INEN 420 Semester Project Grummins Engine Company

advertisement

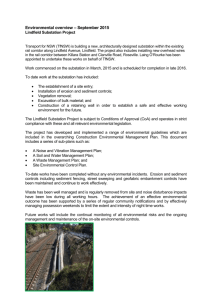

INEN 420 Semester Project Grummins Engine Company Wheat Warehouse Power Generation By Class of ‘93 Javier Garcia Dinh Nguyen Rhoda Read Class of ’93: Garcia, Nguyen, Read Page 1 CONTENTS 1.0 Executive Summary ………………………………………….……………………. Page 3 2.0 Problem Description ………………………………………………….……………...……. 3.0 2.1 Problem 1 (Grummins Engine Company) ………………...............……….. Page 3 2.2 Problem 2 (Wheat Warehouse) …………….……………………………… Page 5 2.3 Problem 3 (Power Generation) ………....………………………………….. Page 7 Computational Results ………………………………………………..…………………… 3.1 Problem 1 (Grummins Engine Company) ………………...……..……….. Page 14 3.2 Problem 2 (Wheat Warehouse) ………………………….……..………… Page 17 3.3 Problem 3 (Power Distribution) ………………………………………….. Page 21 4.0 Conclusions and Recommendations ………………………..……………………. Page 29 5.0 References ……………………………………………………………………….. Page 32 Class of ’93: Garcia, Nguyen, Read Page 2 1.0 Executive Summary This report focuses on three different possible scenarios. First, a diesel truck manufacturing company wants to maximize profit, but is restricted by industry and government regulations. Its model fits the profile of an optimal solution but upon testing the ranges produced in the sensitivity analysis, it became clear that the original LP is degenerate. A similar case surfaced after analyzing a model to maximize profit for a wheat farmer with a small warehouse and a rigid selling/purchasing schedule. Again, we deduced that the original LP was degenerate. Lastly, power generation in Puerto Rico was studied to determine how to minimize costs. The ranges produced by its sensitivity analysis, again, indicate degeneracy. However, in all three cases the LPs were functional. The interpretations and recommendations should be made with caution and understanding of the effects of degeneracy is important. 2.1 Problem 1 (Grummins Engine Company) The Grummins Engine Co. produces 2 types of diesel trucks that have different selling prices, manufacturing costs, and pollution emission. We want to formulate an LP that can be used to determine how to maximize profit during the next three years given the following conditions: Sales Price, Manufacturing Costs and Pollution Emission: Sales Price Manufacturing Costs Emissions Type 1 $20,000.00 $15,000.00 15 grams Type 2 $17,000.00 $14,000.00 5 grams Maximum Demand for Trucks: Year Type 1 Type 2 1 100 200 2 200 100 3 300 150 Class of ’93: Garcia, Nguyen, Read Page 3 • Production capacity limits total truck production during each year to at most 300 trucks. • It cost $2,000.00 to hold 1 truck (of any type) in inventory for one year. • From the table above, at most 300 type 1 trucks can be sold in year 3. Demand may be met from previous production or the current year’s production. Grummins Engine Co. wants a plan to help them arrange their product in the next three years to get the maximum profit. This means that there should be no trucks in stock at the end of the third year. Assumptions include that the company should not keep more trucks in inventory than demand predicts, so production is regulated by the amount of trucks in inventory and the amount of trucks that can be sold. Also, we assume that trucks are only produced and sold, not acquired by any other method such as auctions, trading, etc. We determined our decision variables to be the following: Pij= Number of trucks (each type i) produced for each year j Sij= Number of trucks (each type i) sold for each year j Rij= Number of trucks (each type i) that remain in stock at the end of each year j With i=1, 2; j=1, 2, 3. The objective function for the maximum profit is as follows: Max Z= s.t. 20 (S11+S12+S13) + 17 (S21+S22+S23) - 15 (P11+P12+P13) -14 (P21+P22+P23) - 2 (R11+R12+R21+R22) (in $ thousands) P11+P21 <=320 P12+P22 <=320 P13+P23 <=320 S11 <=100 S12 <=200 S13 <=300 S21 <=200 S22 <=100 S23 <=150 R11-P11+S11 =0 R21-P21+S21 =0 R12-P12+S12-R11 =0 Class of ’93: Garcia, Nguyen, Read (Production) (Sale) (Remain in stock) Page 4 R22-P22+S22-R21 =0 P13+R12-S13 =0 P23+R22-S23 =0 5P11+5P12+5P13-5P21-5P22-5P23<=0 Pij, Sij, Rij >=0; i=1,2; j=1,2,3 2.2 (Emissions requirement) Problem 2 (Wheat Warehouse) As owner of a wheat warehouse with a capacity of 20,000 bushels, we want to formulate an LP that can be used to determine how to maximize the profit earned over the next 10 months, given the following conditions: • We begin Month 1 with 6,000 bushels of wheat. • Each month, wheat can be bought and sold at the price per 1000 bushels listed in the following table: • Month Selling Price ($) Purchase Price ($) 1 3 8 2 6 8 3 7 2 4 1 3 5 4 4 6 5 3 7 5 3 8 1 2 9 3 5 10 2 5 Each month, the sequence of events is as follows: o Observe the initial stock of wheat. o Sell any amount of wheat up to the initial stock at the current month’s selling price. o Buy (at the current month’s buying price) as much wheat as wanted, subject to the warehouse size limitation. Assumptions include that wheat can only be sold or purchased (at the given rates). In this way, ending inventory is simply determined by the following equation: Class of ’93: Garcia, Nguyen, Read Page 5 ending inventory = beginning inventory – amount sold + amount purchased For Month 1, our beginning inventory is 6,000 bushels of wheat. We can then sell up to 6,000 bushels. Next, we can purchase any amount of wheat up to our capacity (20,000 bushels) minus the beginning inventory plus the amount previously sold. Finally, our ending inventory is as stated above (6,000 – amount sold + amount purchased). For Month 2, our beginning inventory is the ending inventory from Month 1. We can then sell up to our ending inventory from Month 1. Next, we can purchase up to 20,000 minus the beginning inventory plus the amount previously sold. Finally, our ending inventory for Month 2 is the ending inventory from Month 1 – amount sold during Month 2 + amount purchased during Month 2. The remaining months follow the same process and are detailed in the constraints listed later. We determined our decision variables to be the following: si = amount of wheat (in thousands) sold during month i, i = 1,…,10 pi = amount of wheat (in thousands) purchased during month i, i=1,…,10 ej = # of bushels (in thousands) left at the end of month j, j=1,…,9 For our objective function, we want to maximize profit over the next 10 months, and determined it to be the following equation: max z = 3s1 – 8p1 + 6s2 – 8p2 + 7s3 – 2p3 + s4 – 3p4 + 4s5 – 4p5 + 5s6 – 3p6 + 5s7 – 3p7 + s8 – 2p8 + 3s9 – 5p9 + 2s10 – 5p10 Therefore, the LP formulation is as follows: max z = 3s1 – 8p1 + 6s2 – 8p2 + 7s3 – 2p3 + s4 – 3p4 + 4s5 – 4p5 + 5s6 – 3p6 + 5s7 – 3p7 + s8 – 2p8 + 3s9 – 5p9 + 2s10 – 5p10 s.t. s1 <= 6 s2 – e1 <= 0 s3 – e2 <= 0 s4 – e3 <= 0 s5 – e4 <= 0 s6 – e5 <= 0 s7 – e6 <= 0 s8 – e7 <= 0 s9 – e8 <= 0 s10 – e9 <= 0 p1 – s1 <= 14 Class of ’93: Garcia, Nguyen, Read (selling restrictions – up to current inventory) (purchasing restrictions – up to warehouse capacity) Page 6 p2 – s2 + e1 <= 20 p3 – s3 + e2 <= 20 p4 – s4 + e3 <= 20 p5 – s5 + e4 <= 20 p6 – s6 + e5 <= 20 p7 – s7 + e6 <= 20 p8 – s8 + e7 <= 20 p9 – s9 + e8 <= 20 p10 – s10 + e9 <= 20 e1 + s1 – p1 =6 (ending inventory for each month) e2 + s2 – p2 – e1 =0 e3 + s3 – p3 – e2 =0 e4 + s4 – p4 – e3 =0 e5 + s5 – p5 – e4 =0 e6 + s6 – p6 – e5 =0 e7 + s7 – p7 – e6 =0 e8 + s8 – p8 – e7 =0 e9 + s9 – p9 – e8 =0 si, pi >= 0, i = 1,…,10; ei >= 0, i = 1,…,9 2.3 Problem 3 (Power Generation) GENERAL BACKGROUND Puerto Rico enjoys a highly diversified economy, a strong tourist sector, and good trade relations with the United States, its largest trading partner. Despite mixed current economic indicators, Puerto Rico’s short-term economic outlook looks relatively positive given the strengthening of the U.S. economy, which is expected to grow over 4% this year. The island’s real gross domestic product (GDP) is expected to grow 3.3% in 2004 and 2.8% in 2005, and 2.4% over the medium term (2006–10). As consumers take advantage of low interest rates, private consumption has increased. Over the past year, high oil prices have had an adverse affect on Puerto Rico's economy and inflation, as the Commonwealth is heavily dependent on oil imports to meet its domestic energy needs, particularly for electricity generation. Class of ’93: Garcia, Nguyen, Read Page 7 ENERGY OVERVIEW Puerto Rico lacks domestic hydrocarbon reserves (including oil, natural gas, and coal) and relies on imports to meet its energy needs. Imported oil, mainly from U.S. and Caribbean suppliers, is the source of about 90% of Puerto Rico's power. Although consumption of natural gas has been increasing over the past few years, Puerto Rico still relies overwhelmingly on oil. Many industry analysts agree that gas- or coal-fired facilities are needed to supplement oil-burning power plants. However, plans to widen and/or diversify the electric power supply through cogeneration and agreements with independent power producers have barely progressed due to opposition from environmental groups and powerful labor unions. In 2004, Puerto Rico generated an estimated 22.1 billion kilowatt hours (Bkwh) of electricity, predominantly from five oil-fired generators, with a fraction coming from small hydroelectric dams. Also, the country consumed about 223,000 barrels per day (bbl/d) of oil, all imported, primarily for transportation and electric power generation. As of 2003, installed generation capacity was 4.9 gigawatts. The five oil-fired plants are: the Costa Sur plant (1,090 MW); the Aguirre plant (900 MW); the Palo Seco plant (602 MW); the San Juan plant (400 MW); and the Arecibo plant (248 MW). The Puerto Rico Electric Power Authority (PREPA) accounts for a majority of net electricity generation, and is the Commonwealth's sole distributor of electric power. PREPA also purchases excess power generation from co-generators, primarily in the cement industry, and from independent power producers. Early this year, Puerto Rico began importing liquefied natural gas (LNG) to supply the EcoEléctrica facility, a 540-megawatt (MW) natural gas-fired power plant that will supply power generation under a contract to the island at the end of this year. Also, they begin importing coal to the new 454-MW coal-fired plant in Guayama (ASE-PR). With power consumption increasing more than 3% per year for more than a decade, both PREPA and independent power producers have been investing in new capacity in order to meet growing demand and to diversify energy sources. The following table provides the power plant capacity, expected demand for each substation for next year and the cost of shipping power from a plant to a substation. Class of ’93: Garcia, Nguyen, Read Page 8 Cost of Shipping to Substation # FROM (As of 30 SEP 2004) 1 2 3 4 5 6 7 8 9 10 11 12 6 5 6 7 9 10 9 12 14 17 11 10 (Plant) San Juan Supply (MW) 400 Palo Seco 6 6 5 8 10 11 10 11 13 16 10 9 602 Aguirre 10 10 11 12 11 13 9 7 8 10 12 13 900 Costa Sur 15 14 15 13 18 20 17 9 6 8 9 10 1090 Arecibo 9 8 9 10 12 15 11 11 9 10 6 4 248 ASE-PR 9 8 9 9 9 9 7 5 6 7 6 10 454 14 13 14 13 16 17 14 7 5 8 7 8 507 190 175 175 195 165 190 200 190 200 175 145 190 2190 Eco Electrica Expected Demand in MW (2005) Last September, the tropical storm Jeanne hit the island. PREPA initial system-operations report shows the island’s largest electricity-generating plants collapsed between noon and 1:00 p.m. while operating at their average capacity, causing expensive damage to the equipment. Not only did the thermoelectric plants collapse, but so did the island’s gas and steam turbines and the cogeneration plants. The failures meant the system was producing only some 607 megawatts (MW) to power the entire island out of a maximum capacity of 3,240 MW, or less than 19%. If a plant is operating at more than 50% of its peak capacity when objects such as broken trees and flying debris strike or knock transmission poles down, the resultant shock to the power grid can be destructive. "When the technicians went to inspect the systems on Thursday, the filed reports indicated cracks in equipment, failed start-ups, a damaged generator in Costa Sur No. 3, and a cracked boiler in Costa Sur No. 4," said the PREPA source. "Aguirre’s steam turbines alone had an oil leak in the electrohydraulic system, a broken cooling fan, and a damaged rotor. The damage to Puerto Rico’s power grid was estimated at $60 million. PREPA wants to add two (2) new substations, ASE-PR and Eco Electrica, to the power grid beginning next year and want them to provide at least 20% of the power demand during high peak demand. Both ASE-PR and Eco Electrica are privately-owned and will be operational in November 2004. Also, the Palo Seco plant will be able to supply only 50% of its maximum output and Costa Sur only 70% of its maximum output during high peak demand beginning next Class of ’93: Garcia, Nguyen, Read Page 9 year due to an upgrade to their plants. The peak power demand occurs at the same time (around 0100 PM) on each substation. Assumptions include that all plants operate at 90% of their maximum capacity and that all power supply to the substation is only being used by the intended sources. Also, in the event of any bad weather, we will assume that at most two plants, Palo Seco and Aguirre, will be disconnected. We want to formulate two LPs with different conditions: The first condition is to minimize the cost of meeting each substation’s peak power demand for next year during high peak demand. The second condition is to minimize the cost of meeting each substation’s peak power demand if Palo Seco and Aguirre are disconnected due to bad weather. 