strongly believes this will affect the U.S. export boom

advertisement

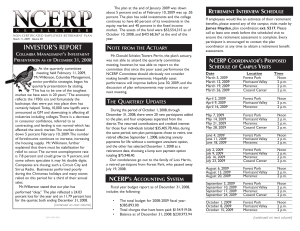

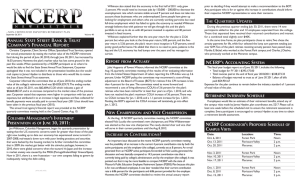

NON-CERTIFICATED EMPLOYEES RETIREMENT PLAN December 17, 2008 Volume 37 CLIFTON GUNDERSON ANNUAL AUDITING REPORT, ENDING JUNE 30, 2008 Nancy Jones of Clifton Gunderson, LLP, the college’s auditors, indicated the annual auditor’s report was conducted in accordance with auditing standards generally accepted in the United States of America. In her opinion, the financial statements represented fairly, in all material respects, the financial status of the Non-Certificated Employees Retirement Plan of the Junior College District of St. Louis, St. Louis County, Missouri, as of June 30, 2008.The changes in the plan’s financial status for the year ended in conformity with accounting principles generally accepted in the U.S. A brief summary of the audits financial highlights are as follows; the net assets available for benefits at the beginning of the year, July 1, 2007, equaled $63,339,186, compared to the net assets available as of June 30, 2008, totaled $58,309,484.This represents a decrease over $5 million from the previous year assets. The net depreciation of the fair value of investments was ($4,921,392), interest and dividends earned $1,767,171, less the investment expenses of $135,430, resulting in the total net investment income totaling ($3,289,651). Also, contributions made by the college and participants were $865,790 each, totaling $1,731,580. Total deductions including benefits paid to participants and administrative expenses add up to $3,471,631, and the net decrease during the [AFFIX LABEL HERE] auditing period was ($5,029,702). Also, in closing, Jones shared with the NCERP Committee that the decreased value of investments as of September 30, 2008, was decreased to $53,554,132. She informed the committee that the decrease is a result of $974,946 of distributions, with total contributions of $485,818, investment income of $279,716 and a decline in the fair market value of investment of $4,579,674, since June 30, 2008. The information was provided to the NCERP Committee at their quarterly committee meeting held November 13, 2008. INVESTOR’S REPORT COLUMBIA MANAGEMENT’S INVESTMENT PRESENTATION AS OF SEPTEMBER 30, 2008. At the quarterly committee meeting held November 13, 2008, Jim Wilkinson, senior portfolio strategist from Columbia Management, began his quarterly presentation by stating, “The current market is trying is an understatement.” Wilkinson acknowledged that we have not experienced anything like this in 25 years – current investment environment is reminiscent of the investment environment of the 1920s-1930s which was not like any other recession. Fortunately, some of the backstops from that time period (1920s/1930s) have worked and some things have gotten better. Wilkinson stated that in the month of September 2008, several major shifts occurred in the economy including the government purchasing Fannie May and Freddie Mac, Lehman Brothers filing bankruptcy, AIG receiving an $85 billion bail-out, the reserve fund being frozen, credit markets seizing up and the country of Iceland filing for bankruptcy. Wilkinson believes the epicenter for this problem is the home lending market. Falling home prices, tighter lending standards and slumping net worth have impacted home buying intentions. Unemployment rates may reach a high of 7.5 to 8 percent. As of early November 2008, the rate was 6.5 percent with more layoffs and cut-backs on the way. The positive is that the dollar has strengthened and the price of oil has decreased. Part of this is due to less oil being used because of the economy. Gas can now be found for less than $2 per gallon. On the negative,Wilkinson strongly believes this will affect the U.S. export boom because trade has been the main facet holding the government up in the last year, but this support will likely fade now that the financial crisis has gone global. The benefit of this plan is that it has well diversified in its asset allocation.Wilkinson further explained that the fixed income