Green accounting: (i) Welfare results (ii) Open economies

advertisement

Green accounting:

(i) Welfare results

(ii) Open economies

Lectures in resource economics

Spring 2004, Part 5

G.B. Asheim, nat.res. 5, updated 31.03.2004

1

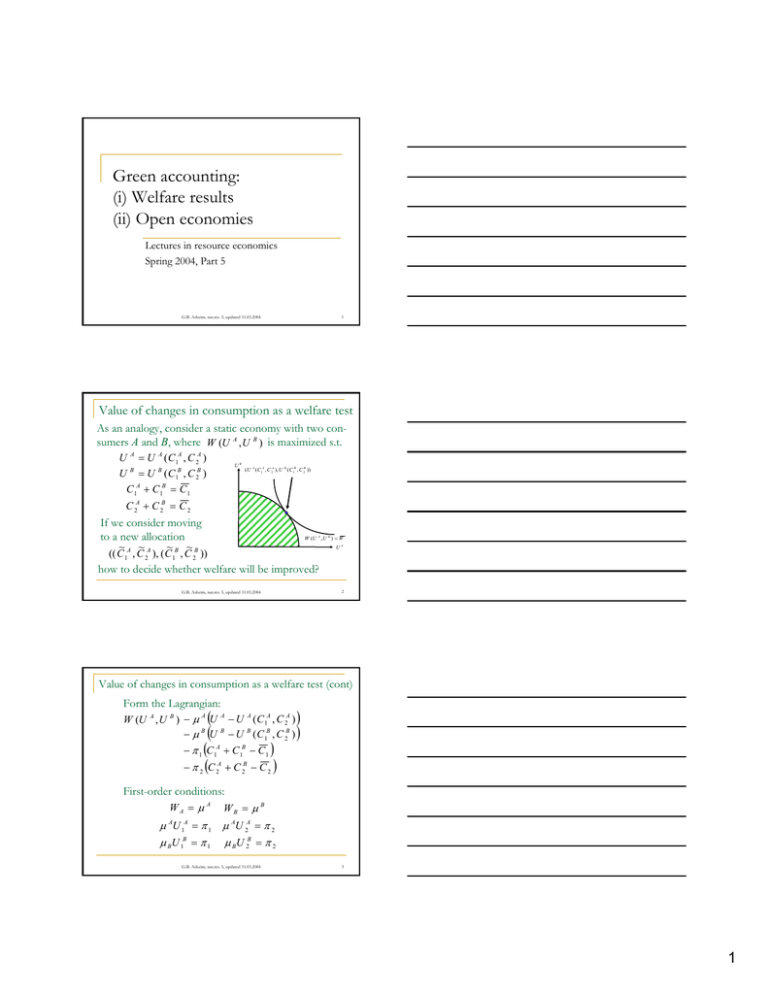

Value of changes in consumption as a welfare test

As an analogy, consider a static economy with two consumers A and B, where W (U A , U B ) is maximized s.t.

= U A (C 1A , C 2A )

= U B (C 1B , C 2B )

A

C 1 + C 1B = C 1

U

U

A

B

UB

(U A (C 1A , C 2A ), U B ( C 1B , C 2B ))

C 2A + C 2B = C 2

If we consider moving

to a new allocation

W (U A , U B ) = W

~ ~

~ ~

(( C 1A , C 2A ), ( C 1B , C 2B ))

UA

how to decide whether welfare will be improved?

G.B. Asheim, nat.res. 5, updated 31.03.2004

2

Value of changes in consumption as a welfare test (cont)

Form the Lagrangian:

W (U A , U B ) − µ A (U A − U A ( C 1A , C 2A ) )

− µ B (U B − U B ( C 1B , C 2B ) )

− π 1 (C 1A + C 1B − C 1 )

− π 2 (C 2A + C 2B − C 2 )

First-order conditions:

WA = µ A WB = µ B

µ AU 1A = π 1 µ AU 2A = π 2

µ BU 1B = π 1 µ BU 2B = π 2

G.B. Asheim, nat.res. 5, updated 31.03.2004

3

1

Value of changes in consumption as a welfare test (cont)

~ ~

~ ~

W (U A ( C 1A , C 2A ), U B ( C 1B , C 2B ))

− W (U A ( C 1A , C 2A ), U B ( C 1B , C 2B ))

~A

~

A

≈ W A ⋅ U 1 ⋅ ( C 1 − C 1A ) + W A ⋅ U 2A ⋅ ( C 2A − C 2A )

~

~

+ W B ⋅ U 1B ⋅ ( C 1B − C 1B ) + W B ⋅ U 2B ⋅ ( C 2B − C 2B )

~A

~A

A

A

= π 1 ⋅ (C1 − C1 ) + π 2 ⋅ (C 2 − C 2 )

~

~

+ π 1 ⋅ ( C 1B − C 1B ) + π 2 ⋅ ( C 2B − C 2B )

~

~

= π 1 ⋅ (C 1 − C1 ) + π 2 ⋅ (C 2 − C 2 ) = π 1 ⋅ ∆ C1 + π 2 ⋅ ∆ C 2

(π 1 , π 2 ) corresponds to market prices in a comp. eq.

Welfare impr. iff pos. value of changes in consumption.

