Performance Analysis of CBOE S&P 500 Options‐Selling Indices Keith Black, Ph.D., CAIA, CFA Edward Szado, Ph.D., CFA

advertisement

Performance Analysis of CBOE S&P 500 Options‐Selling Indices Keith Black, Ph.D., CAIA, CFA Managing Director of CAIA (Chartered Alternative Investment Analyst Association) Edward Szado, Ph.D., CFA Assistant Professor of Finance, Providence College Director of Research, INGARM (Institute for Global Asset and Risk Management) www.INGARM.org January 2016 2/10/2016 “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 1 Introduction Executive Summary Summary of Results • The study provides an analysis of 29 ½ years of performance (from mid1986 through the end of 2015) for six Options-selling indices and for stock, bond and commodity indices. Key findings of the new study include: • HIGHER RISK-ADJUSTED RETURNS. The Options-selling indices had generally similar returns as the S&P 500® Index with much lower volatility and lower maximum drawdowns. The Options-selling indices had higher risk-adjusted returns, as measured by the Sharpe Ratio, Sortino Ratio, and Stutzer Index. • IMPROVED RETURN DISTRIBUTIONS. The Options-selling indices exhibited less tail risk with lower likelihood of large losses and lower likelihood of large gains than the S&P 500. • LOWER BETAS AND POSITIVE ALPHAS. Options-selling indices tend to have relatively low betas ranging from 0.13 to 0.82 and have positive alphas. • STRONG PERFORMANCE FOR BENCHMARKS THAT SELL SPXSM INDEX OPTIONS. Both the CBOE S&P 500 PutWrite Index (PUTSM) and the CBOE S&P 500 30-Delta BuyWrite Index (BXMDSM) had higher returns and lower volatility than the S&P 500 Index. A key source of strong risk-adjusted returns has been the fact that the index options usually have been richly priced. • HIGHER GROSS PREMIUMS. Over a period of more than 8 years, the index that sells SPX put options once a week (WPUT Index) generated gross monthly premiums that in aggregate were about 8% higher for a rolling six-month period than the index that sells SPX put options once a month (PUT Index). • HIGH NOTIONAL VALUE. The average daily notional value for volume on the S&P 500 options rose to more than $190 billion in 2015. • • • An options-selling fund may sell calls, puts, covered calls, or sell cash-secured puts at a variety of levels of moneyness and initial time to expiration. The choice of moneyness reflects a tradeoff between the amount of premium collected versus the likelihood that the short options will expire inthe-money. The further the option is out-of-themoney, the more likely that the premium collected from writing the option will represent the increase in net income, and not be mitigated by the option expiring in-the-money. However, the further the option is out-of-the-money, the less premium will be collected. In general, option premiums tend to decay more quickly as they approach expiration. Thus the choice of initial time to expiration can also significantly impact performance of options-selling strategies. The Chicago Board Options Exchange® (CBOE®), which sponsored this study, lists several benchmark indices (including the BXMSM, BXMDSM, BFLYSM, CNDRSM, CMBOSM and PUTSM indexes) that follow options-selling strategies. Please email comments to eszado@providence.edu, kblack@caia.org or institutional@cboe.com. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 2 Co-authors of the Study Keith Black, Ph.D., CAIA, CFA Keith Black has over twenty years of financial market experience, serving approximately half of that time as an academic and half as a trader and consultant to institutional investors. He currently serves as Managing Director of Curriculum and Exams for the CAIA Association. During his most recent role at Ennis Knupp + Associates, Keith advised foundations, endowments and pension funds on their asset allocation and manager selection strategies in hedge funds, commodities and managed futures. Prior experience includes commodities derivatives trading at First Chicago Capital Markets, stock options research and CBOE market-making for Hull Trading Company, and building quantitative stock selection models for mutual funds and hedge funds for Chicago Investment Analytics. Dr. Black previously served as an assistant professor and senior lecturer at the Illinois Institute of Technology's Stuart school, where he taught courses in both traditional and alternative investments. He contributes regularly to The CFA Digest, and has published in a number of journals, including The Journal of Trading and The Journal of Alternative Investments. He is the author of the book "Managing a Hedge Fund," as well as a contributor to the second and third editions of the CAIA Level I and Level II textbooks. Dr. Black was named to Institutional Investor magazine's list of "Rising Stars of Hedge Funds" in 2010. Dr. Black earned a BA from Whittier College, an MBA from Carnegie Mellon University, and a PhD from the Illinois Institute of Technology. He has earned the Chartered Financial Analyst (CFA) designation and was a member of the inaugural class of the Chartered Alternative Investment Analyst (CAIA) candidates. Edward Szado, Ph.D., CFA Edward Szado is Assistant Professor of Finance, Providence College. He is also the Director of Research at the Institute for Global Asset and Risk Management and received his Ph.D. in Finance from the Isenberg School of Management, University of Massachusetts, Amherst. He has taught Risk Management at the Boston University School of Management, Derivatives at Clark University and a range of finance courses at the University of Massachusetts Amherst. He is a former options trader and his experience includes product development in the areas of volatility based investments and structured investment products. He is also a Chartered Financial Analyst and has consulted for the Options Industry Council, the Chicago Board Options Exchange, the Chartered Alternative Investment Analyst Association and the Commodity Futures Trading Commission. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 3 Strategy Descriptions Strategy Year Introduced Earliest Historical Price CBOE S&P 500 Iron Butterfly Index (BFLY) Sell at-the-money call and put options on S&P 500 index and buy 5% out-of-themoney call and put options 2015 June 30, 1986 CBOE S&P 500 Buy Write Index (BXM) Purchase stocks in the S&P 500 index, and each month sell at-the-money index call options 2002 June 30, 1986 CBOE S&P 500 30-Delta Buy-Write Index (BXMD) Purchase stocks in the S&P 500 index, and each month sell a 30-delta index call option 2015 June 30, 1986 CBOE S&P 500 Covered Combo Index (CMBO) Each month, a 2% out-of-the-money call option and an at-the-money put option is sold. The calls are covered by a long position in the S&P 500 index and the puts are covered by one-month Treasury bills 2015 June 30, 1986 CBOE S&P 500 Iron Condor Index (CNDR) Each month, 20-delta put and call options on the S&P 500 index are sold and 5-delta put and call options are purchased 2015 June 30, 1986 CBOE S&P 500 PutWrite Index (PUT) Purchase Treasury bills and sell cashsecured put options on the S&P 500 index 2007 June 30, 1986 All six indices above sell SPX options and have had less volatility than the S&P 500 Index over the past 29 years. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 4 P&L Diagrams and Histograms of Returns BXM & BXMD The SPX call options sold generate premiums that can provide a cushion in months with stock market drawdowns. