Document 11580853

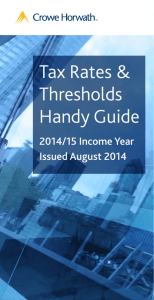

advertisement

Taxation of Superannuation Benefits Superannuation benefits from a taxed source Payments to dependants Age of recipient Lump Sum Income stream 60 and over Preservation age to age 59 Not assessable not exempt – No tax on amount below the low rate cap* Not assessable not exempt Taxed at marginal rates, but eligible for 15% tax offset Under preservation age Taxation of Superannuation Death Benefits – Taxed at a maximum rate of 15% on amount over the low rate cap Taxed at maximum rate of 20% Taxed at marginal rates, with no tax offset (15% tax offset available if a disability superannuation benefit) Age of deceased Superannuation Age of death benefit recipient Any age Lump sum Any age Aged 60 and above Income stream Any age Below age 60 Income stream Above age 60 * Low rate cap amount: $195,000 (2015/16) Age of recipient Lump sum 60 and over – Taxed at a maximum rate of 15% Taxed at marginal rates but on amount up to the untaxed eligible for a 10% tax offset plan cap* Preservation age to age 59 Income stream Under preservation age Income stream Below age 60 – element untaxed in the fund is taxed at marginal rates. Recipient entitled to a 10% tax offset on this amount Taxable component: Tax treatment Lump sum Taxable component: – element taxed in the fund is taxed at a maximum rate of 15% Taxed at marginal rates, with no tax offset Any age Income stream Any age – Taxed at 45% on amount over the untaxed plan cap * Untaxed plan cap amount: $1.395m (2015/16) ** Low rate cap amount: $195,000 (2015/16) Note that for the 2015/16 year, the 2% budget repair levy applies if an individual’s taxable income exceeds $180,000. While the levy applies to superannuation lump sums to the extent that the individual’s taxable income (including the lump sum) exceeds $180,000, a tax offset mechanism ensures that the effective tax rate applying to the lump sum payment does not exceed the relevant maximum tax rate. – element untaxed in the fund is taxed at a maximum rate of 30% – Death benefit cannot be paid as income stream – Income streams that commenced before 1 July 2007 are taxed as if received by a dependant (see above) Capital Gains Tax Purchase date CGT event happens CGT Calculation Before 20/9/1985 20/9/1985 - 20/9/1999 Any time After 20/9/1999 After 20/9/1999 Any time Nil Indexed cost base method* or discount method** Discount method** ** 50% discount (individuals and trusts); 33 1/3% discount (complying superannuation entities, FHSA trust and life insurance companies for complying superannuation/FHSA assets) Note that from 8 May 2012, the CGT discount no longer applies to non-residents but remains available for capital gains accrued before this time where non-residents choose to obtain a market valuation of assets as at 8 May 2012. Receiving spouse’s assessable income (AI)* Maximum contributions entitled to tax offset (MC) Maximum tax offset (18% of the lesser of) $0 - $10,800 $10,801 - $13,799 $13,800 + $3,000 $3,000 - (AI - $10,800) Nil MC or actual contributions MC or actual contributions Nil * AI is the sum of the person’s assessable income, reportable fringe benefits total and reportable employer superannuation contributions. Payroll tax rates and thresholds The following payroll tax rates and thresholds are applicable in the various states and territories for the financial year commencing 1 July 2015: Maximum contribution base Year Amount in a quarterly contribution period State Rate (%) Annual wages threshold ($) Monthly wages threshold ($) $50,810 New South Wales 5.45 750,000 59,426; 61,475 or 63,5251 Victoria Queensland South Australia Western Australia Tasmania 4.85 4.75 4.95 5.5 6.10 550,000 1,100,000 600,000 800,0002 1,250,000 ACT Northern Territory 6.85 5.5 1,850,000 1,500,000 45,833 91,666 50,000 66,6673 99,044; 102,459 or 105,8744 154,166.66 125,000 2015/16 The maximum contribution base acts as a ceiling on an employee’s earnings for each quarter in a financial year effectively limiting the amount of superannuation support that the employer is required to provide for the employee for the quarter, and the amount of the SG shortfall (and consequent SG charge) payable in respect of the employee. Contribution caps Contributions cap type 2015/16 Concessional contributions cap Concessional contributions cap – aged 49 years or more on 30 June 2015 Non-concessional contributions