Concepts of Fairness in the Global Trading System

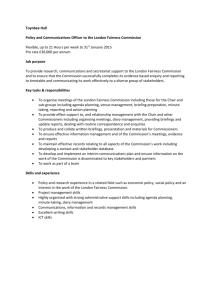

advertisement