4

G.B. Asheim, nat.res. 5, updated 31.03.2004

Value of changes in consumption as a

welfare test in a dynamic economy

Turn now to a dynamic economy with a continuum of

consumers. In analogy, if welfare is maximized, then welfare improvement is measured by the present

− i dτ

∞

value of future changes in consumption: ∫0 C& t e ∫ dt

t

0

Since K& 0 − p0 R0 =

∞

∫0

(

t

τ

)

− iτ dτ

C& t e ∫0 dt and Y&0 = i0 K& 0 − p0 R0 :

Observation: Welfare improvement is indicated by

non-negative genuine savings and growth in Green

NNP. This holds under comprehensive accounting.

(G.B. Asheim and M.L. Weitzman, Does NNP growth indicate welfare improvement? Econ Letters, 2001)

5

G.B. Asheim, nat.res. 5, updated 31.03.2004

Can wealth

indicate welfare?

∞

∞

t

W&0 = ∫ C& t e ∫0

∞

t

W0 = ∫ Ct e ∫0 dt

{

0

Genuine

1

4243

wealth

− iτ dτ

Present value of

future consumption

t

dt + ∫ (i0 − it )Ct e ∫0 dt

A decreasing

0

interest rate leads to capital

gains not corresponding to

In the D-H-S model with

welfare improvement.

constant returns to scale:

− iτ dτ

− iτ dτ

0

W0 = K 0 + p0 S 0

A decreasing interest rate is

W&0 = K& 0 + p0 S&0 + p& 0 S 0

reflected by capital gains on

= K& 0 − p0 R0 + i0 p0 S 0 by Hotelling’s rule the resource.

> K& − p R which indicates welfare improvement

0

0

0

G.B. Asheim, nat.res. 5, updated 31.03.2004

6

2

Hartwick’s rule in open economies: Should

resource-rich countries reinvest resource rents?

k&t + K& t = Q(kt + K t , rt + Rt ) − ct − Ct

D-H-S model

with 2 countries

S&t = − Rt

s&t = −rt

∞

∞

s0 = ∫ rt dt

S 0 = ∫ Rt dt

0

0

Lower case:

Domestic

Upper case:

Foreign

Assume that the production function is Cobb-Douglas:

Q(k + K , r + R) = (l + L)1− a −b (k + K ) a (r + R)b

= w(l + L) + i (k + K ) + p (r + R) where

wage

w = (1 − a − b)

Q

l+L

interest

rate i =

a

Q

k+K

resource

price p

=b

Q

r+R

7

G.B. Asheim, nat.res. 5, updated 31.03.2004

Hartwick’s rule in open economies (cont)

Assume that the world as a whole reinvests resource

rents by following Hartwick’s rule:

k& + K& = bQ = p (r + R)

This means that total consumption equals the

functional shares of labor and reproducible capital:

c + C = (1 − b)Q = w(l + L) + i (k + K )

= Q − p(r + R)

Question: Since total consumption equals the shares of

labor and capital, is it resource owners’ responsibility to reinvest resource rents? Should reinvestment be done by resource prod. (Saudi Arabia) or resource cons. (Japan)?

8

G.B. Asheim, nat.res. 5, updated 31.03.2004

Hartwick’s rule in open economies (cont)

Assume that workers, capitalists and resource owners

each follows a constant consumption path.

Q

bQ

Workers’ cash-flow is Capitalists’ cash-flow Resource owners’

constant and equal to is constant and equal cash-flow is conto i ( k + K ) − k& − K& stant and equal to

w(l + L) =

(1 − a − b)Q

= (a − b)Q

p (r + R ) = bQ

It is capitalists’ responsibility to reinvest resource rents!

G.B. Asheim, nat.res. 5, updated 31.03.2004

9

3

Hartwick’s rule in open economies (cont)

The budget constraint in each country implies:

c = wl + ik − k& + pr

C = wL + iK − K& + pR

Assume that the countries accumulate capital and

deplete the resource in proportion to their stocks:

k& = bQ k +kK

pr = bQ s +s S

pR = bQ s +S S

K& = bQ k +KK

The consumption in each country is constant and equal

to maximal sustainable consumption: c + C = (1 − b)Q

c = (1 − a − b)Q l +l L + (a − b)Q k +kK + bQ s +s S

c& = 0

S

L

K

C = (1 − a − b)Q

+ (a − b)Q

+ bQ

C& = 0

l+ L

k +K

s+S

G.B. Asheim, nat.res. 5, updated 31.03.2004

10

Hartwick’s rule in open economies (cont)

Since k& − pr = wl + ik − c and K& − pR = wL + iK − C

s ⎞

⎛ k

k& − pr = bQ ⋅ ⎜

−

⎟

⎝k +K s+S ⎠

S ⎞

⎛ K

&

K − pR = bQ ⋅ ⎜

−

⎟

Conclusions:

k

+

K

s

+

S⎠

⎝

If each country consumes sustainable income

reinvestment of resource rents is done in proportion to

capital endowment, not resource endowment.

& − pR in a resource

sustainable income exceeds C + K

S

K

rich country like Saudi-Arabia, where s + S > k + K , and

the opposite for a capital rich country like Japan. Why?

(G.B. Asheim, Hartwick’s rule in

open economies, CJE, 1986)

Alternative presentation of the material in Section 19.4.2

in Perman et al. on the Proops-Atkinson indicator

G.B. Asheim, nat.res. 5, updated 31.03.2004

11

Genuine (or comprehensive) savings must

account for

accumulation of ordinary reproducible capital,

technological change and human capital

accumulation,

reduced availability of natural and environmental

resources,

in the case of open economies, changing terms-oftrade (which are improving for resource exporters).

G.B. Asheim, nat.res. 5, updated 31.03.2004

12

4