Handout 4th Lecture ECON 4230/35 Kjell Arne Brekke 1

advertisement

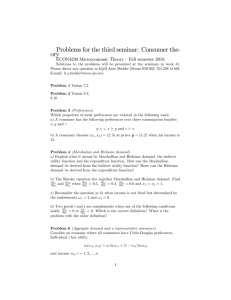

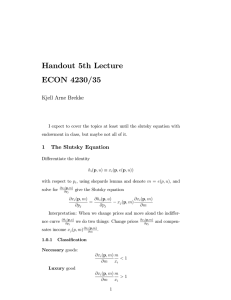

Handout 4th Lecture ECON 4230/35 Kjell Arne Brekke 1 Utility The consumption set is denoted X and is usually the non-negative ortant of Rn . Preferences, is a relation between two objects x and y in X. x y means "The consumer think that x is at least as good as y." We assume preferences are Complete: x y or y Re‡exive: x x Transitive: x x. y and y z implies x z. Note that we can construct strict preferences and indi¤erences from the basic preferences: x y if x y and y x y if it is not the case that y x y means y x x (similar for 1 x (by completness x ) y) Convexity Preferences are convex if for any x; y and z 2 X; such that x and y z then tx + (1 t)y z z for t 2 [0; 1] Preferences are strictly convex if for any x; y and z 2 X; such that x z and y z then tx + (1 z for t 2 (0; 1) t)y A technical condition called continuity: fx 2 X : x yg and fx 2 X : x yg are closed sets. Two assumptions that makes sure that a consumer spend the entire budget: Monotonicity If x y and x 6= y then x y: Local nonsatiation: for any x and " > 0 there is an y such that jy xj < " and y x Problem 1 Explain in word (understandable to a non-economist) what monotonicity means. Still in words understandable to a non-economist, give an example of preferences that are nocally nonsatiated but not monotone. Now we are able to state the main theorem: Theorem 2 (Existence of a utility function) Suppose that preferences are complete, re‡exive, transitive, continuous and strongly monotonic, then there exist a continuous utility function u such that (x y) () (u(x) 2 u(y)) 1.0.1 What is utility The important message to take home from this is that even when we use a utility function, we really talk about preferences. Utilities are only a way of expressing prefenrences. 1.1 Utility maximization Budget set B = fx 2 X : px mg Assuming monotonicity or local nonsatiation px = m Thus the utility maximization may be written v(p; m) = max u(x) such that px = m The function v(p; m) is called the indirect utility function. 1.2 The social animal Humans are social animals, we like to hang together. (Franz de Waal, in ’The age of empathy’quote an aboriginal: "It is bad to die, because when you die you are alone.") Problem 3 To what extent does the framework above alow for a description of humans as social animals? 1.3 Properties of the indirect utility 1) Non-increasing in p and non-decreasing in m. (look at the budget set) 2) Homogenous of degree zero in (p; m) : v(tp; tm) = v(p; m) 3 (obvious property of the budget set) 3) Quasiconvex in p, that is fp :v(p; m) kg is convex for all k 4) Continuous in (p; m) for positive prices and income. 1.4 The expenditure function De…ned as e(p; u) = min px such that u(x) u Note that this is just like a cost function c(w; y) = min px such that f (x) y so the properties are the same. 1.5 Marshallian and Hicksian demand The marshallian demand x(p; m) is the solution to the utility maximization problem v(p; m) = max u(x) such that px = m while the Hicksian demand h(p; y)is the solution to expenditure minimization problem e(p; u) = min px such that u(x) 4 u Note that the hicksian demand can be derived from the expenditure function using Shepards lemma hi (p; y) = @e(p; u) @pi Problem 4 If the price of co¤e increases by 1 kroner per cup, and the income Bob need to maintain his utility inceases by 20 kroner. How many cups do Bob buy per month? Use the above theory to answer. 1.6 Some identities Both problem get the same solution, where the indi¤erence curve and the budget line are in tangent. u0i pi = 0 pj uj They only take income or utility as given respectively, but are intimately related: e(p; v(p; m)) = m v(p; e(p; u)) = u xi (p; m) = hi (p; v(p; m)) hi (p; u) = xi (p; e(p; u)) 1.7 Roys Identity xi (p; m) = 1.8 @v(p;m) @pi @v(p;m) @m Moneymetric utility Moneymetric utility is m(p; x) =e(p; u(x)) Moneymetric indirect utility (p; q;m) =e(p; v(q;m)) 5 2 The Slutsky Equation Di¤erentiate the identity hi (p; u) xi (p; e(p; u)) with respect to pi , using shepards lemma and denote m = e(p; u); and solve for @xi (p;m) @pj give the Slutsky equation @xi (p; m) @hi (p; u) = @pj @pj xj (p; m) @xi (p; m) @m Interpretation: When we change prices and move alond the indi¤ernce curve @hi (p;u) @pj we do two things: Change prices @xi (p;m) @pj and compen- (p;m) sates income xj (p; m) @xi@m . 2.0.1 Classi…cation Necessary goods: @xi (p; m) m <1 @m xi Luxury good @xi (p; m) m >1 @m xi Inferior goods @xi (p; m) >0 @m Normal goods @xi (p; m) <0 @m Gi¤en good @xi (p; m) >0 @pi Problem 5 Use the Slutsky equation to explain why normal goods are not Gi¤en goods. 6 2.0.2 Implications of Shepards lemma and Slutsky Next note that @hi (p; y) @ 2 e(p; u) @ 2 e(p; u) @hj (p; y) = = = @pj @pj @pi @pi @pj @pi Two goods are complements if @hj (p;y) @pi @hj (p;y) @pi < 0 and substitutes if > 0. Note that this de…nition would not work with Marshalliand demand where it is conceivable that @xj (p; m) @xi (p; m) <0< @pj @pi 2.1 Properties of the demand function Symmetry and the negative diagonal elements @hi (p; y) @pi 3 0 Revealed preferences Problem 6 If we invoke the assumptions about preferences above (including monotonicity) and observe that the person choose x at prices p then x y for all y such that py < px Why do we know this? 7