Partial equilibrium analysis: Competitive markets Partial vs. general equilibrium analysis

advertisement

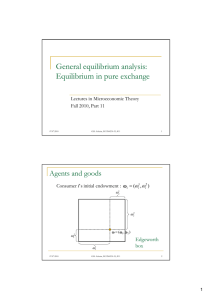

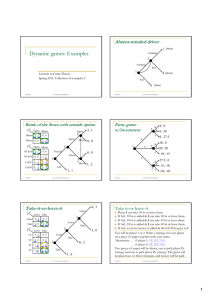

Partial equilibrium analysis: Competitive markets Lectures in Microeconomic Theory Fall 2009, Part 16 02.09.2009 G.B. Asheim, ECON4230-35, #16 1 Partial vs. general equilibrium analysis In a partial equilibrium model, all prices other than the price of the good studied are assumed to remain Price fixed. Aggregate supply given factor prices. Equilibrium price. Aggregate demand given prices of other goods and given income. Equilibrium quantity. Quantity In a general equilibrium model, all prices are variable. A general equilibrium requires that all markets clear. 02.09.2009 G.B. Asheim, ECON4230-35, #16 2 1 Overview of lectures on partial equilibrium 22 Oct: Competitive markets Quasi-linear utility functions. Welfare analysis. 29 Oct: Monopoly Price discrimination. 5 Nov: Oligopoly and game theory Cournot competition. Nash equilibrium (12 & 19 Nov: Repetition of the theory of the firm, consumer theory, and general equilibrium analysis) 02.09.2009 G.B. Asheim, ECON4230-35, #16 3 A competitive market is characterized by Sellers and buyers take the market price as given and determine their supply and demand accordingly. The market price is determined so that market supply = market demand. A good is transferred if and only if the price is paid. Sellers and buyers have the same information about the transferred good. 02.09.2009 G.B. Asheim, ECON4230-35, #16 4 2 Demand facing each competitive firm if p p 0 D ( p ) any amount if p p if p p p p D( p) 02.09.2009 5 G.B. Asheim, ECON4230-35, #16 Supply of a competitive profit maximizing firm, if convex costs ( p ) max py c ( y ) c( y ) y( p) p y y ( p ) arg max py c ( y )p y If interior solution: FOC : p c ( y ( p )) SOC : c ( y ( p )) 0 p y( p) How does a competitive firm respond to a change in the price of output? 02.09.2009 y By differentiating the FOC: 1 c ( y ( p )) y ( p ) c ( y ) 0 y ( p ) 0 G.B. Asheim, ECON4230-35, #16 6 3 Supply of a competitive profit maximizing firm, if non-convex costs (1, p) (1, p) OutputOutput Cost Cost at profit-maximizing output 02.09.2009 Profit-max. output Profit in terms of output Interior solution if price exceeds minimal average variable cost. 7 G.B. Asheim, ECON4230-35, #16 Supply of a competitive profit maximizing firm, if non-convex costs (cont.) Price y ( p) AC AVC p Min. AVC p MC Output 02.09.2009 G.B. Asheim, ECON4230-35, #16 8 4 Further analysis of the profit function ( p ) py ( p ) c ( y ( p )) ( p ) y ( p ) Hotelling’s lemma y ( p) p p c ( y ( p )) y ( p ) p p y ( p ) if p ( p) (0) p ( p ) 0 y ( p ) if p p y ( p) ( p ) ( 0 ) p 0 ( p ) dp 02.09.2009 p 0 y ( p ) dp p p 9 G.B. Asheim, ECON4230-35, #16 Firm 2 Price Firm 1 The industry supply function with a given number of firms Market supply m S ( p) y j ( p) j 1 Output 02.09.2009 G.B. Asheim, ECON4230-35, #16 10 5 Market equilibrium Price Market supply Equil. price n m x ( p) y ( p) i 1 i j 1 j Market demand Output Equil. output 02.09.2009 11 G.B. Asheim, ECON4230-35, #16 Entry with non-convex costs Price Long-run market supply Long-run equil. price Market demand Long-run equil. output 02.09.2009 G.B. Asheim, ECON4230-35, #16 Output 12 6 Welfare economics Assume that lump-sum transfers are available, and that the distribution is optimal. This allows us to adopt the representative