Document 11478381

advertisement

This article has been accepted for publication in a future issue of this journal, but has not been fully edited. Content may change prior to final publication. Citation information: DOI

10.1109/TETC.2014.2335541, IEEE Transactions on Emerging Topics in Computing

1

User-Centric Demand Response Management in the

Smart Grid with Multiple Providers

Sabita Maharjan, Member, IEEE, Yan Zhang, Senior Member, IEEE, Stein Gjessing Senior Member, IEEE, and

Danny Hin-Kwok Tsang Fellow, IEEE

Abstract—The smart grid is the next generation power grid

with bidirectional communications between the electricity users

and the providers. Demand Response Management is vital in

the smart grid to reduce power generation costs as well as to

lower the users’ electricity bills. In this paper, we introduce

multiple fossil-fuel and multiple renewable energy sources based

utility companies on the supply side, and propose an enduser oriented utility company selection scheme to minimize user

costs. We formulate the problem as a game, incorporating the

uncertainty associated with the power supply of the renewable

sources, and prove that there exists a Nash equilibrium for the

game. To further reduce users’ costs, we develop a joint scheme

by integrating shiftable load scheduling with utility company

selection. We model the joint scheme also as a game, and prove

the existence of a Nash equilibrium for the game. For both

schemes, we propose distributed algorithms for the users to find

the equilibrium of the game using only local information. We

evaluate our schemes and compare their performances to two

other approaches. The results show that our joint utility company

selection and shiftable load scheduling scheme incurs the least

cost to the users.

Index Terms—Demand response management, discrete time

Markov chain, game theory, Nash equilibrium, renewable energy

sources, smart grid, user cost.

I. I NTRODUCTION

A smart grid is an intelligent electricity network that makes

use of the advanced information, control, and communication

technologies to save energy, reduce cost and enhance reliability

and transparency of the grid [1], [2]. The realization of the

smart grid is geared by the goal of effective management

of power supply and demand loads. Demand response (DR)

is the response system of the end-users to manage their

consumption of electricity in response to supply conditions.

Demand response management (DRM) smooths out the system

power demand profile across time and provides short-term

reliability benefits as it can offer load relief to resolve system

and/or local capacity constraints. Thus, from the operator

aspect, DRM reduces the cost of operating the grid, while

from the user aspect it lowers their bills. In the smart grid,

bidirectional communications between energy providers and

end users, will greatly enhance DR capabilities of the whole

system. E.g., consumers will be able to control and manage

S. Maharjan is with Simula Research Laboratory, Norway, Martin Linges

Vei 15, Fornebu, Norway. Email: sabita@simula.no

Y. Zhang and S. Gjessing are with Simula Research Laboratory and

Department of Informatics, University of Oslo, Gaustadalleen 23, Oslo,

Norway. Email: yanzhang@ieee.org, steing@ifi.uio.no

D.H.K. Tsang is with Department of Electronic and Computer Engineering, Hongkong University of Science and Technology, Hongkong. Email:

eetsang@ece.ust.hk

their electricity usage, and the providers can plan and manage

the generation and supply of power in a more structured

and efficient manner. Thus, power generation, distribution

and consumption are envisaged to be more efficient, more

economical and more reliable in the smart grid.

The smart grid aims to incorporate components such as

renewable energy sources, distributed micro-generators and

energy storage entities like plug-in electric vehicles and batteries. With the internationalization of energy market and the

incorporation of new renewable energy sources (e.g., wind

and solar power) in the smart grid, users will have more

options in terms of choosing providers or the type or energy

they use. With this motivation, we include multiple renewable

energy sources on the supply side, in addition to the traditional

fossil-fuel based sources. While existing literature has focused

mainly on minimizing the power generation cost of a single

provider or utility company (UC) by scheduling the shiftable

load of the end-users to different time-slots, we introduce

a utility company selection (UCS) approach for DRM, to

minimize the costs of the users, considering the uncertainty

about the states of the renewable energy sources. To this end,

in order to reduce the costs of the users further, we develop a

joint scheme by combining UCS and conventional shiftable

load scheduling (SLS) schemes. This joint scheme is very

generic, and is useful for residential, commercial as well as

industrial electricity consumers.

The cost of a user depends not only on its own demand

and scheduling, but also on the demands and scheduling of

other users, who choose the same UC. Moreover, in a multiple

UC scenario which is the focus of this paper, the cost of

each user varies according to the cost of power generation

of many sources, and the selection of the UC by other

users, thus making the interactions between users and sources,

and among users, complicated. This complicated coupling

makes game theory an appealing approach to model users’

costs in this scenario. The users schedule their demands by

optimally choosing the UCs and by optimally scheduling their

shiftable appliances in order to minimize their payments to

the providers. We model these interactions among the users

as games, and we characterize the Nash equilibrium (NE)

solution of the games.

Our contributions in this work are as follows.

1) We study DRM with multiple UCs with a user-centric

approach, incorporating uncertainty regarding the power

supply from the renewable energy sources.

2) We propose a UC selection game among users, and

develop a distributed algorithm to find the NE of the

2168-6750 (c) 2013 IEEE. Translations and content mining are permitted for academic research only. Personal use is also permitted, but republication/redistribution requires IEEE

permission. See http://www.ieee.org/publications_standards/publications/rights/index.html for more information.

This article has been accepted for publication in a future issue of this journal, but has not been fully edited. Content may change prior to final publication. Citation information: DOI

10.1109/TETC.2014.2335541, IEEE Transactions on Emerging Topics in Computing

2

game using only local information.

3) We introduce a joint UC selection and load scheduling

game, to further improve the users’ costs, and propose

a distributed algorithm to reach the NE of the game.

The rest of the paper is organized as follows: Related work

is described in Section II. The system model that includes the

generator availability model and the cost model, is described

in Section III. In Section IV, we introduce a utility company

selection game among the users and design a distributed

algorithm for the game to converge to the NE. In Section

V, we develop a joint scheme by integrating shiftable load

scheduling with the utility company selection scheme, and

propose a distributed algorithm to find the NE of the game

using only local information. In Section VI we present and

discuss our results and Section VII concludes the paper.

II. R ELATED W ORK

There are several studies on DRM in the smart grid [3][7]. In [3], the authors formulated the energy consumption

scheduling problem as a game among the consumers for

increasing and strictly convex cost functions. In [4], the

authors considered a distributed system where price is modeled

by its dependence on the overall system load. Based on the

price information, the users adapt their demands to maximize

their own utilities. In [5], a robust optimization problem was

formulated to maximize the utility of a consumer, taking into

account price uncertainties at each hour. In [6], the authors

have exploited the awareness of the end-users and proposed

a method to aggregate and manage end-users’ preferences to

maximize energy efficiency and user satisfaction. In [7], a dynamic pricing scheme was proposed to incentivize customers

to achieve an aggregate load profile suitable for providers, and

the demand response problem was investigated for different

levels of information sharing among the consumers in the

smart grid. We observe that [3]-[7] mainly focus on either

only one source or a number of sources/providers treated as

one entity, and the cost minimization problem was solved from

the provider’s perspective. Differently in our study, we include

multiple renewable and non-renewable energy sources based

UCs, and we focus on minimizing the cost for each user.

We notice that there are few studies exploring DRM in the

context of multiple energy sources, incorporating renewable

energy sources on the supply side [10], [12]. However, these

two studies also treat the sources as parts of a single entity,

and are also based on the cost minimization of the supply side.

In our previous work [8], we introduced multiple UCs who

aim to maximize their revenues, and multiple consumers who

aim to maximize their utilities. In [8], we focused our analysis

on a static one time-slot game. In this paper, we deploy a

pricing scheme that is closely related to the cost of power

generation, and we also introduce the temporal aspect of DRM

in the joint scheme.

Recently there has been a drastic increase in the volume of

work considering batteries as storage devices, or solar panels at

buildings to reduce the peak-to-average ratio of power demand,

and thus the cost for the users [14], [15]. The problem we

address in this paper is different. When each user has a battery

or a solar panel, these alternatives are local for each user. In

our study, the renewable energy sources are on the supply

side and the same renewable sources can supply power to

multiple users, which makes the problem more complicated.

Moreover, there has been an increasing interest in integrating

renewable energy sources into the grid with storage units [16],

[17]. Our focus in this paper is different than the analyses in

[16], [17]. While[16], [17] focus on the integration issues of

renewable sources into the grid, we concentrate our analysis

on the market level and provide user-centric solutions to get

economic benefits by making optimal choices.