11 12 4 1 3 2 5 6 7 10 9 8 EcoElectrica ASE-PR New Power Plant Substations Class of ’93: Garcia, Nguyen, Read Page 10 FORMULATION (Both Conditions): First, we defined our decision variables by determining how much power is sent to each substation during high peak hour (0100 PM). We define seven plants (i = 1, 2, …., 7). Plant 1 is San Juan, Plant 2 is Palo Seco, Plant 3 is Aguirre, Plant 4 is Costa Sur, Plant 5 is Arecibo and Plants 6 and 7 are the two new facilities (ASE-PR and Eco Electrica). The twelve substations are defined j = 1,2,3,4,…,12. See map for locations. Xij = number of megawatts produced at plant i and sent to substations j For our objective function, we want to minimize the cost of meeting each substation’s peak power demand: Min Z = 6X11 + 5X12 + 6X13 + 7X14 + 9X15 + 10X16 + 9X17 + 12X18 + 14X19 + 17X110 + 11X111 + 10X112 + 6X21 + 6X22 + 5X23 + 8X24 + 10X25 + 11X26 + 10X27 + 11X28 + 13X29 +16X210 + 10X211 + 9X212 + 10X31 + 10X32 + 11X33 + 12X34 + 11X35 + 10X36 + 9X37 + 6X38 + 7X39 + 9X310 + 12X311 + 13X312 + 15X41 + 14X42 + 15X43 + 13X44 + 18X45 + 20X46 + 17X47 + 9X48 + 5X49 + 8X410 + 9X411 + 10x412 + 9X51 + 8X52 + 9X53 + 10X54 + 12X55 + 15X56 + 11X57 + 11X58 + 9X59 + 9X510 + 6X511 + 4X512 + 9X61 + 8X62 + 9X63 + 9X64 + 9X65 + 9X66 + 7X67 + 5X68 + 6X69 + 7X610 + 6X611 + 10X612 + 14X71 + 13X72 + 14X73 + 13X74 + 16X75 + 17X76+ 14X77 + 7X78 + 5X79 + 8X710 + 7X711 + 8X712 PREPA faces three types of constraints. First, the total power supplied by each plant cannot exceed the plant capacity. Examples are: amount of power sent from San Juan to the twelve substations cannot exceed 360 megawatts (=90% MAX). Also, we have restrictions to Palo Seco and Costa Sur power generation. Palo Seco can only supply 50% of its maximum capacity and Costa Sur 70%. The formulation problem contains the following constraints for supply: X11+X12+X13+X14+X15+X16+X17+X18+X19+X110+X111+X112 <= 360 X21+X22+X23+X24+X25+X26+X27+X28+X29+X210+X211+X212 <= 301 X31+X32+X33+X34+X35+X36+X37+X38+X39+X310+X311+X312 <= 810 X41+X42+X43+X44+X45+X46+X47+X48+X49+X410+X411+X412 <= 743 X51+X52+X53+X54+X55+X56+X57+X58+X59+X510+X511+X512 <= 224 X61+X62+X63+X64+X65+X66+X67+X68+X69+X610+X611+X612 <= 409 X71+X72+X73+X74+X75+X76+X77+X78+X79+X710+X711+X712 <= 451 Class of ’93: Garcia, Nguyen, Read Page 11 The following constraint ensures the ASE-PR and Eco Electrica supply at least 20% of total power demand (3,240 MW): 4X61 + 4X62+ 4X63 + 4X64 + 4X65 + 4X66 + 4X67 + 4X68 + 4X69 + 4X610 + 4X611 + 4X612+ 4X71 + 4X72 + 4X73 + 4X74 + 4X75 + 4X76 + 4X77 + 4X78 + 4X79 + 4X710 + 4X711 + 4X712 - X11 - X12 - X13 - X14 - X15 - X16 - X17 - X18 -X19 X110 - X111 - X112 - X21 - X22 - X23 - X24 - X25 - X26 - X27 - X28 - X29 -X210 X211 - X212 - X31 - X32 - X33 - X34 - X35 - X36 - X37 - X38 - X39 - X310 -X311 X312 - X41 - X42 - X43 - X44 - X45 - X46 - X47 - X48 - X49 - X410 - X411 -X412 X51 - X52 - X53 - X54 - X55 - X56 - X57 - X58 - X59 - X510 - X511 - X512 >= 0 Also, we need to ensure that each substation will receive sufficient power to meet its peak demand. The demand constraint is as follows: X11+X21+X31+X41+X51+X61+X71 >= 190 (Substation 1) X12+X22+X32+X42+X52+X62+X72 >= 175 (Substation 2) X13+X23+X33+X43+X53+X63+X73 >= 175 (Substation 3) X14+X24+X34+X44+X54+X64+X74 >= 195 (Substation 4) X15+X25+X35+X45+X55+X65+X75 >= 165 (Substation 5) X16+X26+X36+X46+X56+X66+X76 >= 190 (Substation 6) X17+X27+X37+X47+X57+X67+X77 >= 200 (Substation 7) X18+X28+X38+X48+X58+X63+X78 >= 190 (Substation 8) X19+X29+X39+X49+X59+X69+X79 >= 200 (Substation 9) X110+X210+X310+X410+X510+X610+X710 >= 175 (Substation 10) X111+X211+X311+X411+X511+X611+X711 >= 145 (Substation 11) X112+X212+X312+X412+X512+X612+X112 >= 200 (Substation 12) Sign Restrictions: Xij >= 0 Therefore, the LP formulation for condition 1 is as follows: Min Z = 6X11 + 5X12 + 6X13 + 7X14 + 9X15 + 10X16 + 9X17 + 12X18 + 14X19 + 17X110 + 11X111 + 10X112 + 6X21 + 6X22 + 5X23 + 8X24 + 10X25 + 11X26 + 10X27 + 11X28 + 13X29 +16X210 + 10X211 + 9X212 + 10X31 + 10X32 + 11X33 + 12X34 + 11X35 + 10X36 + 9X37 + 6X38 + 7X39 + 9X310 + 12X311 + 13X312 + 15X41 + 14X42 + 15X43 + 13X44 + 18X45 + 20X46 + 17X47 + 9X48 + 5X49 + 8X410 + 9X411 + 10x412 + 9X51 + 8X52 + 9X53 + 10X54 + 12X55 + 15X56 + 11X57 + 11X58 + 9X59 + 9X510 + 6X511 + 4X512 + 9X61 + 8X62 + 9X63 + 9X64 + 9X65 + 9X66 + 7X67 + 5X68 + 6X69 + 7X610 + 6X611 + 10X612 + 14X71 + 13X72 + 14X73 + 13X74 + 16X75 + 17X76+ 14X77 + 7X78 + 5X79 + 8X710 + 7X711 + 8X712 Class of ’93: Garcia, Nguyen, Read Page 12 s.t. X11+X12+X13+X14+X15+X16+X17+X18+X19+X110+X111+X112 <= 360 X21+X22+X23+X24+X25+X26+X27+X28+X29+X210+X211+X212 <= 301 X31+X32+X33+X34+X35+X36+X37+X38+X39+X310+X311+X312 <= 810 X41+X42+X43+X44+X45+X46+X47+X48+X49+X410+X411+X412 <= 743 X51+X52+X53+X54+X55+X56+X57+X58+X59+X510+X511+X512 <= 224 X61+X62+X63+X64+X65+X66+X67+X68+X69+X610+X611+X612 <= 409 X71+X72+X73+X74+X75+X76+X77+X78+X79+X710+X711+X712 <= 451 4X61 + 4X62+ 4X63 + 4X64 + 4X65 + 4X66 + 4X67 + 4X68 + 4X69 + 4X610 + 4X611 + 4X612+ 4X71 + 4X72 + 4X73 + 4X74 + 4X75 + 4X76 + 4X77 + 4X78 + 4X79 + 4X710 + 4X711 + 4X712 - X11 - X12 - X13 - X14 - X15 - X16 - X17 - X18 -X19 X110 - X111 - X112 - X21 - X22 - X23 - X24 - X25 - X26 - X27 - X28 - X29 -X210 X211 - X212 - X31 - X32 - X33 - X34 - X35 - X36 - X37 - X38 - X39 - X310 -X311 X312 - X41 - X42 - X43 - X44 - X45 - X46 - X47 - X48 - X49 - X410 - X411 -X412 X51 - X52 - X53 - X54 - X55 - X56 - X57 - X58 - X59 - X510 - X511 - X512 >= 0 X11+X21+X31+X41+X51+X61+X71 >= 190 X12+X22+X32+X42+X52+X62+X72 >= 175 X13+X23+X33+X43+X53+X63+X73 >= 175 X14+X24+X34+X44+X54+X64+X74 >= 195 X15+X25+X35+X45+X55+X65+X75 >= 165 X16+X26+X36+X46+X56+X66+X76 >= 190 X17+X27+X37+X47+X57+X67+X77 >= 200 X18+X28+X38+X48+X58+X63+X78 >= 190 X19+X29+X39+X49+X59+X69+X79 >= 200 X110+X210+X310+X410+X510+X610+X710 >= 175 X111+X211+X311+X411+X511+X611+X711 >= 145 X112+X212+X312+X412+X512+X612+X112 >= 200 Xij >= 0, i=1,……..,7; j = 1,………..,12 (Substation 1) (Substation 2) (Substation 3) (Substation 4) (Substation 5) (Substation 6) (Substation 7) (Substation 8) (Substation 