Impact of Long-term Care Insurance on Care

advertisement

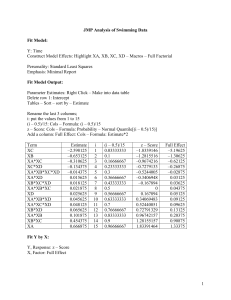

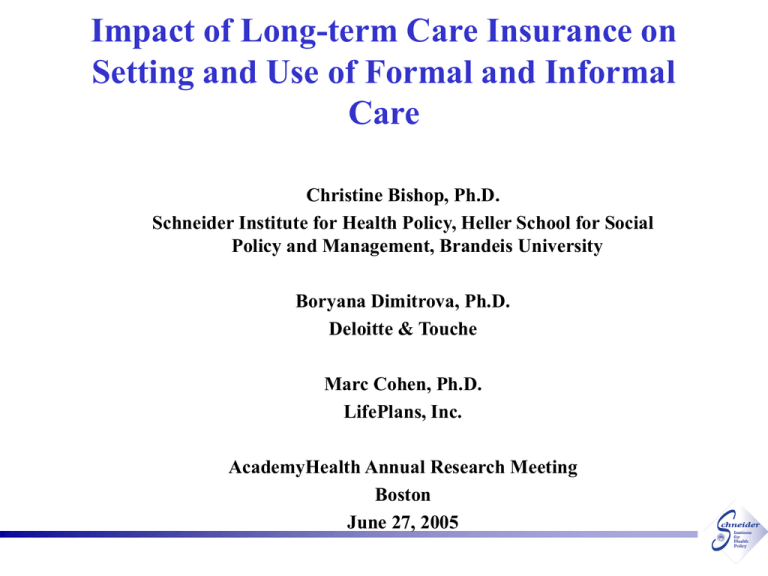

Impact of Long-term Care Insurance on Setting and Use of Formal and Informal Care Christine Bishop, Ph.D. Schneider Institute for Health Policy, Heller School for Social Policy and Management, Brandeis University Boryana Dimitrova, Ph.D. Deloitte & Touche Marc Cohen, Ph.D. LifePlans, Inc. AcademyHealth Annual Research Meeting Boston June 27, 2005 Research Support • Health Care Financing and Organization, an initiative of Robert Wood Johnson Foundation • Data developed in previous projects supported by ASPE/ Office of the Assistant Secretary for Planning and Evaluation, Department of Health and Human Services Robert Wood Johnson Foundation/HCRI 2 The LTCI Market Has Experienced Steady Growth Policies Sold (In Thousands) 10000 9,000 9000 8,261 8000 7,529 6,831 7000 6,080 6000 5,542 4,960 5000 4,351 3,837 4000 3,417 2,930 3000 2,430 2000 1000 1,550 815 1,930 1,130 0 1987 1992 1997 Source: LifePlans computations; Number of Long-Term Care Insurance Policies Sold, Cumulatively 1987-2002 estimates AAHP-HIAA LTC Market Survey 2003. Includes preliminary numbers for 2002. 3 2002 The Fastest Growing Segment of the LTCI Market is Employer-Sponsored Average Annual Growth Rates in the LTC Insurance Marketplace (1991-2001) 25 Percent 20 22% 18% 15 12% 10 6% 5 0 Total Individual Source: HIAA LTC Market Survey 2003: Lifeplans Computations 4 Employer Life Riders Estimated Market Penetration 2002 10% 9% 8% 7% 6% 5% 4% 3% 2% 1% 0% 9% 6% 4% Age 45+ LifePlans Inc., 2003 5 Ages 45 to 64 Age 65+ Long-Term Care Insurance A “contingent claim” Provides holder with more resources when the insured “event” (disability) occurs If the event occurs, resources have high value for consumption 6 Research Questions • Does insurance affect choice of setting of care at home vs. residential setting • For community residents, does insurance affect 7 Use of paid care Use of unpaid care (informal care) Impact of insurance on choice of setting • • • 8 Higher income is associated in cross-section with greater use of residential care given disability, perhaps because of living arrangement and caregiver patterns by socioeconomic status “Extra” resources contingent on disability could support earlier entry into residential care OR Could support care at home, other things (marital status, age, disability, living arrangement, caregivers) constant. Choice of Setting by Income for Elders with Disabilities—NLTCS 1999 Income <$20K >$20K All Care at Home 36.6% 17.2% 30.1% Residential Care 63.4% 82.8% 69.9% 100.0% 9 100.0% 100.0% Modeling Selection Effect for Holding LTC Insurance • LTC insurance market is new; age will differ • Income: Medicaid programs, premium costs • • • 10 higher income for purchasers Education Marital status at time of purchase: more likely to be married Race: marketing to whites? Unmeasured Effects • Purchasers have a higher self-assessed probability of needing LTC in next five years • Purchasers are more risk averse than nonpurchasers See Finkelstein and McGarry (2004) 11 Data Sources • All insured persons claiming benefits from 8 private LTC insurance companies in 1999 Disabilities in 2+ ADLs OR Cognitive impairments • 1999 National Long-term Care Survey comparison group – same functional level