III. S YSTEM M ODEL

Fig. 1 shows the system model. There are N energy users,

N := {1, 2, ....., N}, and K different UCs, K := {1, 2, ....., K}.

Some of the UCs provide electricity from fossil-fuel based

sources, and some UCs are based on renewable energy sources.

Then, we have, K = K f + Kr , where K f and Kr are the number

of fossil-fuel sources based UCs and renewable energy sources

based UCs, respectively. The fossil-fuel based sources are

available all the time but the price charged to the users by the

corresponding UCs will include the cost due to their pollution

emission. On the other hand, the renewable energy sources

are pollution free but they cannot provide a stable supply of

power.

The daily energy consumption schedule of each user is

divided into different time-slots. Each user intends to select the

UC that minimizes the cost it pays to the UCs. In each timeslot, each user can select only one UC, but in case of deficit

power from a renewable energy based UC, the demand will

be served by using another generator. There is bidirectional

communication between the providers and the consumers.

The consumers form a Neighborhood Area Network (NAN).

The data from the users’ side (total demand from each UC),

and from the supply side (price) is exchanged through the

Neighborhood Area Network Gateway (NAN-GW) as shown

in Figure 1. Users can communicate through a Local Area

Network (LAN), as described in [3].

In the current power system and the electricity market, the interactions among the generators, energy service

providers/UCs, transmission companies (transcos), distribution

network operator (DNO), distribution system operator (DSO),

etc. are quite complex. Although our model might be simplified in this respect, since the transmission and distribution

costs are normally fixed, the market price and the consumerdemands are mainly affected by the generation costs from the

supply side and consumers’ parameters from the demand side.

Thus our model leads to simplified decision problems, which

allows detailed analysis and yields some useful insights about

the interactions, without losing generality of the grid structure.

Moreover, considerable volume of work has used this kind

of scenario with electricity consumers and providers/UCs

interacting with each other without including transcos, DNOs,

DSOs, etc. [3], [18], [19], [20], in the context of DRM in the

smart grid.

There are two components associated with the price charged

by a UC to the consumers: the cost of power generation and

the availability of the renewable energy sources.

2168-6750 (c) 2013 IEEE. Translations and content mining are permitted for academic research only. Personal use is also permitted, but republication/redistribution requires IEEE

permission. See http://www.ieee.org/publications_standards/publications/rights/index.html for more information.

This article has been accepted for publication in a future issue of this journal, but has not been fully edited. Content may change prior to final publication. Citation information: DOI

10.1109/TETC.2014.2335541, IEEE Transactions on Emerging Topics in Computing

3

!"#-%(&'

!"#$%$&'

!"#$%(&'

!"#-%$&'

)*+*,''

-'

)*+*,''

$'

!"#-%-&'

)*+*,''

('

....'

!"#$%-&'

!"#(%(&'

!"#(%$&'

!"#(%-&'

Fig. 2. DTMC for renewable energy based utility company k

Fig. 1. Communication between the utility companies and the users

A. Cost of Power Generation

We choose the cost function of each UC such that the

following properties are satisfied for both fossil-fuel based and

renewable energy sources based UCs.

Property 1. The cost functions and hence the prices charged

to the users are increasing with higher demand for any timeslot, i.e., if d k,tot , d˜k,tot ≥ 0, are the total demands from UC

k, (k ∈ K ) such that d k,tot < d˜k,tot , and if CUC,k (d k,tot ) and

CUC,k (d˜k,tot ) are the corresponding costs of power generation,

then, CUC,k (d k,tot ) < CUC,k (d˜k,tot ), ∀ d k,tot < d˜k,tot , ∀k ∈ K .

Property 2. The cost functions and hence the prices

charged to the users are strictly convex in any timeslot, i.e., CUC,k (θ d k,tot + (1 − θ )d˜k,tot ) < θCUC,k (d k,tot ) + (1 −

θ )CUC,k (d˜k,tot ), ∀k ∈ K , where d k,tot , d˜k,tot ≥ 0, and 0 < θ < 1

is any real number.

Examples of cost functions that satisfy these properties

can be the two-step conservation rate model, quadratic cost

function, etc. These types of cost functions are of significant

importance and are realistic too, since they have been deployed

by many big power plants such as BC Hydro [9], and they can

be closely related to the cost of power generation. Hence, we

employ a quadratic cost function for the UCs.

Let the coefficients of UC k for the cost of power generation be βk,2,p , βk,1,p and βk,0,p , respectively. Let the pollution coefficients be αk,2 , αk,1 and αk,0 , respectively. Then

βk,2 := βk,2,p + αk2 , βk,1 := βk,1,p + αk,1 and βk,0 := βk,0,p + αk,0

are the coefficients of the cost function of UC k. Note that for a

renewable energy sources based UC, k, αk,2 = αk,1 = αk,0 = 0.

Let dnh denote the demand of user n at time-slot h, h ∈ H ,

where H := {1, 2, . . . , H}. Let gn := {ghn,k , k ∈ K , h ∈ H },

denote the UCS strategy of user n, where ghn,k is the decision

of user n for UC k in time-slot h, i.e.,

1 if user n selects UC k in time-slot h,

h

gn,k =

(1)

0 otherwise.

We use vectors ghn to represent the strategy of user n for time-

slot h, i..e., ghn := {ghn,k , k ∈ K }.

Suppose user n prefers UC k in time-slot h. Let Nkh :=

{1, 2, . . . , Nkh }, denote the set of users who select UC k, where

Nkh := |Nkh |, is the total number of users who prefer power

from UC k in time-slot h. Then, the total demand from UC k in

time-slot h is ∑m∈N h dmh . The cost of generating this amount

k

of power is

2

h

= βk,2

CUC,k

∑

m∈Nkh

dmh + βk,1

∑

dmh + βk,0 .

(2)

m∈Nkh

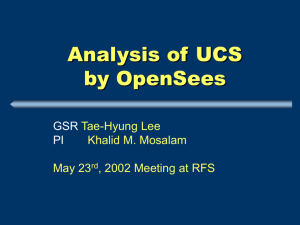

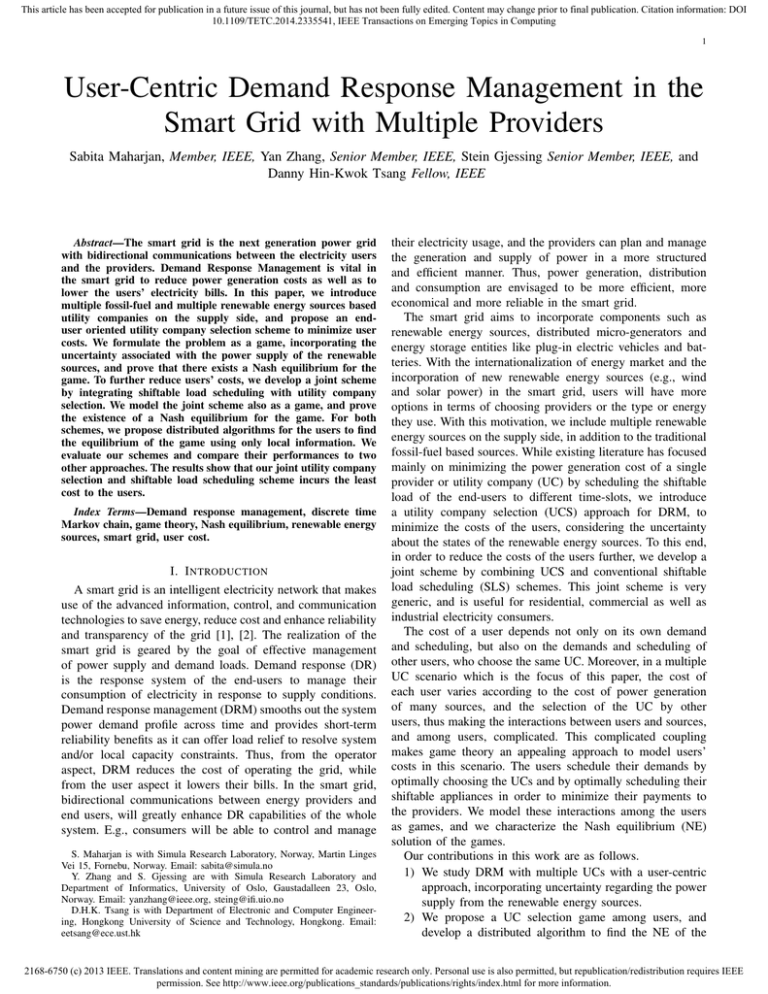

B. Availability of Renewable Energy based Utility Companies

When renewable energy sources such as wind power and

solar power are incorporated into the system, the inherent

uncertainty is added to the supply side. We employ a discrete

time Markov chain (DTMC) to model the power available

with the renewable energy sources based UCs. Although the

choice of the DTMC model is motivated for mathematical

tractability as it facilitates the derivation of the structure of

the optimal strategies for the games, it is able to satisfactorily

represent the transition between different states as has been

shown by [21], [22] for wind power, and by [23], [24], [25] for

solar radiation. Moreover, DTMC has been extensively used to

model the availability of different kinds of renewable energy

sources [10], [24], [25], [26].

