Integr ation and Industr ial Specialization in the

advertisement

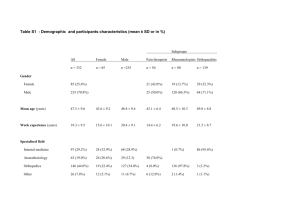

Integr ation and Industr ial Specialization in the Eur opean Union. K.H. Midelfar t-Knar vik Norwegian School of Economics and Business Adminitsration and CEPR H. G. Over man London School of Economics and CEPR Stephen Redding London School of Economics and CEPR A.J . Venables London School of Economics and CEPR * This paper draws on ‘The location of European Industry’, by the same authors, Economic Papers no.142 (2000), European Commission, Directorate-General for Economic and Financial Affairs, and ‘Comparative advantage and economic geography: estimating the location of production in the EU.’ by K.H. Midelfart-Knarvik, H.G. Overman and A.J. Venables, CEPR Discussion paper no. 2618 1. Intr oduction European integration has caused substantial increases in trade flows between member states. The growth in trade can be thought of as comprising two elements. One is ‘intra-industry’ trade. This takes the form of countries importing and exporting similar products as firms from each country penetrate the markets of other member states. Intra-industry trade can occur even if countries have identical industrial structures, and its economic benefit derives from the fact that it is pro-competitive, intensifying competition between firms located in different countries. The other element is inter-industry trade: economic integration is likely to lead to growing trade between sectors, as economies come to specialize more. The objective of this paper is to assess the extent to which this process of specialization has occurred, what its determinants are, and whether it is likely to continue. A process of specialisation can occur for several different reasons. One is traditional comparative advantage. Countries differ in their endowments of labour skill and other inputs to production, or in their technological capacities. Trade allows sectors to expand and contract in response to these advantages, to better match production to each country’s supply potential. Comparative advantage can also derive from geography. Proximity to markets might be particularly important for some sectors, in which case these sectors will relocate towards regions with good market access – the centre rather than the periphery of Europe. A further driver of specialisation is a process of agglomeration or clustering of activities. It might be that no country or region has any inherent comparative advantage in a sector, but that firms derive advantage from the presence of other firms in the sector. The advantage could be due to knowledge spillovers, sharing a pool of common labour skills, or just forward and backward linkages between supplier and customer firms. Any of these forces will tend to induce firms to cluster together in particular locations, although the choice of location might be a matter of historical accident. Integration facilitates this sort of clustering, and it will show up as a process of increasing national (and regional) specialisation. Specialization brings with it both benefits and costs. The benefits are that gains from comparative advantage depend on countries actually specialising according to their advantages. Furthermore, clustering usually brings with it efficiency benefits, as firms can interact more efficiently with neighbouring firms engaged in similar or related activities. But a possible cost is that specialisation increases the vulnerability of countries or regions to economic shocks – for example, the contraction of a particular industry in which a region is highly specialised. The magnitude of this potential problem depends on, amongst other things, the effectiveness of international (or inter-regional) adjustment mechanisms, and might be greater in monetary union, when adjustment via the exchange rate has been given up. In this paper we argue that a process of specialisation has been occurring in the EU and that – on the basis of comparison with the US – the process may have some way further to go. However, the process has been gradual, and has not been dramatic enough either to cause major adjustment problems, or to significantly increase the vulnerability of regions to industry specific shocks. 