Disabilities in 2+ ADLs OR Cognitive impairments 12 Comparing the two groups • Insured group with physical disability is Younger More likely to be married Higher education Higher income More likely to be white 13 Elders with disabilities: Insured elders differ from general population Age Married Male Education HS, Not College College Graduate Income $20K+ Proportion White 14 Insured Not Insured with Disability 85.723 79.843 *** 0.142 0.487 *** 0.216 0.346 *** 0.350 0.074 0.327 0.898 0.531 0.349 0.715 0.974 *** *** *** *** Proportion in nursing home 100% 90% 38.0% 80% 70% 65.2% 60% 50% 40% 62.0% 30% 20% 34.8% 10% Nursing Home Receiving Care at Home 0% Not Insured with Disability 15 Insured with Disability Bivariate Probit for Insured State and Setting of Care • • Sample: restrict to nonpoor (couples or singles) Insured status Insurance as the endogenous variable of interest Education and never married as instruments: affect insured • state Setting of care Insurance Level of disability Income 16 Bivariate Probit Results Estimates for Insured Status Insured = 1 Variable Coefficient se t Pr > |t| Intercept -2.287 0.542 -4.22 <.0001 Never married -0.659 0.253 -2.60 0.0092 HS graduate 0.558 0.132 4.23 <.0001 Technical school 1.682 0.235 7.17 <.0001 Some college 1.213 0.158 7.68 <.0001 College graduate 1.470 0.168 8.77 <.0001 Graduate school 2.167 0.261 8.30 <.0001 White 1.443 0.215 6.70 <.0001 Age:Years 65-59 0.227 0.116 1.96 0.0497 Age: Years 70-79 -0.052 0.022 -2.35 0.0185 Age: Years 80+ -0.096 0.012 -8.14 <.0001 17 Bivariate Probit Results (2) Estimates for Setting of Care: Community = 1 Variable Coefficient se t Pr > |t| Intercept 3.023 0.621 4.87 <.0001 Insured 1.427 0.220 6.49 <.0001 Married 0.212 0.129 1.64 0.1008 Never married -0.394 0.270 -1.46 0.1443 Male -0.205 0.116 -1.77 0.0761 Log of Income (000) -0.113 0.074 -1.53 0.1249 White -1.819 0.190 -9.56 <.0001 Age:Years 65-59 0.115 0.114 1.01 0.3112 Age: Years 70-79 -0.036 0.022 -1.65 0.0996 Age: Years 80+ -0.032 0.013 -2.42 0.0156 Disabled in 1 ADL -1.331 0.344 -3.87 0.0001 - 2 ADLs -1.203 0.313 -3.84 0.0001 - 3 ADLs -1.426 0.308 -4.64 <.0001 - 4 ADLs -1.685 0.304 -5.54 <.0001 - 5 ADLs -1.793 0.295 -6.07 <.0001 - 6 ADLs -2.187 0.302 -7.24 <.0001 Cognitive impairment -0.647 0.118 -5.49 <.0001 18 Marginal Effects on Probability of Community Residence Variable Insured Married Never married Male Log of Income (000) White Age:Years 65-59 Age: Years 70-79 Age: Years 80+ Disabled in 1 ADL - 2 ADLs - 3 ADLs - 4 ADLs - 5 ADLs - 6 ADLs Cognitive impairment 19 Mean Marginal Effect for Sample 0.390 0.058 -0.108 -0.056 -0.031 -0.497 0.032 -0.010 -0.009 -0.364 -0.329 -0.390 -0.460 -0.490 -0.598 -0.177 Insurance is Associated with Higher Probability of Care at Home • Care at home is not associated with higher • • 20 income -- does not appear to be a “superior good” But perhaps additional resources contingent on disability are used differently from ordinary income? Or people preferring care at home are more likely to purchase insurance? For Community Residents: Effect of Insurance on Paid Care and/or Unpaid Care? • Conditional on community residence: selection effect Because insurance affects who remains at home, we are observing a different group than would occur otherwise • Should be modeled as simultaneous with choice • • 21 of setting (choose based on care