Trust Board Integrated Performance Report November 2014 ORBIT Reporting

advertisement

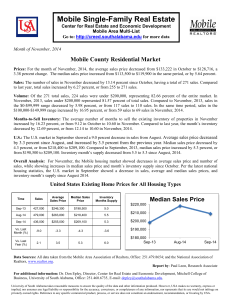

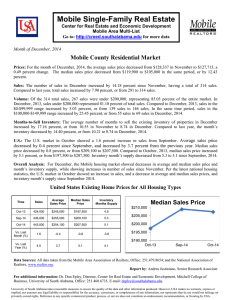

ORBIT Reporting Trust Board Integrated Performance Report November 2014 At A Glance report Escalation report Data Quality Indicator Graph Legend The data quality rating has 2 components. The first component is a 5 point rating which assesses the level and nature of assurance that is available in relation to a specific set of data. The levels are described in the box below. Rating Required Evidence 1 Standard operating procedures and data definitions are in place. 2 As 1 plus: Staff recording the data have been appropriately trained. 3 As 2 plus: The department/service has undertaken its own audit. 4 As 2 plus: A corporate audit has been undertaken. As 2 plus: An independent audit has been undertaken (e.g. by the Trust's internal or external auditors). 5 Underachieving Standard Plan/ Target Performance The second component of the overall rating is a traffic-light rating to include the level of data quality found through any auditing / benchmarking as below Rating Green Data Quality Satisfactory Amber Data can be relied upon but minor areas for improvement identified. Red Unsatisfactory/significant areas for improvement identified. 1 OUH -At A Glance 2014-15 ORBIT Reporting Operational Access Standards Standard YTD Forecast next period Data Quality RTT - admitted % within 18 weeks 90% Nov-14 82.79% 87% 85.9% 3 RTT - non-admitted % within 18 weeks 95% 92% NA Nov-14 Nov-14 Nov-14 92.88% 92.56% 39719 94.6% 91.4% 93.9% 92.2% 40181 2 2 2 11.1 6.6 23 18.3 Nov-14 Nov-14 Nov-14 Nov-14 8.7 5.18 29.44 20.59 7.86 5.09 26.21 18.59 8.4 5.2 26.9 19.4 2 2 3 3 0 Nov-14 9 0 Nov-14 8 RTT - incomplete % within 18 weeks RTT - #waiting on incomplete RTT pathway RTT admitted - median wait RTT - non-admitted - median wait RTT 95th centile for admitted pathways RTT - 95th percentile for non-admitted RTT RTT - # specialties not delivering the admitted standard RTT - # specialties not delivering the nonadmitted standard % Diagnostic waits waiting 6 weeks or more 1% Nov-14 0.6% 1.2% 0.8% 2 Zero tolerance RTT waits AP 0 Nov-14 14 53 8.7 4 Zero tolerance RTT waits IP 0 Nov-14 10 171 17 4 Zero tolerance RTT waits NP 0 Nov-14 4 34 6.7 4 11716.3 2 Ambulance Handovers within 15 minutes 0% Nov-14 Number of attendances at A/E depts in a month NA Nov-14 10651 % <=4 hours A&E from arrival/trans/discharge 95% Q3 14-15 89.09% 92% Last min cancellations - % of all EL admissions 0.5% Nov-14 0.62% 0.5% 0.3% 0% 0 Nov-14 Nov-14 3.45% 0 4.9% 0 3.5% 0 0 Nov-14 0 0 0 NA NA Nov-14 Nov-14 11325 9404 2 3 NA Nov-14 1217 4 % patients not rebooked within 28 days zero Urgent cancellations - 2nd time Urgent cancellations Activity Current Data Period Period Actual Total on Inpatient Waiting List # on Inpatient Waiting List dates less than 18 weeks # on Inpatient Waiting List waiting between 18 and 35 weeks # on Inpatient Waiting List waiting 35 weeks & over % Planned IP WL patients with a TCI date 2 No data available 94475 Quality Outcomes Standard YTD Forecast next period Data Quality Summary Hospital-level Mortality Indicator** NA Sep-14 0.99 Total # of deliveries NA 62% 23% Nov-14 Nov-14 Nov-14 646 64.4% 19.81% 5618 62.6% 21.9% 706.3 63.8% 22% 3 3 5 15% NA 0% 80% Nov-14 Nov-14 Nov-14 Nov-14 15.79% 0 3.19% 80.04% 15.5% 0 3.8% 79.3% 14.1% 5 4 5 4 Proportion of normal deliveries Proportion of C-Section deliveries Proportion of Assisted deliveries Maternal Deaths 30 day emergency readmission Medication reconciliation completed within 24 hours of admission Medication errors causing serious harm Patient Experience Current Data Period Period Actual Number of CAS Alerts received by Trust during the month Number of CAS Alerts with a deadline during the month Number of CAS alerts that were closed having breached during the month Dementia CQUIN patients admitted who have had a dementia screen Monthly numbers of