1 2. The specialization of countr ies Our focus will be on specialisation within the manufacturing sector, but it is useful to first sketch out the overall distribution of manufacturing in the EU. Table 1 shows the location of the European manufacturing sector as a whole. At the beginning of the 1970s, more than 63% of manufacturing was located in the UK, France and Germany (countries accounting for around 52% of Europe’s population), and over the last three decades this share has fallen, standing at 59% in 1994/97. Southern European countries (Italy, Greece, Portugal and Spain) raised their share gradually, from 19.9% in the early 70's to 24.6% in 1988/91 (compared to a population share of 32%). The smaller countries – Austria, Finland and Ireland -- have seen a steady increase in their share of European manufacturing. The changes are due to different overall growth rates in each economy, and to changes in the share of manufacturing in each country. Table 1: Regional str uctur e of Eur opean manufactur ing Austria Belgium Denmark Spain Finland France UK Germany Greece Ireland Italy Netherlands Portugal Sweden 70/73 2.1 % 3.9 % 1.4 % 5.8 % 1.3 % 16.9 % 16.9 % 29.4 % 0.7 % 0.4 % 12.5 % 4.3 % 0.9 % 3.6 % 100.0 % 82/85 2.4 % 3.3 % 1.4 % 6.3 % 1.8 % 16.4 % 15.5 % 27.7 % 1.0 % 0.7 % 14.5 % 4.3 % 1.2 % 3.3 % 100.0 % 88/91 2.5 % 3.4 % 1.3 % 6.3 % 1.8 % 15.6 % 14.3 % 28.8 % 0.7 % 0.7 % 16.4 % 3.9 % 1.2 % 3.2 % 100.0 % 94/97 2.4 % 3.8 % 1.6 % 6.5 % 1.7 % 15.1 % 13.9 % 30.0 % 0.7 % 1.2 % 14.5 % 4.3 % 1.4 % 3.1 % 100.0 % UK+GER+FRA ESP+ITA+GRC+PRT 63.2 % 19.9 % 59.6 % 23.0 % 58.7 % 24.6 % 59.0 % 23.1 % Against this background we now turn to look within manufacturing, and see if countries have become more or less specialised in particular manufacturing industries. We have consistent data for 36 manufacturing industries, across 14 EU countries and covering the period 197097. It is possible to construct an index of specialization that compares the share of a particular country’s manufacturing in each industry with the share of industries in the rest of the EU (see appendix for details). The index takes value zero if the country has industrial structure identical to that of the rest of the EU, and is higher the more different is the industrial structure. Table 2 gives values of this index for each EU country at a series of dates. Two striking points emerge. First, countries became more less specialised between 1970/73 and 1980/83, 2 as the index fell for 10 of the 14 countries. But from the early 80's onwards, the index registered a steady and substantial increase for all countries except 1 (the Netherlands), indicating a growing process of specialisation. Table 2: How differ ent ar e countr ies fr om the r est of the EU? 70/73 80/83 88/91 94/97 Austria Belgium Denmark Spain Finland France G. Britain Germany Greece Ireland Italy Netherlands Portugal Sweden 0.314 0.327 0.562 0.441 0.598 0.204 0.231 0.319 0.531 0.701 0.351 0.508 0.536 0.424 0.275 0.353 0.553 0.289 0.510 0.188 0.190 0.309 0.580 0.623 0.353 0.567 0.478 0.393 0.281 0.380 0.585 0.333 0.528 0.207 0.221 0.354 0.661 0.659 0.357 0.547 0.588 0.402 0.348 0.451 0.586 0.338 0.592 0.201 0.206 0.370 0.703 0.779 0.442 0.517 0.566 0.497 Weighted average 0.326 0.302 0.33 0.351 Note: Minimum values for each country in bold font. Figure 1 combines this information for countries grouped according to their entry date -- so EC1 is the original 6, EC2 is Denmark, Ireland and the UK, EC3 is Greece, Spain and Portugal, and EC4 Austria, Finland and Sweden. The main point to note from this figure is not the level of the curves, but their slopes. There has been a more or less steady increase in the specialisation of the EC1 group over the entire period. For the other groups the index starts to increase after their entry to the EU. This suggests that, as theory would suggest, integration in the EU has led to increasing national specialisation. 3 EC3 EC2 EC4 EC1 A further application of this specialization index is informative. So far, we have constructed the index to measure the difference between one country’s industrial structure and the structure of the rest of the EU. We can also construct it bilaterally, to measure the difference between the industrial structures of any two selected countries. Table 3 reports some of these bilateral comparisons, just for France, the UK and Germany, and comparing 1994-97 with 1980-83. Looking along each row of the table we see that the large economies are most like each other – the lowest values of the indices occur within the group France, Germany, UK. However, these countries are most unlike Greece, Portugal, Ireland and Finland. (Although we do not report the full results for these countries, Greece and Portugal are similar to each other, although very different from Ireland and Finland). Turning to changes, we see that over the period UK economy becomes more different from all others except France and the Netherlands: France becomes more different from all others except the UK and the Netherlands: and Germany becomes more different from all except the Netherlands. Once again then, this confirms the picture of divergence of industrial structures from the early 1980s onwards. 