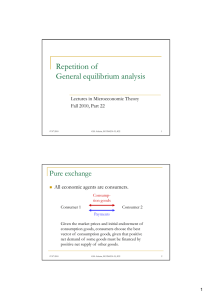

Repetition of General equilibrium analysis Pure exchange All economic agents are consumers.

advertisement

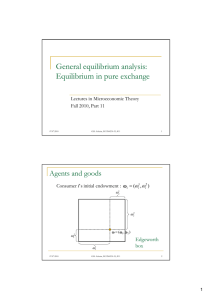

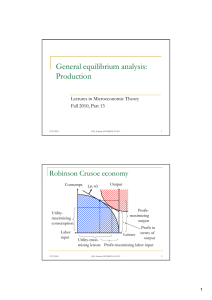

Repetition of General equilibrium analysis Existence Pareto efficient allocation (welfare theorems) Lectures in Microeconomic Theory Fall 2010, Part 22 07.07.2010 G.B. Asheim, ECON4230-35, #22 1 Pure exchange All economic agents are consumers. Consumption goods Consumer 1 Consumer 2 Payments Given the market prices and initial endowment of consumption goods, consumers choose the best vector of consumption goods, given that positive net demand of some goods must be financed by positive net supply of other goods. 07.07.2010 2 G.B. Asheim, ECON4230-35, #22 Agents and goods Consumer i' s initial endowment : i (i1 , i2 ) 2 All illustrations and analysis will be made with two consumers and two goods, but can be generalized to n consumers and d k goods. d 22 1 (1 , 2 ) 12 1 1 07.07.2010 G.B. Asheim, ECON4230-35, #22 Edgeworth box 3 1 Feasible allocation Consumer i' s consumptio n bundle : x i ( xi1 , xi2 ) x12 x22 x2 Allocation : x (x1 , x 2 ) An allocation is feasible if x1 x12 (1 , 2 ) x11 x12 1 and x x22 2 2 1 x11 07.07.2010 4 G.B. Asheim, ECON4230-35, #22 Budget sets If consumers take market prices, p ( p1 , p2 ), as given, their budget sets will be as follows : x2 p ( p1 , p2 ) x1 07.07.2010 Even if consumers choose consumption mpti bundles in their budget sets, the resulting allocation need not be feasible. G.B. Asheim, ECON4230-35, #22 5 Walrasian equilibrium Definition : A pair of an allocation , x ( x 1 , x 2 ) , and a price vector, p ( p1 , p 2 ) , satisfying (1) The allocation , x ( x 1 , x 2 ) , is feasible. (2) It holds h ld for f each h consumer i that th t px i p i , andd u i ( x i ) u i ( x i ) implies px i p i ( x i maximizes utility s.t. the budget constraint ). Does a Walrasian equilibrium exist? 07.07.2010 G.B. Asheim, ECON4230-35, #22 6 2 Price vectors leading to excess demand Low price of good 1 … High price of good 1 … … leads to excess demand. … leads to excess supply. Is there an equilibrium price? 07.07.2010 7 G.B. Asheim, ECON4230-35, #22 Assumption on the utility functions x2 Assumption : For each i , u i is (1) continuous , x1 (2) strictly quasi - concave, and (3) monotone (i.e., x i x i implies u i ( x i ) u i ( x i) ). Assume that x i maximizes u i ( x i ) s.t. px i m . Part (3) implies px i m . Parts (2) and (3) implies that p 0 . Parts (1) - (3) imply x i x i ( p , m ) , where x i is point valued and continuous in positive prices and income. 07.07.2010 8 G.B. Asheim, ECON4230-35, #22 Existence of a Walrasian equilibrium Suppose the Assumption on the utility functions holds. Define the aggregate excess demand function: z ( p ) x 1 ( p , p 1 1 x 2 ( p , p 2 ) 2 p is an equilibr. price vector if z ( p ) 0 . Why? Walras' law. For all p 0 , it holds that pz ( p ) 0 . Implications given thatpx both prices are positive: Proof. Follows since i p i holds for each i . (1) If one market clears, then so does the other. (2) In a Walrasian equilibrium it holds that z ( p ) 0 . Result. There exists p such that z ( p ) 0 . 