complaints received 5 3.4% 80.4% 0 Nov-14 0 2 5 NA Nov-14 8 82 5 NA Nov-14 15 98 5 0 Nov-14 0 1 5 0% Oct-14 71.71% 65.5% 67.4% 4 NA Nov-14 80 687 89.3 5 26.4% 25.1% 2 72.3 2 9.8% 2 52 2 Patient Satisfaction -Response rate (friends & family -Inpatients) Net promoter (friends & family -Inpatients) 0% Nov-14 25.1% NA Nov-14 71 Patient Satisfaction- Response rate (friends & family -ED) Net promoter (friends & family -ED) 0% Nov-14 10.28% 2 NA Nov-14 38 2 Same sex accommodation breaches 0 80% Q3 14-15 Nov-14 10 86% 21 83.2% 7 86.7% 3 5 0% Nov-14 64.95% 77.9% 77.2% 3 0 5 Nov-14 Nov-14 0 8 4 43 0.7 6.7 5 5 % adult inpatients have had a VTE risk assess 95% Q3 14-15 94.61% 93.8% 93.8% 5 5 # patients spend >=90% of time on stroke unit Time to Surgery (% patients having their operation within the time specified according to their clinical categorisation) Safety HCAI - MRSA bacteraemia HCAI - Cdiff 14.4% NA Nov-14 704 3 Number SIRIs NA Nov-14 7 34 4.3 5 Nov-14 Nov-14 Nov-14 29.27% 12453 17261 101797 141909 12628 18085.3 3 3 2 Number of Patient Falls with Harm Total number of first outpatient attendances NA 0 0 0 NA NA Nov-14 Nov-14 Nov-14 5 4.85 4.73 28 5.15 4.91 2.7 5.6 4.7 2 2 3 1st outpatient attends following GP referral 0 Nov-14 10272 81790 10418 2 Other refs for a first outpatient appointment 0 Nov-14 8292 72219 9120.7 3 Non-elective FFCEs 0 0 Nov-14 Nov-14 5687 2068 46366 15624 5755.3 2005.7 2 3 # acquired, avoidable Grade 3/4 pressure Ulcers % of Patients receiving Harm Free Care (Pressure sores, falls, C-UTI and VTE) Never Events 0 0 Nov-14 Nov-14 7333 112 59353 913 7543.7 124 3 3 3.5% Q3 14-15 11.17% 10% 10% 5 No of GP written referrals Number of Elective FFCEs - admissions Number of Elective FFCEs - day cases Delayed transfers of care: number (snapshot) Delayed transfers of care as % of occupied beds Patient Falls per 1000 bed days Incidents per 100 admissions Cleaning Scores- % of inpatient areas with initial score >92% NA Oct-14 1 10 1.7 5 0% Nov-14 93.32% 93.2% 93.5% 3 NA NA Nov-14 Nov-14 3 69.23% 3 54.5% 1 55.4% 5 5 2 Operational Activity Cancer Waits Standard Current Data Period Period Actual YTD Forecast next period Data Quality Theatre Utilisation - Total 75% Nov-14 73.11% 72.5% 71.8% 2 Theatre Utilisation - Elective 80% Nov-14 84.38% 76.1% 75.5% 3 Theatre Utilisation - Emergency 70% Nov-14 64.58% 61.4% 61.3% 2 %patients cancer treatment <62-days urg GP ref 85% Oct-14 80.49% 77.2% 75.8% 5 %patients cancer treatment <62-days - Screen 90% Oct-14 100% 94.2% 93.8% 5 % patients treatment <62-days of upgrade %patients 1st treatment <1 mth of cancer diag 0% 96% 0% Oct-14 97.06% Finance Capital Financial Risk I&E 5 95.2% 97% Standard Current Data Period Period Actual YTD 90% Nov-14 93.91% 90% 5 Capital servicing capacity (times) 1.75 Nov-14 1.84 1.8 5 Liquidity ratio (days) defined as Working Capital balance *360/Annual Operating Expenses -7 Nov-14 -5.44 -7 5 Monitor Risk Rating 3 Nov-14 3 3 5 95% Nov-14 91.96% 90% 5 1% Nov-14 1.27% 1% 5 Forecast next period Data Quality CIP Performance Compared to Plan 5 Standard Nov-14 97.19% 4 Nov-14 2.11% 5 0% Nov-14 5.56% 5 101% Nov-14 101.49% 5 Nov-14 Nov-14 Nov-14 6.73% 3.61% 13.07% 3 5 3 Oct-14 95.88% 95% 95.7% 5 98% Oct-14 100% 100% 100% 5 94% Oct-14 98.7% 86.9% 97.2% 5 Agency usage (displayed as a % of total)** %2WW of an urg GP ref for suspected cancer 93% Oct-14 95.04% 93.9% 94.6% 5 Total cost of staff ( displayed as a %)** %2WW urgent ref - breast symp 93% Oct-14 96.3% 94.2% 96.1% 5 Vacancy rate 5% 3% 10.5% Sickness absence** Turnover rate YTD 0% 94% %patients subs cancer treatment <31-days Drugs %patients subs treatment <31days - Radio Worked WTE against Plan (displayed as a % of total)** Bank usage (displayed as a % of total)** Current Data Period Period Actual 101% %patients subs cancer treatment <31days - Surg Staff Experience Data Quality Capital Programme Compared to Plan I&E Surplus Margin (%) Workforce Head count/Pay costs Forecast next period 12.8% * This measure is