multicrystalline 46% thin-film 7.9%

advertisement

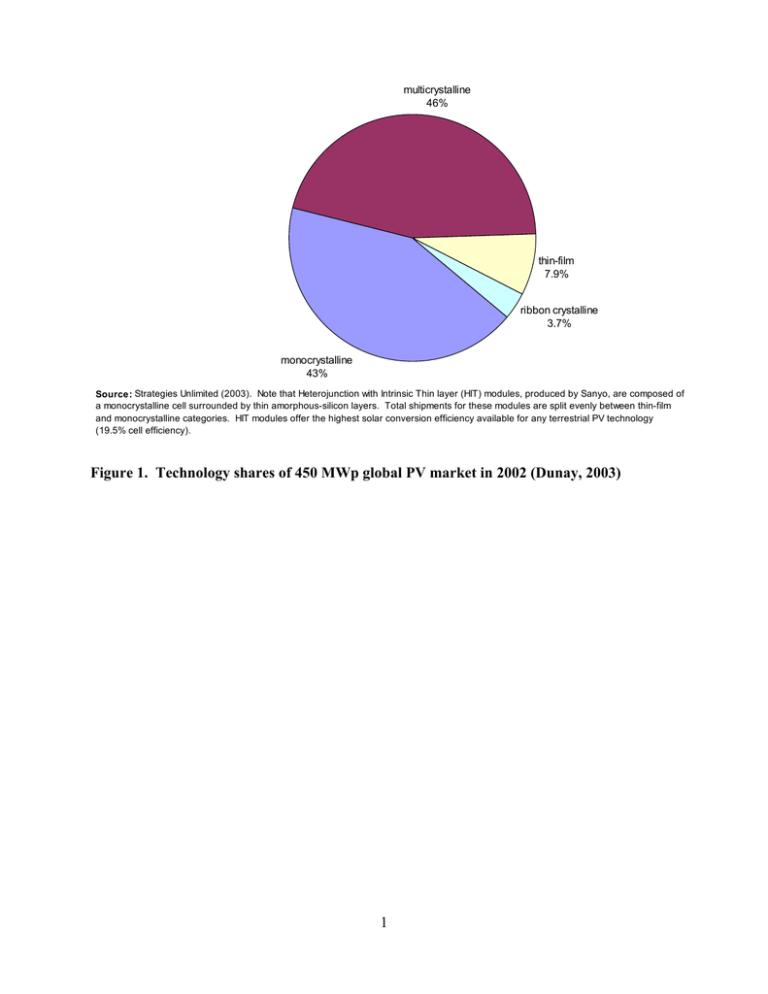

multicrystalline 46% thin-film 7.9% ribbon crystalline 3.7% monocrystalline 43% Source: Strategies Unlimited (2003). Note that Heterojunction with Intrinsic Thin layer (HIT) modules, produced by Sanyo, are composed of a monocrystalline cell surrounded by thin amorphous-silicon layers. Total shipments for these modules are split evenly between thin-film and monocrystalline categories. HIT modules offer the highest solar conversion efficiency available for any terrestrial PV technology (19.5% cell efficiency). Figure 1. Technology shares of 450 MWp global PV market in 2002 (Dunay, 2003) 1 $100.0 1976 PR=0.80 2 Price (2002$/Wp) R = 0.99 $10.0 2002 $1.0 $0.1 0 1 10 100 1,000 10,000 cumulative PV production (GWp) Source: Johnson (2002) and Dunay (2003) Figure 2. PV experience curve This figure shows the historical experience curve for crystalline and thin-film power modules (excluding small consumer cells and modules for space applications) based on average global wholesale prices (Johnson, 2002). The experience curve indicates a tight fit and a 20 percent decline in price with every doubling of cumulative production (PR = 0.80). The 95 percent confidence interval ranges from PR = 0.79 to PR = 0.81 and the spread around the curve for PR = 0.80 is so tight that it is almost visually imperceptible, and therefore not depicted. 2 350 grid-connected 300 off-grid + consumer MWp 250 200 150 100 50 00 01 20 99 20 97 98 19 19 96 19 95 19 19 94 93 19 91 92 19 19 89 90 19 19 88 19 86 87 19 19 85 19 83 84 19 19 82 19 81 19 19 19 80 0 Source: Demeo et al. , 1999; Johnson, 2002 Figure 3. Global PV markets Terrestrial PV markets grew at a compound average growth rate of 24 percent from 1980-2001. Off-grid markets dominated through the mid-1990s except for the early 1980s when subsidized central-station grid projects gained prominence. Since 1990 off-grid sales have grown substantially but buydown programs have fueled a torrid 45 percent annual growth in grid-connected markets. Small cells used in consumer products held a significant market share in the mid-1980s, but this sector is now trivial and declining. 3 value of modules ($/Wp) $2.50 $2.00 $1.50 $1.00 $0.50 $0.00 0 0.5 1 1.5 2 2.5 3 GWp per year Figure 4. Financial breakeven for a-Si PV in new US housing A detailed bottom-up financial breakeven analysis (Duke, Williams, and Payne, submitted) shows the annual potential demand for PV modules installed in new single-family homes in the US after 2005, assuming that 50 percent of new homes (housing data are from www.census.gov/const.) offer acceptable shading and orientation. A point on this curve indicates the PV quantity demanded in new single-family homes for a given PV module price. This financial breakeven curve was constructed based on a detailed lifecycle analysis that assumes net metering and accounts for variation in county-level insolation and state-level electricity prices. Homeowners finance their systems through tax-advantaged home mortgages and incremental homeowner insurance costs are assumed to be trivial. Finally, it is assumed that states and localities exempt the value of PV systems from property tax assessments to level the playing field with less capital-intensive conventional electricity technologies. All other existing or planned tax incentives are excluded—including any mechanisms to reward PV for its environmental advantages relative to conventional electricity supplies. 