sector is doing better than other sectors and 47 percent of the allocation is currently in this market.The allocations are based upon the retirement committee’s previous and careful decision making. The asset value at the end of the quarter September 30, 2008, was $53,544,315 which is a $4.5 million decrease since June 30, 2008.Wilkinson reminded the committee that this pension plan is designed as a long-term benefit and in the short term there will be bumps in the road, examples being - today’s economy (November 2008), the 1999 technology bubble and the events of September 11, 2001. The portfolio performance is down 14 percent year to date and the global equity market is down 20 percent.Wilkerson ended his presentation by stating that due to the asset allocation – over time, this situation will all pan out. THE QUARTERLY UPDATES During the period of July 1-September 30, 2008, there were 20 new participants added to the plan, and six employees separated from the college.Their returned contributions totaled $43,284.57. During the same time frame, four plan participants chose to retire – two elected to retire July 1, 2008, one chose August 1, 2008, and the other selected September 1, 2008. One chose to receive annuity payments for life without a contingent annuitant option and the remaining three chose lump sum options. Our condolences go out to the family of Irene E. Dennis, a retired participant from Meramec, who passed away in September. NCERP’S ACCOUNTING SYSTEM Fiscal year budget report as of September 30, 2008, includes the following: • • • • The total budget for 2008-2009 fiscal year: $385,893.00 Total charges that have been paid: $57,488.19 Quarterly Encumbered charges: $20,412.50 Balance as of June 30, 2008: $307,992.31 RETIREMENT INTERVIEW SCHEDULE If employees would like an estimate of their retirement benefits, please attend any of the campus visits made by James Hayden, plan coordinator, ext. 5217. Please call at least one week before the scheduled visit to ensure the retirement assessment is complete. Every participant is encouraged to contact the plan coordinator at any time to obtain a retirement benefit assessment. NCERP COORDINATOR’S PROPOSED SCHEDULE OF CAMPUS VISITS Location Forest Park Florissant Valley Meramec Cosand Center Time Noon 2 p.m. 2 p.m. 2 p.m. February 5, 2009 February 12, 2009 February 19, 2009 Forest Park Florissant Valley Meramec Noon 2 p.m. 2 p.m. March March March March Forest Park Florissant Valley Meramec Cosand Center Noon 2 p.m. 2 p.m. 2 p.m. April 2, 2009 April 9, 2009 April 16, 2009 Forest Park Florissant Valley Meramec Noon 2 p.m. 2 p.m. May May May May 7, 2009 14, 2009 21, 2009 28, 2009 Forest Park Florissant Valley Meramec Cosand Center Noon 2 p.m. 2 p.m. 2 p.m. June 4, 2009 June 11, 2009 June 18, 2009 Forest Park Florissant Valley Meramec Noon 2 p.m. 2 p.m. Date January January January January July July July July 8, 2009 15, 2009 22, 2009 29, 2009 5, 2009 12, 2009 19, 2009 26, 2009 2, 2009 9, 2009 16, 2009 23, 2009 Forest Park Florissant Valley Meramec Cosand Center Noon 2 p.m. 2 p.m. 2 p.m. August 6, 2009 August 13, 2009 August 20, 2009 Forest Park Florissant Valley Meramec Noon 2 p.m. 2 p.m. Locations are: Meramec, BA-105; Florissant Valley, Training Center,TC-109; Forest Park, Academic Affairs Conference Room; Cosand Center, Room 208. Points of contact: The NCERP committee representatives are listed on the back panel of this brochure. NCERP COMMITTEE MEETING SCHEDULE S M T W T F S Plan participants are encouraged to attend the next NCERP quarterly committee meeting, which will be held at the Cosand Center, February 11, 2009, 9:15 a.m. The quarterly NCERP committee meetings are now being rotated from various campus locations please take notice that a quarterly committee meeting will be soon coming to a location near you. The tentative time and dates are listed below: February 11, 2009, CC 9:15 a.m. May 13, 2009, FV 9:15 a.m. August 12, 2009 MC 9:15 a.m. November 11, 2009 FV 9:15 a.m. BENEFICIARY ACCURACY Please make sure beneficiary information on file for NCERP retirement contributions is accurate. Failure to do so could