HEALTH REFORM IN THE CARE

advertisement

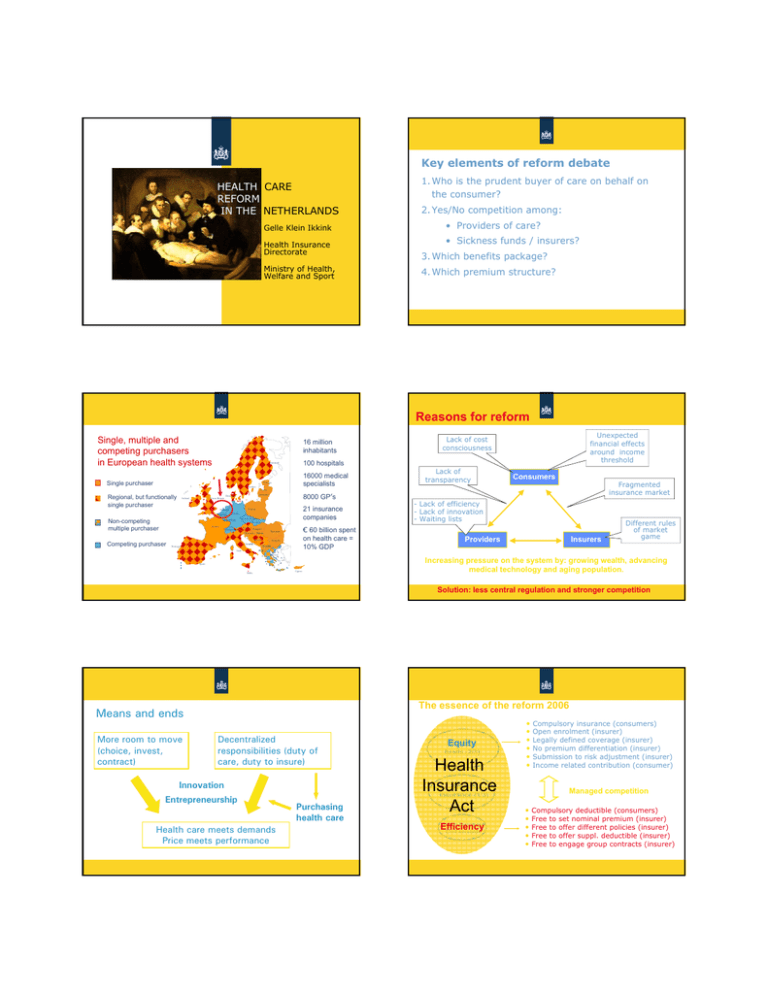

Key elements of reform debate HEALTH CARE REFORM IN THE NETHERLANDS Gelle Klein Ikkink Health Insurance Directorate Ministry of Health, Welfare and Sport 1. Who is the prudent buyer of care on behalf on the consumer? 2. Yes/No competition among: • Providers of care? • Sickness funds / insurers? 3. Which benefits package? 4. Which premium structure? Reasons for reform Single, multiple and competing purchasers in European health systems 16 million inhabitants 100 hospitals Finnland Single purchaser 16000 medical specialists Estonia Sweden Regional, but functionally single purchaser Great-Britain Ireland 21 insurance companies Germany Czech Republic Slovakia Luxemburg France Switzerland Austria Hungary Slovenia Competing purchaser 8000 GP’s Poland Holland Belgium Non-competing multiple purchaser Serbia Bosnia Croatia Portugal Italy Lack of transparency Consumers Fragmented insurance market Latvia Lithuania Denmark Unexpected financial effects around income threshold Lack of cost consciousness € 60 billion spent on health care = 10% GDP Romania Bulgaria FYRM ALB - Lack of efficiency - Lack of innovation - Waiting lists Providers Insurers Different rules of market game Greece Spain Malta Ciprus Increasing pressure on the system by: growing wealth, advancing medical technology and aging population. Solution: less central regulation and stronger competition The essence of the reform 2006 Means and ends More room to move (choice, invest, contract) Decentralized responsibilities (duty of care, duty to insure) Innovation Entrepreneurship Health care meets demands Price meets performance Purchasing health care Equity Sickness funds (2/3) Health Private Insurance insurance (1/3) Act Public Insurance Efficiency Civil servants • • • • • • Compulsory insurance (consumers) Open enrolment (insurer) Legally defined coverage (insurer) No premium differentiation (insurer) Submission to risk adjustment (insurer) Income related contribution (consumer) Managed competition • • • • • Compulsory deductible (consumers) Free to set nominal premium (insurer) Free to offer different policies (insurer) Free to offer suppl. deductible (insurer) Free to engage group contracts (insurer) Q ua lit y • Freedom to contract, preferred providers • From budget payment to pay for performance • Free pricing in hospital care (2005:10%, 2009: 34%) • Capital costs in integrated tariffs (DRG’s) • Quality indicators for hospital care and outpatient care • Development of guidelines, clinical standards • Step by step increase the amount of risk of co nt De ex t be gr e ar e in o g fr pr is ov k id De er s be gr ar ee in o g fr in is su k re rs Instruments of providers of insurers Performance • Take off: with caution • There is more space available than used. Explanation: Shortcomings incentive structure Government oriented → self oriented → each other oriented → future oriented Period of incubation, trust building, management of expectations So far, so good • • • • • • • Initiatives managed care, DRG contracting More focus on prevention Substantial steps in increasing risk providers and insurers Preference policy pharmaceuticals More relaxed attitude on preferred provides Quality awareness moving upwards Patient channeling with restitution of compulsory excess Any growth yet? What’s next? • • • • • Will health care purchasing grow up? Will the insurer be accepted as health care guide? Will we / the insurer (!) be able to connect and integrate separate domains (primary/hospital, prevention/cure) ? Will we succeed in improving incentive structures? How far does the absorption capacity of the HC sector reach? Competition on insurance market YAGWYPF • • • You always get what you pay for 80’s First: Then: Now Later : : : : 90’s 00’s Availability Waiting lists Production Health outcomes • • • • t Developments free pricing 2005 - 2007 • • • • • • Increase in volume seems to be moderate Waiting times decrease slightly Quality issues in negotiations: many talks less commitments Tariffs “first portion” 10% DRG’s 2005: 2007: +2,1, 2008: -/- 1,6% Tariffs “second portion” 10% DRG’s: 2008 + 1,9% Balance of power hospital / insurer seems to be ok 2006: nearly 20% switched 2009: app. 4% (“just enough”) Four insurance companies have almost 90% of the market (“just enough”) Fierce competition, particularly on premium Cumulated losses 2006-2007 500 mln € People satisfied with their insurer Product differentiation below desired level (modest initiatives on preferred providers) Defaulters & uninsured Both: 1.5% (240.000 each) Defaulters • Large portion didn’t pay as from 2006 (Σ 3000 €) • Due to yearly open enrollment: merry-go-round along insurers • 2007: ban on canceling policies • 2009: withholding 130% nominal premium on income source Uninsured • 2008: Mapping, giving information • 2009/2010: • final warning • fines • Registration with insurer by government You need public enforcement to sustain a private system…. Agenda 2007 - 2011 Agenda 2007 - 2011 Improve quality transparency • Increase risk providers • Increase risk insurers End budget financing Less ex-post corrections RAF • • Ab Klink Minister of Health Incentive compulsory deductible More prevention Disease Management Programs • Limit free rider behaviour • Corporate governance 9 Uninsured 9 Defaulters Don’ Don’t ever give up