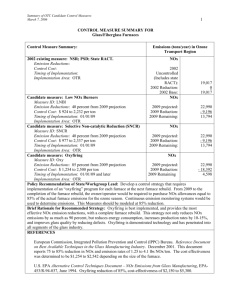

Ancillary Benefits of Reduced Air Pollution in the United States from

advertisement