Taxes and the cost of capital

advertisement

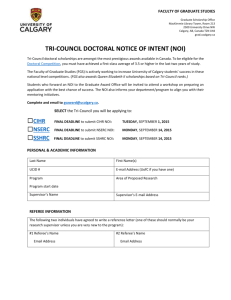

SØK460 Finance Theory, Diderik Lund, 13 February 2001 Taxes and the cost of capital Section 2.G in C&W: How calculate net present values after corporate taxes when a firm is partly financed by borrowing? Assume for simplicity that a project has one initial investment, partly financed by borrowing. After that, the same happens every year forever: There is a replacement investment I, sufficient to maintain the capital equipment, and there is an operating surplus Opsur = Rev − VC − FCC. Cash flow before taxes is Opsur − I. Corporate tax system instead allows a schedule of depreciation allowances, assumed to be dep each year. At the rate τ the taxes are τ (Opsur − dep), and cash flow after taxes is NOCF = Opsur(1 − τ ) + τ dep − I. After noting that we might have I 6= dep, C&W nevertheless assume I = dep in order to simplify. C&W assume that those who receive dividends will use a discount rate ks for these, while those who receive interest income (the lenders to the firm) will use a rate kb. This is justified (see footnote 11) by differences in risk. Here: Assume instead that all cash flows are certain, but that there is a different tax treatment of dividends and interest income in the personal tax system. 1 SØK460 Finance Theory, Diderik Lund, 13 February 2001 First method (p. 38): Calculate each period’s net cash flow to owners, and use the owners’ discount rate ks to find present values. The net present value to the owners of the perpetual dividend stream is S= NOCF − (1 − τ )kb B . ks The criterion for the initial investment: Do it if it costs less than B + S, where S is taken from the formula. Requires that each division in firm tries to take firms’ borrowing into account, and makes a deduction for it, before using the discount rate for dividend income. Instead many firms use a WACC (Weighted Average Cost of Capital). Second method (p. 39): The WACC is denoted k, and it should be defined in such a way that when applied to the cash flow NOCF, then it gives the present value B + S. The present value criterion says: Invest if the present value NOCF/k exceeds the initial investment cost. But now k will be chosen so that the present value equals B + S, and we get the exactly the same investment decision as under the first method. The correct k can be found by using the S formula above: k(B + S) ≡ NOCF = ks S + (1 − τ )kb B, ⇒ k = ks B S + kb (1 − τ ) . B+S B+S 2 SØK460 Finance Theory, Diderik Lund, 13 February 2001 Personal taxes and tax neutrality The WACC formula is independent of the firm’s financing if ks = kb (1 −τ ). In such a case, the taxes and the firm’s financing decision do not affect the real investment decision, which is a form of “tax neutrality.” If there are no personal taxes, this formula may be hard to obtain. The owners of the firm and the lenders are most likely quite similar. The usual assumption under certainty is that they require the same rate of return. But that would be after personal taxes. In the United States, dividends and interest income are taxed similarly by the personal tax system, and the personal tax system will not easily lead to ks = kb(1 − τ ). We return to this in chapter 13 of C&W. Unfortunately, C&W and most of the economics literature is concerned with the U.S. tax system. But there are exceptions, and we will consider Europe as well. 3 SØK460 Finance Theory, Diderik Lund, 13 February 2001 The imputation system In most of Europe the situation is different. Since firms can deduct interest payments when they pay taxes, these are taxed more heavily than dividends by the personal tax system. Neutrality is obtained when the personal dividend tax rate, τd, and the personal interest tax rate, τi , are related by (1 − τd) = 1 − τi . 1−τ That this leads to neutrality, can be shown as follows: If the firm yields the required rates of return (after corporate taxes, but before personal taxes) ks to owners and kb to lenders, then tax neutrality is obtained if ks = kb (1−τ ). But this is exactly what the personal tax system would lead to, since the lenders get kb (1 − τi ) after personal taxes, and the owners get ks(1 − τd) = (1 − τ )kb (1 − τi)/(1 − τ ) = kb (1 − τi) after personal taxes. Thus the rates of return to owners and lenders are the same and the firm’s real investment decision is independent of the financing decision if the personal tax system is of this kind. In Norway this is obtained by τi = τ and τd = 0. 4 SØK460 Finance Theory, Diderik Lund, 13 February 2001 Capital structure and the cost of capital Two main questions: 1. How does a firm’s capital structure affect its market value? 