4 100 Price (USD(2000)/Wp) Nitsch 1976-84 PR=.84 Nitsch 1984-87 PR=.53 10 Nitsch 1976-96 PR=.80 Nitsch 1987-96 PR=.79 Harmon (PR=.80) Strategies Unlimited (PR=.80) 1 0.1 1 10 100 1000 10000 Cumulative Sales (MW) Figure 5. Spurious microstructure in PV experience curves Comparing two PV experience curves (Johnson, 2002; Harmon, 2000) with the curve from Nitsch (1998) suggests that the apparent knee in the latter may be spurious. Nitsch (1998) uses European price data for crystalline modules, raising the possibility of an exchange rate anomaly or a shift in the price survey methods during 1984-1987 (e.g. towards a sample definition that is more heavily weighted towards wholesale prices rather than retail). In any case, the long-term experience curve for the Nitsch data has the same progress ratio (PR = 0.80) as the other two curves. . 5 PV module break-even value ($/Wp) $30.00 $25.00 $20.00 $15.00 X=7.5P-2.5 R2 = 0.99 $10.00 $5.00 $0.00 0 1 2 3 4 5 6 7 8 9 10 GWp per year Figure 6. PV demand elasticity estimation The square data points plot historical PV prices versus unsubsidized off-grid sales levels from 1980-2000 (Johnson, 2002). The triangles represent 20 points taken from Figure 4 (with the quantities multiplied by a factor of 4 to account for retrofit and international markets) at evenly spaced quantity intervals. The best-fit isoelastic demand schedule consistent with these data has an elasticity of 2.5; however, some of this historical demand growth reflects diffusion effects rather than price effects, so the base case analysis assumes an elasticity of 2. 6 $5.00 break-even value of modules ($/Wp) $4.50 $4.00 $3.50 $3.00 $2.50 $2.00 X(50)=(25/(1+exp(-0.09*50+2))*P^-2 $1.50 X(10)=(25/(1+exp(-0.09*10+2))*P^-2 $1.00 $0.50 X(1)=(25/(1+exp(-0.09*2+2))*P^-2 $0.00 0 2 4 6 8 10 12 GWp per year 14 16 18 20 Figure 7. Logistic demand shift for the optimal path method This figure compares the logistically shifting all-market PV demand schedule used in the optimal path method analysis with the annual OECD residential PV demand schedule (i.e. the breakeven schedule for PV demand in new U.S. homes from Figure 4 increased by roughly a factor of 4 to account for retrofits as well as markets in Europe and Japan). In the first year of the analysis (i.e. 2003) annual demand falls short of the breakeven schedule, but the two schedules overlap by year 10 after markets have matured (i.e. after a doubling of the coefficient on the isoelastic demand). After 50 years, demand shifts out by another factor of four due to growth in commercial buildings and developing country markets. At the price floor of $0.50/Wp, this yields a mature sales rate of 100 GWp/y. Even in the first year, the all-market demand schedule exceeds the OECD residential PV schedule for sales levels below 1 GWp/y because it includes off-grid PV markets for which the willingness to pay is much greater than for distributed grid-connected PV (although the potential non-grid market is small). Similarly, the all-market demand schedule extends beyond 10 GWp/y (at which point the OECD residential PV demand schedule tapers off) because other markets open up at these low prices—including commercial buildings and a full range of grid-connected applications in developing countries. 7 $ billions per year (r=0.05) $4 $3 $2 $1 $0 0 10 20 30 40 50 60 70 80 90 100 70 80 90 100 70 80 buydown year minimum subsidies + transfer subsidies minimum subsidies GWp per year 100 90 80 70 60 50 40 30 20 10 0 0 10 20 30 40 50 60 buydown year buydow n NSS 50 60 $5 $/Wp $4 $3 $2 $1 $0 0 10 20 30 40 90 100 buydown year buydown price buydown net price NSS price Figure 8. Optimal path method base case scenario (MEB = 0) The top panel shows the expenditure rate ($ billions/year) for an optimal global PV buydown considering both minimum possible subsidies and minimum possible subsidies plus transfer subsidies (both are illustrated in Figure 9). The middle panel shows the output path under the optimal buydown and the slower sales growth under the no subsidy scenario (NSS). The bottom panel shows the baseline NSS price trajectory, much faster price reductions under the buydown, and the net price paid by buydown participants (i.e. current buydown price minus unit subsidies). 