9) (Substation 10) (Substation 11) (Substation 12) The LP formulation for the condition 2 is as follows: Min Z = 6X11 + 5X12 + 6X13 + 7X14 + 9X15 + 10X16 + 9X17 + 12X18 + 14X19 + 17X110 + 11X111 + 10X112 + 6X21 + 6X22 + 5X23 + 8X24 + 10X25 + 11X26 + 10X27 + 11X28 + 13X29 +16X210 + 10X211 + 9X212 + 10X31 + 10X32 + 11X33 + 12X34 + 11X35 + 10X36 + 9X37 + 6X38 + 7X39 + 9X310 + 12X311 + 13X312 + 15X41 + 14X42 + 15X43 + 13X44 + 18X45 + 20X46 + 17X47 + 9X48 + 5X49 + 8X410 + 9X411 + 10x412 + 9X51 + 8X52 + 9X53 + 10X54 + 12X55 + 15X56 + 11X57 + 11X58 + 9X59 + 9X510 + 6X511 + 4X512 + 9X61 + 8X62 + 9X63 + 9X64 + 9X65 + 9X66 + 7X67 + 5X68 + 6X69 + 7X610 + 6X611 + 10X612 + 14X71 + 13X72 + 14X73 + 13X74 + 16X75 + 17X76+ 14X77 + 7X78 + 5X79 + 8X710 + 7X711 + 8X712 Class of ’93: Garcia, Nguyen, Read Page 13 s.t. X11+X12+X13+X14+X15+X16+X17+X18+X19+X110+X111+X112 <= 360 X21+X22+X23+X24+X25+X26+X27+X28+X29+X210+X211+X212 <= 0 X31+X32+X33+X34+X35+X36+X37+X38+X39+X310+X311+X312 <= 0 X41+X42+X43+X44+X45+X46+X47+X48+X49+X410+X411+X412 <= 743 X51+X52+X53+X54+X55+X56+X57+X58+X59+X510+X511+X512 <= 224 X61+X62+X63+X64+X65+X66+X67+X68+X69+X610+X611+X612 <= 409 X71+X72+X73+X74+X75+X76+X77+X78+X79+X710+X711+X712 <= 451 4X61 + 4X62+ 4X63 + 4X64 + 4X65 + 4X66 + 4X67 + 4X68 + 4X69 + 4X610 + 4X611 + 4X612+ 4X71 + 4X72 + 4X73 + 4X74 + 4X75 + 4X76 + 4X77 + 4X78 + 4X79 + 4X710 + 4X711 + 4X712 - X11 - X12 - X13 - X14 - X15 - X16 - X17 - X18 -X19 X110 - X111 - X112 - X21 - X22 - X23 - X24 - X25 - X26 - X27 - X28 - X29 -X210 X211 - X212 - X31 - X32 - X33 - X34 - X35 - X36 - X37 - X38 - X39 - X310 -X311 X312 - X41 - X42 - X43 - X44 - X45 - X46 - X47 - X48 - X49 - X410 - X411 -X412 X51 - X52 - X53 - X54 - X55 - X56 - X57 - X58 - X59 - X510 - X511 - X512 >= 0 X11+X21+X31+X41+X51+X61+X71 >= 190 X12+X22+X32+X42+X52+X62+X72 >= 175 X13+X23+X33+X43+X53+X63+X73 >= 175 X14+X24+X34+X44+X54+X64+X74 >= 195 X15+X25+X35+X45+X55+X65+X75 >= 165 X16+X26+X36+X46+X56+X66+X76 >= 190 X17+X27+X37+X47+X57+X67+X77 >= 200 X18+X28+X38+X48+X58+X63+X78 >= 190 X19+X29+X39+X49+X59+X69+X79 >= 200 X110+X210+X310+X410+X510+X610+X710 >= 175 X111+X211+X311+X411+X511+X611+X711 >= 145 X112+X212+X312+X412+X512+X612+X112 >= 200 Xij >= 0, i=1,……..,7; j = 1,………..,12 3.1 (Substation 1) (Substation 2) (Substation 3) (Substation 4) (Substation 5) (Substation 6) (Substation 7) (Substation 8) (Substation 9) (Substation 10) (Substation 11) (Substation 12) Problem 1 (Grummins Engine Company) The optimal solution obtained through Lindo is as follows: Z S11 S12 S13 S21 S22 S23 P11 P12 = 3,600.00 (in $ thousands) =100 =200 =150 =200 =100 =150 =100 =200 Class of ’93: Garcia, Nguyen, Read Page 14 P13 P21 P22 P23 R11 R12 R21 R22 =150 =200 =100 =150 =0 =0 =0 =0 Lindo determined that 10 iterations were necessary to find this optimal solution. The solution indicates that the best way to get the maximum profit is to not have remaining inventory at the end of each year. Therefore, the company should sell every truck they make each year, for both types of trucks. After examining the sensitivity analysis report, we determined the ranges for our decision variables could be as follows, and still remain the optimal solution: Decision Variables Current Sale & Production Range of Increase/Decrease ($ thousands) Objective Function Coefficient Range of Decision Variables S11 20 0<=∆<= +∞ 20<=C11<= +∞ S12 20 0<=∆<= +∞ 20<=C12<= +∞ S13 20 -5<=∆<= 0 15<=C13<= 20 S21 17 -8<=∆<= +∞ 9<=C21<= +∞ S22 17 -8<=∆<= +∞ 9<=C22<= +∞ S23 17 -8<=∆<= +∞ 9<=C23<= +∞ P11 15 -2<=∆<=0 13<=C14<=15 P12 15 -2<=∆<=0 13<=C15<=15 P13 15 0<=∆<=2 15<=C16<=17 P21 14 -2<=∆<=8 12<=P24<=22 P22 14 -2<=∆<=2 12<=P25<=16 P23 14 -∞<=∆<= 2 -∞<=P26<= 16 R11 2 -2 <=∆<=+∞ 0 <=C1<=+∞ R12 2 -2 <=∆<=+∞ 0 <=C2<=+∞ R21 2 -2 <=∆<=+∞ 0 <=C3<=+∞ R22 2 -2 <=∆<=+∞ 0 <=C4<=+∞ Class of ’93: Garcia, Nguyen, Read Page 15 The selling price for a type 1 truck (which emits 15 gm of pollution) can vary from $20,000 up to +∞ for the first two years and the manufacturing price can also increase up to $20,000 more. In other words, the company can increase the selling price C11 but due to the constraint in truck sale S11 <= 100, it will not affect the current basis. By increasing C11, the current basis remains optimal and the only change will be the optimal Z (Cbv B-1b). However, the company has to reduce the price for the type 1 truck at the third year down to $15,000 to guarantee that all type 1 trucks will be sold. It is similar for the manufacturing costs for type 1 trucks. The company can make up to $2,000.00 for each type 1 truck for the first two years, but then they have to reduce its price on the third year. When we change the value of S11 or S12 of the objective function coefficient out of range, that variable will leave the basis and change the optimal solution, thus decreasing the profit for Grummins Engine Company. Similarly, when we increase the value of S13 out of range (above 20), the optimal solution will include less trucks sold in year 2 (plus leftover inventory) in order to sell as many trucks as possible during year 3, when the selling price is higher. For type 2 trucks, the selling price can vary from $9,000.00 up to +∞ for all three years. The manufacturing costs are also the same; their price can vary from $6,000.00 to $16,000.00 for the first year and produce more profit for each year later. But we have the same situation as we explain in the prior paragraph (Constraint in selling trucks will not affect the current basis, only the optimal Z). Also as type 1 trucks, if we change the objective function coefficient (S21, S22, S23) out of the range, that variable also will leave the basis and change the optimal solution, thus decreasing the company’s profit. Similarly, Grummins Engine Company could reduce the manufacturing prices (P11, P12, P13, P21, P22, P23) out of range to less than the minimum value and the maximum profit will increase. Otherwise, the maximum profit will decrease when manufacturing costs increase above the range maximum. However, upon closer inspection of the variable P22, the optimal solution changes if P22 = 16, which is in the allowable range. Similarly, if P21 = 12, which is within the allowable range, the optimal solution changes. These particular occurrences indicate that our original LP is degenerate. The ranges for the right-hand side variables are listed in the table below: Class of ’93: Garcia, Nguyen, Read Page 16 Decision Current Right-Hand Side Range of Increase/Decrease Ranges of Right-Hand Sides b1 320 -20 <= ∆ <= ∞ 300 <= b1 <= ∞ b2 320 -20 <= ∆ <= ∞ 300 <= b2 <= ∞ b3 320 -20 <= ∆ <= ∞ 300 <= b3 <= ∞ b4 100 -20 <= ∆ <= 20 80 <= b4 <= 120 b5 200 -20 <= ∆ <= 20 180 <= b5 <= 220 b6 300 -150 <= ∆ <= ∞ 150 <= b6 <= ∞ b7 200 -150 <= ∆ <= 20 50 <= b7 <= 220 b8 100 -100 <= ∆ <= 20 0 <= b8 <= 120 b9 150 -150 <= ∆ <= 10 0 <= b9 <= 160 b10 0 -20 <= ∆ <= 20 -20 <= b10 <= 20 b11 0 -20 <= ∆ <= 150 -20 <= b11 <= 150 b12 0 -20 <= ∆ <= 20 -20 <= b12 <= 20 b13 0 -20 <= ∆ <= 100 -20 <= b13 <= 100 b14 0 -150 <= ∆ <= 150 -150 <= b14 <= 150 b15 0 -150 <= ∆ <= 10 -150 <= b15 <= 10 b16 0 -750 <= ∆ <= 100 -750 <= b16 <= 100 Variable According to this analysis, the range for b1 could be increased to any amount & the solution would remain optimal. That is, our limit for total truck production could be any amount over 300 trucks per year. Also, the range of optimality for the amount of each truck we can sell each year is given by the ranges of b4 – b9. For instance, the ranges indicate that if the right-hand side of the constraint for the amount of type 1 trucks sold in year 1 (b4) is less than 80 or more than 120, we should receive a new optimal solution. However, upon testing this range, we see that the optimal value stays the same for any value chosen greater than 120. This, too, seems to indicate that our original LP is degenerate. 3.2 Problem 2 (Wheat Warehouse) The optimal solution obtained through Lindo is as follows: z = 162 s3 = 6 p3 = 20 s5 = 0 p5 = 0 s6 = 20 p6 = 20 (in thousands $) (in thousands) ” ” ” ” ” Class of ’93: Garcia, Nguyen, Read Page 17 s7 = 20 p7 = 0 p8 = 20 s9 = 20 s10 = 0 ” ” ” ” ” Lindo determined that 20 iterations were necessary to find this optimal solution. The solution indicates that we should hold our initial stock of wheat (6,000 bushels) until Month 3, when we should sell the entire stock at $7 per bushel and then purchase 20,000 bushels at $2 per bushel. Again, this solution suggests that we should hold this stock until Month 6, when we should sell all of it at $5 per bushel and purchase 20,000 more bushels at $3 per bushel. Then, in Month 7, we should sell all 20,000 bushels at $5 per bushel and then have zero bushels in inventory until we could purchase 20,000 bushels in Month 8 at $2 per bushel. Finally, the solution indicates we should sell the entire stock in Month 9 at $3 per bushel, leaving the wheat warehouse empty through Month 10. This solution makes sense because it encourages us to sell the wheat at a higher rate than we can purchase it, thus maximizing profit. After examining the sensitivity analysis report, we determined that the ranges for our decision variables could be as follows, and still maintain the optimal solution: Objective Function Decision Current Selling/Purchase Variable Price s1 $3 -∞ <= ∆ <= 4 -∞ <= c1 <=7 p1 $8 -1 <= ∆ <= ∞ 7 <= c11 <= ∞ s2 $6 -∞ <= ∆ <= 1 -∞ <= c2 <= 7 p2 $8 -1 <= ∆ <= ∞ 7 <= c21 <= ∞ s3 $7 -1 <= ∆ <= 1 6 <= c3 <= 8 p3 $2 -1 <= ∆ <= 1 1 <= c31 <= 3 s4 $1 -∞ <= ∆ <=1 -∞ <= c4 <= 2 p4 $3 -1 <= ∆ <= ∞ 2 <= c41 <= ∞ s5 $4 -2 <= ∆ <=0 2 <= c5 <= 4 p5 $4 0 <= ∆ <= ∞ 4 <= c51 <= ∞ s6 $5 -1 <= ∆ <= ∞ 4 <= c6 <= ∞ p6 $3 -∞ <= ∆ <= 2 -∞ <= c61 <= 5 s7 $5 -2 <= ∆ <= ∞ 3 <= c7 <= ∞ p7 $3 -1 <= ∆ <= 2 2 <= c71 <= 5 s8 $1 -∞ <= ∆ <= 1 -∞ <= c8 <= 2 p8 $2 -1 <= ∆ <= 1 1 <= c81 <= 3 s9 $3 -1 <= ∆ <= 2 2 <= c9 <= 5 Class of ’93: Garcia, Nguyen, Read Range of Increase/Decrease Coefficient Ranges of Decision Variables Page 18 Objective Function Decision Current Selling/Purchase Variable Price p9 $5 -2 <= ∆ <= ∞ 3 <= c91 <= ∞ s10 $2 -2 <= ∆ <= 1 0 <= c10 <= 3 p10 $5 -5 <= ∆ <= ∞ 0 <= c11 <= ∞ Range of Increase/Decrease Coefficient Ranges of Decision Variables That is, the selling price of wheat c1 during Month 1 can vary from –∞ (we pay someone to take our wheat – which is not profitable) to $7 (up $4 from the given selling price). In the same way, the purchase price of wheat during Month 1 can vary from $7 (down $1 from the given purchase price) to ∞ (again, this is not profitable), etc. We see that for the basic variables in the optimal solution, the range of possible increases/decreases is much smaller, and therefore, more sensitive to change(s). When we increase/decrease the objective function coefficients outside of the range, that variable will enter/leave the basis & change the optimal solution. We tested this by changing the coefficient of c1 to $8 & solving the LP again. As expected, s1 entered the basis, was part of the optimal solution, and increased the z-value of the LP. By changing the range for c31, the optimal solution changed as expected when c31 = 4, which is out of the allowable range. Our new basis doesn’t include p3 as basic variable, and the new optimal Z = 142,000. Also, the allowable range for c9 was found to be between 2 and 5, but setting c9 = 7, the current basis changed but remains optimal and the only change will be the optimal Z (Cbv B-1b) with Z = 222,000. This happen is because a constraint on the selling quantity s8– e8 <= 0. Event if we increased the selling price to a value greater than $5, we can only sell what we have on inventory (20,000 bushels). Similarly, picking values outside the ranges of c3 and c9 will only affect the Zvalue, but will not affect the current basis. However by changing c5 , the basis will remain the same but s5 will be equal to 20,000. Originally s5 was a basic variable equal to 0. In other words, this leads us to believe that the original LP is degenerate, especially since there are at least one basic variable in the optimal solution equal to zero. In looking at the sensitivity ranges for the right-hand side, we see that the only major affectation is to increase/decrease the storage capacity of the warehouse. Then, we could sell more wheat and purchase more as determined by a new optimal solution. The ranges for the right-hand side are listed in the table below: Class of ’93: Garcia, Nguyen, Read Page 19 Decision Current Right-Hand Side Range of Increase/Decrease Ranges of Right-Hand Sides b1 6 -6 <= ∆ <= ∞ 0 <= b1 <= ∞ b2 0 -6 <= ∆ <= ∞ -6 <= b2 <= ∞ b3 0 -6 <= ∆ <= ∞ -6 <= b3 <= ∞ b4 0 -20 <= ∆ <= ∞ -20 <= b4 <= ∞ b5 0 -20 <= ∆ <= ∞ -20 <= b5 <= ∞ b6 0 -20 <= ∆ <= ∞ -20 <= b6 <= ∞ b7 0 0 <= ∆ <= ∞ 0 <= b7 <= ∞ b8 0 0 <= ∆ <= ∞ 0 <= b8 <= ∞ b9 0 0 <= ∆ <= ∞ 0 <= b9 <= ∞ b10 0 0 <= ∆ <= ∞ 0 <= b10 <= ∞ b11 14 -14 <= ∆ <= ∞ 0 <= b11 <= ∞ b12 20 -14 <= ∆ <= ∞ 6 <= b12 <= ∞ b13 20 0 <= ∆ <= ∞ 20 <= b13 <= ∞ b14 20 0 <= ∆ <= 0 20 <= b14 <= 20 b15 20 -20 <= ∆ <= 0 0 <= b15 <= 20 b16 20 -20 <= ∆ <= ∞ 0 <= b16 <= ∞ b17 20 -20 <= ∆ <= ∞ 0 <= b17 <= ∞ b18 20 -20 <= ∆ <= ∞ 0 <= b18 <= ∞ b19 20 -20 <= ∆ <= ∞ 0 <= b19 <= ∞ b20 20 -20 <= ∆ <= ∞ 0 <= b20 <= ∞ b21 6 -6 <= ∆ <= 14 0 <= b21 <= 20 b22 