4 Table 3: How differ ent ar e countr ies fr om each other ? Aus Bel Den Spa Fin Fra UK Ger Gre Ire Ita Net Por Swe France 1980-83 1994-97 0.38 0.34 0.57 0.26 0.49 0.00 0.22 0.31 0.57 0.63 0.39 0.51 0.47 0.41 0.43 0.44 0.57 0.33 0.62 0.00 0.19 0.35 0.69 0.78 0.51 0.46 0.55 0.51 UK 1980-83 1994-97 0.32 0.42 0.56 0.37 0.54 0.22 0.00 0.25 0.61 0.67 0.40 0.53 0.55 0.39 0.39 0.48 0.58 0.38 0.58 0.19 0.00 0.36 0.72 0.77 0.47 0.46 0.59 0.51 Germany 1980-83 1994-97 0.33 0.43 0.65 0.40 0.66 0.31 0.25 0.00 0.73 0.75 0.43 0.64 0.64 0.42 0.46 0.61 0.72 0.43 0.66 0.35 0.36 0.00 0.86 0.82 0.49 0.61 0.74 0.49 3. National specialisation and industr ial concentr ation. The previous section tells us that a process of specialisation is going on, but what sorts of industries are going to what sorts of countries, and what underlying factors are driving these changes? Simple description is not very helpful (since there are 36 x 14 changes to describe). There are several ways in which we can try to organise the information to answer these questions. 3.1 What sor t of industr ies do countr ies attr act? First, we can identify selected characteristics of industries, and ask what countries are attracting or losing industries with those characteristics. For example, industries are classified by the OECD into high, medium and low technology groups, which can be scored 2, 1, 0. We can compute the average score for each country (industry scores weighted by the share of the industry in the country), and compare these scores across countries and across time. Several results come through very clearly. The technology scores are highest for Germany, France, the UK and Sweden, although they decline slightly for all these countries except Sweden. The largest changes are, as would be expected, for Ireland and Finland: these both start low and increase dramatically, measuring the growing share of high technology industries in these countries. The lowest levels are in Greece and Portugal, which start and remain low. Another classification of industries, is by their use of high skilled labour. Taking a fixed measure of this for each industry, we can compute a score for each country. We find that the Netherlands has the highest score on this characteristic, indicating an industrial composition skewed towards skill intensive sectors. The Netherlands is followed by the UK, Germany, France, Belgium and Sweden, although all these countries are overtaken by Ireland, rising from near lowest to second highest from the early 80s to mid 90s. 5 3.2 Which industr ies ar e spatially concentr ated? A second approach is to group industries according to their initial locational pattern, and then investigate major changes that have occurred. Table 4 classifies industries according to the extent to which they are spatially concentrated or dispersed across Europe. To measure concentration we used the Gini coefficient. Details on calculation of the coefficient and a complete table of indices for all industries are found in the appendix. Industries in the category CC were the most spatially concentrated in both 1970/73 and 1994/97, and industries in category CD were initially concentrated but became dispersed by 1994/97. Table 4: Industr ies gr ouped by levels and changes in concentr ation. Concentrated industries that have remained concentrated over time; (CC) Concentrated industries that have become less concentrated; (CD), Motor Vehicles Motor Cycles Aircraft Electrical Apparatus Chemical Products NEC Petroleum & Coal Products Beverages Tobacco Office & Computing Machinery Radio, TV & Communication Professional Instruments Machinery & Equipment NEC Dispersed industries that have become more concentrated over time; (DC) Dispersed industries that have stayed dispersed; (DD) Textiles Wearing Apparel Leather & Products Furniture Transport Equipment NEC Food Wood Products Paper & Products Printing & Publishing Metal Products Non-Metallic Minerals NEC Shipbuilding (Residual group of 12 industries omitted). Amongst the CC industries, the motor vehicles and motorcycles sectors saw consolidation of the German position relative to both France and the UK, although this is slightly offset by the increases in shares of production occurring in Portugal, Austria, and Spain. For Aircraft, Germany, the UK and France remain the dominant countries with a 78% share of EU Aircraft production in 1997. In the electrical apparatus industry there was little relocation, although