collected on a year to date basis and displays the latest available values ** This measure is collected for a 12 month period preceding the latest period shown *** Sickness absence figures shown in period actual reflect the financial year to date Year: 2014-15 Directorate: Acute Medicine & Rehabilitaion ,Acute Medicine & Rehabilitation,Ambulatory Medicine ,Anaesthetics, Critical Care & Theatres,Assurance,Biomedical Research,Cardiology, Cardiac & Thoracic Surgery ,Central Trust Services,Chief Nurse Patient Services & Education,Children's ,Children’s,CRS Implementation,Division of Clinical Support Services,Division of Corporate Services,Division of Medicine, Rehabilitation & Cardiac,Division of Neuroscience, Orthopaedics, Trauma & Specialist Surgery,Division of Operations & Service Improvement,Division of Research & Development,Division of Surgery & Oncology,Estates and Facilities,Finance and Procurement,Gastroenterology, Endoscopy and Theatres (CH),Horton Management,Human Resources and Admin,Legacy Cardiac, Vascular & Thoracic Surgery,Legacy Cardiology,Legacy Division of Cardiac, Vascular & Thoracic,Legacy Division of Musculoskeletal and Rehabilitation,Legacy Rehabilitation & Rheumatology,MARS -Research & Development,Medical Director,Networks,Neurosciences ,OHIS Telecoms & Med Records,Oncology & Haematology ,Oncology & Haematology ,Orthopaedics,Pathology & Laboratories,Pharmacy,Planning & Communications,Private Patients,Radiology & Imaging,Renal, Transplant & Urology,Specialist Surgery ,Strategic Change,Surgery ,Teaching Training and Research,Trauma ,Trust wide R&D,Trust-wide only,Unknown,Women's 3 IPF Red Escalation Report FY 2014-15 RTT - admitted % within 18 weeks What is driving the reported underperformance? Admitted performance continues to be a challenge. November performance has deteriorated further but is not attributable to a dip in activity. What actions have we taken to improve performance Standard Current Data Period Period Actual YTD Forecast next period 90% Nov-14 82.79% 87% 85.86% Weekly meetings continue to be held with Divisional Teams and the Director of Clinical Services. Specialties with significant challenges continue to be: Orthopaedics Spinal Ophthalmology Neurosurgery Additional theatres lists are being undertaken and external providers are being used to support some surgical activity. Expected date to meet standard Lead Director End of November for Trust Director of Clinical Services level standard with risk limited to Orthopaedics and Spinal. 4 IPF Red Escalation Report FY 2014-15 RTT 95th centile for admitted pathways What is driving the reported underperformance? What actions have we taken to improve performance November’s reporting period saw a significant increase in the 95th percentile of admitted waits. The 95th percentile wait is likely to increase in the short term whilst the services refocus the effort to treat the longest waiting patients first. Weekly meetings with the Clinical Divisions and the Director of Clinical Services to ensure the sustainable recovery plans are being implemented to reduce and treat those patients waiting over 18 weeks. Expected date to meet standard Lead Director Standard Current Data Period Period Actual YTD Forecast next period 23 Nov-14 29.44 26.21 26.91 End of November for Trust level Director of Clinical Services with risk limited to Orthopaedics and Spinal. 5 IPF Red Escalation Report FY 2014-15 RTT - 95th percentile for non-admitted RTT What is driving the reported underperformance? What actions have we taken to improve performance Due to the prolonged non achievement of the nonadmitted target, the 95th percentile waits have seen an increase. This is expected to increase further in the short term, as services re-focus on treating the longest waiting patients. Weekly 18 week performance meetings are held with Divisional Teams and the Director of Clinical Services. Expected date to meet standard Lead Director Standard Current Data Period Period Actual YTD Forecast next period 18.3 Nov-14 20.59 18.59 19.45 End of November for Trust level Director of Clinical Services standard with risk limited to Orthopaedics and Spinal. 