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 5 P&L Diagrams and Histograms of Returns CNDR & BFLY The O‐T‐M puts purchased help lessen the risk of big monthly losses. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 6 P&L Diagrams and Histograms of Returns CMBO & PUT The histograms provided on pages 5 through 7 reflect the observed return distributions of the Options-selling indices and the S&P 500 over the period of study. In general, the histograms reflect a lower occurrence of large losses or large gains for the Options-selling indices than for the S&P 500. Source: Bloomberg. 7 “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. Net Returns in Recent Years 2007 6.2% 9.5% 5.5% 2008 -31.3% -26.8% -37.0% 2009 32.1% 31.5% 26.5% 2010 11.2% 9.0% 15.1% 2011 7.3% 6.2% 2.1% 2012 11.0% 8.1% 16.0% 2013 19.1% 12.3% 32.4% 2014 6.2% 6.4% 13.7% 2015 4.0% 6.4% 1.4% CBOE S&P 500 30-Delta BuyWrite Index (BXMD) CBOE S&P 500 PutWrite Index (PUT) S&P 500 Exhibit 1: This exhibit provides the cumulative growth of $100 invested in Options-selling indices and benchmark indices over the period of study. The Options-selling indices provided similar cumulative return over the period to an S&P 500 investment. All index performance reflected in the study are pre-tax and assume reinvestment of dividends. Source for Six Histograms on 3 pages: Bloomberg. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 8 Exhibit 2: This exhibit provides annualized compound total returns for Options-selling and benchmark indices. Annualized compound total returns represent the total cumulative growth over the period converted into an annual compounded return. Two of the Options-selling indices compare favorably to the S&P 500 over the period of study from a total return perspective. Sources: Bloomberg “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 9 Exhibit 3: Five of the Options-selling indices had a lower standard deviation than the T-bond, stock and commodity indices. Source: Bloomberg. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 10 Exhibit 4: Maximum Drawdown is an indicator of the worst loss an investment exhibited in a historical period. Options-selling Indices experienced lower drawdown risk than the S&P 500 Index. Source: Bloomberg. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 11 Exhibit 5: Options-selling Indices experienced smaller losses in 2008 than the S&P 500 Index. Source: Bloomberg. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 12 Exhibit 6: Summary Statistics Options-Selling and Benchmark Indices (July 1986 to December 2015) July 1986 to December 2015 CBOE S&P 500 CBOE S&P CBOE S&P S&P 500 500 500 Iron BuyWrite 30-Delta Butterfly Index (BXM) BuyWrite Index (BXMD) (BFLY) Annualized Return Average Monthly Return Standard Deviation Auto-correlation Maximum Drawdown 2008 Skew Kurtosis Jensen's Annual Alpha Leland's Annual Alpha Beta Leland's Beta Treynor Ratio Annual Sharpe Ratio Sortino Ratio Stutzer Index Correlation with S&P 500 Semi standard deviation* M2 9.85% 0.88% 15.26% 0.04 -50.95% -37.00% -0.79 2.45 0.00% 0.00% 1.00 1.00 0.07 0.48 0.63 0.48 1.00 11.67% 10.62% 5.96% 0.53% 10.77% 0.03 -33.75% -5.34% 0.02 -0.39 2.20% 2.00% 0.13 0.16 0.25 0.29 0.41 0.29 0.18 7.62% 7.69% 8.88% 0.76% 10.85% 0.09 -35.81% -28.65% -1.54 6.23 1.25% 1.03% 0.63 0.66 0.09 0.55 0.68 0.53 0.89 8.76% 11.55% 10.66% 0.92% 13.18% 0.04 -42.73% -31.25% -1.09 3.74 1.74% 1.62% 0.82 0.84 0.10 0.59 0.76 0.58 0.95 10.30% 12.30% CBOE S&P 500 Covered Combo Index (CMBO) 9.55% 0.82% 11.17% 0.08 -38.13% -30.21% -1.51 5.76 1.64% 1.44% 0.67 0.69 0.10 0.59 0.73 0.57 0.91 9.02% 12.20% CBOE S&P 500Iron Condor Index (CNDR) 7.09% 0.60% 7.23% 0.08 -13.66% -3.99% -2.11 6.08 2.66% 2.37% 0.17 0.21 0.23 0.54 0.63 0.52 0.36 6.23% 11.48% CBOE S&P 500 