Austria and Italy registered slight increases in their shares. In Chemicals the UK, Germany and France remain dominant despite Spain and Ireland capturing around 6% of the industry. The second group of industries, CD, started off concentrated but experienced dispersion over the period. Some, although not all, of these are relatively fast growing industries. In particular, Office & Computing equipment and Radio, TV & Communication Equipment experienced a 6 major decline in geographical concentration between 1991 and 1997. The increased geographical dispersion is primarily driven by decreasing German dominance and reinforced by shrinking shares of the UK and France. In Office & Computing Machinery, Machinery & Equipment, Radio, TV & Communication Equipment and Professional Instruments, between 7% and 17% of the EU production left Germany, France and the UK. Countries that strengthened their positions in some, or all, of these industries, were small countries such as Austria, Finland, Ireland and Sweden; and also the Southern European countries Italy, Portugal, and Spain. The third group are industries that were initially dispersed and have become more spatially concentrated. These are typically slow growing or declining industries. Thus, France, Germany and the UK experienced reduced shares in Textiles, Wearing Apparel and Leather & Products, while the Southern European countries showed growing shares. The final group of industries, DD, are industries that have been relatively dispersed throughout the period. These include a mixture of industries, many of which are highly dependent on local markets or face high transport costs. 4. Deter minants of specialisation. To this point we have been simply describing changes that have occurred. Is it possible to go behind the description, and explain the changing patterns of industrial location? Economic reasoning tells us that industrial location is determined by the interaction between characteristics of industries and characteristics of countries. Thus, skilled labour intensive industries are likely to be located in countries that are abundant in skilled labour. Industries that are intensive users of intermediate goods are likely to locate where they have good access to supply of these goods, and so on. It is possible to get data on some, if not all, of the relevant industry and country characteristics, and then use econometric techniques to explore the hypotheses suggested by theory. What do we learn about the fundamental determinants of industrial specialisation in Europe when we do this? The six pairs of interactions that are used in the econometric study are listed in table 5, together with a final column summarising the importance of the interaction. It is worth discussing each of these interactions in turn. The first is between countries’ endowments of skilled labour (the share of the population aged 25-59 with secondary or higher education) and industries’ ratio of non-manual to manual workers. This turns out to be a highly significant interaction, and one that increases in importance over time. The order of magnitude of the effect is indicated by the fact that increasing the share of a country’s labour force that has secondary or higher education by 10% will, other things being equal, increase output in Professional Instruments, Drugs and Medicines, Office and Computing equipment, and Printing and Publishing by around 40%: most other machinery and electrical equipment sectors would experience a rise of around 10%. Of course, other sectors have to shrink to accommodate these expanding sectors. For example, the estimates indicate that Motor Vehicles would contract by 4%, Non-Ferrous metals by around 10%, and Footwear, Textiles, Apparel, and Leather sectors by between 5 and 12%. These numbers indicate how quite small changes in endowments will have magnified effects on increasing output in some sectors, while leading to the contraction of others. 7 The second interaction is between the endowment of scientists and the R&D intensity of industries, and this too is highly significant and of increasing importance. The third indicates that industrial sectors that use agricultural inputs do, as expected, locate in countries with relatively large agricultural sectors, although the effect is weaker than the previous two interactions. Remaining interactions deal with countries’ geographical characteristics. Market potential is a measure of the centrality of each country, based on its average distance from sources of demand. This is interacted with transport costs (interaction 5), with the expectation that countries with good market potential