07.07.2010 G.B. Asheim, ECON4230-35, #22 9 3 Pareto efficiency Edgeworth box The initial endowment is not Pareto-efficient, since both consumers can be made better off by moving to x (x1 , x 2 ) 21 22 x ( x , x ) 1 2 x (x1 , x 2 ) (1 , 2 ) 12 is Paretoefficient, since no consumer can be made better off without making the other worse off. 11 07.07.2010 10 G.B. Asheim, ECON4230-35, #22 Illustrating the first welfare theorem First welfare theorem: Assume that Any Walrasian equilibriumxis (x1 , x 2 ) Pareto-efficient. is a Walrasian x2 x2 x1 p ( p1 , p2 ) x1 equilibrium. Then it is not feasible to make both consumers better off. Why? 07.07.2010 G.B. Asheim, ECON4230-35, #22 11 First welfare theorem Result. If ( x 1 , x 2 , p ) is a Walrasian equilibr., then it is not feasible to make both consumers better off Proof. Suppose ( x 1 , x 2 , p ) is a Walrasian equilibr., and it is feasible to make both consumers better off. Then there is a feasible allocation ( x 1 , x 2 ) such that u i ( x i ) u i ( x i ) for both i . Hence, 1 2 x 1 x 2 and p x i p i for both i . This leads to a contradict ion : p 1 2 p x 1 x 2 p x 1 p x 2 p 1 p 2 . 07.07.2010 G.B. Asheim, ECON4230-35, #22 12 4 Illustrating the second welfare theorem Assume that Second welfare theorem: x (x1 , x 2 ) Any Pareto-efficient allocation is Pareto efficient. can be implemented as a If utility functions Walrasian equilibrium. x are quasi-concave, i then x can be implemented as a Walrasian equilibrium How? 07.07.2010 13 G.B. Asheim, ECON4230-35, #22 Why is quasi-concavity assumed in the second welfare theorem? x ( x1 , x 2 ) is still Pareto efficient, but the allocation ll ti cannott be b implemented as a Walrasian equilibrium because of consumer 1’s nonconvex preferences. x Kinks — no problem. 07.07.2010 14 G.B. Asheim, ECON4230-35, #22 Second welfare theorem Result. Suppose the assumption on the utility functions holds. If the feasible allocation ( x 1 , x 2 ) is PE, then there is a p such that ( x 1 , x 2 , p ) is a Walrasian equilibr. x12 x22 Set of aggregate consumption vectors that lead to a Pareto improvement. P x1 x2 2 p ( p1 , p2 ) x11 x12 07.07.2010 1 G.B. Asheim, ECON4230-35, #22 15 5 With production Some economic agents are consumers, other agents are firms. Consumption goods and payments Consumers Profits Firms Labor (and capital) and Given the market Given the market prices, each consumer wages (and interest) prices and the chooses a best combination of technological constraints, labor supply and consumption each firm chooses a good demand, given that he combination of consumption must pay for the consumption good supply and factor demand that maximizes profits. goods with his labor income. 07.07.2010 16 G.B. Asheim, ECON4230-35, #22 Robinson Crusoe economy Consumpt. ( p, w) Output Profitmaximizing output UtilityUtilit maximizing consumption Labor input Leisure Profit in terms of output Utility-maximizing leisure Profit-maximizing labor input 07.07.2010 17 G.B. Asheim, ECON4230-35, #22 Equilibrium with production Consumpt. ( p , w ) Profitmaximizing output UtilityUtilit maximizing consumption Labor input 07.07.2010 Output Utility-maximizing leisure Profit in Leisure terms of Profit-maximizing output labor input G.B. Asheim, ECON4230-35, #22 18 6 x12 x22 Main existence result of general equilibrium theory P x1 x2 p ( p1 , p2 ) x11 x12 Result. (Arrow-Debreu-McKenzie, 1951–54) If production sets are convex, and utility functions are quasi-concave, then an equilibrium exists. 07.07.2010 19 G.B. Asheim, ECON4230-35, #22 1st welfare theorem holds … Consumpt. Output Labor input Leisure … even if the production set is not convex. 07.07.2010 20 G.B. Asheim, ECON4230-35, #22 2nd welfare theorem need not hold … Consumpt. Output Labor input Leisure … if the production set is not convex. 07.07.2010 G.B. Asheim, ECON4230-35, #22 21 7