Check Writing Terms, Definitions, and General Information

advertisement

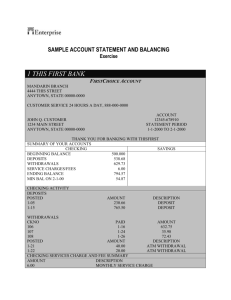

Check Writing Terms, Definitions, and General Information Payee: The party that receives the check. Payor: The party that writes the check (to the payee). Check Register: A booklet that is used to keep a record of all your checking related transactions, including checks written and deposits. Check Stub: A strip on the side of some checks that is torn off. Used to keep record of the amount of the check. Endorse a Check - Check Endorsement: When the payee signs their name on the back of a check to cash or deposit the check. Balance: The amount of money currently in your checking account. Non-sufficient Funds: When you write a check for more money than you have in your account. Minimum Balance: The minimum amount of money required in your account. Having an amount less than the minimum balance may result in extra service charges or reduced privileges. Service Charge: An amount the bank charges (fees) for use of the checking account. Check Writing Terms, Definitions, and General Information After viewing the above lessons, here are some important additional points to keep in mind when writing a check: Be sure not to leave any blank areas on your check. The safest method is to draw a line though any open spaces. When writing the check amount, be sure to always start at the beginning (the far left) of the line. This will help make sure no one tries to make any unauthorized changes to your check. Write clearly and only use ink when writing your check to help prevent anything from being altered or changed. Your check is not legal until you sign it. However, keep your checks in a safe place until you are ready to use them for payment. Also, never sign a blank check. If you postdate your check, it may not be cashed until on or after that date. However, it is recommended that you do not postdate a check. Banks will often process the check even if the check is post dated if they do not notice the date. Also, they may charge an additional processing fee. Make sure the amount box (where the amount of the check written in numbers) and the amount line (the amount of the check written in words) match. If you make a mistake when writing a check, write "VOID" in big letters on the check and tear it up. Keep a record in your check register of voided checks and canceled checks. Be sure to keep a record of all your written checks in your check register. Also, keep track of your check numbers. Each new written check should be written with the next available check number. When paying by check in person, keep in mind that you may need to show proper identification. This may include a driver’s license, passport, or other form of ID. Check to make sure that the numbers written out in long-hand match the numbers written on the box on the check. Often, bank employees only look at the long-hand numbers, and ignore the numbers written in the box. A common mistake is an amount such as $100.42 is incorrectly written as One-hundred fortytwo instead of One-hundred and 42/100. If you do this, the larger amount may be deducted from your account. Instead of first writing the check and then recording it in the checkbook, consider entering it in the checkbook first. People often forget who they wrote a check out to and how much it was for because they were in a hurry or just absent minded. So enter the check information in the checkbook first to help eliminate this potential mistake.