2. How does it affect the firm’s cost of capital? • “Cost of capital” means required (expected) rate of return. • Several different required rates of return: ks is rate required by shareholders. kb is rate required by bondholders, lenders to the firm. k is a weighted average of these, the WACC. • Requirement to pay out to shareholders and bondholders lead to requirement on earnings, which is the WACC (after tax). • A project must earn WACC after having paid corporate tax. • “Capital structure” means composition of firm’s financing. • Right-hand side of balance sheet: Liabilities. • Consists of book value of shares + retained earnings + debt. • Crucial question: How much to borrow. • Our main concern: Tax effect of borrowing. 5 SØK460 Finance Theory, Diderik Lund, 13 February 2001 Main messages of chapter 13 1. If there are no taxes, the value of the firm and the cost of capital do not depend on “leverage” (= relative amount of borrowing). 2. With corporate taxes, but no personal taxes, the value of the firm is increasing with its leverage, and the cost of capital is decreasing. 3. When personal taxes also in analysis, conclusion may change. (For Norway: It does change. Taxes 1992—2000 were designed to be neutral, i.e., they do not encourage (or discourage) borrowing.) 6 SØK460 Finance Theory, Diderik Lund, 13 February 2001 Modigliani and Miller (1958): Irrelevance of borrowing • Famous proof that borrowing does not matter. • Absence-of-arbitrage proof. ˜ • Consider firm with net operating income NOI. • Used to pay shareholders, bondholders, taxes (if any). • Assumptions: — No taxes (in first version). — Debt of firm is riskless. ˜ and debt payment every period. — Same NOI — Net investment equals zero. — Perfect credit markets. 7 SØK460 Finance Theory, Diderik Lund, 13 February 2001 Proof of Modigliani-Miller theorem ˜ Consider two corporations with identical NOI’s but different leverage. S is market value of outstanding shares. ˜ to shareholders Firm U (for unlevered) has no debt. Pays NOI every period. Value of corporation belongs to shareholders, V U = SU . Firm L (for levered) has debt with market value B. Payment to debtholders is kb B every period. Payment to shareholders is ˜ − kb B every period. Value of corporation is V L = S L + B. NOI If V U 6= V L, there is an arbitrage opportunity. Suppose, e.g., that V U < V L . Then now each subsequent period ˜ − kbB) Sell shares in L + αS L − α(NOI ˜ + αNOI Buy shares in U − αS U Borrow + αB − αkbB α(V L − V U ) > 0 0 Conclude: Under these assumptions a higher leverage does not increase or decrease share values. Any desired borrowing can just as well be done by shareholders themselves, “homemade leverage.” 8 SØK460 Finance Theory, Diderik Lund, 13 February 2001 Dependence of ks on leverage, without taxes Without taxes the total value of the firm is independent of leverage. Call it V0. In the model we used, a claim to the perpetual flow of ˜ This gives a risk-adjusted expeced rate of return NOI. ˜ E(NOI) ρ= , V0 also independent of leverage. ˜ uncertain, but not to the extent that payment Have assumed NOI to debtholders becomes uncertain. Shareholders take all the risk. In relative terms (in relation to S) this risk increases with leverage. Therefore the required rate of return on equity, ks , also increases with leverage. Can be seen as follows: ˜ ˜ − kbB kb B + ksS E(NOI) kb B + E(NOI) ρ= = = , V0 V0 V0 which implies that B B+S B ρ − kb = ρ + (ρ − kb) . S S S Increasing B/S means that the same absolute risk is carried by a lower S. ks = 9 SØK460 Finance Theory, Diderik Lund, 13 February 2001 Value of firm with leverage and corporate taxes • Considers U.S. corporate tax system. • Interest expenditures deductible in corporate taxes, τc. • But no deductions for dividends to shareholders. • Total cash flow to debtholders and shareholders is ˜ ˜ − kbB)(1 − τc) + kb B = NOI(1 − τc) + kb Bτc, (NOI as if interest payments are subsidized. • Discounting each with the appropriate discount rate: ˜ E(NOI)(1 − τc) kb Bτc V = + = V U + τcB. ρ kb L • Value of taxed levered firm increases with borrowing. • Consequence: Choose 100 per cent debt financing. • Not observed empirically in the U.S. • More realistic: Some costs to having too much debt. • Debt becomes risky, may go bankrupt. • Interest rate demanded, kb, will be increasing in leverage. 10 SØK460 Finance Theory, Diderik Lund, 13 February 2001 Value of levered firm with corporate and personal taxes • Distinguish interest rate paid, kd, and received, kb , kb = kd(1 − τpB ), with τpB the personal tax rate on interest income. • Payment to shareholders, after corp. and pers. tax, ˜ − kdB)(1 − τc)(1 − τps). (NOI • Payment to bondholders, after tax, kdB(1 − τpB ). • Summing these and discounting at appropriate rates gives V L = V U + 1 − (1 − τc)(1 − τps) B. 1 − τpB • The gain from leverage is the second term. • The case without personal taxes reappears for τps = τpB . • But gain from leverage reduced if τps < τpB , as in U.S. • In Norway 1992—2000, τps = 0, τpB = τc, so gain disappeared. 11