The users do not know the exact state of the renewable

energy sources, but they have knowledge about the statistical

behavior of the renewable energy sources based UCs, i.e., the

only information the users have access to, is the steady state

probabilities of the DTMC. The availability of the renewable

energy based UCs is represented as an M state DTMC as

shown in Fig. 2. Let the state of the renewable energy based

UC k (k ∈ Kr , Kr := {1, 2, . . . , Kr }; Kr := |Kr |) be shk at timeslot h. Each state of a UC represents its power supply level.

The power supply state space can be divided into M discrete

levels i.e., shk = mk , (mk ∈ M , M := {1, 2, . . . , M}; M := |M |).

Let the 1 × Kr vector sh := (sh1 , sh2 , ....., shKr ) represent the power

supply state of all renewable energy based UCs, i.e., the system

state in time-slot h. Then, the state space of this vector is

Ωs = {(ω1 , ω2 , ....., ωKr )|ωk = mk , k ∈ Kr }. If the UCs are

independent, the dynamics of sh follows DTMC with transition

0

probability from state vector ω to ω , given by

2168-6750 (c) 2013 IEEE. Translations and content mining are permitted for academic research only. Personal use is also permitted, but republication/redistribution requires IEEE

permission. See http://www.ieee.org/publications_standards/publications/rights/index.html for more information.

This article has been accepted for publication in a future issue of this journal, but has not been fully edited. Content may change prior to final publication. Citation information: DOI

10.1109/TETC.2014.2335541, IEEE Transactions on Emerging Topics in Computing

4

If a user chooses a renewable energy based UC but the source

is not available or if the power supply level of the UC is

0

0

0

0

P(ω, ω ) = Pr(sh+1 = ω |sh = ω) = ∏ Pk (ωk , ωk ), ∀ω, ω ∈ Ωs , not adequate to meet the demand, the total available power is

k=1

supplied proportionally to the users’ demands. The amount of

(3)

power that can not be supplied by the source (deficit power)

0

th

where ωk and ωk are the k element of the state vector ω and

will have to be generated by and bought from either a source

0

0

ω , respectively, and Pk (ωk , ωk ) represents the state transition that can immediately generate the deficit power, or from a

probability matrix of UC k.

reserve. In either case, the power from this additional source

For a time homogeneous DTMC model, the steady state (backup source) is normally costlier than the power from the

probabilities of renewable energy based UC k, (k ∈ Kr ), being committed units. We consider a quadratic cost function for this

in state m at time t can be obtained as follows. Let us define additional source too, and denote the coefficients of its cost

function as {βres,2 , βres,1 , βres,0 }.

0

0

πkt (ω ) = Pr(stk = ω ), ∀k ∈ Kr .

(4)

Let phk,mk denote the steady state probability of the renewable energy based UC k, k ∈ Kr , being in state mk , mk ∈

Then,

are obtained from πkh =

t+1

t

πk = πk P,

(5) Mh. The steady state probabilities

h

{pk,m , mk ∈ M , h ∈ H }. Let Savl, UC,k,mk be the available

where πk is a row vector. The stationary distribution is

power of UC k in time-slot h if it is in state mk . Then, the

amount of power supplied by UC k is

πk = lim πkt , if the limit exists.

(6)

t→∞

h

h

h

Ssupp,

.

UC,k,mk = min Savl, UC,k,mk , ∑ dl

If πk exists, it can be obtained by solving

h

Kr

l∈Nk

0

πk = πk P,

∑0 πk (ω ) = 1.

(7)

ω

The average supply of renewable energy based UC k is

h

Ssupp,

UC,k =

C. Interactions between Utility Companies and Users

∑

mk ∈M

h

phk,mk Ssupp,

UC,k,mk .

(9)

Each residential user has a smart meter that, with the aid of

the bidirectional communication, can perform load scheduling

and UCS optimally in order to minimize the cost for the user.

The data communication between the supply and demand sides

is carried out through a NAN-GW as shown in Fig. 1.

If a user chooses renewable energy based UC k, k ∈ Kr , in

time-slot h i.e. if ghn,k = 1, then, the amount of power that it

gets from k is

!

dnh

h

h

h

Savl, UC,k,mk .

Savl, user,n,mk = min dn ,

∑l∈N h dlh

IV. U TILITY C OMPANY S ELECTION : A G AME

T HEORETICAL A PPROACH

The amount of power that user n gets, averaged over all the

states of UC k is

k

Different users choose the UCs independently. However, the

aim of each user is to minimize the cost that it pays to the

UCs. In this section, we discuss the pricing scheme, i.e., the

cost model for the users, and formulate the UCS game among

the users, for which, we show that a Nash equilibrium (NE)

solution exists. Then, we present a distributed algorithm to

reach a NE and prove that the algorithm converges to a NE.

h

Savl,

user,n =

∑

mk ∈M

h

phk,mk Savl,

user,n,mk .

(10)

If the demand from the renewable energy based UC in timeslot h is higher than the available power in state mk , the deficit

power for user n will be

h

h

h

Sdef,

user,n,mk = dn − Savl, user,n,mk .

(11)

The average deficit for user n will be

h

Sdef,

user,n =

A. Pricing Mechanism: Cost Model for Users

In [3], the authors showed that charging each user in

proportion to its demand leads to minimizing the cost of the

single UC when each user schedules its demands to minimize

its own charges. Thus, in order to motivate the users to help in

the demand side management, the providers employ a pricing

scheme such that the consumers are charged according to the

cost of generating the required power, as in [3].

0

If a user selects a fossil-fuel based UC k ∈ K f , in time-slot

h, i.e., if gh 0 = 1, the price charged to the user for time-slot

n,k

h will be

βk0 ,0

h

(8)

Cuser,n

= βk0 ,2 ∑ dmh dnh + βk0 ,1 dnh + h .

N0

m∈N h

k

0

k

∑

mk ∈M

h

phk,mk Sdef,

user,n,mk .

(12)

The total amount of deficit power for renewable energy based

UC k in time-slot h is

h

Sdef,

UC,k,mk = max

h

dlh − Savl,

UC,k,mk , 0

∑

l∈Nkh

The deficit power for all renewable sources k ∈ Kr , which are

in states m1 , m2 , . . . mKr , respectively, is supplied by an extra

source such as a gas turbine, which can generate the shortage

power immediately. The total amount of power to be supplied

by the extra source is

h

Sdef,

tot,{m1 ,...mK } =

r

∑

h

Sdef,

UC,k,mk .

(13)

k∈Kr

2168-6750 (c) 2013 IEEE. Translations and content mining are permitted for academic research only. Personal use is also permitted, but republication/redistribution requires IEEE

permission. See http://www.ieee.org/publications_standards/publications/rights/index.html for more information.

This article has been accepted for publication in a future issue of this journal, but has not been fully edited. Content may change prior to final publication. Citation information: DOI

10.1109/TETC.2014.2335541, IEEE Transactions on Emerging Topics in Computing

5

Using (13) and the steady-state probabilities in each time-slot,

we can compute the total deficit power from all UCs averaged

over all the states of all the renewable energy based UCs as

h

Sdef,

tot =

∑

m1 ∈M

ph1,m1

∑

m2 ∈M

ph2,m2 · · ·

(14)

r

Therefore, if user n chooses renewable energy based UC k in

time-slot h, the price charged to the user will be

h

h

h

h

Cuser,n

:= βk,2 Ssupp,

UC,k Savl, user,n + βk,1 Savl, user,n +

h

h

h

+ βres,2 Sdef,

tot Sdef, user,n + βres,1 Sdef, user,n +

βres,0

,

h

Nres

(15)

B. Utility Company Selection Game Among Users

The centralized cost minimization problem for users can be

written as

min

∑

Cuser,n =

s.t.

min

∑ ∑

{gn ,n∈N } n∈N h∈H

h

Cuser,n

,

ghn,k dnh ≤ Pk,max , ∀k ∈ K f ,

∑

(16)

(17)

n∈Nkh

where Pk,max is the capacity of fossil-fuel based UC k, k ∈ K f .