6 IPF Red Escalation Report FY 2014-15 RTT - # specialties not delivering the admitted standard What is driving the reported underperformance? Nine services did not achieve the admitted standard in November and are as follows: 1. 2. 3. 4. 5. 6. 7. 8. 9. Trauma & Orthopaedics Ear, Nose & Throat Ophthalmology Neurosurgery Plastic Surgery Cardiology Cardiac Surgery Urology Other services What actions have we taken to improve performance Standard Current Data Period Period Actual 0 Nov-14 9 YTD Forecast next period 8 Weekly meetings with the Clinical Divisions and the Director of Clinical Services to ensure the sustainable recovery plans are being implemented to reduce and treat those patients waiting over 18 weeks. Expected date to meet standard Lead Director End of November for Trust level standard with risk limited to Orthopaedics and Spinal. Director of Clinical Services 7 IPF Red Escalation Report FY 2014-15 RTT - # specialties not delivering the non-admitted standard What is driving the reported underperformance? Six services did not achieve the non- admitted standard in September and are as follows: 1. 2. 3. 4. 5. 6. 7. 8. Trauma & Orthopaedics Ear, Nose & Throat Ophthalmology Plastic Surgery Cardiology Urology Respiratory medicine Other services What actions have we taken to improve performance Standard Current Data Period Period Actual 0 Nov-14 8 YTD Forecast next period 7 Weekly meetings with the Clinical Divisions and the Director of Clinical Services to ensure the sustainable recovery plans are being implemented to reduce and treat those patients waiting over 18 weeks. Expected date to meet standard Lead Director End of November for Trust level standard with risk limited to Orthopaedics and Spinal. Director of Clinical Services 8 IPF Red Escalation Report FY 2014-15 Zero tolerance RTT waits AP What is driving the reported underperformance? What actions have we taken to improve performance Standard Current Data Period Period Actual YTD Forecast next period 0 Nov-14 14 53 9 Large increase in 52 week There is an action plan in place to reduce breaches treated within the number of patients waiting. November, this was planned as the backlog clearance work continues. The services were: Plastic Surgery (7) Spinal Surgery Service (2) Ophthalmology (2) Paediatric Plastic Surgery (2) Neurosurgery (1) Expected date to meet standard Lead Director End of November for Trust level Director of Clinical Services with risk limited to Orthopaedics and Spinal. 9 IPF Red Escalation Report FY 2014-15 Zero tolerance RTT waits IP What is driving the reported underperformance? What actions have we taken to improve performance Standard Current Data Period Period Actual YTD Forecast next period 0 Nov-14 10 171 17 Large reduction in the number There is an action plan in place to reduce of incomplete pathways waiting the number of patients waiting. over 52 weeks, this is to be expected when clearing the longest waiting patients as a priority. The services were: Spinal Surgery Service (8) Maxillo Facial Surgery (1) Physiotherapy (1) Expected date to meet standard Lead Director End of November for Trust level Director of Clinical Services with risk limited to Orthopaedics and Spinal. 10 IPF Red Escalation Report FY 2014-15 Zero tolerance RTT waits NP What is driving the reported underperformance? What actions have we taken to improve performance Standard Current Data Period Period Actual YTD Forecast next period 0 Nov-14 4 34 7 A reduction in the nonThere is an action plan in place to reduce admitted patients treated over the number of patients waiting. 52 weeks during November. The services were: Spinal Surgery Service (2) Ophthalmology (1) Physiotherapy (1) Expected date to meet standard Lead Director End of November for Trust level Director of Clinical Services with risk limited to Orthopaedics and Spinal. 