available) Paid and unpaid care: substitutes or complements? Zeros Bivariate Probit for Joint Distribution of ANY Paid and ANY Unpaid Help Any Paid Care = 1 Any Unpaid Care = 1 Variable Coefficient Sig t Coefficient Sig t Intercept -1.398 0.298 -0.748 ns Insurance 2.659 <.0001 0.090 ns Log of income (000) 0.166 ns -0.092 ns Male 0.284 0.260 0.168 ns Years 65 to 69 0.079 ns 0.087 ns Years 70 to 79 -0.066 0.131 -0.004 ns Years Over 80 0.010 ns 0.055 0.019 3 ADLs 0.415 0.202 0.508 0.035 4 ADLs 0.159 ns 0.726 0.002 5 ADLs 0.917 0.002 0.595 0.004 6 ADLs 1.098 0.001 0.430 0.107 Cognitive Impairment -0.425 0.059 0.547 0.002 Child within 25 miles 0.088 ns 0.497 0.001 Married -0.554 0.044 0.893 <.0001 Rho 0.108 ns 22 If assume unpaid hours given -Variable Intercept Insured Log of Income (000) Male Age:Years 65-59 Age: Years 70-79 Age: Years 80+ - 3 ADLs - 4 ADLs - 5 ADLs - 6 ADLs Cognitive impairment Child within 25 mi Married Informal Care Hours 23 Hours of Paid Care Coefficient Sig t -37.087 0.0328 56.282 <.0001 3.405 0.1739 2.115 ns 2.355 ns -0.946 0.1129 -0.300 ns 12.113 0.0191 19.405 <.0001 25.537 <.0001 46.469 <.0001 -3.863 0.2509 -5.146 0.1052 -18.489 <.0001 -0.211 <.0001 Tobit Analysis Paid and Informal Hours Variable Intercept Insured Log of Income (000) Male Age:Years 65-59 Age: Years 70-79 Age: Years 80+ - 3 ADLs - 4 ADLs - 5 ADLs - 6 ADLs Cognitive impairment Child within 25 mi Married 24 Hours of Paid Care Hours of Informal Care Coefficient Sig t Coefficient Sig t -40.750 0.025 -27.074 0.185 59.843 <.0001 -11.338 0.022 3.982 0.124 -3.248 0.296 1.096 ns 5.980 0.162 2.045 ns 4.737 0.241 -0.856 0.166 -0.090 ns -0.492 ns 0.999 0.071 10.046 0.059 21.834 0.000 15.996 0.001 27.174 <.0001 21.361 <.0001 29.646 <.0001 41.828 <.0001 32.861 <.0001 -5.375 0.121 12.469 0.002 -6.485 0.047 10.448 0.006 -23.536 <.0001 30.554 <.0001 Insurance has a strong effect on paid care for community-resident elders • Bivariate probit shows large significant effect • on any paid (of course) Estimate given paid hours are nonzero implies 56 hours a week more for insured; paid hours are reduced by about 12 minutes for every hour of informal care • Tobit shows large effect – 60 hours 25 Insurance affects informal care through effect on amount of paid care • • • 26 No significant effect on the probability of any informal care Tobit shows reduction of about 11 hours for insured (Of course) insured must be buying more care for themselves than they would with an equal income increase – (about an hour a week for a $10000 income increase) Compute Inverse Mills Analog Based on Bivariate Probit Results Y X ( X ) 1 2 2 (1 ) commres F ( X , Y , ) 27 Paid Hours (2SLS) Variable Intercept Insurance Hours of Unpaid Help ln Income (est) Number ADL Disabilities Cognitive Impairment R-squared =.2439 N=414 28 Parameter Standard Estimate Error -5.263 20.717 -0.702 1.401 8.779 4.695 7.465 3.866 0.138 2.279 1.312 3.227 t Value Pr > |t| -0.71 0.4812 5.36 <.0001 -5.09 <.0001 0.61 0.539 6.69 <.0001 1.45 0.1465 Unpaid Hours (2SLS) Variable Intercept Hours of Paid Help Child within 25 miles Married Number ADL Disabilities Cognitive Impairment R-squared =.25684 N=414 29 Parameter Standard Estimate Error 1.326 -0.451 3.089 15.510 8.285 7.627 4.272 0.114 2.926 3.171 1.027 3.156 t Value Pr > |t| 0.31 0.7564 -3.96 <.0001 1.06 0.2917 4.89 <.0001 8.07 <.0001 2.42 0.0161