result in retirement contributions being paid to the employee’s estate versus having the contributions going to loved ones. If there are questions or concerns, contact James Hayden, plan coordinator ext. 5217. UNOFFICIAL… Restrain Your Holiday Spending: According to the Illinois CPA Society, just as holiday feasting can ruin your waistline, holiday spending can bust your budget. Here are ways to plan your holiday spending: • • • Review what you spent last year. Include amounts you spent on gifts, decorating, entertaining, clothes and travel. If you don’t have these records, try to estimate what you spent. Write a holiday budget. Determine a realistic budget that meets your needs without going overboard.Think of ways to reduce your costs perhaps by some gifts and decorations. Set Limits. Once you’ve made your gift list stick to it. Decide beforehand how much you can afford to spend on each person. Look for bargains or sale items. (continued on back panel) • If possible, avoid using credit. Paying in cash is a good way to reduce your spending since most people think more carefully when they pay with cash. A debit card is a good alternative to a credit card, however, keep track of your expenditures. If you choose to use credit, keep a running tally of your balance to deter overspending. Be sure to use a low-interest credit card. The NCERP Committee would like to wish a happy holiday season to each plan participant… POINTS OF CONTACT: Board of Trustees Appointment Calla White 6688 Chesapeake Drive Apartment C Florissant, Missouri 63033 Phone: 314-355-9112 Term expires: BOT’s pleasure Board of Trustees Appointment Ruth Lewis 10455 Litzsinger Road St. Louis, MO 63131 Telephone: 314-567-7098 Term Expires: BOT’s pleasure Unit Representative Kevin White CC – TESS Systems Operations Office Phone: 314-539-5058 E-mail: kwhite@stlcc.edu Term expires: June 30, 2010 Physical Plant Mike Wibbenmeyer MC – Utilities/HVAC Phone: 314-984-7749 E-mail: mwibbenmeyer@stlcc.edu Term expires: June 30, 2009 Non-Unit Representative Vicki Lucido FV - VP Academic Affairs' Office Telephone: 314-513-4214 e-mail: vlucido@stlcc.edu Term expires: June 30, 2011 Any suggestions for improvements, questions, comments or other concerns about the retirement plan may be directed to any of the NCERP committee representatives. Any proposed agenda items may be sent to James Hayden or the employee representative 10 days prior to the meeting date. Individuals with speech or hearing impairments may call via Relay Missouri by dialing 711. St. Louis Community College FLORISSANT VALLEY FOREST PARK MERAMEC WILDWOOD ACCOMMODATIONS STATEMENT St. Louis Community College makes every reasonable effort to accommodate individuals with disabilities. If you have accommodation needs, please contact the Access office at the campus where you are registering at least six weeks before the beginning of the class. Event or other public service accommodation requests should be made with the event coordinator or applicable location non-discrimination officer at least two working days prior to the event or public service. NON-DISCRIMINATION STATEMENT St. Louis Community College is committed to non-discrimination and equal opportunities in its admissions, educational programs, activities and employment regardless of race, color, creed, religion, sex, sexual orientation, national origin, ancestry, age, disability or status as a disabled or Vietnam-era veteran and shall take action necessary to ensure non-discrimination. This newsletter is designed to summarize and explain basic changes in the Non-Certificated Employees Retirement Plan and provides updates on other related matters. Since it is only a summary, this newsletter does not cover the Plan's provisions in detail. Therefore, if there is any conflict between this newsletter and the Plan document itself, the Plan document will always govern. An official copy of the Plan is available for inspection in the Human Resources Department at the Joseph P. Cosand Community College Center, 300 South Broadway, St. Louis, MO and in each campus’ library during regular business hours. 100710 12/08