Application to the theory of consumption Observed saving behavior

advertisement

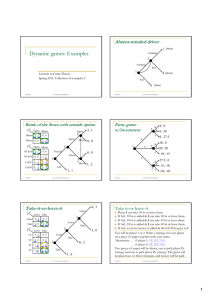

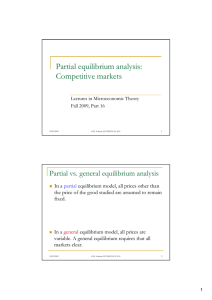

Observed saving behavior Application to the theory of consumption Lectures in Behavioral economics Spring 2016, Part 3 12.11.2015 G.B. Asheim, ECON4260, #3 1 Relevance of behavioral economics Acc. to Vernon Smith (”Rational choice: The contrast between economics and psychology”, JPE 99, 1991, 877-89) much beh. economic critique stems from the premises that Two-sided auction: buyers announce bids, sellers announce asking prices. 1. ... rationality in the economy … derives from the rationContracts on acceptance. Some information but incomplete information alitytoofeach. theExperiments individual decision makers in theconverges economy. available show that such a market to price and volume represented by theoretical intersection intensive, of supply and demand 2. ... individual rationality is a cognitively calculating curves--competitive equilibrium. "This is some kind of magic!" What it shows process of maximization of the self-interest. is that people are quite good at discovering prices and quantities that clear a 3. ... even economic theory be tested by testing directly the market if they have onlycan incomplete market information. economic rationality of the individuals isolated from interactive experience in social and economic environments. Instead, V. Smith thinks that beh. economic critique is important if it predicts different economic behavior at an aggregate level. 12.11.2015 G.B. Asheim, ECON4260, #3 2 Present-biased pref. can explain these phenomena. Illiquid assets combined with credit card debt Illiquid assets are commitments. Credit cards provide consumption smoothing, but facilitate tempting shopping splurges. Co-movement between income and consumption Consequence of self-imposed liquidity constraints. Becomes more binding at the time of retirement. Laibson: A model that explains empirical evidence. 12.11.2015 3 G.B. Asheim, ECON4260, #3 Outline Cons.-saving model w/illiquid asset Laibson (1997). Application of the multi-self approach, where sophisticates use illiquid asset as commitment. Yields explanation of observed saving behavior. A theoretical result in the cons.-saving model Laibson (1998). Empirical test of the cons.-saving model Angeletos et al. (2001). Show that present-biased pref. fit data better. 12.11.2015 G.B. Asheim, ECON4260, #3 4 1 Laibson’s (1997) consumption-saving model Consumer makes decisions in periods 1, , T max ln(c1 ) ln(c2 ) 2 ln(c3 ) One liquid asset x One illiquid asset z Exogenous initial asset holdings x0 , z0 0 subject to c1 In period t : earn labor inco me yt earn asset inco me Rt ( xt 1 zt 1 ) choose consumptio n ct and a new c10 asset allocation xt and zt such that ct xt zt yt Rt ( xt 1 zt 1 ) ct yt Rt xt 1 zt 1 cannot be con - xt , zt 0 sumed at time t . U Et u (ct ) t 1 t T t u (c ) subject to c1 7 c2 c3 y y 2 y1 2 32 W R R R R Solution : c2 c3 y y 2 y1 2 32 W R R R R c11 W RW (R ) 2 W 1 1 , c , c 2 3 1 2 1 2 1 2 Numerical illustrati on (optimal period - 1) 0) : Numerical illustrati on : c110 $$422 369.30 00,, cc1220 $$334 365..46 31, c3130 $$331 361..11 66 0.8, 0.9, R 1.1, and W $1000. G.B. Asheim, ECON4260, #3 G.B. Asheim, ECON4260, #3 max ln(c1 ) ln(c2 ) 2 ln(c3 ) Instantane ous utility : u (c) ln c 12.11.2015 12.11.2015 Optimal period-1 behavior 3-period consumption-saving example Budget constraint : c1 W RW (R ) 2 W 0 0 , c , c 2 3 1 2 1 2 1 2 c10 $369.00, c20 $365.31, c30 $361.66 Laibson’s (1997) consumption-saving model (2) Period - t intertemp oral preference s : c2 c3 y y 2 y1 2 32 W R R R R Numerical illustrati on : 5 G.B. Asheim, ECON4260, #3 Solution : The illiquid asset 12.11.2015 Optimal period-0 behavior 6 12.11.2015 G.B. Asheim, ECON4260, #3 8 2 Naive period-2 behavior Sophisticated period-1 behavior max ln(c1 ) ln(c 2 (c1 )) 2 ln(c 3 (c1 )) max ln(c2 ) ln(c3 ) subject to c2 c3 R (1 )W W2N R (W c11 ) R 1 2 R 2 (W c1 ) R (W c1 ) 2 ln max ln c1 ln 1 1 Solution : c2N Solution : W RW , c3N 1 1 N 2 N 2 c1S 1 W 2 , R (1 )W R R (1 )W c2S c 2 (c1 ) 11 , c3S c 3 (c1 ) 1 1 2 1 2 Numerical illustrati on (naivete) (optimal :period - 0) : Numerical illustrati on (sophistic (naivete) (optimal :period ation) :- 0) : c $$422 369.30 00,, cc $$365 369..31 46,, cc $$361 292.66 .61 c110S $$422 369 422..30 00 30,, cc2N202S $$365 369..31 46,, cc303NS $$361 292.66 .61 10 1 N 0 22 12.11.2015 0N 33 G.B. Asheim, ECON4260, #3 9 Sophisticated period-2 behavior c3 W2 R (W c1 ) R (which yields $334.46 in period 2) W2 R (W c1 ) 1 1 save $273.64 in the illiquid asset (which yields $331.11 in period 3) RW2 R 2 (W c1 ) c 3 (c1 ) 1 1 12.11.2015 11 If 0.8, 0.9, R 1.1, Y1 1000, and Y2 Y3 0, then In period 1 : consume $422.30 save $304.05 in the liquid asset Solution : c 2 (c1 ) G.B. Asheim, ECON4260, #3 Sophisticates can implement optimal period-1 behavior by using the illiquid asset max ln(c2 ) ln(c3 ) subject to c2 12.11.2015 G.B. Asheim, ECON4260, #3 10 Sophisticates strictly prefer the use of illiquid assets. Naifs do not recognize the commitment value of illiquid assets. 12.11.2015 G.B. Asheim, ECON4260, #3 12 3 Proof of a theoretical result in the cons.-saving model The illiquid asset is not a perfect commitm. techn. cash on hand : xt yt R ( xt 1 ct 1 ) dU t 1 choose consumptio n : ct xt dxt 1 dU t 2 dU t 2 u (ct 1 ) u (ct 1 ) R dxt 2 dxt 2 R 3-period consumption-saving example 0.5, 1, R 1, and W $1200. You cannot prevent yourself from consuming current income. ● If u (ct ) R Optimal period-1 Income Consumption Liquid asset 0.8, 0.9, R 1.1, Y1 500, Y2 550, dc dU t 2 dU t 1 dct 1 u (ct 1 ) R1 t 1 dxt 1 dxt 1 dxt 1 dxt 2 and Y3 0, then the illiquid asset does not help at all. An illiquid asset does not work as a commitment device if you can borrow against its future payoff. dc dc 1 t 1 1 t 1 u (ct 1 ) dxt 1 dxt 1 dc dc u (ct ) R t 1 1 t 1 u (ct 1 ) dxt 1 dxt 1 ● Credit cards (and other liquidity enhancing intruments) may undermine the commitment value of illiquid assets. 12.11.2015 13 G.B. Asheim, ECON4260, #3 A theoretical result in the consum.-saving model (Laibson, 1998) Assume no illiquid asset Period - t intertemp oral preference s : U Et u (ct ) t 1 t T Optimality condition if 1 : t u (c ) s cash on hand : xt yt R( xt 1 ct 1 ) dU t 1 choose consumptio n : ct xt dxt 1 dU t 2 dU t 2 u (ct 1 ) u (ct 1 ) R dxt 2 dxt 2 R dc dc 1 t 1 1 t 1 u(ct 1 ) dxt 1 dxt 1 dc dc u (ct ) R t 1 1 t 1 u(ct 1 ) dxt 1 dxt 1 dc dc u (ct ) Et R t 1 1 t 1 u (ct 1 ) dxt 1 dxt 1 A source of ”under-saving”. 12.11.2015 G.B. Asheim, ECON4260, #3 14 15 Compare data with simulations Angeletos et al. (2001) under exponential disc. and hyperbolic disc. (sophisticates) Households with liquid assets > 1 month’s income: Exponent. simulation: 73% Hyperbolic simulation: 40% Data: 43% Generalize d opt. condition for sophistica tes with 1 : u (ct ) R dc dU t 2 dU t 1 dct 1 u(ct 1 ) R1 t 1 dxt 1 dxt 1 dxt 1 dxt 2 G.B. Asheim, ECON4260, #3 Empirical test of the consumption-saving model Proof of a theoretical result in the cons.-saving model u (ct ) Et Ru (ct 1 ) Et R u (ct s ) s 12.11.2015 Households with positive credit-card borrowing: Exponent. simulation: 19% Hyperbolic simulation: 51% Data: 70% 12.11.2015 Mean credit-card borrowing (all households): Exponent. simulation: $900 Hyperbolic simulation: $3400 Data: >$5000 Cons.-income comovement (income coefficent): Exponent. simulation: 0.032 Hyperbolic simulation: 0.166 Data: 0.2 G.B. Asheim, ECON4260, #3 16 4 12.11.2015 G.B. Asheim, ECON4260, #3 17 12.11.2015 G.B. Asheim, ECON4260, #3 19 12.11.2015 G.B. Asheim, ECON4260, #3 18 12.11.2015 G.B. Asheim, ECON4260, #3 20 5 Additional references Choi, J., D. Laibson, B. Madrian & A. Metrick (2002), Defined Contribution Pensions: Plan Rules, Participant Decisions, and the Path of Least Resistance, Tax Policy and the Economy 16, 67–114 DellaVigna, S. & U. Malmendier (2006), Paying Not to Go to the Gym, American Economic Review 96, 694–719 Shapiro, J.M. (2005), Is there a daily discount rate? Evidence from the food stamp nutrition cycle, Journal of Public Economics 89, 303–325 12 November 2015 G.B. Asheim, ECON4260, #4 21 6