Since, each user is selfish, the objective of each user is to

minimize its own cost. The optimization problem for user n

given the strategies of other users, (OPuser,n ) is

min

gn

∑

h

Cuser,n

, s.t. (17).

(18)

h∈H

For the UCS game, the power consumptions and thus the

costs are decoupled in time. Hence, minimizing the total price

over a time span of H time-slots is equivalent to minimizing

the price in each time-slot, i.e., (OPuser,n ) takes the form

min

{ghn,k ,k∈K }

h

, ∀h ∈ H , s.t. (17).

Cuser,n

For a finite N-user game, a NE is a solution at which a

player cannot improve its payoff by deviating alone from the

equilibrium, given the strategies of all other players. For the

UCS game, the NE is any strategy set (g∗n , g∗−n ) at which

uuser,n (g∗n , g∗−n ) ≥ uuser,n (gn , g∗−n ), ∀n ∈ N ,

βk,0

Nkh

where Nres is the total number of users whose deficit powers

are served by the additional generator. Note that the above

formulation can easily accommodate the scenario with more

than one kind of backup sources. In this scenario, a possible

approach is to choose the cheapest type of backup generator

if it can make up the deficit, otherwise multiple generators

supply the deficit power.

{gn ,n∈N } n∈N

Payoffs: uuser,n (gn , g−n ), for each user n ∈ N , where

uuser,n (gn , g−n ) = −Cuser,n (gn , g−n ), and g−n is the strategy of all users other than n.

C. Existence of Nash equilibrium

h

phKr ,mKr Sdef,

tot,{m1 ,...mK } .

∑

mKr ∈M

•

(19)

The choice of UCs by consumers depends not only on their

own demands but also on the demands and UCS strategies of

the other consumers. This implies that the strategy of each user

is coupled with the strategies of the other users. As each user

is concerned about maximizing its own payoff, game theory

[11] is a natural fit to model the behavior of the users in this

case.

The components of the game are as follows:

• Players: Users in the set N .

• Strategies: The strategy set of user n is the selection of

UCs for all time-slots in a day, gn . The strategy space is

defined as g := {g1 × g2 × . . . gN }.

where g∗n is the optimal UCS strategy of user n, for given optimal strategies of other users g∗−n , and uuser,n (.) = −Cuser,n (.).

Theorem 1. The UCS game between the consumers is a

concave N-user game and a Nash equilibrium exists for the

game.

Proof: For the UCS game for one whole day, since there

is no coupling in time, it is sufficient to prove that an NE

exists for the game for each time-slot.

For time-slot h, the demand of user n from UC k can

h = gh d h = {0, d h }. If k is a renewable

be written as dn,k

n

n,k n

h

from k, and

energy based UC, user n will get Savl,user,n

h

Sdef,user,n from the corresponding additional source. The demand of users other than n who also prefer UC k, can

be represented as dh−n,k = ghm,k dmh , ∀m ∈ Nkh , m 6= n. Let us

write the payoff of user n, who gets power from UC k, as

h , . . . , d h , . . . , d h ). Since the cost

uuser,n (dhall,k ) = uuser,n (d1,k

n,k

Nkh ,k

functions are increasing and strictly convex for each UC, the

h , dh

h

payoff function uuser,n (dn,k

−n,k ) is strictly concave w.r.t. dn,k

h

h

h , . . . , dh

for given (d1,k

n−1,k , dn+1,k , . . . , d h 0 ) and is continuous

Nk ,k

in dhall,k . This holds for all users n ∈ N , who prefer a different

0

0

UC k ∈ K , k 6= k, too. Thus, the UCS game is a concave Nuser game. An NE exists for a concave N-user game [13].

The game will be a concave game even if a part of the

demand of user n from k ∈ Kr , is supplied by the additional

generator, since the sum of the convex functions is also convex.

Consequently, an NE exists for this game.

D. Distributed Algorithm to Converge to Nash Equilibrium

Equation (16)-(17) can be solved in a centralized manner

by using convex programming techniques such as interior

point method (IPM). Nonetheless, a solution that can be

implemented and updated autonomously to accommodate the

changes within the demand side, is of arguably higher value

compared to a centralized solution. We are therefore interested

in presenting a distributed solution for (16)-(17). Notably, (18)

or (19) can be solved by each user locally provided the users

can select their strategies sequentially. Exploiting this fact,

next, we propose a distributed algorithm to implement the UCS

scheme.

Let, gn,t = {ghn,t , h ∈ H } denote the UCS strategy of user

n. Each user starts by randomly selecting a UC for each timeslot. In the next iteration, one of the consumers solves the

local optimization problem (19), ∀h ∈ H , and updates its

strategy for the whole day. Then, another user gets its turn to

2168-6750 (c) 2013 IEEE. Translations and content mining are permitted for academic research only. Personal use is also permitted, but republication/redistribution requires IEEE

permission. See http://www.ieee.org/publications_standards/publications/rights/index.html for more information.

This article has been accepted for publication in a future issue of this journal, but has not been fully edited. Content may change prior to final publication. Citation information: DOI

10.1109/TETC.2014.2335541, IEEE Transactions on Emerging Topics in Computing

6

solve its local optimization problem and to update its choice.

If in one complete round of updating, the selection of UCs

from all users do not change, the point is an equilibrium.

We call this user-centric algorithm, Algorithm 1. The strategy

update iterations should be performed until the strategies of

all users do not change compared to their strategies in the

previous iterations. Note that strategy update should be done

asynchronously by each user. The NAN-GW can be used to

send the control signal (e.g., a 1-bit signal) for asynchronously

giving turn to each user to update their strategies. Users’

strategies can be updated randomly, thus making the optimal

strategies independent of the order of their turns.

Next, we display Algorithm 1 in more detail. Note that

the term iteration ’t’ and the term time-slot ’h’ are used to

represent different time scales. An optimal UCS game for

one time-slot needs many iterations for the users’ strategy to

converge (see results in Section VI).

Algorithm 1 : Distributed Algorithm for NE

1: t=1; Arbitrarily choose gn,t = {ghn,t , h ∈ H }, ∀n ∈ N ,

and announce the starting {gn,t , n ∈ N }.

2: t = t + 1

3: Randomly choose user n, n ∈ N .

4: User n: Solve optimization problem (19), ∀h ∈ H

to find optimal gn,t .

5: If gn,t changes compared to gn,t−1 ,

6:

Send a control message to announce the new gn,t

to other smart meters.

7: end

8: If any user has not updated its strategy for iteration t,

9:

Send a control message to user l who has not

updated its strategy for iteration t, l ∈ N , l 6= n.

10: Update n = l. User n, go to Step 4.

11: end

12: If gn,t changes for at least one user,

13: Go to Step 2.

14: end

Theorem 2. Algorithm 1 converges to an NE as long as the

individual strategies are updated asynchronously.

Proof: Line 4 in Algorithm 1 finds the best response.

If users play the best responses using this algorithm in a

sequential manner, the cost of each user decreases or remains

unchanged every time a user updates its strategy. However, the

cost cannot decrease below a certain value since Cuser,n ≥ 0.

This implies that the algorithm converges to a fixed point, beyond which the cost can not be improved, for given strategies

of other users. To prove that this fixed point is an NE, let

∗

(g∗n , g∗−n ) as the cost for user n at the fixed

us denote Cuser,n

point, which corresponds to the strategy set (g∗n , g∗−n ) and let

0

0

Cuser,n (gn , g∗−n ) be the cost for the same user for the strategy

0

0

set (gn , g∗−n ) where g∗n 6= gn . By definition, if (g∗n , g∗−n ) is a

fixed point of the UCS game, then,

0

0

∗

Cuser,n

(g∗n , g∗−n ) ≤ Cuser,n (gn , g∗−n ),

0

0

⇒ u∗user,n (g∗n , g∗−n ) ≥ uuser,n (gn , g∗−n ).

Thus, the fixed point (g∗n , g∗−n ) is an NE of the game. If the

NE is unique, the algorithm converges to the unique NE. If

the game possesses multiple Nash equilibria, the algorithm

converges to one of them depending on the initially selected

strategies.