8 Year One $10 quantity demanded w/o year-one subsidy $9 quantity demanded w/ year-one subsidy $8 $7 $/Wp $6 $5 consumer surplus current price $4 $3 free riders $2 minimum possible subsidy cost failure to price discriminate TMC $1 $0 0 0.2 0.4 0.6 0.8 1 1.2 1.4 GWp/y Year 20 $2 quantity demanded w/o year-20 subsidy quantity demanded w/ year-20 subsidy consumer surplus $/Wp current price $1 free riders failure to price discriminate minimum possible subsidy cost TMC $0 0 5 10 15 20 25 30 GWp/y Figure 9. Base case (MEB = 0) snapshots for t = 1 and t = 20 The minimum possible subsidy in each period of the buydown equals the integral of current price minus the willingness to pay schedule for all the buydown participants. There may be additional transfer subsidies: 1) if the buydown program fails to price discriminate when distributing subsidies and, 2) if the buydown program cannot exclude free riders. In later years, transfer subsidy costs may account for an increased proportion of total subsidies because the potential base of free riders is higher. 9 300 Deployment Demonstration R&D millions of 2000$ 250 200 150 100 50 ly Ita UK Ko re a Sw it z er la nd Au st ra lia Fr an ce an y Ne th er la nd s G er m Source: IEA (2000) US A EU Ja pa n 0 Figure 10. Current PV support allocations by leading IEA countries The figure shows a break down of PV funding allocations by leading IEA countries for the year 2000. The totals include federal, state, and local support programs and they highlight strong investment by Japan and rapidly growing support by Germany, which spends nearly twice as much as the U.S. on a per capita basis. 10 600 Deployment Demonstration R&D millions of constant 2000$ 500 400 300 200 100 0 1994 1995 1996 1997 1998 1999 2000 Source: IEA (2000) Figure 11. Trends in PV support among IEA countries These figures reflect total funding at the federal, state, and local level by seventeen major industrialized countries in the International Energy Agency. Funding for R&D and demonstration programs has been relatively stable (aside from a dip in 1996), but buydown funding increased sharply over the seven-year period shown. 11 500 450 400 Other German residential buydown 350 Japanese residential buydown MWp 300 250 200 150 100 50 0 1993 1994 1995 1996 1997 1998 1999 2000 2001 Source: Berger (2001); Weiss and Sprau (2001); Hirschman and Takano (2003); Krampitz and Schmela (2003) Figure 12. PV buydown sales trends in Germany and Japan Germany and Japan have scaled up large buydown programs primarily targeting grid-connected residential customers. By 2000, these combined programs accounted for more than half of global module sales and were expected to drive global PV sales growth through at least 2003. 12 2002 . $35 US$/Wp (120Yen/$) $30 Installation Balance of systems Modules $25 $20 $15 $10 $5 $0 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 Source: Kurokawa and Ikki (2001); NEF (2001); Hirshman and Takano (2003) Figure 13. Japanese residential PV system price trends Installed residential PV systems have dropped from over $30/Wp in 1993 when the Japanese buydown began to under $7/Wp by 2001 (in constant 2000 dollars). System prices can be broken down into modules, balance of systems (BOS) equipment, and installation costs. The associated progress ratios are roughly similar for all three (PR = 0.80 for modules, PR = 0.78 for BOS, and PR = 0.84 for installations) but installation costs have fallen by a factor of five (while module prices dropped by just over a factor of two) because the local experience base for installations was initially minimal. BOS prices have fallen even faster (by a factor of 8) because the associated progress ratio is better than for modules. Note that inverters are global commodities—but even for this internationally traded component of BOS costs, manufacturers still had to tailor new models to the particular needs of the Japanese market (e.g. eliminating battery backup charging capability). 13