Mean-var portfolio choice: 1 risk free, risky assets n

advertisement

SK460 Finance Theory, Diderik Lund, 30 January 2001

Mean-var portfolio choice: 1 risk free, n risky assets

Assume all believe in same means, variances, covariances.

With mean-variance preferences, all want some combination of

risk free asset with same portfolio of risky assets, tangency.

Straight line ecient set.

Preferences determine preferred location along line.

Higher risk aversion: Closer to risk free asset.

Lower risk aversion: Above tangency portfolio: Borrow money

(short sell risky asset) and invest more than W0 in tangency

portfolio.

\Two-fund spanning": Restriction of opportunity set to Rf and

tangency portfolio is just as good as original opportunity set.

\Separation" of portfolio composition: May leave to a fund

manager to make tangency portfolio available.

1

SK460 Finance Theory, Diderik Lund, 30 January 2001

Equilibrium condition

Everyone demands same combination of risky assets.

Necessary condition for equilibrium: This is equal to supply.

(More complete equilibrium model later. Mossin. Roll.)

Agent h splits W0h = W0hf + W0hM .

W0hf in risk free asset, possibly negative.

W0hM in tangency portfolio, strictly positive. (Why?)

Tangency portfolio has weights w1M ; : : :; wnM .

Per denition P wjM = 1.

Total demand for n risky assets written as vector:

2

H 666

X

66

h=1 4

3 2

w1M W 77 66 w1M

..

77 = 66 ..

75 64

h

wnM W0M

wnM

h

0M

3

77 X

77 H W h

0M

75

h=1

Total has same value composition as each part.

This must also be value composition of supply.

Observable, \market portfolio."

\Portfolio" here means a vector, summing to one.

The word \portfolio" may sometimes mean some money amount

invested in each of the n assets, a vector not summing to one.

2

SK460 Finance Theory, Diderik Lund, 30 January 2001

CML, market price of risk

Everyone combines risk free asset and market portfolio.

Line through (0; Rf ) and (M ; M ) called Capital Market Line,

CML,

= R + M , Rf :

P

M

f

p

Slope, M,MRf , sometimes called market price of risk.

Shows how much must be given up in expected portfolio rate

of return in order to reduce standard deviation by one unit.

All agents have MRS between p and p equal to this.

Will soon see: This is relevant concept for comparing whole

portfolios, but not for individual assets.

3

SK460 Finance Theory, Diderik Lund, 30 January 2001

Motivating CAPM: Covariances important

Next derive most important formula in this part of course.

Model known as the Capital Asset Pricing Model. This name

also used for the main formula. Formula also called the Security

Market Line.

Shows what determines prices of individual assets.

First motivation: Covariances important.

Comparing alternative portfolios, when only one of them can

be chosen, have assumed variances of rates of return are the

relevant measure of risk.

But for individual assets, which can be combined in portfolios,

the relevant measure turns out to be a covariance with other

rates of return. (Known from \andre avdeling.")

Make two simple, motivating arguments rst, without reference

to any equilibrium model.

Consider making an equally weighted portfolio of n assets, i.e.,

with all wj = 1=n. Assume that among the rates of return, one

2 . Then

has the maximum variance, max

2

nlim

!1 p = ij ;

the average covariance between rates of return, and

@p2

nlim

!1 @wi = 2ij :

4

SK460 Finance Theory, Diderik Lund, 30 January 2001

Proof of motivating results

Observe that

n X

n

X

wiwj ij :

p =

i=1 j =1

2

An equally weighted portfolio has

n n

n

p2 = 12 X X ij = 12 X i2 + 12

n

n

i=1 j =1

i=i

n

n X

X

ij :

i=1 j 6=i

Observe that the rst term satises

1 Xn 2 1

2

n2 i=i i < n2 n max ! 0 ( n ! 1:

The second term satises

2,n

1 Xn X

n

ij = 2 ij ! ij ( n ! 1;

2

n

i=1 j 6=i

n

which proves the rst result. Observe next that for any portfolio,

@p2

X

= 2wii2 + 2 wiij :

@wi

j 6=i

Evaluated where all wi = 1=n, this becomes

2

n , 1 ! 2 ( n ! 1:

i

2 +2

ij

n

n ij

5

SK460 Finance Theory, Diderik Lund, 30 January 2001

Derivation of CAPM formula

Warning: Copeland and Weston's proof is mathematically cor-

rect, but contains some misleading text pp. 196{197.

Consider an equilibrium, everyone holds combination of risk

free asset and market portfolio.

Will derive relation between j ; j (of any asset, numbered j )

and the economy-wide variables Rf ; M ; M .

As a thought experiment (only), make a portfolio with a fraction a in asset j and a fraction 1 , a in the market portfolio.

(Possible, even though M already contains j .)

For this portfolio p we have

p

p = aj + (1 , a)M ; @

@a = j , M ;

r

p = a2j2 + (1 , a)2M2 + 2a(1 , a)jM ;

@p = r2aj2 , 2(1 , a)M2 + 2a(1 , a)jM :

@a

a2j2 + (1 , a)2M2 + 2a(1 , a)jM

6

SK460 Finance Theory, Diderik Lund, 30 January 2001

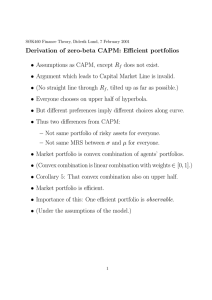

Illustrating the derivation

Small hyperbola goes through M (i.e., (M ; M )).