V. L OAD S CHEDULING AND U TILITY C OMPANY

S ELECTION : A J OINT A PPROACH

Scheduling in time is a conventional approach used to

reduce the Peak to Average Ratio (PAR) of a single UC which

consequently reduces the cost of generation for the (single) UC

and also the user bills. However, it should be noted that not

all users prefer saving on their bills by shifting their flexible

load. Such time-scheduling schemes are useful only for those

users who have a considerable amount of flexible load. In

fact, many consumers may not even have any shiftable load,

or they may have some flexible appliances but they may prefer

to use them at certain hours rather than scheduling them at any

time for the sake of reducing costs. In addition, the electricity

requirements of the commercial and the industrial consumers

are usually rather strict, and scheduling in time may not be a

preferable option for them. On the contrary, if the users have

shiftable appliances, their costs can be reduced significantly

by scheduling their shiftable appliances in different time-slots.

We accommodate the needs and goals of all these types of

consumers together into one framework in our proposed DRM

solution. To this end, we introduce a joint scheme where users

schedule their shiftable appliances in different time-slots and

also choose UCs in each time-slot.

As mentioned in Section I, we would like to emphasize that

the UCS scheme incorporating the uncertainty in the supply

side associated with the renewable energy resources, is one

of our main contributions in this paper. The joint scheme is

another contribution of this work which further reduces the

cost for the users. The joint scheme is not a straightforward

extension of the UCS game. The joint scheme is comprised

of two levels of games: the optimal SLS in time for the

whole day and the optimal UCS for all time-slots in a day.

It is worth noting that the two scenarios have rather different

application domains. The UCS game finds its extensive use

in a scenario where the end-users have relatively strict power

requirements such as commercial and/or industrial users who

have either no or very little flexible demands. On the other

hand, the scheduling in time is more useful for users with

higher proportion of shiftable appliances, such as residential

users. The joint scheme is very generic and is suitable for

residential, commercial as well as industrial users.

In addition to a non-shiftable demand in each time-slot, we

now incorporate some shiftable power requirement for each

h , d h be the non-shiftable demand in timeconsumer. Let dn,ns

n,s

slot h, and part of the shiftable demand of user n, scheduled in

time-slot h, respectively, for a given scheduling in time. Here,

the subscript s represents shiftable, n is the user index and ns

indicates non-shiftable. The total amount of shiftable power

per day is fixed but its scheduling in time and the selection

of UCs is the strategy of each consumer in this case. We

incorporate the coupling among different time-slots for the

2168-6750 (c) 2013 IEEE. Translations and content mining are permitted for academic research only. Personal use is also permitted, but republication/redistribution requires IEEE

permission. See http://www.ieee.org/publications_standards/publications/rights/index.html for more information.

This article has been accepted for publication in a future issue of this journal, but has not been fully edited. Content may change prior to final publication. Citation information: DOI

10.1109/TETC.2014.2335541, IEEE Transactions on Emerging Topics in Computing

7

renewable energy sources based UC k in time-slot h, the price

charged to the user will be

shiftable load of consumer n as

τn,2

∑

h

h

dn,s

= d¯n,s ; dn,s

≥ 0, ∀h ∈ [τn,1 τn,2 ],

h

h

h

h

Cuser,n

:= βk,2 Ssupp,

UC,k Savl, user,n + βk,1 Savl, user,n +

h=τn,1

where τn,1 , τn,2 are the beginning and the end time-slots,

respectively, for the shiftable demand of user n.

A. Pricing Mechanism: Cost Model for Users

For this scheme, the strategy of each consumer is {xn , gn },

where {xn } := {xnh , h ∈ H }, is a demand scheduling vector

h + dh ,

that incorporates its shiftable load d¯n,s , i.e., xnh = dn,ns

n,s

is the power requirement of user n in time-slot h, and gn :=

{ghn,k , h ∈ H , k ∈ K } is the UCS strategy of user n for one

complete day, for a given schedule of the shiftable appliances.

0

If a user selects a fossil-fuel based UC k ∈ K f , in time-slot

h, the price charged to the user for time-slot h will be

βk0 ,0

h

h h

h

(20)

Cuser,n

= βk0 ,2 ∑ xm

xn + βk0 ,1 xn + h .

N0

m∈N h

k

If a user chooses renewable energy based UC k in time-slot

h, the price charged on user n is calculated as follows. The

amount of power supplied by UC k, if it is in state mk , is

h

h

Ssupp,

UC,k,mk = min Savl, UC,k,mk ,

∑

xlh .

(21)

l∈Nkh

h

where Savl,

UC,k,mk is the corresponding available power of UC

k in state mk . The amount of power that user n gets from UC

k is

!

xnh

h

h

h

(22)

Savl, UC,k,mk .

Savl, user,n,mk = min xn ,

∑l∈N h xlh

k

If the demand from the renewable energy based UC k in timeslot h is higher than the available power in state mk , the deficit

power for user n will be

h

h

h

Sdef,

user,n,mk = xn − Savl, user,n,mk .

(23)

h

(Ssupp,

UC,k ),

The average supply of UC k

the average power

h

that user n gets from it (Savl, user,n ), and the average deficit for

h

user n (Sdef,

user,n ), can be obtained using (21) in (9), (22) in

(10), and (23) in (12), respectively.

The total deficit power for renewable energy based UC k in

time-slot h if the source is in state mk , is

∑

h

xlh − Savl,

UC,k,mk , 0

(24)

l∈Nkh

The total amount of power to be generated by the extra

source to supply the deficit power for all the renewable sources

when the UCs are in states m1 , m2 , . . . , mKr , is denoted as

h

Sdef,

tot,{m1 ,...mKr } , and can be calculated by substituting (24)

into (13). Similarly, the total deficit power for all renewable

energy based UCs averaged over all the states can be obtained

h

by using Sdef,

tot,{m ,...mK } in (14). Therefore, if user n chooses

1

r

βres,0

.

h

Nres

(25)

B. Utility Company Selection and Shiftable Load Scheduling

Game among Users

The objective for a centralized approach would be to minimize the total daily cost of all users i.e.,

min

∑

{gn ,xn ,n∈N } n∈N

Cuser,n =

min

∑ ∑

{gn ,xn ,n∈N } n∈N h∈H

h

Cuser,n

(26)

τn,2

s.t.

∑

h

dn,s

= d¯n,s , ∀n ∈ N ,

(27)

ghn,k xnh ≤ Pk,max , ∀k ∈ K f .

(28)

h=τn,1

∑

n∈Nkh

k

0

h

Sdef,

UC,k,mk = max

h

h

h

+ βres,2 Sdef,

tot Sdef, user,n + βres,1 Sdef, user,n +

βk,0

Nkh

The objective of each user, is to minimize its own cost given

the strategy of other users, i.e., the optimization problem for

user n (OPuser,n ) in this case, is

min

∑

{gn ,xn } h∈H

h

Cuser,n

, s.t. (27), (28).

(29)

In the UCS game, the coupling of the strategies was only in

terms of the selected UCs. There was no coupling in time. In

the joint UCS and SLS game, although the UCs are chosen for

each time-slot in an independent manner, since each consumer

also optimizes its choice of the UCs based on the scheduling

of its shiftable load, the strategies of the consumers are thus

coupled in both time and the UCs. We design the interactions

as a joint game in this case, where the players are the

consumers: N , the strategies are {xn , gn }, ∀n ∈ K , and their

payoffs are uuser,n (xn , gn , x−n , g−n ) = −Cuser,n (xn , gn , x−n , g−n ).

C. Existence of Nash Equilibrium

For the joint UCS and SLS game, the NE is defined as the

strategy set {x∗ := {x∗n , x∗−n }, g∗ := {g∗n , g∗−n }} such that

Cuser,n (x∗n , x∗−n , g∗n , g∗−n ) ≤ Cuser,n (xn , x∗−n , gn , g∗−n ),

Theorem 3. The joint UCS and SLS game is a concave N-user

game and a Nash equilibrium exists for this game.

Proof: The payoff is given by the function uuser,n (x, g) =

uuser,n ({x1 , . . . , xn , . . . , xNk }, {g1 , . . . , gn , . . . , gNk }) for user n,

where (x1 , . . . , xn , . . . xNk ) and (g1 , . . . , gn , . . . gNk ) are the vectors that represent the demands and the UCS of users

1, . . . , n, . . . , Nk , all of whom get power from UC k, (k ∈ K ,

here k may indicate different UCs at different time-slots).

