Who Uses Individual Health Insurance & For How Long? Erika Ziller Andrew Coburn

advertisement

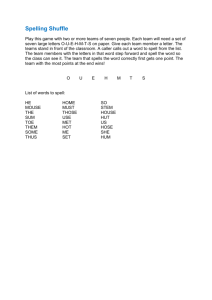

Who Uses Individual Health Insurance & For How Long? Erika Ziller Andrew Coburn Timothy McBride Courtney Andrews Muskie School of Public Service University of Southern Maine Muskie School of Public Service University of Southern Maine Acknowledgment The authors would like to thank the “Changes in Health Care Financing & Organization” (HCFO) initiative of the Robert Wood Johnson Foundation for its generous funding support. Muskie School of Public Service University of Southern Maine Previous Studies Most prior estimates of individual insurance coverage rely on CPS, yielding static estimates Research into coverage has primarily been descriptive Definition of individual insurance has generally been residual—”private, not employer” Muskie School of Public Service University of Southern Maine Research Questions 1. Who uses individual insurance and what are their patterns of coverage? 2. What characteristics predict how long a person has coverage? and, 3. What insurance status do people have before and after individual insurance spells? Muskie School of Public Service University of Southern Maine Data 1996-2000 Survey of Income & Program Participation (SIPP) 12 “waves” of quarterly retrospective interviews ≈ 55,500 non-elderly adults (18-64) interviewed in month 1 Individual insurance defined as private coverage that was “privately purchased” All presented results are statistically significant where p .05 Muskie School of Public Service University of Southern Maine Spells of Individual Coverage Number of Spells over 48 months* 5.9% had individual coverage in month 1 13.0% had at least one spell of individual insurance between 1996 & 2000 More than 1/2 of those with a spell had only one spell (58%) 10% 32% 58% 1 Spell 2 Spells 3+ Spells *Among those with 1+ spells Muskie School of Public Service University of Southern Maine Who is Individually Insured? 59% have attended college or graduated 61% are married – but rate for widows/ers is nearly 2x’s higher (10.5%) 84% are white, non-Hispanic – rates are highest for Asian-Americans (8.4%) Muskie School of Public Service University of Southern Maine Who is Individually Insured? (cont’d) 74% are working, half of them self-employed 72% work for firms with less than 25 employees 1/3 have family income at or below 200% of poverty level Almost 90% report themselves to be in good or better health About 1/2 are aged 45-64 Muskie School of Public Service University of Southern Maine Spell Beginnings & Endings: Employer-Sponsored Spell Endings About 2/3 of all spells begin and/or end with employer coverage 84% of spells that begin with employer also end with employer coverage 11% 5% 84% Uninsured Public Employer Muskie School of Public Service University of Southern Maine Spell Beginnings & Endings: Public 14% of the individually insured enter from a public spell Three-quarters of individual spells that begin with public coverage also end with public Spell Endings 18% 75% 7% Uninsured Public Employer Muskie School of Public Service University of Southern Maine Spell Beginnings & Endings: Uninsured 18% of individual spells begin from an uninsured spell 1/2 of those uninsured before their individual spell gain employer coverage 42% of those who enter an individual spell after being uninsured, return to being uninsured Spell Endings 9% 42% Uninsured 49% Public Employer Muskie School of Public Service University of Southern Maine Spell Lengths Median length of individual insurance spells is 8 months 48% retain individual coverage less than 6 months Spell Lengths (in months) 17% 5% 48% 14% 17% have individual coverage for 24 months or more 16% <6 6 to 11 12 to 17 18 to 23 24+ Muskie School of Public Service University of Southern Maine Duration Analysis Multivariate survival analysis of 6,134 spells with observed beginnings Variables – Employment characteristics – Socio-demographic characteristics – Health status – Prior insurance status – State insurance regulation Muskie School of Public Service University of Southern Maine Characteristics Associated with Spell Length Longer Spells* Out of labor force (1.09) Entered from employerbased coverage (1.20) Self-employed (1.21) Firm <25 workers (1.15) Rate-banding in individual market (1.12) White, non-Hispanic (1.31) Female (1.09) Asian (1.21) Single, divorced or separated (1.07) *Expected survival time ratios in parentheses Muskie School of Public Service University of Southern Maine Characteristics Associated with Spell Length (cont’d) Shorter Spells* Fair/poor health (.91) Entered from public coverage (.81) Community rating of small group (.93) Other Age has curvilinear relationship to spell length (inverse-U) Income is not significantly associated with spell length *Expected survival time ratios in parentheses Muskie School of Public Service University of Southern Maine Conclusions Findings indicate that the individual insurance market is heterogeneous: – Most individual insurance spells bridge periods of employer coverage – 17% of spells last more than 24 months; Smallbusiness employees & self-employed have the longest spells – 1/6 of those exiting individual plans become uninsured; future analyses should seek to improve coverage stability for this group Muskie School of Public Service University of Southern Maine Conclusions Median spell length is 8 months and 48% of all individual insurance spells last less than six months, supporting insurance industry claims that marketing & administrative costs are higher than for group coverage Those in poorest health have the shortest coverage. Future research needed to understand whether these are voluntary or involuntary exits. Muskie School of Public Service University of Southern Maine Conclusions HIPAA & state portability regulations do not apply to some segments of the individual market. – Nearly 1/5 gain individual insurance after being uninsured & therefore are not protected by portability regulations – Some of those entering individual insurance from group coverage likely do not meet continuous coverage requirements Family income is not related to being individually insured or the length of spell; future research should examine access to care for lower income individual insurance holders.