PutWrite Index (PUT) MSCI EAFE US$ S&P GSCI Citigroup 1 Month 30-yr Tbill Yield Treasury Bond 10.13% 6.28% 3.52% 7.05% 0.85% 0.64% 0.47% 0.63% 10.16% 17.48% 20.69% 12.26% 0.13 0.08 0.18 0.05 -32.66% -56.68% -79.44% -25.96% -26.77% -43.38% -46.49% 41.27% -2.10 -0.40 -0.20 0.29 9.75 0.93 1.97 2.79 2.88% -1.50% 0.73% 4.88% 2.61% -1.57% 0.43% 4.95% 0.56 0.80 0.23 -0.07 0.59 0.81 0.27 -0.08 0.13 0.06 0.11 -0.61 0.69 0.25 0.12 0.35 0.83 0.34 0.16 0.51 0.65 0.25 0.12 0.36 0.84 0.70 0.17 -0.09 8.45% 12.92% 14.93% 8.47% 13.73% 7.09% 4.99% 8.64% 3.27% 0.27% 0.70% 0.99 1.35% 0.05 -1.15 -0.01% -0.01% 0.00 0.00 0.00 0.00 0.00 0.03 0.50% 3.22% *Below mean Exhibit 6: The return and risk of Options-selling indices generally compare favorably to long-only equity indices both from the perspective of absolute returns and risk-adjusted returns. The Stutzer Index and Sortino ratio compensate for non-Normal return distributions. Source: Bloomberg. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 13 Exhibit 7: Return-to-Risk Ratios – Options-Selling and Benchmark Indices (July 1986 to December 2015) Exhibit 7: Most Options-selling indices had higher risk-adjusted returns than the stock and commodity benchmark indices. The Sharpe ratio assumes normally distributed returns and uses total deviation in returns as the measure of risk. The Sortino ratio considers downside risk, while the Stutzer Index accounts for skewness and kurtosis in the risk measures. All measures are annualized. The PUT Index had the highest values for all four ratios in the chart above. Sources: Morningstar and Bloomberg. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. Exhibit 8: Betas and Alphas Options-Selling and Benchmark Indices (July 1986 to December 2015) Exhibit 8: Beta provides a measure of the index sensitivity to market (S&P 500) returns. Options-selling indices tend to have relatively low exposure to market movements, with betas ranging from 0.13 to 0.82. Jensen’s Alpha and Leland’s Alpha are measures of risk-adjusted performance relative to the S&P 500. Leland’s alpha accounts for skewness and kurtosis in the return distributions, while Jensen’s alpha assumes normally distributed returns. Options-selling indices had higher risk-adjusted returns than the S&P 500 Index by both measures. Sources: Morningstar and Bloomberg. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 15 Exhibit 9: Risk-Return Tradeoff Options-Selling and Benchmark Indices (July 1986 to December 2015) Exhibit 9: This exhibit provides the average return-to-risk tradeoff for the Options-selling indices as well as the benchmark indices; a 60/40 equity and bond portfolio; and a portfolio made up of 80% of the 60/40 portfolio and 20% of an equally weighted exposure to the Options-selling indices. The best tradeoff can be found in the upper left portion of the diagram. Adding 20% Options-selling index exposure to a traditional portfolio improves its return-to-risk tradeoff, reducing risk while leaving returns virtually unchanged. Source: Bloomberg. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 16 Exhibit 10: Rolling 12 Month Standard Deviation and Returns Options-Selling and Benchmark Indices (July 1986 to December 2015) Exhibit 10: This exhibit provides 12-month rolling standard deviations and returns for Options-selling and benchmark indices. While the rolling returns of the Options-selling indices are generally quite similar to those of the S&P 500 (particularly for the BXM and PUT), the standard deviations of the Options-selling indices are typically significantly lower than those of the S&P 500. Sources: Bloomberg and CBOE. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 17 Exhibit 11: Annual Returns - Options-Selling and Benchmark Indices Year S&P 500 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 5.3% 16.6% 31.7% -3.1% 30.5% 7.6% 10.1% 1.3% 37.6% 23.0% 33.4% 28.6% 21.0% -9.1% -11.9% -22.1% 28.7% 10.9% 4.9% 15.8% 5.5% -37.0% 26.5% 15.1% 2.1% 16.0% 32.4% 13.7% 1.4% CBOE S&P 500 CBOE S&P Iron Butterfly 500 BuyWrite Index (BFLY) Index (BXM) -4.6% 9.4% 15.0% 8.9% 33.5% 13.8% 21.2% 4.2% 0.8% 5.1% 15.7% 6.3% 18.9% 19.3% -3.3% 6.2% 4.1% 4.9% 5.3% 15.6% 6.6% -5.3% 15.7% -12.9% 4.2% -13.2% -11.6% 0.3% 4.8% -3.0% 21.0% 25.0% 4.0% 24.4% 11.5% 14.1% 4.5% 21.0% 15.5% 26.6% 18.9% 21.2% 7.4% -10.9% -7.6% 19.4% 8.3% 4.2% 13.3% 6.6% -28.7% 25.9% 5.9% 5.7% 5.2% 13.3% 5.6% 5.2% CBOE S&P 500 CBOE S&P 500 Citigroup CBOE S&P 500 CBOE S&P 500 30-Delta Covered MSCI EAFE 30 Yr Iron Condor PutWrite Index S&P GSCI BuyWrite Index Combo Index US$ Treasury Index (CNDR) (PUT) (BXMD) (CMBO) Bond -0.2% 22.8% 32.7% 3.9% 23.5% 10.8% 11.1% 5.5% 32.9% 19.2% 33.7% 22.4% 21.2% 0.1% -8.9% -13.2% 25.9% 10.4% 5.0% 17.8% 6.2% -31.3% 32.1% 11.2% 7.3% 11.0% 19.1% 6.2% 4.0% -0.7% 22.1% 27.9% 5.8% 24.0% 12.4% 12.9% 5.6% 23.3% 17.7% 27.2% 17.9% 19.1% 6.0% -10.7% -8.8% 22.4% 9.5% 4.4% 14.1% 5.5% -30.2% 28.5% 7.7% 6.4% 7.5% 16.4% 5.5% 4.3% -4.0% 16.4% 20.3% 9.7% 17.0% 13.4% 14.0% 14.1% 9.4% 11.3% 9.8% 1.7% 13.5% 20.8% -4.9% 0.1% 7.5% 10.1% 10.0% 13.7% 4.9% -4.0% 12.6% -4.9% 1.7% -3.0% -0.7% -5.2% 5.8% -2.6% 19.7% 24.6% 8.9% 21.3% 13.8% 14.1% 7.1% 16.9% 16.4% 27.7% 18.5% 21.0% 13.1% -10.6% -8.6% 21.8% 9.5% 6.7% 15.2% 9.5% -26.8% 31.5% 9.0% 6.2% 8.1% 12.3% 6.4% 6.4% 24.6% 28.3% 10.5% -23.4% 12.1% -12.2% 32.6% 7.8% 11.2% 6.0% 1.8% 20.0% 27.0% -14.2% -21.4% -15.9% 38.6% 20.2% 13.5% 26.3% 11.2% -43.4% 31.8% 7.8% -12.1% 17.3% 22.8% -4.9% -0.8% 23.8% 27.9% 38.3% 29.1% -6.1% 4.4% -12.3% 5.3% 20.3% 33.9% -14.1% -35.7% 40.9% 49.7% -31.9% 32.1% 20.7% 17.3% 25.6% -15.1% 32.7% -46.5% 13.5% 9.0% -1.2% 0.1% -1.2% -33.1% -32.9% -8.0% 8.1% 20.3% 4.8% 17.3% 6.8% 18.3% -11.9% 33.5% -4.4% 15.4% 16.5% -14.9% 20.0% 3.4% 16.2% 0.8% 8.7% 8.8% -1.1% -0.8% 41.3% -25.9% 8.7% 35.4% 2.4% -15.0% 29.3% -3.1% Exhibit 11: This exhibit provides annual returns for each year since 1987 of Options-selling and traditional indices. While the Options-selling indices generally underperform the S&P 500 in years when the S&P 500 has very strong performance, they tend to have more favorable returns in years in which the S&P 500 is flat or experiences losses. Source: Bloomberg. “Performance Analysis of CBOE S&P 500 Options‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 18 Exhibit 12: Gross Premium Earned Over Rolling Six‐Month Periods for BXM vs. BXMD Exhibit 12: This exhibit provides the gross premium earned by writing calls for the BXM and BMXD indices as a percent of the level of the underlying S&P 500. If the calls expire out-of-themoney, this premium reflects income generated by the strategy. This income will be mitigated by the extent to which the calls expire in-the-money. The exhibit reflects the higher premium generated by the atthe-money calls of the BXM index. While the BXM Index generated more gross premiums than the BXMD Index, note in the table that the BXMD Index had higher net returns than the BXM Index in all six of the bullish years from 2009 through 2014. The average cumulative sixmonth gross premium generated by the BXM Index was 10.4%, while the BXMD generated 4.6% per six-month period. (November 1988 to November 2015) Gross Premiums - Higher for A-T-M (vs. O-T-M) Option-writing. Sources: Bloomberg and CBOE. Net Returns in Recent Years CBOE S&P 500 BuyWrite Index (BXM) CBOE S&P 500 30-Delta BuyWrite Index (BXMD) S&P 500 2007 6.6% 6.2% 5.5% 2008 -28.7% -31.3% -37.0% 2009 25.9% 32.1% 26.5% 2010 5.9% 11.2% 15.1% 2011 5.7% 7.3% 2.5% 2012 5.2% 11.0% 15.5% 2013 13.3% 19.1% 32.4% 2014 5.6% 6.2% 13.7% 2015 5.2% 