For a given scheduling of the shiftable load of the users, an

NE exists for the UCS game for each time-slot, as shown in

Section IV-C. Thus we need to prove that an NE exists only

for the scheduling game.

Since the cost function of each UC is increasing and

strictly convex, the payoff function uuser,n (xn , x−n ) is strictly

2168-6750 (c) 2013 IEEE. Translations and content mining are permitted for academic research only. Personal use is also permitted, but republication/redistribution requires IEEE

permission. See http://www.ieee.org/publications_standards/publications/rights/index.html for more information.

This article has been accepted for publication in a future issue of this journal, but has not been fully edited. Content may change prior to final publication. Citation information: DOI

10.1109/TETC.2014.2335541, IEEE Transactions on Emerging Topics in Computing

8

concave w.r.t. xn . For xn ∈ x, where x = x1 × x2 × . . . × xNk ,

uuser,n (x) is continuous in x and is concave in xn for given

(x1 , . . . , xn−1 , xn+1 , . . . , xNk ). This holds for all users n ∈ N

selecting different time-slots h ∈ H for their load scheduling

from the same UC. Hence, the load scheduling game is a

concave N-user game and the existence of an NE for such a

game is straightforward [13].

D. Distributed Algorithm to Find Nash Equilibrium

in an asynchronous manner, the cost of each user decreases

or remains unchanged every time a user updates its strategy.

However, the cost cannot decrease below a certain value because Cuser,n ≥ 0. This implies that the algorithm converges to

∗

a fixed point. Let us denote Cuser,n

(x∗n , x∗−n , g∗n , g∗−n ) as the cost

for user n at the fixed point, which corresponds to the strategy

0

0

0

space {x∗n , x∗−n , g∗n , g∗−n } and let Cuser,n (xn , x∗−n , gn , g∗−n ) be the

0

0

cost for the same user for the strategy space {xn , x∗−n , gn , g∗−n }

0

0

where {x∗n 6= xn , g∗n 6= gn }. By definition, if (xn , x∗−n , g∗n , g∗−n )

is a fixed point of the game, then,

0

Problem (26)-(28) can be solved in a centralized setting by

using convex programming techniques such as IPM. Notably,

(29) represents a local optimization problem for each user

given the strategies of other users. Therefore, each user can

reach the NE of the game starting from some arbitrary initial

selection vectors {xn , gn }. We devise a user-centric distributed

algorithm for each user to solve (29) locally in order to find

its optimal strategy. We name this algorithm, Algorithm 2,

which follows, and is described next.

Each user starts with a random scheduling of the shiftable

appliances and by randomly selecting a generator, for each

time-slot. To start the next iteration, a 1-bit control information

is sent to one of the users by the NAN-GW to update its

strategy. The user who gets the control signal solves the local

optimization problem (29) for given {x−n , g−n } and updates

its strategy {xn , gn }. Then, another user is chosen randomly

to update its strategy. The process stops when the strategies

of all users ({xn , gn , n ∈ N }) do not change.

Algorithm 2 : Distributed Algorithm for the Joint Scheme

1: t = 1; Arbitrarily choose xn,t = {xhn,t }, gn,t = {ghn,t },

∀h ∈ H , such that (27), (28) is satisfied ∀n ∈ N , and

announce the initial {xn,t , gn,t , n ∈ N }.

2: t = t + 1

3: Randomly choose user n, n ∈ N .

4: User n: Solve (29) to find optimal {xn,t , gn,t }

for given strategies of other users.

5: If {xn,t , gn,t } changes compared to {xn,t−1 , gn,t−1 },

6:

Send a control message to announce the new

{xn,t , gn,t } to other smart meters.

7: end

8: If any user has not updated its strategy for iteration t,

9:

Send a control message user l who has not

updated its strategy for iteration t, l ∈ N , l 6= n.

10: Update n = l. User n, go to Step 4.

11: end

12: If {xn,t gn,t } changes compared to {xn,t−1 , gn,t−1 }

for at least one user,

13:

Go to Step 2.

14: end

Theorem 4. Algorithm 2 converges to an NE as long as the

updating of the individual strategies is done sequentially.

Proof: Line 4 in Algorithm 2 finds the best response. If

users play the best responses sequentially using this algorithm

0

0

∗

Cuser,n

(x∗n , x∗−n , g∗n , g∗−n ) ≤ Cuser,n (xn , x∗−n , gn , g∗−n ).

This implies that the fixed point (x∗n , x∗−n , g∗n , g∗−n ) is an NE

of the game. If the NE is unique, the algorithm converges to

the unique NE. If there exists multiple Nash equilibria, the

algorithm converges to one of them depending on the initially

selected strategies.

If the energy consumption needs of all users is the same for

different days, theorems 3 and 4 imply that starting from any

initial point, Algorithm 2 converges to an optimal UCS and

SLS solution for each day, without having to recalculate the

solution everyday. If however, the energy consumption needs

for the users are different for different days, then Algorithm 2

will converge to different optimal UCS and SLS solutions for

different days. We note that even in the later case, the optimal

solutions can be computed at least a day before as long as the

users know their total demands and the shiftable demands for

the next day, which makes Algorithm 2 a practical approach.

The same applies to Algorithm 1 discussed in Section IV also.

Since both Algorithm 1 and Algorithm 2 require sequential

update of the strategies, a natural concern may arise regarding

the practicality of the algorithms for large population of

consumers. For this scenario, users can be grouped based on

their electricity consumption needs or geographical proximity

or some other relevant condition, and the optimal solutions

should be calculated for those groups. Within each group,

a predefined scheduling scheme can be deployed or further

optimizations can be carried out locally.

VI. N UMERICAL R ESULTS

In this section we show the convergence of Algorithms

1 and 2, and evaluate and compare the performance of the

algorithms. The equilibrium of the game will certainly depend

on the values of the parameters. Nonetheless, for the purpose

of illustration, we use a certain set of parameters in all analyses

in this section. Note that the value of the results may change

with a different set of parameters, but the pattern of the results

will be similar. We consider 30 users (N = 30) and 4 UCs

(K = 4). UC 1 and 2 are fossil-fuel based, and UCs 3 and 4

are renewable energy based. We divide the daily consumption

of users into 24 hours. The renewable energy based UCs have

three states: state 1 is the OFF state i.e. no power available,

state 2 means it has a power of 45 KW and state 3 means it

has a power of 90 KW. The capacity of UCs 1 and 2 used for

the analysis are P1,max = P2,max = 500KW .

Each user has some non-shiftable appliances such as refrigerators, bulbs, heating/cooling units, electric stoves, televisions, computers, etc., and some shiftable appliances such

2168-6750 (c) 2013 IEEE. Translations and content mining are permitted for academic research only. Personal use is also permitted, but republication/redistribution requires IEEE

permission. See http://www.ieee.org/publications_standards/publications/rights/index.html for more information.

This article has been accepted for publication in a future issue of this journal, but has not been fully edited. Content may change prior to final publication. Citation information: DOI

10.1109/TETC.2014.2335541, IEEE Transactions on Emerging Topics in Computing

for both renewable energy based UCs. We chose this matrix

such that it is closely related to the transition probability

matrix used in [10], but we slightly modified the values since

[10] employs the matrix for 2 states. Note that the transition

probability matrix was chosen as above for illustrating the

performance of the proposed schemes. Choosing different

values for the two renewable energy based UCs may alter the

cost values but the pattern of the results will persist.

A. Distributed Algorithm for Utility Company Selection

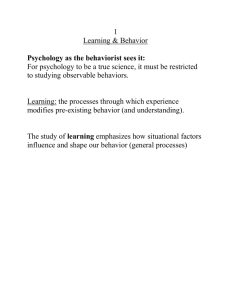

Fig. 3 depicts the daily cost paid by 10 randomly selected

consumers (out of 30), and shows that Algorithm 1 converges.

This figure represents the convergence of the cost of each user

to the NE for a 24 hours period without using shiftable load.

The convergence is within 3 iterations. Note that one iteration

here means one round of strategy updating for all users. Fig.

4 depicts the daily cost for 10 randomly selected users with

and without employing optimal UCS strategy. It is evident

that the cost decreases for each user when the UCS scheme is

employed. E.g., for consumer 3, the daily cost reduces from

21.2 to 14, i.e., the UCS scheme results in an improvement

of about 34% for this consumer.

