Topic 4: Financial markets and the macroeconomy:

advertisement

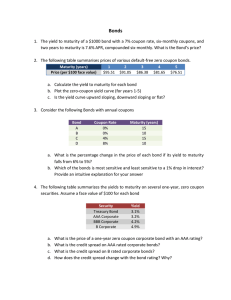

This lecture concludes Topic 4: “Financial markets and the Macroeconomy”. Topic 4: Financial markets and the macroeconomy: Part 3: Asset pricing and macroeconomics Sub topics: • Bond price and yield • Short-term and long-term interest rates: The yield curve Øystein Børsum, Temporary lecturer, University of Oslo Reading: B&W ch 19.1-3. April 6, 2005 1 Short-term and long-term interest rates Role of bonds in the economy In the portfolio model: "Kroner bonds" are not actually bonds but a bank A standard bond is a fixed income assets: Both the periodic payments deposit paying the short-term interest rate. (coupons) and the final payment (principal) are predetermined in kroner. OK simplification for understanding the relationship between domestic money market and market for foreign exchange. But in practice: Loans and credits have different maturities. Long maturities are important for decisions that effect consumption, employment and investments in real capital. The price of the bond depends on how valuable these payments are to the investor. Discounting with some appropriate interest rate. The effective interest rate of holding a bond until the final payment (maturity) is called the yield. Empirically, bond yields are responsive to changes in money-market interest rates (most directly controlled by economic policy). Through equilibrium in asset markets: Transmission of changes in yields between different assets with similar characteristics (government bonds, mortgages, business credits etc.) Conclusion: Bond market transforms changes in short-term policy rate to Bond price and yield changes in all types of long-term interest rates. Relevant for the impact of monetary policy. Bond holder: Receives specified payments at specified dates in the future, for a specified period of rime. Periodic payments are called coupons C. The final payment (principal) equals the face value, F , is paid in the period when the bond matures. The price P of the bond is established by discounting the future payments over all the n periods with the appropriate interest rates: (1.1) P = C C C F + + ... + + 1 + i1 (1 + i2)2 (1 + in)n (1 + in)n This defines P as the present value of all future fixed payments. Note: Return on a bond = Change in price + received payments. Price changes imply that bond returns are variable - not fixed! Given the price P , the yield y is defined as the single interest rate that solves The yield curve the discounting equation: (1.1) P = C C F C + ... + + + 1 + y (1 + y)2 (1 + y)n (1 + y)n Note: If the fist coupon is paid exactly 1 year from now, and thereafter every There is a market bonds with different maturities. From their prices, we compute the (annualised) yield as a function of the years to maturity: yn = f (years to maturity) year, then y is the annual rate of interest. By holding the bond to maturity, you are certain to obtain this interest rate: Yield is actually "yield to maturity" P and y are negatively related. Nonlinear relationship. Pricing formulea for other fixed income assets can be derived from this. E.g. a "consol": F = 0 and long maturity (n → ∞), 1 P = . y where yn is the yield of the a bond with n years to maturity The graph of this function is called the yield curve. The market prices can change rapidly, so it only makes sense to talk about a yield curve at a specific point in time. Daily reporting in business newspapers. The shape of the yield curve is given attention by economists: Believed to embody the market’s response to policy-changes (and other shocks), and market participants’ anticipations of future policy-changes. Illustrating the expectations hypothesis of the yield curve. Upward-sloping yield curve: Expectations of interest rate increases in the future. Consider a succession of 1-year investments paying the 1-year money market Downward-sloping yield curve: Expectations of interest rate cuts. interest rate: Current and expected money market interest rate: % today 1 year ahead 2 years ahead 3 years ahead 4 years ahead .... Many years ahead 3 4 5 6 6 6 Return Maturity (approx.) 3 (3+4) 2 (3+4+5) 3 (3+4+5+6) 4 (3+4+5+6+6) 5 = = = = ... ≈ 3 3.5 4 4.5 4.9 ... 6 1 year 2 year 3 year 4 year 5 year ... Long The expectations hypothesis states that these returns should be equal to the yields for all bonds with the correponding maturities. From the actual yield curve, expectations about future interest rates are “backed out”. E.g. Norwegian National Budget 2004. Assumes that no other factors influence the yield curve. Other popular theories: Risk premium linked to maturity. Market segmentation (e.g. life insurance companies). Also: Need to account for inflation to find the real interest rates. Empirically: Econometric studies support the expectations hypothesis for short and medium-term maturities (up to 2-3 years) across countries.