cap* Non-concessional contributions - CGT cap amount $30,000 $35,000 $180,000 $1.395m * A bring forward rule allows individuals aged under 65 to make non-concessional contributions of up to three times their non-concessional contributions cap over a three-year period. The bring-forward cap is three times the non-concessional contributions cap of the first year in which the rule applies. Government co-contribution (2015/16) Maximum co-contribution payable Lower income threshold Higher income threshold $500 $35,454 $50,454 Low income superannuation contribution* Individual’s adjusted taxable income: $0 - $37, 000 Assets held longer than 12 months * Indexation of cost base frozen as at 30 September 1999 (68.7). Crowe Horwath is the largest provider of practical accounting, audit, tax, business and financial advice to individuals and businesses from a network of over 80 offices throughout the country. Superannuation Guarantee Charge The charge percentage remains at 9.5% for the 2015/16 to 2020/21 years. The charge percentage will then increase by 0.5% in 2021/22 and in each later year until it reaches 12% for years starting on or after 1 July 2025. Superannuation Age of death benefit recipient Any age - Type 1 benefits - 2.1463 - Type 2 benefits - 1.9608 The SG rate is 9.5% for 2015/16. Payments to non-dependants Any age 49 % – element untaxed in the fund is taxed at marginal rates. Recipient entitled to a 10% tax offset on this amount Taxable component: – element untaxed in the fund is taxed at marginal rates Age of deceased Fringe benefit taxable amount - gross-up rate – element taxed in the fund is tax-free – element taxed in the fund is taxed at marginal rates. Recipient entitled to a 15% tax offset on this amount Taxed at marginal rates, with no tax offset – Taxed at maximum rate of 30% on amount above the low rate cap amount up to the untaxed plan cap – Taxed at 45% on amount over the untaxed plan cap – Taxed at a maximum rate of 30% on amount up to the untaxed plan cap Below age 60 FBT rate (2015/16) Tax-free (not assessable, not exempt income) Taxable component: – element taxed in the fund is tax-free Superannuation benefits from an untaxed source – Taxed at 45% on amount over the untaxed plan cap* – Taxed at maximum rate of 15% on amount up to the low rate cap** Tax treatment Spouse contributions – tax offset Fringe Benefits Tax LISC amount payable is: (i) ECC x 15% (except where (ii) or (iii) applies) (ii) $500 where the amount worked out in (i) exceeds $500 (iii) $10 where the amount worked out in (i) is less than $10 An individual is entitled to a low income superannuation contribution (LISC), based on 15% of the individual’s total eligible concessional contributions (ECC), up to a maximum of $500. However, the LISC has been abolished for financial years starting from 1 July 2017. NSW monthly threshold is based on 29,30 or 31 days in a month. From 2016/17 the annual threshold will be $850,000. From 2016/17 the monthly threshold will be $70,833. 4 Tasmania monthly threshold is based on 29, 30 or 31 days in the month. 1 2 3 HELP repayment thresholds and rates The Higher Education Loan Programme income thresholds and the repayment rates for 2015/16 are as follows: 2015/16 repayment income Below $54,126 $54,126-$60,292 $60,293-$66,456 $66,457-$69,949 $69,950-$75,190 $75,191-$81,432 $81,433-$85,718 $85,719-$94,331 $94,332-$100,519 $100,520 and above *The repayment rate is applied to the repayment income. Rates of repayment* Nil 4% 4.5% 5% 5.5% 6% 6.5% 7% 7.5% 8% DISCLAIMER The information provided in this guide is believed to be accurate as at August 2015. However, the publisher and authors expressly disclaim all and any liability and responsibility to any person, of the consequences of anything done or omitted to be done by any such person in reliance of the contents of this publication. For all your taxation information, refer to the CCH Australian Master Tax Guide - the essential reference guide for tax professionals. Tax Rates & Thresholds Handy Guide 2015/16 Income Year Issued August 2015 Company rates (2015/16) Income Tax Rates Individuals (2015/16) Residents 2015/16 Taxable income (column 1) Tax on column 1 % on excess (marginal rate) $18,200 $37,000 $80,000 $180,000* Nil $3,572 $17,547 $54,547* 19 32.5 37 45* Medicare levy/Medicare levy surcharge For 2015/16, the rate of Medicare levy is 2% of a resident individual’s taxable income for