B. Distributed Algorithm for Utility Company Selection and

Shiftable Load Scheduling

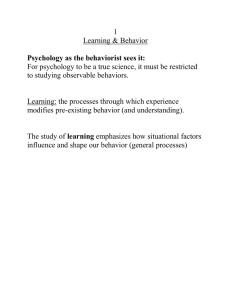

We added shiftable demands of 20 KWh to all the users such

that each user needs this amount of energy in 5 hours. Each

user schedules this demand in time. Fig. 5 shows the total cost

of each user for a 24-hour period calculated using Algorithm

2. The figure shows that the algorithm converges very fast,

in about 5 iterations. Note that one iteration here means one

5

10

5

10

5

10

5

10

5

10

Cost($) Cost($) Cost($) Cost($) Cost($)

15

10

5

0

30

20

10

0

15

10

5

0

20

10

0

0

15

10

5

0

20

15

10

5

0

20

15

10

0

10

8

6

0

30

20

10

0

15

10

5

0

5

10

5

10

5

10

5

10

5

Iterations

10

Fig. 3. Convergence of the costs of 10 randomly selected users to NE for a

30-users utility company selection game

30

Without UCS and SLS

25

Daily cost ($)

as dishwashers, laundry machines, electrical vehicles, Plug-in

hybrid electric vehicles (PHEVs), etc. The power requirement

for these appliances are typical standard values, e.g., 1.32 3.96 KWh for refrigerators (depending on the number of refrigerators a household has), 1-2 KWh for bulbs, 6.4-9.6 KWh

for heating, 3.9 KWh for electric stoves, 1.1-2.0 KWh for

televisions/computers, 1.44 KWh for a dish-washer, 3.43 KWh

for a laundry machine and 9.9 KWh for PHEVs. The power

requirement for the non-shiftable appliances was generated

using a uniform random distribution over the typical values mentioned above. For UCs 1 and 2, we used β1,2 =

0.3 cents, β1,1 = β1,0 = 0 as in [3], and β2,2 = 0.1 cents, β2,1 =

0.5 cents, β2,0 = 0 as in [18]. Similar values were assigned to

the pollution coefficients, i.e., αk,2 = βk,2 , αk,1 = βk,1 , αk,0 =

βk,0 for k = 1, 2. For the renewable energy based UCs, we

considered β3,2 = 0.1 cents, β3,1 = 0.3 cents, β3,0 = 0.3 cents,

β4,2 = 0.05 cents, β4,1 = 0.3 cents, β4,0 = 0.2 cents. unless otherwise stated. Note that we have chosen β1,2 , β2,2 ≥ β3,2 , β4,2 ,

and β1,0 , β2,0 β3,0 , β4,0 , assuming that the production cost

is dominant for fossil-fuel based generators and the initial

installation cost is higher for renewable energy sources. The

transition probability matrix used for the numerical analysis is

0.3 0.4 0.3

P = 0.2 0.4 0.4 ,

0.1 0.6 0.3

Cost($) Cost($) Cost($) Cost($) Cost($)

9

With UCS and SLS

20

15

10

5

0

2

4

6

User

8

10

Fig. 4. Comparison of the daily costs of 10 randomly selected users with and

without employing optimal utility company selection strategies

complete round of strategy updates for all consumers. Fig.

6 depicts the total cost of all users for a 24-hour period.

The figure shows four curves. The curve with ’+’ markers

is the cost when neither the optimal UCS nor the optimal SLS

is employed. The dashed line shows the scheme where only

optimal SLS is performed. The dotted line with square markers

shows the performance of the UCS scheme. The solid line

shows the performance of our joint scheme where both optimal

SLS and optimal UCS are employed. The fourth curve (solid

line) shows that Algorithm 2 converges within 5 iterations.

We observe that the SLS and the UCS schemes reduce the cost

compared to the case when no scheduling is done, from about

485$ to about 420$, and 280$, respectively, i.e., by 13.4% and

42.2%, respectively. Our joint scheme incurs the least total

cost compared to the remaining three schemes. It reduces the

cost paid by the users to about 230$, i.e., by 10.3% compared

to the UCS scheme, by 39.17% compared to the SLS scheme

and by 52.5% compared to the scheme without using UCS and

SLS. An interesting observation from this figure is that optimal

UCS can yield drastic savings even for those consumers who

do not have a big proportion of shiftable appliances, or those

who prefer not to shift their appliances, if the consumers have

options to choose different providers or UCs.

Fig. 7 shows the total daily cost paid by 10 randomly

selected consumers with and without using the joint scheme.

The figure clearly indicates that the daily cost is reduced

significantly for every user. E.g., for consumer 3, the daily

cost reduces from about 21.22 to about 11.5, a reduction of

about 45.8%.

2168-6750 (c) 2013 IEEE. Translations and content mining are permitted for academic research only. Personal use is also permitted, but republication/redistribution requires IEEE

permission. See http://www.ieee.org/publications_standards/publications/rights/index.html for more information.

This article has been accepted for publication in a future issue of this journal, but has not been fully edited. Content may change prior to final publication. Citation information: DOI

10.1109/TETC.2014.2335541, IEEE Transactions on Emerging Topics in Computing

10

10

5

10

5

10

5

10

5

10

20

10

0

0

20

10

0

0

10

8

6

0

40

20

0

0

15

10

5

0

5

10

5

10

5

10

5

10

5

Iterations

10

Total daily cost of all users ($)

450

300

Without UCS and SLS

UCS only

SLS only

With both UCS and SLS

250

200

0

5

10

Iterations

15

10

0

0

2

4

6

8

10

User

500

350

20

5

Fig. 5. Convergence of the costs of 10 randomly selected users to NE for a

30-users utility comapny selection and shiftable load scheduling game

400

Without UCS and SLS

With UCS and SLS

25

Daily cost ($)

5

Cost($) Cost($) Cost($) Cost($) Cost($)

Cost($) Cost($) Cost($) Cost($) Cost($)

30

15

10

5

0

30

20

10

0

15

10

5

0

20

10

0

0

15

10

5

0

15

20

Fig. 6. Total daily cost paid by 30 users for various schemes

VII. C ONCLUSION

We have formulated a utility company selection game,

incorporating multiple renewable and non-renewable energy

based utility companies. We have proved that there exists

a Nash equilibrium for the game and have proposed a distributed algorithm that converges to the Nash equilibrium.

Next, we improved the performance of our proposed scheme

by integrating optimal load scheduling with it, using a twostage game framework for analysis. This is a novel approach

exploiting both spatial and temporal dimensions for demand

response management in the smart grid. We have proven

the existence of a Nash equilibrium for this game also, and

have developed a distributed algorithm to converge to the

equilibrium. We have verified the convergence of the proposed

algorithms and have shown that while the utility company

selection scheme improves the costs of the users compared

to the case without any scheduling, the joint scheme yields

the lowest costs compared to three other schemes.

R EFERENCES

[1] H. Farhangi, The Path of Smart Grid, IEEE Power and Energy Magazine,

Vol. 8, No. 1, pp. 18-28, Jan.-Feb. 2010.

[2] A & B National Energy Technological Laboratory (2007-07-27), A Vision

for the Modern Grid, United State Department of Energy, May 2010.

[3] A. H. Mohsenian-Rad, V. W. S. Wong, J. Jatskevich, R. Schober and

A. Leon-Garcia, ”Autonomous Demand Side Management Based on Game

Theoretic Energy Consumption Scheduling for the Future Smart Grid,

IEEE Transactions on Smart Grid, Vol. 1, No. 3, pp. 320-331, December

2010.

[4] Z. Fan, Distributed Demand Response and User Adaptation in Smart

Grids, IEEE International Symposium on Integrated Network Management

(IM), 2011.

Fig. 7. Comparison of the daily costs of 10 randomly selected users with

and without employing optimal utility company selection and shiftable load

scheduling strategies for a 30-users game

[5] A. J. Conejo, J. M. Morales and L. Baringo, Real-Time Demand Response

Model, IEEE Transactions on Smart Grid, Vol. 1, No. 3, pp. 236-242,

December 2010.

[6] C. Wang and M. D. Groot, Managing End-user Preferences in the Smart

Grid, in ACM e-Energy, 2010.

[7] S. Caron and G. Kesidis “Incentive Based Energy Consumption Scheduling Algorithms for the Smart Grid”, SmartGridComm 2010, pp. 391-396.