consumer approach. Assume that there are no income effects; i.e., the Mashallian and Hicksian demand functions coincide. This means that preferences are represented by a quasi-linear utility function: Utility u ( x ) z Utility derived from good in question 02.09.2009 Utility u ( x ) z x Marg. willingness to pay u (x) u (x) dz u(x) dx x x v MRS is independent x of money spent on other goods 02.09.2009 13 G.B. Asheim, ECON4230-35, #16 Quasi-linear utility u ( x)dx dz 0 Money spent on other goods Demand fn is determined by: p u ( D( p )) z G.B. Asheim, ECON4230-35, #16 14 7 Welfare analysis p p Efficiency gain c(x) c(x) S ( p) S ( p) D( p ) D( p ) u(x) x u(x) x x x x x x x u ( x) u ( x) u( x)dx c( x) c( x) c( x)dx Willingness to pay for increased quantity Cost to produce increased quantity x 02.09.2009 x 15 G.B. Asheim, ECON4230-35, #16 Welfare analysis (cont.) p In equilibrium: u ( D( p )) p c( S ( p )) c( x) D( p) S ( p) S ( p) 1st welfare thm 2nd welfare thm p̂ D( p ) u( x) Welfare maximization: max u ( x) z s.t. z c( x) x FOC : u ( x) c( x) 02.09.2009 G.B. Asheim, ECON4230-35, #16 x x̂ 16 8 Welfare analysis (cont.) Total surplus maximization … p CS ( xˆ ) u ( xˆ ) pˆ xˆ c( x) arg maxCS ( x) PS ( x) x S ( p) arg maxu ( x) px x p̂ D( p ) px c( x) u( x) arg maxu ( x) c( x) x x x̂ … entails maximization of u(x)c(x), PS ( xˆ ) pˆ xˆ c( xˆ ) which is achieved in equilibrium. 02.09.2009 17 G.B. Asheim, ECON4230-35, #16 Taxes and subsidies Market equilibrium with a tax. p Tax revenue D( pˆ d ) S ( pˆ s ) pˆ d pˆ s t Alternatively: D( pˆ s t ) S ( pˆ s ) p̂d c( x) S ( p) t D( p ) p̂s u( x) Or: D( pˆ d ) S ( pˆ d t ) x x̂ Tax revenue is smaller than the reduction in total surplus. 02.09.2009 G.B. Asheim, ECON4230-35, #16 Deadweight loss 18 9 Rôle for intervention Prevent that firms get market power ― competition policy A competitive market is characterized by Sellers and buyers take the market price as given and determine their supply and demand accordingly. The market price is determined so that market supply = market demand. A good is transferred if and only if the price is paid. Sellers and buyers have the same information about the transferred good. Ensure that markets clear ― labor market policy Protect private property, create low transaction costs Ensure that firms pay for external effects (pollution) Ensure efficient provision of public goods Address informational problems Contribute to a just income distrubution 02.09.2009 Fields of microeconomics 19 G.B. Asheim, ECON4230-35, #16 Industrialthat Prevent organization firms get market power ― (Game theory) competition policy A competitive market is characterized by Sellers and buyers take the market price as given and determine their supply and demand accordingly. The market price is determined so that market supply = market demand. A good is transferred if and only if the price is paid. Sellers and buyers have the same information about the transferred good. Ensuremarket Labor that markets economics clear ― labor market policy Protect private Economics of crime, property, transaction create low costs transaction economics costs Ensure that firms Environmental economics pay for external effects (pollution) Ensureeconomics Public efficient provision of public goods Address informational Information economicsproblems (Game theory) Contribute Welfare economics, to a just income public finance distrubution 02.09.2009 G.B. Asheim, ECON4230-35, #16 20 10