4.0% 1.4% “Performance Analysis of CBOE S&P 500 Option‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 19 Exhibit 13: Gross Premium Earned Over Rolling Six Month Periods for Weekly (WPUT) vs. Monthly (PUT) PutWrite Indices (June 2007 to December 2015) Exhibit 13: The CBOE S&P 500 OneWeek PutWrite Index (WPUT) was not covered in most exhibits in this paper because its data history begins in 2006. The WPUT Index writes cash-secured SPX put options once a week, as opposed to once a month for the PUT index. This exhibit provides the gross premium earned by writing puts for the WPUT and PUT indices as a percent of the level of the underlying S&P 500. If the puts expire out-of-the-money, this premium reflects income generated by the strategy. This income will be mitigated by the extent to which the puts expire in-the-money. The exhibit reflects the higher cumulative premium generated by the weekly puts of the WPUT index due the increasing level of premium decay as options approach expiration. The average cumulative sixmonth premium was 21.3% for WPUT and 13.2% for PUT. Cumulative Gross Premiums Higher for Writing Options Once a Week (vs. Once a Month) Sources: Bloomberg and CBOE. Net Returns in Recent Years CBOE S&P 500 One-Week PutWrite Index (WPUT) CBOE S&P 500 PutWrite Index (PUT) S&P 500 2007 10.2% 9.5% 5.5% 2008 -15.2% -26.8% -37.0% 2009 15.2% 31.5% 26.5% 2010 6.9% 9.0% 15.1% 2011 3.9% 6.2% 2.5% 2012 11.5% 8.1% 15.5% 2013 14.4% 12.3% 32.4% 2014 0.2% 6.4% 13.7% 2015 0.4% 6.4% 1.4% “Performance Analysis of CBOE S&P 500 Option‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 20 Exhibit 14: Richness is calculated as the level of the CBOE Volatility Index (VIX© Index) at the start of a 30-day period (implied volatility) minus the annualized standard deviation of returns of the S&P 500 that is actually realized in that 30-day period (realized volatility). Since the VIX index is a forward looking measure, each VIX index level corresponds with the same 30-day period as the forward looking annualized standard deviation calculation. During times when this richness measure is positive, sellers of options may earn a profit relative to the amount by which implied volatility exceeds realized volatility. During the 25-year period shown in this chart, the average level of the VIX index was about 19.8 and the average realized volatility was 18.7%, so the S&P 500 Index options were richly priced by about 1.1%. Please note that the final calculation in this time series is made on Dec. 2, 2015 to cover data through Dec. 31, 2015 since these measures are forward looking. Sources: Morningstar and Bloomberg. “Performance Analysis of CBOE S&P 500 Option‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 21 Exhibit 15: Notional Value of Average Daily Volume in S&P 500 Options (in $Billions) (2000 – 2015) More than $190 billion per day in 2015 Exhibit 15: Fund managers examine trading liquidity and capacity when considering investment vehicles. The approximate daily notional value of trading in SPX options in 2015 can be estimated by multiplying the average daily volume times the value of the S&P 500 Index times the $100 options contract multiplier, for a value of more than $193 billion per day. Some investors use a deltaweighting multiplier to develop a more conservative estimate for notional value of options trading. Sources: Bloomberg and CBOE. “Performance Analysis of CBOE S&P 500 Option‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 22 Chicago Board Options Exchange® (CBOE®) provided financial support for the research for this paper. Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, by calling 1‐888‐OPTIONS, or from The Options Clearing Corporation at www.theocc.com. The information in this paper is provided for general education and information purposes only. No statement within this paper should be construed as a recommendation to buy or sell a security or to provide investment advice. The BXM, BXMD, BFLY, CMBO, CNDR, PUT and WPUT indices (the “Indexes”) are designed to represent proposed hypothetical options strategies. The actual performance of investment vehicles such as mutual funds or managed accounts can have significant differences from the performance of the Indexes. Investors attempting to replicate the Indexes should discuss with their advisors possible timing and liquidity issues. Like many passive benchmarks, the Indexes do not take into account significant factors such as transaction costs and taxes. Transaction costs and taxes for strategies such as the Indexes could be significantly higher than transaction costs for a passive strategy of buying‐and‐holding stocks. Investors should consult their tax advisor as to how taxes affect the outcome of contemplated options transactions. Past performance does not guarantee future results. This document contains index performance data based on back‐testing, i.e., calculations of how the index might have performed prior to launch. Back‐tested performance information is purely hypothetical and is provided in this paper solely for informational purposes. Back‐tested performance does not represent actual performance and should not be interpreted as an indication of actual performance. No representation is being made that any investment will or is likely to achieve a performance record similar to that shown. It is not possible to invest directly in an index. CBOE calculates and disseminates the Indexes. Supporting documentation for any claims, comparisons, statistics or other technical data in this paper is available from CBOE upon request. The methodologies of the Indexes are the property of Chicago Board Options Exchange, Incorporated (CBOE). CBOE®, Chicago Board Options Exchange®, CBOE Volatility Index® and VIX® are registered trademarks and BXM, BXMD, BFLY, CMBO, CNDR, PUT, WPUT, BuyWrite, and PutWrite are service marks of CBOE. S&P® and S&P 500® are registered trademarks of Standard and Poor's Financial Services, LLC and are licensed for use by CBOE. Financial products based on S&P indices are not sponsored, endorsed, sold or promoted by Standard & Poor’s, and Standard & Poor’s makes no representation regarding the advisability of investing in such products. MSCI, and the MSCI index names are service marks of MSCI Inc. or its affiliates and have been licensed for use by CBOE. All other trademarks and service marks are the property of their respective owners. The Indexes and all other information provided by CBOE and its affiliates and their respective directors, officers, employees, agents, representatives and third party providers of information (the “Parties”) in connection with the Indexes (collectively “Data”) are presented "as is" and without representations or warranties of any kind. The Parties shall not be liable for loss or damage, direct, indirect or consequential, arising from any use of the Data or action taken in reliance upon the Data. Redistribution, reproduction and/or photocopying in whole or in part are prohibited without the written permission of CBOE. Copyright © CBOE 2016. All Rights Reserved. Please email comments to eszado@providence.edu, kblack@caia.org or institutional@cboe.com. “Performance Analysis of CBOE S&P 500 Option‐Selling Indices” (January 2016) Please see the last slide for important disclosures. 23

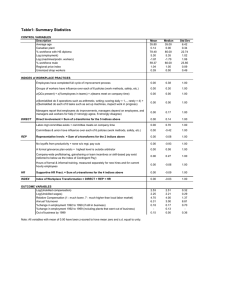

![[#EXASOL-1429] Possible error when inserting data into large tables](http://s3.studylib.net/store/data/005854961_1-9d34d5b0b79b862c601023238967ddff-300x300.png)