[8] S. Maharjan, Q. Zhu, Y. Zhang, S. Gjessing and T. Başar, “Dependable

Demand Response Management in the Smart Grid: A Stackelberg Game

Approach,” IEEE Transactions on Smart Grid, Vol. 4, Issue 1, pp. 120-132,

March 2013.

[9] British Columbia Hydro Conservation Electricity Rates, https://www.

bchydro.com/youraccount/content/residential inclining block.jsp2009

[10] S. Bu, F. R. Yu and P. X. Liu, Stochastic Unit Commitment in Smart

Grid Communications, IEEE International Conference on Computer Communications (Infocom) 2011 Workshop on Green Communications and

Networking, 2011.

[11] H. Gintis, Game Theory Evolving, Princeton Univ. Press, May 2000.

[12] M. He, S. Murugesan and J. Zhang, Multiple Timescale Dispatch and

Scheduling for Stochastic Reliability in Smart Grids with Wind Generation

Integrations, IEEE Infocom 2011.

[13] J. B. Rosen, Existence and Uniqueness of Equilibrium Points for

Concave N-Person Games, Econometrica, Volume 33, Issue 3, pp. 520534, Jul. 1965.

[14] A. T. Al-Awamivand E. Sortomme, “Coordinating Vehicle-to-Grid Services With Energy Trading, ” IEEE Transactions on Smart Grid, Vol. 3,

No. 1, March 2012, pp. 453-462, 2012.

[15] S. Shao, M. Pipattanasomporn and S. Rahman, “Grid Integration of

Electric Vehicles and Demand Response with Customer Choice,” IEEE

Transactions on Smart Grid, Vol. 3, No. 1, March 2012, pp. 543-550,

2012.

[16] C. A. Hill, , M. C. Such and D. Chen, “Battery Energy Storage

for Enabling Integration of Distributed Solar Power Generation,” IEEE

Transactions on Smart Grid, Vol. 2, No. 2, June 2012, pp. 850-857, 2012.

[17] M. Fazeli, G. M. Asher, C. Klumner, L. Yao and M. Bazargan, “Novel

Integration of Wind Generator-Energy Storage Systems within Microgrids,”

IEEE Transactions on Smart Grid, Vol. 2, No. 2, June 2012, pp. 728-737,

2012.

[18] R. Deng, J. Chen, X. Cao, Y. Zhang, S. Maharjan, and S. Gjessing,

“Sensing-Performance Tradeoff in Cognitive Radio enabled Smart Grid”,

IEEE Transactions on Smart Grid, Vol. 4, Issue 1, pp. 302-310, March

2013.

[19] I. Koutsopoulos, and L. Tassiulas, “Optimal Control Policies for Power

Demand Scheduling in the Smart Grid”, IEEE Journal on Selected Areas

in Communications, Vol. 30, No. 6, pp. 1049-1060, July, 2012.

[20] C. J. Wong, S. Sen, S. Ha, and M. Chiang, “Optimized-Day Ahead

Pricing for Smart Grids with Device-Specific Scheduling Flexibility”, IEEE

Journal on Selected Areas in Communications, Vol. 30, No. 6, pp. 10751085, July, 2012.

[21] H. Nfaoui, H. Essiarab and A. Sayigh, “A Stochastic Markov Chain

Model for Simulating Wind Speed Time Series at Tangiers, Morocco,”

Renewable Energy, Vol. 29, No. 8, pp. 1407-1418, 2004.

[22] A. Shamshad, M.A. Bawadi, W.M.A. Wan Hussin, T.A. Majid, S.A.M.

Sanusi, “First and Second Order Markov Chain Models for Synthetic

Generation of Wind Speed Time Series,” Energy, Vol. 30, No. 5, pp. 693708, 2005.

2168-6750 (c) 2013 IEEE. Translations and content mining are permitted for academic research only. Personal use is also permitted, but republication/redistribution requires IEEE

permission. See http://www.ieee.org/publications_standards/publications/rights/index.html for more information.

This article has been accepted for publication in a future issue of this journal, but has not been fully edited. Content may change prior to final publication. Citation information: DOI

10.1109/TETC.2014.2335541, IEEE Transactions on Emerging Topics in Computing

11

[23] A. Zeroual and M. Ankrim and A. J. Wilkinson, “Stochastic modelling

of daily global solar radiation measured in Marrakesh, Morocco,” Solar

Energy, Vol. 6, No. 7, pp. 787-793, 1995.

[24] P. Poggi, G. Notton, M. Muselli, and A. Louche, “Stochastic Study

of Hourly Total Solar Radiation in Corsica Using a Markov Model,”

International Journal of Climatology, Vol. 20, No. 14, pp. 1843-1860,

Nov. 2000.

[25] J. S. G. Ehnberg and M. H. J. Bollen, “Simulation of Global Solar

Radiation Based on Cloud Observations,” Solar Energy, Vol. 28, No. 2,

pp. 157-162, 2005.

[26] D. Niyato, E. Hossain and A. Fallahi, “Sleep and Wakeup Strategies

in Solar-Powered Wireless Sensor/Mesh Networks: Performance Analysis

and Optimization,” IEEE Transactions on Mobile Computing, 2007, Vol.

6, No. 2., pp. 221-236, Feb. 2007.

Sabita Maharjan is currently a Postdoctoral Fellow in Simula Research Laboratory, Norway. She

received M.E. from Antenna and Propagation Lab,

Tokyo Institute of Technology, Japan, in 2008 and

Ph.D from University of Oslo and Simula Research

Laboratory, Norway, in 2013. Her research interests

include wireless networks, security in wireless networks, smart grid communications, cyber-physical

systems and machine-to-machine communications.

Danny H.K. Tsang (M’82-SM’00-F’12) received

the Ph.D. degree in electrical engineering from the

Moore School of Electrical Engineering at the University of Pennsylvania, U.S.A., in 1989. He has

joined the Department of Electronic & Computer

Engineering at the Hong Kong University of Science and Technology since summer of 1992 and

is now a professor in the department. He was a

Guest Editor for the IEEE Journal of Selected Areas

in Communications’ special issue on Advances in

P2P Streaming Systems, an Associate Editor for the

Journal of Optical Networking published by the Optical Society of America,

and a Guest Editor for the IEEE Systems Journal. He currently serves as

Technical Editor for the IEEE Communications Magazine. He was nominated

to become an IEEE Fellow in 2012. During his leave from HKUST in 20002001, Dr. Tsang assumed the role of Principal Architect at Sycamore Networks

in the United States. He was responsible for the network architecture design of

Ethernet MAN/WAN over SONET/DWDM networks. He also contributed to

the 64B/65B encoding proposal for Transparent GFP in the T1X1.5 standard

which was advanced to become the ITU G.GFP standard. The coding scheme

has now been adopted by International Telecommunication Union (ITU)’s

Generic Framing Procedure recommendation GFP-T (ITU-T G.7041/Y.1303)).

His current research interests include Internet quality of service, P2P video

streaming, cloud computing, cognitive radio networks and smart grids.

Yan Zhang received a PhD degree from Nanyang

Technological University, Singapore. From August

2006, he has been working with Simula Research

Laboratory, Norway. He is currently senior Research

Scientist at Simula Research Laboratory, Norway.

He is an adjunct Associate Professor at the University of Oslo, Norway. He is a regional editor, associate editor, on the editorial board, or guest editor

of a number of international journals. His research

interests include wireless networks and smart grid

communications.

Stein Gjessing is a Professor of Computer Science

in Department of Informatics, University of Oslo. He

received his the Cand. Real. degree in 1975 and his

Dr. Philos. degree in 1985, both form the University

of Oslo. He acted as head of the Department of Informatics for 4 years from 1987. From February 1996

to October 2001 he was the chairman of the national

research program Distributed IT-System, founded by

the Research Council of Norway. Gjessing’s original

work was in the field of programming languages

and programming language semantics, in particular

related to object oriented concurrent programming. He has worked with

computer interconnects and computer architecture for cache coherent shared

memory, with DRAM organization, with ring based LANs (IEEE Standard

802.17) and with IP fast reroute. His current research interests are transport,

routing and network resilience in Internet-like networks, in sensor networks

and in the smart grid.

2168-6750 (c) 2013 IEEE. Translations and content mining are permitted for academic research only. Personal use is also permitted, but republication/redistribution requires IEEE

permission. See http://www.ieee.org/publications_standards/publications/rights/index.html for more information.