11 IPF Red Escalation Report FY 2014-15 % <=4 hours A&E from arrival/trans/discharge What is driving the reported underperformance? What actions have we taken to improve performance Quarter 3 performance has seen a deterioration in performance since Quarter 2. Q3 performance at the end of October was 91.38%, but since then this has dipped below 90% for the quarter. November saw only one week where performance was over 90%. December continues to be very challenging. The Urgent Care Working group continues to meet weekly, with OCCG, OH, OCC and OUH colleagues to improve patient flow across the system. Escalation is in place with significant focus across all clinical teams to minimize the number of patients waiting over four hours. Additional short terms actions include: Staffing reviewed each shift to ensure safe staffing Extended consultant presence in ED Additional consultant led ward rounds and senior decision makers in ED. Increased theatre capacity to manage trauma flow Enhanced diagnostic and Pharmacy provision Monitoring number of admissions and discharges to transfer lounge Escalation beds opened Winter Plans have been agreed and being implemented. ECIST report has been received and action plans being implemented. Expected date to meet standard Lead Director Quarter 4 onwards Director of Clinical Services Standard Current Data Period Period Actual YTD 95% Q3 14-15 89.09% 92% Forecast next period 12 IPF Red Escalation Report FY 2014-15 Delayed transfers of care as % of occupied beds What is driving the reported underperformance? Performance in Q3 continues to be extremely challenging, although the actual monthly position for November showed a very marginal improvement on the levels seen in October (128 patients in November, 130 in October). Performance on this metric is very consistent with the levels seen in the last financial year. What actions have we taken to improve performance Standard Current Data Period Period Actual YTD Forecast next period 3.5% Q3 14-15 11.17% 10% 10.03% Daily whole system teleconference calls remain in place, with escalation to Oxfordshire colleagues when system is on RED. Weekly Urgent Care Summit meeting with OCCG, OH and OCC colleagues to manage system and winter funding arrangements and reprioritize where necessary. Further work is progressing internally to improve the discharge process for all patients. Expected date to meet standard Lead Director This system has not agreed a date to achieve this standard. Director of Clinical Services 13 IPF Red Escalation Report FY 2014-15 Theatre Utilisation - Emergency What is driving the reported underperformance? What actions have we taken to improve performance A 4 percentage point improvement on October’s utilisation performance during November. Internal theatre meetings are in place to review utilisation, work is progressing to develop a standardized approach across the Trust to manage the emergency lists which include: Developing and implementing a standard operating procedure and flow chart for all emergency lists. Standardising the urgency category for all procedures. Expected date to meet standard Lead Director Quarter 3 2014/15 Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 70% Nov-14 64.58% 61.4% 61.26% 14 IPF Red Escalation Report FY 2014-15 Same sex accommodation breaches What is driving the reported underperformance? What actions have we taken to improve performance Standard Current Data Period Period Actual YTD Forecast next period 0 Q3 14-15 10 21 7 10 breaches in November 2014. There have been no breaches since 2 were justified and 8 were November. non-justified. The Emergency Department was full and there was no capacity in the hospital. The Trust was required to submit a Unify return of 10. Expected date to meet standard Lead Director December 2014 Chief Nurse 15 IPF Red Escalation Report FY 2014-15 HCAI - Cdiff What is driving the reported underperformance? What actions have we taken