the income year. No Medicare levy is payable where a resident individual’s taxable income does not exceed a certain threshold amount (not yet known for 2015/16; $20,896 for 2014/15). Further, where a resident individual is not covered by private patient hospital insurance and their “income for surcharge purposes” for the year is more than $90,000, an additional Medicare levy surcharge of 1%, 1.25% or 1.5% is payable depending on their level of income and age. The table below indicates how the Medicare levy surcharge rules apply in conjunction with the private health insurance rebate rules. Families* Under 65 years of age 65–69 years of age 70 years of age and over Income $90,001– $105,001– $0–$90,000 $105,000 $140,000 $180,001– $210,001– $0–$180,000 $210,000 $280,000 Private health insurance rebate Tier 1 Tier 2 $140,001 and over $280,001 and over Tier 3 27.82%† 18.55%† 9.27%† 0% 32.46%† 23.18%† 13.91%† 0% 37.09%† 27.82%† 18.55%† Tax Rate Private companies (other than life insurance companies) Public companies (other than life insurance companies) Companies (other than life insurance companies) that are RSA providers – Standard component of taxable income – RSA component of taxable income – FHSA component of taxable income (if any) 30% 30% 30% 15% 15% Life insurance companies: – Ordinary class of taxable income – Complying superannuation/FHSA class of taxable income * For taxable incomes exceeding $180,000, the 2% budget repair levy applies for that part of the taxable income exceeding $180,000. Non-refundable tax offsets cannot be used to offset the budget repair levy; only the foreign income tax offset can be used to offset against the levy. Singles Deceased estates — rates of tax (2015/16) Type of entity 0% Medicare levy surcharge Percentage rate 0% 1% 1.25% 1.5% * The families’ threshold is increased by $1,500 for each dependent child after the first. Families include couples and single parent families. † The private health insurance rebate is indexed annually by a rebate adjustment factor on 1 April each year. Accordingly, these rebate figures are only applicable from 1 April 2015 to 31 March 2016. 30% 15% Small business entities (2015/16) Type of entity Companies Individuals (other than companies) Tax Rate 28.5% General individual rates but 5% discount on tax payable up to $1,000 a year (proposed) Superannuation funds (2015/16) Type of fund Complying superannuation funds: (i) Assessed on income, including realised capital gains and assessable contributions* (ii) Assessed on non-arm’s length income, private company dividends and certain trust distributions Non-complying superannuation funds Assessed on income, including realised capital gains and assessable contributions* Complying ADFs: (i) Assessed on income, including realised capital gains and assessable contributions (ii) Assessed on non-arm’s length income, private company dividends and certain trust distributions Non-complying ADFs: Assessed on income, including realised capital gains and assessable contributions PSTs (i) Assessed on income, including realised capital gains and assessable contributions transferred to the PST (ii) Assessed on non-arm’s length income, private company dividends and certain trust distributions. Tax rate A trustee assessed on the net income of a trust estate of a person who died less than three years before the end of the income year is taxed at the general individual rates. A trustee assessed on the net income of a resident trust estate of a person who died more than three years before the end of the year of income is taxed at the following rates for 2015/16: Share of net income (column 1) ($) Personal tax offsets and rebates Dependant (Invalid and Carer) Medical expenses Private health insurance (see above) 15% Zone rebates • Ordinary Zone A 47% *Additional tax at the rate of 34% (complying funds) and 2% (non-complying funds) is payable on no-Tax File Number (TFN) contributions income that is included in assessable contributions. A tax offset is available if a TFN is provided to the fund within four years. Maximum amount $2,588 Depending on taxpayer’s and/ or family’s adjusted taxable income, 20% of excess of net medical expenses over $2,265 or 10% of excess over $5,343. Note that transitional criteria apply Death benefit employment termination payments Taxable income Amount of offset Component Tax treatment $0 - $37,000 $37,000-$66,667 > $66,667 $445 $445 - [(taxable income - $37,000) x 1.5%] Nil Tax free component Taxable component Tax-free • Payment to a dependant – amount up to ETP cap — tax-free – amount over ETP cap — taxed at 45%* Family situation Maximum offset Single Couple (each) Illness separated couple $2,230 $1,602 $2,040 Shade-out threshold Cut-out threshold $32,279 $28,974 $31,279 $50,119 $41,790 $47,599 Life benefit employment termination payments Cut-out when (adjusted) taxable income reaches $338 + 50% of relevant rebate amount* • Ordinary Zone B $57 + 20% of relevant rebate amount* • Special Zone A or B $1,173 + 50% of relevant rebate amount* Defence Force Same as for Ordinary Zone A Income arrears Applicable to lump sum Medicare levy surcharge lump payments of income paid in sum arrears arrears *”Relevant rebate amount” means the following rebates or notional rebates to which a taxpayer may be entitled: DICTO (max $2,588); sole parent (max $1,607); child (max first child $376, second child or subsequent children $282); and student (max $376). Tax treatment Tax free component Taxable component Tax-free • Preservation age and over – amount up to ETP cap* — taxed at a maximum rate of 15% – amount over ETP cap* — taxed at 45%** • Below preservation age – amount up to ETP cap* — taxed at a maximum rate of 30% – amount over ETP cap* — taxed at 45%** * ETP cap amount: $195,000 (2015/16). For certain ETPs, the ETP cap works in conjunction with a whole-of-income cap ($180,000) ** For taxable incomes exceeding $180,000, the 2% budget repair levy applies for that part of the taxable income exceeding $180,000. Non-refundable tax offsets cannot be used to offset the budget repair levy; only the foreign income tax offset can be used to offset against the levy. Before 1 July 1960 1 July 1960 – 30 June 1961 1 July 1961 – 30 June 1962 1 July 1962 – 30 June 1963 1 July 1963 – 30 June 1964 On or after 1 July 1964 * For taxable incomes exceeding $180,000, the 2% budget repair levy applies for that part of the taxable income exceeding $180,000. Non-refundable tax offsets cannot be used to offset the budget repair levy; only the foreign income tax offset can be used to offset against the levy. Income year Base amount Plus for each complete year of service 2015/16 $9,780 $4,891 Unused annual leave payment rules Assessable portion Period of accrual of leave Maximum rate General retirement or termination: – accrual before 18 August 1993 100% 30% – accrual on or after 18 August 1993 100% Marginal Genuine redundancy amount, early retirement scheme amount or invalidity amount paid on or after 18 August 1993 100% 30% Unused long service leave payment rules Preservation age Date of birth • Payment to trustee of deceased estate – taxed in the hands of the trustee, based on whether the beneficiary is a dependant or non-dependant (see above) Genuine redundancy and early retirement scheme payments Component $10,634 Dependent on age of person(s) covered by policy and income level(s) • Payment to a non-dependant – a mount up to ETP cap — taxed at a maximum rate of 30% – amount over ETP cap — taxed at 45%* Senior Australians and Pensioners Tax Offset (2015/16) Taxation of Emloyment Related Payments Personal tax offsets and rebates (2015/16) 47% 15% 50 19* 32.5 37 47 Personal tax offsets 47% 47% % on excess (marginal rate) 416 Nil 670 127 37,000 7,030 80,000 21,005 180,000 58,005 * Income between $670 and $37,000 is taxed at a flat rate of 19%. 15% 47% Tax on column 1 ($) Low income earner’s tax offset (2015/16) Preservation age 55 56 57 58 59 60 Period of accrual of leave Assessable portion Maximum rate 5% Marginal General retirement or termination: – accrual before 16 August 1978 – accrual 16 August 1978 to 17 August 1993 100% 30% – accrual on or after 18 August 1993 Genuine redundancy amount, early retirement scheme amount or invalidity amount: 100% Marginal 5% Marginal 100% 30% – accrual before 16 August 1978 – accrual on or after 16 August 1978 Non-residents 2015/16 Taxable income (column 1) Tax on column 1 % on excess (marginal rate) Nil $80,000 $180,000 Nil $26,000 $63,000 32.5 37 45* * For taxable incomes exceeding $180,000, the 2% budget repair levy applies for that part of the taxable income exceeding $180,000. Non-refundable tax offsets cannot be used to offset the budget repair levy; only the foreign income tax offset can be used to offset against the levy. Produced by www.wolterskluwer.cch.com.au