TAXES, SUBSIDIES, AND

INSURANCE

Microeconomics Made Easy

by

William Yacovissi

Mansfield University

©William Yacovissi All Rights Reserved

INSURANCE

Insurance is generally a system in which the

consumer prepays for some event.

When the event occurs the consumer pays

no money or some specified small amount

instead of the full amount

INSURANCE

Mostly we insure against bads so we’re not

encouraged to consume the item even

though it’s already paid for.

Still, insurance companies notice increased

consumption when insurance is present.

That is, people with fire insurance have

more fires.

INSURANCE

We can examine the impact of insurance or any prepaid

plan using a market diagram.

On the diagram on the next slide, the market would be in

equilibrium at P1 and Q1.

With insurance the price of the item to the consumer drops

to P2 and consumption increases to Q2

In order to get Q2 of output, the insurance company ahs to

pay P3.

INSURANCE

INSURANCE

Keep in mind that the diagram is drawn in a

way that exaggerates the quantity impact of

the price change.

In the real world, insurance, taxes, and

subsidies can only be applied in situations

that will have a manageable quantity impact

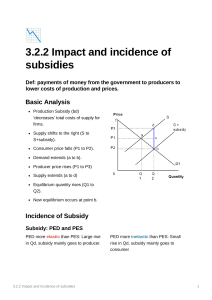

SUBSIDIES

A subsidy is when a third party pays for all

or part of the price of something.

For example, your college education is

subsidized by the state and federal

governments and by Alumni and other

donors to the University.

SUBSIDIES

The impact of a subsidy is the same as insurance in that

both involve a third party payer.

As the price to the consumer is lower from P1 to P2, the

quantity demanded increases from Q1 to Q2

To produce Q2 of the good, suppliers must receive P3 for

that amount of output. So, my salary is higher as a result

of your education being subsidized. The subsidy increase

the demand for college professors.

TAXES

A is the opposite of a subsidy. A person is

required to pay more for the item than the market

would charge.

Looking at the diagram on the next slide, the tax

increases the price from P1 to P2 and reduces the

quantity demanded from Q1 to Q2

Suppliers only need a price of P3 to produce Q2 of

the good.

TAXES

TAXES

Payment of the tax is split between

consumers and producers in proportion to

the relative strengths of the demand and

supply.

In the diagram the tax is P1 – P3 with

consumers paying P2 – P1 of the tax and

producers paying P1 – P3 of the tax.