to improve performance 8 cases of C.diff were reported in November 2014, against a monthly limit set at 6 for the month. All 8 C.diff cases were discussed at the monthly Health Economy meeting held in December 2014 and it was agreed that all cases were unavoidable. Further actions were identified in terms of documentation and patient review, particularly within MRC. Expected date to meet standard Lead Director Standard Current Data Period Period Actual YTD Forecast next period 5 Nov-14 8 43 7 The OUH remained below the Medical Director cumulative limit for November 2014 (45 cases) and remains on track to meet the C.diff objective for 2014/2015. 16 IPF Red Escalation Report FY 2014-15 Total cost of staff ( displayed as a %)** What is driving the reported underperformance? What actions have we taken to improve performance The pay overspend continues to be driven by the on-going payment of premium rates for staff – the high use of bank & agency staff, and additional payments made to medical staff to work weekend sessions required to meet performance targets. The Trust is introducing further workforce measures to reduce the usage and cost of agency staff, and has also initiated recruitment drives to replace temporary staff with permanent employees. It has improved the rate paid to bank staff as part of its strategy to increase bank usage and reduce the reliance on more expensive agency workers. The controls that were in place seemed to have started to reduce agency spend as planned (although not at the rate hoped). However shortages in nursing staff in December has meant that an emergency removal of the controls was effected by the Director of Clinical Services. Therefore agency spend is expected to grow once again over the rest of the year. Expected date to meet standard Lead Director Pay is likely to continue to overspend until performance targets are met and performance is stabilised, and until the policies to recruit & retain permanent staff take effect. Director for Finance & Procurement Standard Current Data Period Period Actual 101% Nov-14 101.49% YTD Forecast next period 17 IPF Red Escalation Report FY 2014-15 Vacancy rate What is driving the reported underperformance? Despite an increase in staff in post, vacancy levels have risen on the previous month from 6.1% to 6.7%. The is due in part to increases in Budget wte . The issues facing recruitment and retention are well documented and continue to influence vacancy levels in a variety of staff groups and areas. What actions have we taken to improve performance Standard Current Data Period Period Actual 5% Nov-14 6.73% YTD Forecast next period The Trust has set improving retention as a key corporate objective. Six high impact areas have been identified to facilitate improved retention rates. Increasing substantive workforce capacity Mitigating high cost of living Applying targeted recruitment and retention incentives Widening participation Improving professional development opportunities and career advancement Creating and sustaining the right environment Expected date to meet standard Lead Director Q4 Director of Organisational Development and Workforce 18 IPF Red Escalation Report FY 2014-15 Sickness absence** What is driving the reported underperformance? What actions have we taken to improve performance Standard Current Data Period Period Actual 3% Nov-14 3.61% YTD Forecast next period Sickness absence is at 3.6% The Trust continues to manage sickness which is above the KPI of 3.0%. absence operationally by the close working of Line Managers, Occupational Improved data quality following Health and HR. The process is aided by FirstCare’s introduction has the improved flow of information to line influenced the rise in reported managers from FirstCare data and the sickness levels. automation of process. Flu vaccination for front line staff is at 58%. Occupational Health is now offering a rapid Psychiatric assessment service to appropriate users. In 2015, FirstCare