AIR FREIGHT MARKET ANALYSIS MAY 2015 KEY POINTS

advertisement

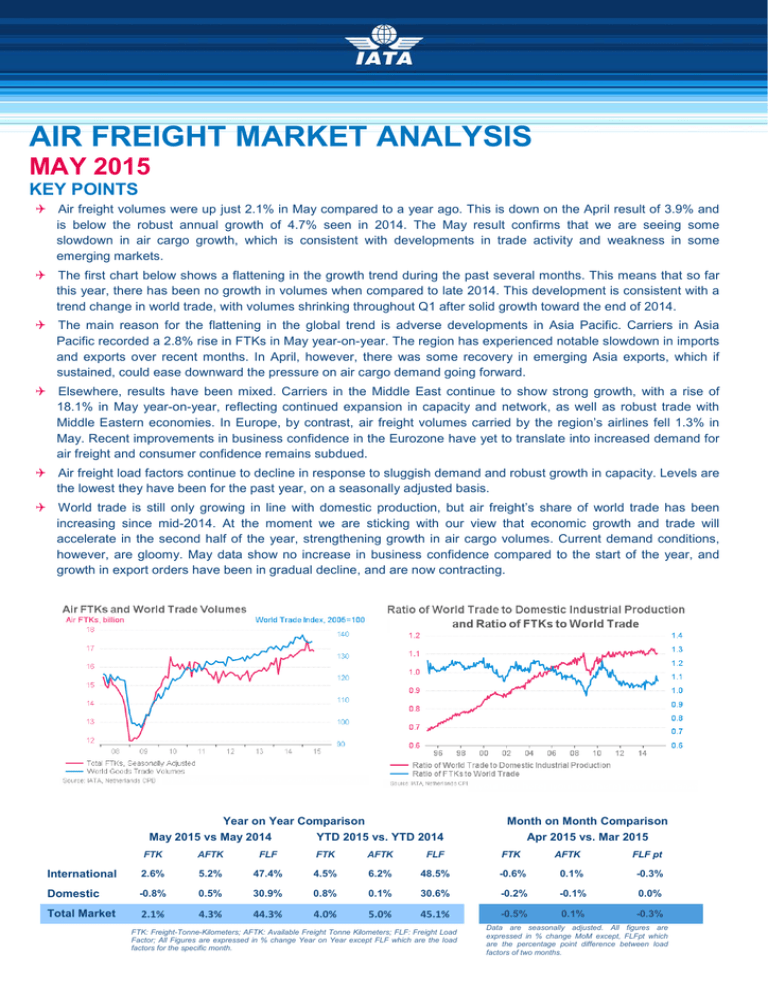

AIR FREIGHT MARKET ANALYSIS MAY 2015 KEY POINTS Air freight volumes were up just 2.1% in May compared to a year ago. This is down on the April result of 3.9% and is below the robust annual growth of 4.7% seen in 2014. The May result confirms that we are seeing some slowdown in air cargo growth, which is consistent with developments in trade activity and weakness in some emerging markets. The first chart below shows a flattening in the growth trend during the past several months. This means that so far this year, there has been no growth in volumes when compared to late 2014. This development is consistent with a trend change in world trade, with volumes shrinking throughout Q1 after solid growth toward the end of 2014. The main reason for the flattening in the global trend is adverse developments in Asia Pacific. Carriers in Asia Pacific recorded a 2.8% rise in FTKs in May year-on-year. The region has experienced notable slowdown in imports and exports over recent months. In April, however, there was some recovery in emerging Asia exports, which if sustained, could ease downward the pressure on air cargo demand going forward. Elsewhere, results have been mixed. Carriers in the Middle East continue to show strong growth, with a rise of 18.1% in May year-on-year, reflecting continued expansion in capacity and network, as well as robust trade with Middle Eastern economies. In Europe, by contrast, air freight volumes carried by the region’s airlines fell 1.3% in May. Recent improvements in business confidence in the Eurozone have yet to translate into increased demand for air freight and consumer confidence remains subdued. Air freight load factors continue to decline in response to sluggish demand and robust growth in capacity. Levels are the lowest they have been for the past year, on a seasonally adjusted basis. World trade is still only growing in line with domestic production, but air freight’s share of world trade has been increasing since mid-2014. At the moment we are sticking with our view that economic growth and trade will accelerate in the second half of the year, strengthening growth in air cargo volumes. Current demand conditions, however, are gloomy. May data show no increase in business confidence compared to the start of the year, and growth in export orders have been in gradual decline, and are now contracting. Year on Year Comparison May 2015 vs May 2014 YTD 2015 vs. YTD 2014 Month on Month Comparison Apr 2015 vs. Mar 2015 FTK AFTK FLF FTK AFTK FLF FTK International 2.6% 5.2% 47.4% 4.5% 6.2% 48.5% -0.6% 0.1% -0.3% Domestic -0.8% 0.5% 30.9% 0.8% 0.1% 30.6% -0.2% -0.1% 0.0% Total Market 2.1% 4.3% 44.3% 4.0% 5.0% 45.1% -0.5% 0.1% -0.3% FTK: Freight-Tonne-Kilometers; AFTK: Available Freight Tonne Kilometers; FLF: Freight Load Factor; All Figures are expressed in % change Year on Year except FLF which are the load factors for the specific month. AFTK FLF pt Data are seasonally adjusted. All figures are expressed in % change MoM except, FLFpt which are the percentage point difference between load factors of two months. Air Freight Market Analysis May 2015 The first chart above shows that after adjusting for seasonal and holiday ups and downs in FTK volumes, there has been no change in volumes since late 2014. So although year-on-year comparisons remain positive (albeit weakening), they are being supported by growth that took place last year, rather than additional gains in 2015. The improvement in air freight volumes seen throughout much of 2014 appears to be slowing down. The main reason for the flattening in the global trend is adverse developments in Asia Pacific. Carriers in Asia Pacific recorded a 2.8% rise in FTKs in April year-on-year, well below the growth year-to-date, 6.4%. The region has experienced notable slowdown in trade over recent months. At the end of Q1, trade volumes for emerging Asia were down 10% when compared to the start of Q4 2014. In April, however, there was some recovery in emerging Asia exports, which if sustained, could ease downward the pressure on air cargo demand going forward. Elsewhere, results have been mixed. Carriers in the Middle East continue to show strong growth, with a rise of 18.1% in May year-on-year. Trade with Middle East