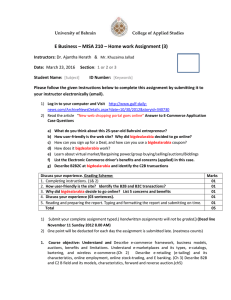

The Impact of E-Commerce Announcements on the Market Value of Firms

advertisement