0 -6 <= ∆ <= ∞ -6 <= b22 <= ∞ b23 0 0 <= ∆ <= 20 0 <= b23 <= 20 b24 0 0 <= ∆ <= ∞ 0 <= b24 <= ∞ b25 0 -20 <= ∆ <= ∞ -20 <= b25 <= ∞ b26 0 -20 <= ∆ <= ∞ -20 <= b26 <= ∞ b27 0 -20 <= ∆ <= 0 -20 <= b27 <= 0 b28 0 -20 <= ∆ <= ∞ -20 <= b28 <= ∞ b29 0 -20 <= ∆ <= 0 -20 <= b29 <= 0 Variable According to this analysis, it is interesting to note that the optimal solution will not change regardless of how large our warehouse storage capacity may be, as seen in the range for b1. On the other hand, the range for b15 indicates that the original warehouse capacity is the maximum value that will keep the current solution optimal. We tested this in Lindo & any increase in the right-hand side of constraint #16 changes the optimal solution where the z-value is greater and p6 increases, as expected. Class of ’93: Garcia, Nguyen, Read Page 20 3.3 Problem 3 (Power Generation) The optimal solution obtained through Lindo for condition 1 is as follows: Z = 14192 X12 = 175 X14 = 185 X15 = 0 X21 = 190 X22 = 0 X24 = 10 X25 = 101 X35 = 30 X36 = 190 X37 = 0 X38 = 15 X49 = 200 X410 = 175 X511 = 24 X512 = 200 X63 = 175 X65 = 34 X67 = 200 X79 = 0 X710 = 0 X711 = 121 Lindo determined that 26 iterations were necessary to find the optimal solution. The solution also highlighted the power supply from each plant. For example the San Juan (1) plant will supply power to the substations 2 and 4, total 360 MW. Palo Seco (2) supplies power to substations 1, 4 and 5, total 301 MW (100% capacity). ASE-PR (6) and Eco Electrica (7) supply 530 MW (24% of the total high peak demand). Also Costa Sur (4) supplies 375 MW (less than the 70% max capacity of the plant). The optimal solution holds the constraints. After examining the sensitivity analysis, we determined that the ranges for our decision variables could be as follows, and still maintain the optimal solution: Decision Cost of Shipping Variables Power ($) X11 6 -1 <= ∆ <= ∞ 5 <= C11<= ∞ X12 5 -7 <= ∆ <= 0 -2 <= C12 <= 5 Class of ’93: Garcia, Nguyen, Read Range of Increase/Decrease Objective Function Coefficient Ranges of Decision Variables Page 21 Decision Cost of Shipping Variables Power ($) X13 6 -3 <= ∆ <= ∞ 3 <= C13 <= ∞ X15 9 0 <= ∆ <= ∞ 9 <= C15 <= ∞ X16 10 -2 <= ∆ <= ∞ 8 <= C16 <= ∞ X17 9 -2 <= ∆ <= ∞ 7 <= C17 <= ∞ X18 12 -8 <= ∆ <= ∞ 4 <= C18 <= ∞ X19 14 -11 <= ∆ <= ∞ 3 <= C19 <= ∞ X110 17 -11 <= ∆ <= ∞ 6 <= C110 <= ∞ X111 11 -6 <= ∆ <= ∞ 5 <= C111 <= ∞ X112 10 -2 <= ∆ <= ∞ 8 <= C112 <= ∞ X21 6 -7 <= ∆ <= ∞ 1 <= C21 <= ∞ X22 6 0 <= ∆ <= ∞ 6 <= C22 <= ∞ X23 5 -1 <= ∆ <= ∞ 4 <= C23 <= ∞ X25 10 -2 <= ∆ <= 0 8 <= C25 <= 10 X26 11 -2 <= ∆ <= ∞ 9 <= C26 <= ∞ X27 10 -2 <= ∆ <= ∞ 8 <= C27 <= ∞ X28 11 -6 <= ∆ <= ∞ 5 <= C28 <= ∞ X29 13 -9 <= ∆ <= ∞ 4 <= C29 <= ∞ X210 16 -9 <= ∆ <= ∞ 7 <= C210 <= ∞ X211 10 -4 <= ∆ <= ∞ 6 <= C211 <= ∞ X212 9 -5 <= ∆ <= ∞ 4 <= C212 <= ∞ X31 10 -3 <= ∆ <= ∞ 7 <= C31 <= ∞ X32 10 -3 <= ∆ <= ∞ 7 <= C32 <= ∞ X33 11 -6 <= ∆ <= ∞ 5 <= C33 <= ∞ X34 12 -3 <= ∆ <= ∞ 9 <= C34<= ∞ X35 11 -1 <= ∆ <= 0 10 <= C35 <= 11 X36 10 -10 <= ∆ <= 1 0 <= C36 <= 11 X39 8 -2 <= ∆ <= ∞ 6 <= C39 <= ∞ X310 10 -1 <= ∆ <= ∞ 9 <= C310 <= ∞ X311 12 -5 <= ∆ <= ∞ 7 <= C311 <= ∞ X312 13 -8 <= ∆ <= ∞ 5 <= C312 <= ∞ X41 15 -8 <= ∆ <= ∞ 7 <= C41 <= ∞ X42 14 -7 <= ∆ <= ∞ 7 <= C42 <= ∞ X43 15 -10 <= ∆ <= ∞ 5 <= C43 <= ∞ X44 13 -4 <= ∆ <= ∞ 9 <= C44 <= ∞ X45 18 -7 <= ∆ <= ∞ 11 <= C45 <= ∞ X46 20 -10 <= ∆ <= ∞ 10 <= C46 <= ∞ X47 17 -8 <= ∆ <= ∞ 9 <= C47 <= ∞ X48 9 -3 <= ∆ <= ∞ 6 <= C48 <= ∞ Class of ’93: Garcia, Nguyen, Read Range of Increase/Decrease Objective Function Coefficient Ranges of Decision Variables Page 22 Decision Cost of Shipping Variables Power ($) X49 6 -5 <= ∆ <= 0 1 <= C49 <= 6 X410 8 -8 <= ∆ <= 0 0 <= C410 <= 8 X411 9 -2 <= ∆ <= ∞ 7 <= C411 <= ∞ X412 10 -5 <= ∆ <= ∞ 5 <= C412 <= ∞ X51 9 -3 <= ∆ <= ∞ 6 <= C51 <= ∞ X52 8 -2 <= ∆ <= ∞ 6 <= C52 <= ∞ X53 9 -5 <= ∆ <= ∞ 4 <= C53 <= ∞ X54 10 -2 <= ∆ <= ∞ 8 <= C54 <= ∞ X55 12 -2 <= ∆ <= ∞ 10 <= C55 <= ∞ X56 15 -6 <= ∆ <= ∞ 9 <= C56 <= ∞ X57 11 -3 <= ∆ <= ∞ 8 <= C57 <= ∞ X58 11 -6 <= ∆ <= ∞ 5 <= C58 <= ∞ X59 9 -5 <= ∆ <= ∞ 4 <= C59 <= ∞ X510 10 -2 <= ∆ <= ∞ 8 <= C510 <= ∞ X511 6 -1 <= ∆ <= 1 5 <= C511 <= 7 X512 4 -5 <= ∆ <= 1 -1 <= C512 <= 5 X61 9 -4 <= ∆ <= ∞ 5 <= C61 <= ∞ X62 8 -3 <= ∆ <= ∞ 5 <= C62 <= ∞ X63 9 -5 <= ∆ <= 1 4 <= C63 <= 10 X64 9 -2 <= ∆ <= ∞ 7 <= C64 <= ∞ X65 9 0 <= ∆ <= 1 9 <= C65 <= 10 X66 9 -1 <= ∆ <= ∞ 8 <= C66 <= ∞ X67 7 -9 <= ∆ <= 0 -2 <= C67 <= 7 X68 5 -7 <= ∆ <= ∞ -2 <= C68 <= ∞ X69 6 -3 <= ∆ <= ∞ 3 <= C69 <= ∞ X610 7 -1 <= ∆ <= ∞ 6 <= C610 <= ∞ X611 6 -1 <= ∆ <= ∞ 5 <= C611 <= ∞ X612 10 -7 <= ∆ <= ∞ 3 <= C612 <= ∞ X71 14 -7 <= ∆ <= ∞ 7 <= C71 <= ∞ X72 13 -6 <= ∆ <= ∞ 7 <= C72 <= ∞ X73 14 -9 <= ∆ <= ∞ 5 <= C73 <= ∞ X74 13 -4 <= ∆ <= ∞ 9 <= C74 <= ∞ X75 16 -5 <= ∆ <= ∞ 11 <= C75 <= ∞ X76 17 -7 <= ∆ <= ∞ 10 <= C76 <= ∞ X77 14 -5 <= ∆ <= ∞ 9 <= C77 <= ∞ X78 7 -1 <= ∆ <= ∞ 6 <= C78 <= ∞ X711 7 -1 <= ∆ <= 1 6 <= C711 <= 8 X712 8 -8 <= ∆ <= ∞ 0 <= C712 <= ∞ Class of ’93: Garcia, Nguyen, Read Range of Increase/Decrease Objective Function Coefficient Ranges of Decision Variables Page 23 Looking at Plant 1, the ranges for X11 (NBV) are 5 <= C11<= ∞. If we decrease the cost of shipping in X11 to $4, then X11 will enter the basis with C11 = 190 and a new optimal solution Z = 14,002. But, by increasing the shipping cost to any value greater than $5, the current basis will remain optimal and the values of the decision variables will remain the same. Another example is the basic variable X12. X12 holds for -2 <= C12 <= 5. But if we increase the shipping cost C12 to more than $6, the solution is no longer optimal and we will get another optimal solution (Z = $14,256 IAW Lindo). Also, X15 (BV = 0) holds for 9 <= C15 <= ∞. But if we increase it to $10, X15 will exit the basis, but the solution will remain unchanged because of the degenerate LP. Because we are dealing with a real-life problem, it’s unrealistic to bring the shipping price to zero ($0). By increasing the shipping price on any BV above the range will help to get another solution and a NBV to enter the basis. Any variation on the shipping cost on any of the NBV (decreasing) or BV (increasing) will change by increasing or decreasing the shipping cost, and we can get a new optimal solution. For the right hand side of the constraints: Objective Function Coefficient RHS Current Value Range of Increase/Decrease b1 0 -∞ <= ∆ <=625 -∞ <= b1< = 625 b2 360 -101 <= ∆ <=10 259 <= b2 <= 370 b3 301 -101 <= ∆ <= 30 200 <= b3 <= 331 b4 810 -575 <= ∆ <= ∞ 235 <= b4 <= ∞ b5 743 -368 <= ∆ <= ∞ 375 <= b5 <= ∞ b9 190 -30 <= ∆ <= 101 160 <= b9 <= 291 b11 175 -30 <= ∆ <= 15 145 <= b11 <= 190 b20 200 -121 <= ∆ <= 24 79 <= b20 <= 224 Ranges of Decision Variables In this part, we examined the supply and demand constraints, which are listed in the table above. For example, if Plant 3 (b3) decreases its output by less than 101 MW or increases by more than 30 MW, then we get a new solution with a new constraints and a new optimal solution. For example, if we decrease its output to 190 MW, the new Z-value we obtain is 14323. Likewise, for a demand constraint, if substation 1 (b9) increases his demand over 291 MW, the new solution is 14472. Even if the current basis remains optimal (between the ranges) the values of the decision variables and Z change. Class of ’93: Garcia, Nguyen, Read Page 24 The optimal solution obtained through Lindo for condition 2 is as follows: Z = 17237.00 X11 = 174 X12 = 175 X15 = 0 X112 = 11 X21 = 0 X36 = 0 X44 = 195 X49 = 200 X410 = 175 X51 = 16 X52 = 0 X55 = 30 X512 = 178 X63 = 175 X65 = 44 X66 = 190 X67 = 0 X75 = 91 X77 = 200 X78 = 15 X711 = 145 Lindo determined that 32 iterations were necessary to find the optimal solution. The power supply by ASE-PR and Eco Electrica increases dramatically due to the shutdown of Palo Seco and Aguirre Plant. ASE-PR (6) supplies power to substations 3, 5, and 6, for a total of 314 MW (70% capacity). Eco Electrica (7) supplies 451 MW (100 % capacity). The solution holds the constraints. After examining the sensitivity analysis, we determined that the ranges for our decision variables could be as follows, and still maintain the optimal solution: Decision Cost of Shipping Variables Power ($) X11 6 0 <= ∆ <= 0 X11 will not change X12 5 -13 <= ∆ <= 0 -8 <= C12 <= 5 X13 6 -5 <= ∆ <= ∞ 1 <= C13 <= ∞ X15 9 0 <= ∆ <= ∞ 9 <= C15 <= ∞ X16 10 -1 <= ∆ <= ∞ 9 <= C16 <= ∞ X17 9 -2 <= ∆ <= ∞ 7 <= C17 <= ∞ Class of ’93: Garcia, Nguyen, Read Range of Increase/Decrease Objective Function Coefficient Ranges of Decision Variables Page 25 Decision Cost of Shipping Variables Power ($) X18 12 -12 <= ∆ <= ∞ 0 <= C18 <= ∞ X19 14 -17 <= ∆ <= ∞ -3 <= C19 <= ∞ X110 17 -17 <= ∆ <= ∞ 0 <= C110 <= ∞ X111 11 -11 <= ∆ <= ∞ 0 <= C111 <= ∞ X112 10 -1 <= ∆ <= 1 9 <= C112 <= 11 X21 6 ∞ <= ∆ <= 1 ∞ <= C21 <= 7 X22 6 -1 <= ∆ <= ∞ 5 <= C22 <= ∞ X23 5 -4 <= ∆ <= ∞ 1 <= C23 <= ∞ X25 10 -1 <= ∆ <= ∞ 9 <= C25 <= ∞ X26 11 -2 <= ∆ <= ∞ 9 <= C26 <= ∞ X27 10 -3 <= ∆ <= ∞ 7 <= C27 <= ∞ X28 11 -11 <= ∆ <= ∞ 0 <= C28 <= ∞ X29 13 -16 <= ∆ <= ∞ -3 <= C29 <= ∞ X210 16 -16 <= ∆ <= ∞ 0 <= C210 <= ∞ X211 10 -10 <= ∆ <= ∞ 0 <= C211 <= ∞ X212 9 -8 <= ∆ <= ∞ 1 <= C212 <= ∞ X31 10 -3 <= ∆ <= ∞ 7 <= C31 <= ∞ X32 10 -4 <= ∆ <= ∞ 6 <= C32 <= ∞ X33 11 -9 <= ∆ <= ∞ 2 <= C33 <= ∞ X34 12 -6 <= ∆ <= ∞ 6 <= C34<= ∞ X35 11 -1 <= ∆ <= ∞ 10 <= C35 <= ∞ X36 13 -∞ <= ∆ <= 1 -∞ <= C36 <= 14 X39 7 -9 <= ∆ <= ∞ -2 <= C39 <= ∞ X310 9 -8 <= ∆ <= ∞ 1 <= C310 <= ∞ X311 12 -11 <= ∆ <= ∞ 1 <= C311 <= ∞ X312 13 -11 <= ∆ <= ∞ 2 <= C312 <= ∞ X41 15 -1 <= ∆ <= ∞ 14 <= C41 <= ∞ X42 14 -1 <= ∆ <= ∞ 13 <= C42 <= ∞ X43 15 -6 <= ∆ <= ∞ 9 <= C43 <= ∞ X44 13 -13 <= ∆ <= 1 0 <= C44 <= 14 X45 18 -1 <= ∆ <= ∞ 17 <= C45 <= ∞ X46 20 -3 <= ∆ <= ∞ 17 <= C46 <= ∞ X47 17 -2 <= ∆ <= ∞ 15 <= C47 <= ∞ X48 9 -1 <= ∆ <= ∞ 8 <= C48 <= ∞ X49 6 -5 <= ∆ <= 1 1 <= C49 <= 7 X410 8 -8 <= ∆ <= 1 0 <= C410 <= 9 X411 9 -1 <= ∆ <= ∞ 8 <= C411 <= ∞ X412 10 -1 <= ∆ <= ∞ 9 <= C412 <= ∞ Class of ’93: Garcia, Nguyen, Read Range of Increase/Decrease Objective Function Coefficient Ranges of Decision Variables Page 26 Decision Cost of Shipping Variables Power ($) X51 9 0 <= ∆ <= 0 9 <= C51 <= 9 X52 8 0 <= ∆ <= ∞ 8 <= C52 <= ∞ X53 9 -5 <= ∆ <= ∞ 4 <= C53 <= ∞ X54 10 -2 <= ∆ <= ∞ 8 <= C54 <= ∞ X55 12 -1 <= ∆ <= 0 11 <= C55 <= 12 X56 15 -3 <= ∆ <= ∞ 12 <= C56 <= ∞ X57 11 -1 <= ∆ <= ∞ 10 <= C57 <= ∞ X58 11 -8 <= ∆ <= ∞ 3 <= C58 <= ∞ X59 9 -9 <= ∆ <= ∞ 0 <= C59 <= ∞ X510 10 -4 <= ∆ <= ∞ 4 <= C510 <= ∞ X511 6 -3 <= ∆ <= ∞ 3 <= C511 <= ∞ X512 4 -0.5 <= ∆ <= 0.5 3.5 <= C512 <= 4.5 X61 9 -3 <= ∆ <= ∞ 6 <= C61 <= ∞ X62 8 -3 <= ∆ <= ∞ 5 <= C62 <= ∞ X63 9 -9 <= ∆ <= 4 0 <= C63 <= 13 X64 9 -4 <= ∆ <= ∞ 5 <= C64 <= ∞ X65 9 -1 <= ∆ <= 0 8 <= C65 <= 9 X66 9 -1 <= ∆ <= 1 7 <= C66 <= 8 X67 7 0 <= ∆ <= ∞ 7 <= C67 <= ∞ X68 5 -13 <= ∆ <= ∞ -8 <= C68 <= ∞ X69 6 -9 <= ∆ <= ∞ -3 <= C69 <= ∞ X610 7 -7 <= ∆ <= ∞ 0 <= C610 <= ∞ X611 6 -6 <= ∆ <= ∞ 0 <= C611 <= ∞ X612 10 -9 <= ∆ <= ∞ 1 <= C612 <= ∞ X71 14 -1 <= ∆ <= ∞ 13 <= C71 <= ∞ X72 13 -1 <= ∆ <= ∞ 12 <= C72 <= ∞ X73 14 -6 <= ∆ <= ∞ 8 <= C73 <= ∞ X74 13 -1 <= ∆ <= ∞ 12 <= C74 <= ∞ X75 16 0 <= ∆ <= 1 15 <= C75 <= 17 X76 17 -1 <= ∆ <= ∞ 16 <= C76 <= ∞ X77 14 -15 <= ∆ <= 0 -1 <= C77 <= 14 X78 7 -4 <= ∆ <= 1 3 <= C78 <= 8 X711 7 -8 <= ∆ <= 1 -1 <= C711 <= 8 X712 8 -9 <= ∆ <= ∞ -1 <= C712 <= ∞ Range of Increase/Decrease Objective Function Coefficient Ranges of Decision Variables Looking at Plant 7, if we decrease the cost of shipping in C71 (NBV) to less than $13, then X71 will enter the basis and the solution is no longer optimal. Now that the shipping cost is less, the Class of ’93: Garcia, Nguyen, Read Page 27 new solution will include X71 (Plant 7 supplies 135 MW to Substation 1) and the new optimal solution is Z = 17,102. For X711 (BV), if the shipping cost (C711) increases to more than $9, the solution is no longer optimal and X67 enters the basis with 44 MW. Also the optimal Zvalue will change ($17,516 IAW Lindo). Any variation on the shipping cost of any of the NBV (decreasing) or BV (increasing) will change by increasing or decreasing the shipping cost, and we will get a new optimal solution. For the right hand side of the constraints: Objective Function Coefficient RHS Current Value Range of Increase/Decrease b1 0 -∞ <= ∆ <=2286 -∞ <= b1 <= 2286 b2 360 -87 <= ∆ <= 8 273 <= b2 <= 368 b3 0 0 <= ∆ <= 8 0 <= b3 <= 8 b4 0 0 <= ∆ <= 11 0 <= b4 <=11 b5 743 -173 <= ∆ <= ∞ 570 <= b5 <= ∞ b7 409 -44 <= ∆ <= 11 365 <= b7 <= 420 b10 175 -8 <= ∆ <= 87 167 <= b10 <= 262 b12 195 -195 <= ∆ <= 173 0 <= b12 <= 368 b15 200 -11 <= ∆ <= 89 189 <= b15 <= 289 b20 200 -11 <= ∆ <= 174 189 <= b20 <= 374 Ranges of Decision Variables In this part, we examined the supply and demand constraints, which are listed in the table above. For example, if Plant 7 (b7) decreases his power supply by less than 44 MW or increases by more than 11 MW, then we get a new optimal solution with new constraints and new optimal solution. For example, if we decrease its power supply to 360 MW, the new Z-value obtained is 17,634. Likewise, if the power demand on the substation 20 (b20) increases over 374 MW, the solution is no longer optimal and the new Z = 18,812 MW. Even if the current basis remains optimal (between the ranges) the values of the decision variables and Z change. Finally, for both conditions, due to the fact that there are more than one basic variable equal to zero, we conclude that this LP is also degenerate. In all three scenarios, Lindo provided adequate ranges. Even with the sensitivity analysis that Lindo provided, some of the ranges do not seem feasible to apply to real-world situations. For instance, we would never pay consumers for using electricity and market demands would not Class of ’93: Garcia, Nguyen, Read Page 28 allow us to increase the selling price to infinity, as suggested. By having a constraint that affect a basic variable, even if the ranges indicated that the solution will be suboptimal if we leave the ranges, the constraint will force the basis to remain the same and the only change will be the Zoptimal. We observed this situation in all three scenarios. Therefore, it is important to consider all aspects of the situation before changing the variables. 