economies has been increasing but a large part of the airlines’ business success is owed to network and capacity expansion that has encouraged air freight to go through Middle East hubs. In Europe, by contrast, air freight volumes carried by regional airlines fell 1.3% in May compared to a year ago. Recent improvements in business confidence in the Eurozone are yet to translate to increased demand for air freight. Recent signs of a positive response to the ECB stimulus have faltered slightly, owing to firming in the Euro and oil prices. The possibility of Greece exiting the Eurozone could inject extra uncertainty in the Eurozone economy. In the US, recent economic data show a disappointing first quarter of GDP performance, with a contraction compared to Q4 2014. The May air freight result is consistent with this recent weakness, showing a 2.9% fall compared to a year ago. However, better economic performance is expected in Q2, as the impacts of bad weather, falling oil prices and US sea port congestion dissipate. Stronger growth in Q2 will likely support expansion in air freight demand in the coming months. In Latin America, regional carriers saw a 10.5% contraction in volumes in May year-on-year. Although key economies like Brazil and Argentina continue to struggle, regional trade activity has increased during recent months. Unfortunately, this has yet to translate into a pick-up in air freight demand on regional carriers. African airlines, carrying a small part of worldwide FTKs, recorded a rise in FTKs of 3.0% in May year-on-year. The data for carriers in this region have shown significant volatility over recent months. From the perspective of demand drivers, major economies Nigeria and South Africa underperformed during parts of 2014, however, regional trade activity is holding-up, which should support demand for air transport of goods. Air Freight Market Analysis May 2015 ANNEX Year on Year Comparison May 2015 vs. May 2014 YTD 2015 vs. YTD 2014 FTK AFTK FLF FTK AFTK FLF Africa 3.3% 1.0% 32.5% 4.4% -0.5% 32.5% Asia/Pacific 2.6% 6.8% 56.0% 6.8% 7.1% 57.4% Europe -1.0% 2.2% 46.1% -0.4% 3.5% 47.6% Latin America -11.3% -0.2% 40.3% -8.3% -0.9% 41.5% Middle East 18.1% 19.6% 43.6% 13.7% 19.1% 43.3% North America -3.2% -4.4% 39.9% 0.7% -0.9% 41.0% International 2.6% 5.2% 47.4% 4.5% 6.2% 48.5% Africa 3.0% 1.3% 31.0% 4.1% -0.2% 30.9% Asia/Pacific 2.8% 6.7% 53.3% 6.4% 6.9% 53.9% Europe -1.3% 2.7% 44.6% -0.6% 3.5% 46.3% Latin America -10.5% 4.7% 36.7% -8.0% 2.9% 37.8% Middle East 18.1% 19.4% 43.2% 13.7% 18.9% 42.9% North America -2.9% -4.2% 35.3% 0.6% -2.1% 36.1% Total Market 2.1% 4.3% 44.3% 4.0% 5.0% 45.1% FTK: Freight-Tonne-Kilometers; AFTK: Available Freight Tonne Kilometers; FLF: Freight Load Factor; All Figures are expressed in % change Year on Year except FLF which are the load factors for the specific month. Month on Month Comparison May 2015 vs. Apr 2015 Market Share FTK AFTK FLFpt FTK Africa -0.2% 1.4% -0.5% 1.8% Asia/Pacific -1.6% 0.2% -1.0% 39.4% Europe -0.8% -0.5% -0.1% 25.7% Latin America -1.4% 2.1% -1.5% 2.8% Middle East 3.0% 2.3% 0.3% 16.7% North America -1.0% -2.1% 0.4% 13.6% International -0.6% 0.1% -0.3% 100.0% Africa -0.3% 1.3% -0.5% 1.6% Asia/Pacific -1.3% -0.2% -0.6% 38.6% Europe -0.8% -0.4% -0.2% 22.8% Latin America -1.3% 2.0% -1.2% 2.7% Middle East 3.0% 2.3% 0.0% 14.5% North America -0.9% -0.9% 0.0% 19.9% Total Market -0.5% 0.1% -0.3% 100.0% Data are seasonally adjusted. All Figures are expressed in % change Month on Month except PLP pt and FLF which are the percentage point difference between load factors of two consecutive months. Julie Perovic E-Mail: perovicj@iata.org ST 1 July 2015 Terms and Conditions for the use of this IATA Economics Report and its contents can be found here: http://www.iata.org/economics-terms By using this IATA Economics Report and its contents in any manner, you agree that the IATA Economics Report Terms and Conditions apply to you and agree to abide by them. If you do not accept these Terms and Conditions, do not use this report. FURTHER ANALYSIS AND DATA NEW RELEASE ALERTS Access data related to this briefing through the Monthly Statistics publication: To receive email notification of new analysis from IATA Economics, select ‘Economic Briefings’ from: www.iata.org/optin http://www.iata.org/publications/Pages/monthly-trafficstatistics.aspx