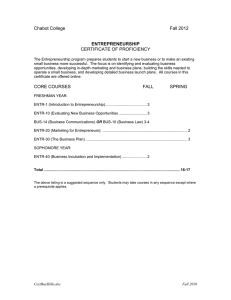

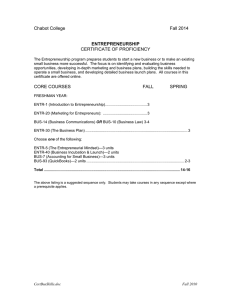

Unit I: Introduction to Entrepreneurship

advertisement