and Divisional representatives will meet to review Division specific data and trends. This will assist in informing and agreeing appropriate actions and strategies. The procurement process is underway for the introduction of an Employee Assistance Programme. Expected date to meet standard Lead Director Q1 2015/16 Director of Organisational Development and Workforce 19 IPF Red Escalation Report FY 2014-15 Turnover rate What is driving the reported underperformance? Turnover has continued to increase and is now 13.1%. Since April 2014 the upward trend is being driven by increases in turnover for most staff groups, with the exception of Estates and Healthcare Scientists. What actions have we taken to improve performance Standard Current Data Period Period Actual 10.5% Nov-14 13.07% YTD Forecast next period 12.79% Actions taken to address turnover are compatible with those for reducing vacancy levels and are highlighted within this report. Nursing and Midwifery and support staff (e.g. Health Care Assistants), account for 58% of current leavers, excluding junior doctors. This figure rises to 78% when Administrative and Clerical staff are included. Allied Health Professional whist smaller in numbers are also experiencing a marked increase in turnover. Expected date to meet standard Lead Director Q1 205/16 Director of Organisational Development and Workforce 20 IPF Amber Escalation Report FY 2014-15 CIP Performance Compared to Plan What is driving the reported underperformance? What actions have we taken to improve performance Standard Current Data Period Period Actual 95% Nov-14 91.96% YTD Forecast next period 90% There has been slippage on the Divisions are aware they have to make up any start of some Divisional and cross- slippage in the remainder of the year and their Divisional schemes. performance is being monitored monthly. Regular meetings are being held with Divisional Directors and Divisional General Managers, and a recovery plan is being agreed. Meetings were also held with individual Divisions at the start of November and stretch targets set to offset the shortfall created by the slippage on schemes. Expected date to meet standard Lead Director Q4 2014/15 Director of Finance & Procurement 21 IPF Amber Escalation Report FY 2014-15 RTT - non-admitted % within 18 weeks What is driving the reported underperformance? Non-admitted performance has not seen an improvement and is below the 95% standard for the fourth month in a row. Performance is likely to dip further as the backlog clearance gathers further momentum throughout December. What actions have we taken to improve performance Standard Current Data Period Period Actual YTD Forecast next period 95% Nov-14 92.88% 94.6% 93.91% Weekly meetings continue to be held with Divisional Teams and the Director of Clinical Services. Specialties with significant challenges continue to be: Orthopaedics Spinal Ophthalmology Neurosurgery Additional theatres lists are being undertaken and external providers are being used to support some surgical activity. Expected date to meet standard Lead Director End of November for Trust level standard with risk limited to Orthopaedics and Spinal Director of Clinical Services 22 IPF Amber Escalation Report FY 2014-15 Last min cancellations - % of all EL admissions What is driving the reported underperformance? What actions have we taken to improve performance Standard Current Data Period Period Actual YTD Forecast next period 0.5% Nov-14 0.62% 0.5% 0.3% A continuation of the worsening The number of elective cancellations increased of cancellation performance due to the number of emergency admissions during November. An increase of directly leading to a lack of elective capacity. 