Document 11582112

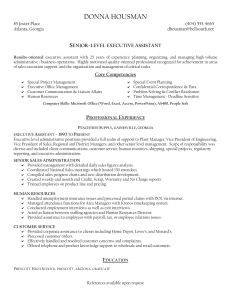

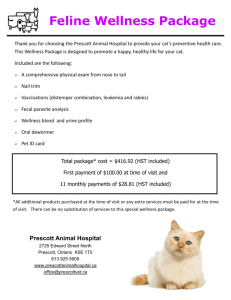

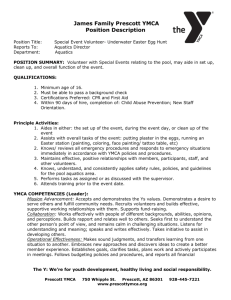

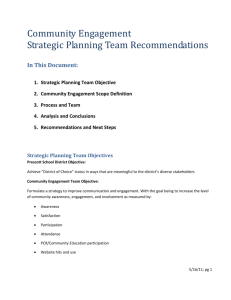

advertisement