4.0 Conclusions and Recommendations In this project, we attempted to maximize or minimize three different situations. The solutions for all three problems using LINDO show that the companies can gain substantial profit or minimize their expenses by implementing recommendations developed by each model. First, our recommendation to Cummings Engine Company is to produce and sell trucks is as follows: Produce st Truck Type 1 Year Type 1 100 Type 2 200 nd 2 Year Sell rd st nd 2 Year 3rd Year 3 Year 1 Year 200 150 100 200 150 100 150 200 100 150 During the formulation, we began by defining the decision variables that would describe each situation and decision to be made (e.g., determine the number of type 1 trucks to produce during the first year). The formulation presented a challenge for the group due to a set of conditions that later became constraints. For example, Grummins Engine Company produces two different types of trucks. The production of each truck was based on how many trucks can be sold every year during a three year period. Also, if a truck is not sold, the company incurs an additional charge for inventory. Because they want to maximize its profit, we have to make sure that our solution takes into consideration all related costs (production, overhaul, etc). During our presentation of the model to the company we must state that during the formulation phase, we assumed that Grummins will sell all trucks produced in that year. Also the government imposes certain restrictions and specifications that we must follow. These restrictions can cost millions of dollars to company if they are violated. Class of ’93: Garcia, Nguyen, Read Page 29 For the inventory problem, we determined the following: Purchase Month Selling Quantity 1 0 0 2 0 0 3 6 20 4 0 0 5 0 0 6 20 20 7 20 0 8 0 20 9 20 0 10 0 0 Quantity The above table represented the optimal solution. During the formulation phase, we needed to determine what real-life facts can affect the situation. The capacity of the warehouse, initial inventory at the beginning of each month, and the monthly selling limitation are some examples of a real-life situation. Sometimes, we must determine all constraints and limitations before we begin the formulation phase. If a limitation is ignored during the formulation phase, the optimal solution can be completely wrong. The above table clearly confirmed the inventory procedures for the next 10 months. We can recommend as an option to increase the capacity of the warehouse in order to increase profits. In the power distribution case, we were asked to develop an LP for two different conditions. The first condition was to minimize the cost of meeting each substation’s peak power demand for next year during high peak demand and the second condition was to minimize the cost of meeting each substation’s peak power demand if two plants were disconnected due to bad weather. This model doesn’t include the operating limits of the generators, loads and the transmission line network. The only two types of critical points that we identified were the transmission line flow limits and generator capability limits (plants). Our final solution was as follows: Class of ’93: Garcia, Nguyen, Read Page 30 Condition 1 Condition 2 Plant i to Power Plant i to Power Substation j Transmitted Substation j Transmitted X12 175 X11 174 X14 185 X12 175 X21 190 X112 11 X24 10 X44 195 X25 101 X49 200 X35 30 X410 175 X36 190 X51 16 X38 15 X55 30 X49 200 X512 178 X410 175 X63 175 X511 24 X65 44 X512 200 X66 190 X63 175 X75 91 X65 34 X77 200 X67 200 X78 15 X711 121 X711 145 Because generating companies and power systems have the problem of deciding how best to meet the varying demand for electricity, which has a daily and weekly cycle, we must develop a model that will support the high peak demand. Electricity cannot be stored; it is necessary to start-up and shut-down a number of generating units at various power stations each day. During the second condition, the problem is to decide when and which generating units to start-up and shut-down, in order to minimize the total fuel cost or to maximize the total profit, over a study period of typically a day, subject to a large number of difficult constraints that must be satisfied. By assuming that two plants will be disconnected at any time, we can develop an optimal solution. The most important constraint is that the total generation must equal the forecast demands for electricity. Also, most of these transportation problems must take into consideration the supply of imported power. In the United States, the supply of imported power is price responsive. The quantity of imported power can increase in the face of higher power prices, dampening market power. In our case, the market is owned by one source, so they can control any changes on the shipping Class of ’93: Garcia, Nguyen, Read Page 31 cost of the decision variables. The source can use our formulation to predict the worst case scenario and to determine any backup plan to sustain the demand if anything should happen. Furthermore, the source can save millions of dollars by improving the transmission line networks and also by obtaining more fuel cells. 5.0 References Winston, W.L. and M.Venkataramanan, Introduction to Mathematical Programming, 4th Edition, Duxbury Press, Belmont, CA, 2003. Gonen, Turan, Electric Power Distribution System Engineering, McGraw-Hill Publishing Company, Oklahoma City, OK, 1986. Puerto Rico Electric Power Authority, Tarifas para Servicio de Electricidad, November 1989. Autoridad de Energia Electrica, www.prepa.com, 2002. Class of ’93: Garcia, Nguyen, Read Page 32