At M it has same tangent as large hyperbola: If not, it would

have to cross over large hyperbola. But that cannot happen,

since large hyperbola is frontier, and j was already available

when large hyperbola was formed as frontier.

The tangent is the capital market line.

Next: Use the equality of these slopes.

7

SK460 Finance Theory, Diderik Lund, 30 January 2001

Derivation of CAPM formula, contd.

Use the formula:

d @ = @ () d = @

@a :

@

d @a @a

d @a

Use partial derivatives just found, evaluate at a = 0:

@ = jM , M2 :

@a a=0

M

Plug in and nd:

d = j , M :

d a=0 (jM , M2 )=M

This slope of small hyperbola must equal slope of CML:

j , M = M , Rf () = R + ( , R ) jM :

j

f

M

f

(jM , M2 )=M

M

M2

Known as the CAPM equation or the Security Market Line.

Dene j jM

. Then rewrite as

M2

E (R~j ) , Rf = j (E (R~M ) , Rf );

\the expected excess rate of return on asset j equals its beta times

the expected excess rate of return on the market portfolio."

8

SK460 Finance Theory, Diderik Lund, 30 January 2001

Illustrating the Security Market Line

j = Rf + j (M , Rf ):

All securities are located on the line.

Also any portfolio of m securities. Show for m = 2:

p = ai+(1,a)j = a[Rf +i(M ,Rf )]+(1,a)[Rf +j (M ,Rf )]

= Rf + [ai + (1 , a)j ](M , Rf )

2

3

~

~

~

~

cov(

R

;

R

)

cov(

R

;

R

)

j

M 7

i M

5 (M , Rf )

+ (1 , a)

= Rf + 64a

2

2

M

M

cov(aR~ i + (1 , a)R~ j ; R~ M )

= Rf +

(M , Rf )

M2

cov(R~ p ; R~ M )

(M , Rf ) = Rf + p(M , Rf ):

= Rf +

M2

9

SK460 Finance Theory, Diderik Lund, 30 January 2001

Interpretation of CAPM equation

~

E (R~j ) = Rf + jM

2 (E (RM ) , Rf ):

Verbal interpretation:

M

The expected rate of return on any asset depends on only

one characteristic of that asset, namely its rate of return's

covariance with the rate of return on the market portfolio.

The expected rate of return is equal to the risk free interest rate plus a term which depends on a measure of risk.

(Higher risk means higher expected rate of return.) The

relevant measure of risk is the asset's beta. This is multiplied with the expected excess rate of return on the market

portfolio.

Obvious: Does not say what Rj will be. Only E (R~j ).

Risk measure depends on covariance because the covariance

determines how much that asset will contribute to the risk of

the agent's portfolio.

This is true for any agent, since all hold the same risky portfolio.

10

SK460 Finance Theory, Diderik Lund, 30 January 2001

Interpretation, contd.

Observe M = 1.

Observe j = jM j =M .

May have j > M , and jM close to 1.

Thus possible to have j > 1 for some assets.

May also have cov(R~j ; R~ M ) < 0; j < 0:

Not very common in practice.

Such assets decrease M (when included in M).

Valuable to investors, thus high value at t = 0, thus low expected rate of return.

11

SK460 Finance Theory, Diderik Lund, 30 January 2001

Avoid confusion

Do not confuse the following two:

The Capital Market Line:

{ Ecient set given 1 risk free and n risky assets.

{ Relevant when comparing alternative portfolios.

{ Drawn in (p; p) diagram.

{ A ray starting at (0; Rf ) in that diagram.

The Security Market Line:

{ Location of all traded assets in equilibrium.

{ Also location of any portfolio of these assets.

{ Drawn in (j ; j ) diagram.

{ A line through (0; Rf ) in that diagram.

12

SK460 Finance Theory, Diderik Lund, 30 January 2001

Other forms of the CAPM equation

Remember: 1 + R~ j = p~j 1=pj 0 . Rewrite:

0

1

E (~pj1 ) , 1 = R + M , Rf cov B@ p~j1 , 1; R~ CA

f

M

2

pj0

M

pj0

0

1

E

(~pj 1 )

p

~

j

1

() p = 1 + Rf + cov B@ p ; R~ M CA ;

j0

j0

with dened as (M , Rf )=M2 .

1

is deterministic, and can be factored out of the covariance. Multiply both sides by

pj 0

pj 0

1 + Rf

and rearrange terms to get

1 ~

pj0 = 1 + R E (p~j1) , cov(~pj1; RM ) :

f

Expression in square bracket is called the certainty equivalent (in

the CAPM sense) of p~j 1 . Price today is present value of expression,

just as if that would be received with certainty one period into the

future. Not what is called certainty equivalent in expected utility

theory.

13

SK460 Finance Theory, Diderik Lund, 30 January 2001

Other forms of the CAPM expression, contd.

Can also rewrite as

pj0 =

E (~pj1)

:

1 + Rf + cov(R~ j ; R~ M )

(Prove yourself how to arrive at this!)

Like previous form: pj0 on left-hand side.

But here: Right-hand side is \expected present value."

However: Risk-adjusted discount rate, RADR.

Obtained by adding something to Rf .

Risk-adjustment again depends on and covariance.

Observe dierence in covariance expressions!

Previously: cov(~pj1; R~ M ).

Now: cov(R~ j ; R~ M ) cov(~pj1=pj0; R~ M ).

If need to solve for pj0, latter less useful.

14