0.1% above standard. Expected date to meet standard Lead Director December 2015 Director of Clinical Services 23 IPF Amber Escalation Report FY 2014-15 Theatre Utilisation - Total What is driving the reported underperformance? What actions have we taken to improve performance November has seen has seen a 2 percentage point increase in total theatre utilization compared with October. Focus continues on productivity for all clinical teams both on the day and forward booking. Recruitment of key critical theatre staff is ongoing. Expected date to meet standard Lead Director Quarter 3 2014/15 Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 75% Nov-14 73.11% 72.5% 71.77% 24 IPF Amber Escalation Report FY 2014-15 %patients cancer treatment <62-days urg GP ref What is driving the reported underperformance? What actions have we taken to improve performance Capacity at ‘front end’ of pathways to see patients within the 2 week target is quite often limited, and demand is very often hugely variable. Capacity and variability in demand impacts on delivery and reduces the time left within the remaining days of the pathway. Patients choosing to wait longer also significantly impacts on the delivery of this particular target to delay which can’t be adjusted for. Plans in place to increase front end capacity. Working with CCG to increase patient/GP understanding of need to uptake appointments. Working with radiology to match diagnostics to demand. Expected date to meet standard Lead Director January 2015 Director of Clinical Services Standard Current Data Period Period Actual YTD Forecast next period 85% Oct-14 80.49% 77.2% 75.75% 25 IPF Amber Escalation Report FY 2014-15 Proportion of Assisted deliveries What is driving the reported underperformance? What actions have we taken to improve performance Standard Current Data Period Period Actual YTD Forecast next period 15% Nov-14 15.79% 15.5% 14.11% The Directorate has been The rate has been below the target for the last 2 reviewing a number of issues months, there is a level of on-going scrutiny related to birth including assisted and review of pathways. deliveries. There is a link between Induction of Labour (IOL) and assisted deliveries. The IOL pathway is currently being reviewed. Expected date to meet standard Lead Director January 2015 Director of Clinical Services 26 IPF Amber Escalation Report FY 2014-15 % adult inpatients have had a VTE risk assess What is driving the reported underperformance? What actions have we taken to improve performance The electronic VTE risk assessment was housed in CaseNotes and when it was transferred to EPR (April 2014) this led to a reduction in VTE risk assessment performance. This was due to the lack of familiarity of EPR but also due to the fact that patients were not being admitted quickly on to EPR and therefore doctors were unable to complete EPR VTE assessments. There have been many actions taken since the dip in VTE risk assessment: 1) Information about how to complete a VTE risk assessment on EPR has been made available to all clinical staff – by the thromboprophylaxis team distributing this information to in-patient wards and a copy of this information has been cascaded to each division, with the intention that it is sent to all doctors. 2) Consultants have been sent a document to show them how to make an in-patient list to evaluate their performance in VTE risk assessments. This was sent to divisions for cascading. 3) An e-mail and a short powerpoint presentation was sent to all the divisions for cascading to inform all doctors about the dip in VTE risk assessment and that as a Trust this needed to improve. 4) EPR informs clinicians at 6 hours and onwards following admission that a VTE risk assessment needs to be completed, if it hasn’t been done. These measures saw a gradual improvement in figures, but 95% has not been reached. This has led to the decision that mandation of VTE risk assessment will be implemented via EPR. This will not take place until e-prescribing has been rolled out. Expected date to meet standard Lead Director Dependent upon EPR e-Prescribing roll-out. Medical Director Standard Current Data Period Period Actual YTD Forecast next period 95% Q3 14-15 94.61% 93.8% 93.79% 27