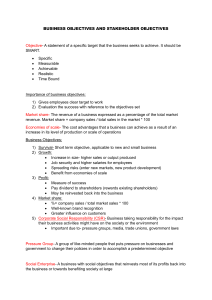

Stakeholders - Bannerman High School

advertisement

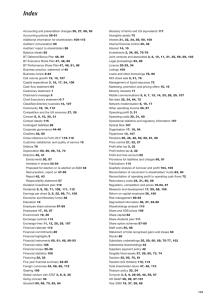

Financial & Management Accounting Financial & Management Accounting Financial Management Purpose Users Finance and Accounts Why do we bother keeping accounting records? There are several groups of people who may have an interest in the finances of the business. The law says that they have a legal right to certain information. The whole process of providing this information (and of maintaining a book-keeping system capable of providing this) is known as financial accounting. Financial Accounting • Concerned with ‘Stewardship’ function of a business. – Accounting for what has happened over the past financial year and reporting that information to shareholders and other interested parties Financial Accountant • Records all the financial transactions which affect the business: – Setting up book-keeping/record-keeping systems to record the income and expenditure of a business – Keeping a record of the businesses assets and liabilities – Preparing the final accounts of a business – Trading and Profit and Loss Account and Balance Sheet – Preparing tax figures Financial Accounting • So Financial Accounting is about keeping records in order to satisfy legal requirements of reporting to stakeholders (users of accounting information). • Limited Companies have far greater legal requirements than do ‘smaller’ businesses such as sole-traders and partnerships. Management Accounting The managers of the business will want to know how things are going. They need financial information in order to plan for the future. They then need more up-to-date information in order to check whether actual performance is on target. This process is known as controlling the costs and finances. Management Accounting In accounting this is known as Management or Cost accounting. So, management accounting is done by the managers, for the managers, for the purposes of planning and control. Plan for the future Make decisions Control costs Management Accountant Provides information to assist management make better informed decisions and to help them plan ahead and to control the costs of the business. –Classifying costs – that is, deciding whether costs relate to materials, labour or overheads –Working out the final cost of a job/product/service in order to determine the price to be charged to the customer –Providing detailed analysis of costs to help management make better informed decisions –Preparing budgets of future requirements in order to meet planned sales and production targets. Financial & Management Accounting Purpose Users Finance and Accounts Bannerman High School: Stakeholders • The interested parties of accounts are often referred to as ‘stakeholders’. Shareholders Customers Government Stakeholders Trade Unions Investors/Lenders Shareholders • Current and potential shareholders will be interested in the following: – Recent profit and dividend percentage trends – The dividend yield in relation to alternative investments – The market price in relation to nominal value Customers • How early will payment be required? Liquidity ratios will give such an indication • Continuity of existence, as it affects after-sales service Investors/Lenders • Are there sufficient funds available to meet interest charges? An examination of the various liquidity ratios will provide significant data in this respect • Are profit levels high enough to produce funds to repay any loans? • Potential lenders will be particularly interested in such items as the Net Book Value of Assets in relation to borrowing requirements and profit trends in recent years. Trade Unions • The existence of profit-sharing schemes and, if so, the level of profits • The relationship between changes in profits and changes in wage levels • The nature and level of directors’ salaries • The firm’s investment policy and its effect on employment Government • Sales and costs for VAT purposes • Profits for Corporation Tax purposes • Wages for PAYE purposes • Other information eg for employment statistics