

14.57

1.02

22.18

0.96

10.85

0.77

5.78

0.85

14.81

0.80

7.01

1.00

5.72

1.00

11.18

1.00

3.43

1.04

6.19

1.04

12.27

1.01

3.89

1.01

9.63

1.06

15.78

1.08

8.50

1.13

6.69

1.05

11.22

0.98

5.84

0.98

4.05

0.90

6.59

0.87

1.43

0.98

3.71

0.88

7.21

Efficient Market Hypothesis

A theory that asset prices reflect all publicly available

information about the value of an asset.

Strong Form: Asset prices reflect all information, public and private,

and no one can earn excess returns

Semi-Strong Form: Asset prices adjust very rapidly to publicly

available new information and in an unbiased fashion, such that no

excess returns can be earned by trading on that information. Semistrong-form efficiency implies that neither fundamental analysis nor

technical analysis will be able to reliably produce excess returns.

Weak Form: Future asset prices cannot be predicted by analyzing

price from the past. Excess returns can not be earned in the long run

by using investment strategies based on historical share prices or

other historical data.

Diversification and Portfolio Theory

Expected Return of a Portfolio (2 investments):

E[rx]= x1E[r1] + x2E[r2]

(x1 + x2 = 1)

Expected Variance of a Portfolio (2 investments):

1,22 = x1212 + x2222 + 2x1x21,2

= x1212 + x2222 + 2x1x2r1,212

Diversification and Portfolio Theory

Portfolio Example

Weights: 0.5

State

1

2

3

4

5

Prob.

0.2

0.2

0.2

0.2

0.2

A

Return

-5.00%

0.00%

5.00%

10.00%

15.00%

0.5

B

Return

15.00%

10.00%

5.00%

0.00%

-5.00%

Portfolio

Return

5.00%

5.00%

5.00%

5.00%

5.00%

E[rx]= x1E[r1] + x2E[r2]

Expected Return:

Variance:

Std. Deviation:

Covariance(A,B)

Correlation(A,B)

5.00%

0.63%

7.91%

5.00%

0.63%

7.91%

-0.0050

-1.0000

5.00%

0.00%

0.00%

1,22 = x1212 + x2222 + 2x1x21,2

= x1212 + x2222 + 2x1x2r1,212

What does a negative beta asset look like?

Was the yen a negative beta asset in 2007 – 2008?

The blue line is FXY, an exchange-traded fund that tracks the yen. The red line is the S&P

500 index. Over the past year, the two time-series look like mirror images of each other.

That is, holding yen seems to hedge U.S. stock-market risk.

Source: http://gregmankiw.blogspot.com/ 29 May 2008

What does a negative beta asset look like?

Was the yen a negative beta asset in 2007 – 2008?

140.00

130.00

Feb. 2007 to May 2008:

Average Weekly Returns

Std. Dev. of Weekly Returns

FXY

0.19%

1.60%

^GSPC

0.01%

2.37%

BLEND

0.10%

0.92%

120.00

Annualized Returns

Annualized Volatility

10.51%

11.56%

0.33%

17.06%

5.29%

6.62%

110.00

100.00

90.00

80.00

70.00

60.00

2/12/2007

5/12/2007

8/12/2007

11/12/2007

FXY

^GSPC

2/12/2008

5/12/2008

What does a negative beta asset look like?

Was the yen a negative beta asset in 2007 – 2008?

160.00

140.00

120.00

100.00

80.00

60.00

40.00

20.00

0.00

FXY

^GSPC

Dealing With Risk: Diversification (Portfolio Theory)

Effect of Additional Investments / Assets on Diversification

Risk and Uncertainty: “Contingent Consumption Plans”

Case 2:

A person with an endowment of

$35,000 faces a 1% probability of

losing $10,000. He is considering

the purchase of full insurance

against the loss for $100.

Case 1:

A person with an endowment of

$100 is considering the purchase

of a lottery ticket that costs $5.

The winning ticket in the lottery

gets $200. 40 tickets will be sold.

$100

Lucky

day

Do not

purchase

Purchase

Do not

purchase

Lucky

day

$295

Pr(Lucky) = 0.025):

Purchase

$35,000

Outcome A:

E x $34 ,900

x $995

Unlucky

day

$25,000

Lucky

day

$34,900

Outcome B:

E x $100

x $31

Unlucky

day

$95

E x $34 ,900

x 0

Unlucky

day

$34,900

Risk and Uncertainty: “Contingent Consumption Plans”

CGood

$35,000

Lucky

day

Do not

purchase

• E

C g0 , Cb0

C g0 $35,000

Purchase

Unlucky

day

Lucky

day

Unlucky

day

C 1g = $34,900

(C

1

g

=C

0

g

A C 1g , Cb1

1

•

- K )

Cb0 $25,000

C

0

b

C g0 K

C

Cb1 $34,900

1

b

Cb0 K K

K = the “expected loss” ($10,000), and K is the insurance premium.

$25,000

$34,900

$34,900

C Bad

Defining Risk Aversion

1. Risk aversion is defined through peoples’ choices:

Given a choice between two options with equal expected values and

different standard deviations, a risk averse person will choose the option

with the lower standard deviation:

If EX1 EX 2 , and 1

2

, then1 2

Given a choice between two options with equal standard deviations and

different expected values, a risk-averse person will choose the option

with the higher expected value:

If 1

2

, and EX1 EX 2 , then1 2

2. Non-linearity in the utility of wealth.

Risk Aversion and the Marginal Utility of Money

Utility

A

l

U3

l

U2

U1

U($)

l

B

D

Risk Premium

l

C

Risk Premium

$0

$99,415

$99,500

$100,000

$

$50,000

U 1 U $50,000

E99

E99,500

U2 U

U2$99

U

,415

,U

500

U 3 U $100,000

Modeling Different Risk Preferences

Utility

U($)

U($)

U($)

$

Classification of Auctions

What is the nature

of the good being

auctioned?

Private values

Common value

What are the

bidding rules?

English ascending

bid

Dutch descending

bid

Sealed bid

Vickrey second

price

Evaluative Criteria for Auctions

Pareto Efficiency

Does the auction design guarantee that the item

will go to the bidder with the highest value?

Revenue or Profit Maximization

Does the auction design guarantee the highest

revenue (or profit) for the seller?

Types of Auctions and optimal bidding strategies

Independent Private Values Auctions

Each bidder knows precisely how highly he/she values the item,

and these values vary across all bidders.

English (ascending bid)

b v

Dutch (descending bid)

vL

b v

n

First-price, sealed bid

vL

b v

n

Second-price, sealed bid

b v

b* optimal bid

v private valuation of bidder

Where

L lowest possible valuation

n number of bidders

Types of Auctions and optimal bidding strategies

Common (or Correlated) Values Auctions

The item being bid has an underlying objective value, but no

bidder knows precisely what that value is.

Winning bids tend to come from those with the most

optimistic estimates.

If estimate errors are randomly distributed around zero, then

the winning bid will be greater than the true value of the item

(the “winner’s curse”):

Distribution of bids:

1

Winning

Bid

0

5

10

True

Value

15