Goals of This Paper Long-term Care Financing Reform:

advertisement

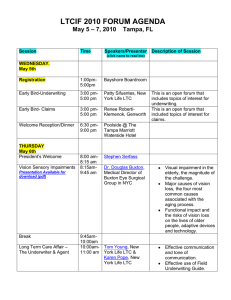

Long-term Care Financing Reform: Lessons from the U.S. and Abroad Howard Gleckman Building Bridges: Making A Difference in Long-Term Care March 23, 2010 Goals of This Paper • • • • • Past US Initiatives: Private Insurance Worldwide Reform Movement: Social Ins. Lessons for U.S. Financing Reform 3.0 CLASS Focus Is On Financing Only—Not Delivery Natalie 1 What Should Long-Term Care Financing Look Like? • Best Possible Care • Insurance not Welfare • Maximum Consumer Flexibility • Relieve Pressure on Government Resources The Problem A Bit of History • 1990s Great Worldwide Interest in LTC – Pepper Commission in U.S. • Early 90s Devolution of Responsibility to Local Governments (Sweden/UK) • Parallel Movement Away from Welfare – Social Insurance (Germany/France/Japan) – Private Insurance (US) 2 Recent Experiences of Six Countries • • • • • • France Germany Japan Netherlands UK US International Models Financing Benefit Eligibility Private Ins. France General revenue Cash Universal 60+ coinsurance Growing Germany Payroll tax Cash/ Service Universal <10% Japan Mixed Service Universal 65+ None Netherlands Mixed Cash/ Service Universal Managed thru Private insurance U.K. Gen Revenue Service/cash Means-tested Limited U.S. Gen Revenue Service/ limited cash Means-tested <10% Germany • Universal Insurance • Payroll Tax Funding • Tax vs. Premium vs. Contributions – framing matters • Cash or Service Benefit • Limited Private Insurance – Take-up similar to US 3 Germany II • • • • Costs Higher Than Anticipated Coverage: 30% vs. 50% Goal Payroll Tax Increases Benefit increases Japan • Universal for 65+ • Coverage for those 40-64 only with agerelated disease. • Mixed Financing: Similar to Medicare – Payroll tax, general revenues and incomerelated premiums. • Service benefit only—90% of costs Japan II • Eligibility, benefits, price and copays fixed by central government • Premiums vary by region • Higher than expected costs—2007 benefit cuts • Still significant hospitalizations • Woodwork? • 80% of certified get benefits • Receive about 50% of maximum 4 The Netherlands • • • • • Early Adapter: Universal LTC since 1968 Constant Revisions Current Version: Managed by Private Carriers w/o risk Financing: – Pay as You Go – Income Related Premiums – Taxes The Netherlands II • Major Cost Problems – Spends twice as much as Others • Now Scaling Back Benefits – Especially for younger disabled France • • • • • • Universal for 60+ Funded by general revenues Cash benefit only Benefits severely means-tested Average for home care $621(30% of costs) Managed by regional departments, benefits uniform across country • Initial costs 1/3 higher than anticipated 5 France II • Developing Private LTCi Market – Covers 25% of 65+ – Pays 30% of Costs. • Covered lives growing by 15%/year • Cash benefit—similar to public insurance United Kingdom • • • • • Means-tested benefit—Medicaid-like Funded by general revenues Service or cash, but few take cash Carer’s Allowance (for low-income, intense care) High-profile studies in 1999 and 2006 called for major reforms. Social insurance. • Few adopted. • No political consensus for reform • Very limited private LTC market United Kingdom II • Latest Initiatives • Brown Government Proposes Broad Insurance-Based Reforms • Taking a Mulligan • Government Proposed Expanding Free Care, But only for Neediest 6 The U.S. • Are We Getting Our Money’s Worth? • How Can We Do Better? Long-Term Care Spending in the U.S. 7 The Future 8 Enhancing Private LTCi • Tax Subsidies • Partnership Act • Government Marketing • Bottom Line: Market is Flat LTC Insurance The Real Crisis of the Uninsured • 250 Million have health insurance • 7 million have long-term care insurance NEXT STEPS • Long-Term Care and Health Reform • Big Steps in the Right Direction • • • CLASS Act More Medicaid HCBS Care Coordination • But Only First Steps 9 Models for U.S. Reform • Enhance Private Insurance • Social Insurance • CLASS Private Insurance • Sell through Medicare, ala Medigap – Optional purchase, underwriting permitted – Consideration for low-income, uninsurable Social Insurance • • • • • Many models-vary mostly by form of tax Medicare Part E Burman/Johnson Income tax surcharge Payroll tax, ala Germany VAT—part of health care 10 CLASS Act Uniquely American Model • • • • • Government insurance Voluntary—Auto-enroll w/ Opt-out Low-income premium subsidy Benefit: Lifetime, cash, modest Medicaid—Yes, as secondary payer Cash • A Big Deal • But… • Can Families Manage? – Caregivers as Small Business People • How Will It Mesh With Private Insurance? – Usually reimbursement, sometimes indemnity CLASS Challenges • • • • • • • • Broad Flexibility for HHS Benefit Design Premiums Will Private Insurance Sell Around CLASS No individual or employer mandate Adverse Selection Who Will Buy and Who Will Opt Out? Fiscal Issues 11 Lessons • Private LTCi may be part of policy solution – But… Not as Stand-alone • Mandate works in Europe and Japan – Tradition of solidarity there, not here • Will Voluntary coverage work here? – Americans see little value in private LTCi – Will they see value in government LTCi? • Cash benefit can succeed – But caregiver training needed • Costs will be higher than anticipated More research • • • • • Regional versus central control Behavioral response to opt-out Woodwork Genetic testing Provider prices Howard Gleckman The Urban Institute hgleckman@urban.org 202-261-5420 www.caringforourparents.com 12