might attract industries with high transport costs: however, no significant relationship was found. Interaction 6 investigates the importance of ‘backwards linkages’ in determining the location of industry. The hypothesis is that upstream industries – those with a high share of their sales going to industry rather than to final consumers – will locate in countries that have a relatively high market potential for sales of intermediate goods. The econometrics reveals that these backward linkages are important, although diminishing in strength during the period. Finally (interaction 6), are ‘forward linkages’. Do industries that are downstream (i.e. heavily dependent on using intermediate goods) locate in countries that have good access to industrial suppliers? In the 1980s this effect was extremely weak, although it increases in importance, becoming a significant determinant of industrial location by the mid 1990s. Table 5: Deter minants of industr ial str uctur e: countr y and industr y inter actions. Countr y Char acter istic Industr y Char acter istic Effect 1 Secondary and higher education, as % population Non-manual workers relative to manual Significant, small increase 2 Researchers and Scientists as % of labour force R&D, as % value added Significant, large increase 3 Agricultural production as % GDP Agricultural input as % of total costs Weak, small increase 4 Market Potential Transport costs ? 5 Market potential intermediates, relative to mp final goods. Sales to industry as % total sales Significant, large decrease. 6 Access to suppliers Intermediate goods as % of total costs Weak, large increase Summarising then, the econometrics paints a quite robust picture of the changing interaction between factor endowment and economic geography determinants of location. The results indicate an increasing importance of forward linkages and of the availability of skilled labour and researchers in determining the location of industry from 1980 onwards. 8 5. An EU-US compar ison We have seen that there is an ongoing process of industrial specialization in the EU, but how much further is this process likely to go? A natural place to look for an answer to this question is the US, a market that has always been tariff free and with a common currency, while experiencing major reductions in internal transport costs as various transport revolutions occurred. Recent US experience has been quite different from that of the EU, as the specialisation of US states has been decreasing. The US has a long time series of data which indicates increasing state specialisation up to the 1940s, followed by a steady decline since. Only two out of 21 US manufacturing industries do not record a decrease in spatial concentration between 70/73 and 94/97 (Tobacco products and Textile mill products). More importantly for present purposes is a comparison of the absolute levels of industrial specialisation in the two continents. This comparison is inherently difficult, as the continents have quite different sizes and shapes, and there is no ‘correct’ way to aggregate US states to mirror the geography of European countries. However, the two approaches we follow below lead us to the conclusion that US industry remains somewhat more spatially concentrated than is European. 5.1 The motor vehicle industr y: A US-EU compar ison We start by making a comparison of the location of the motor vehicle industries in the two continents. The basis of the comparison is to identify the European countries and US states that are the main producers of motor vehicles, and then compare their shares of vehicle production with their shares of manufacturing as a whole. If this share is high, then these countries/ states are highly specialized in motor vehicles In table 6 the row ‘EU2' gives the share of EU motor vehicle production undertaken by the two largest producing countries (Germany and France). Over the period, we see that their share of total EU vehicle production increased somewhat (from 58% to 62%), while their share of manufacturing as a whole decreased slightly, indicating a small increase in the relative concentration of the industry in these two countries. The second row gives the number of US states that produced approximately the same share of US motor vehicles as Germany and France produced of Europe’s. We see that this went from two states in 1970 to six states in 1996. And the share of manufacturing as a whole produced in these matching states went from 13% to 33%. This indicates considerable dispersion of US motor vehicle production relative to European, but also indicates that it remains more concentrated: 63% of US vehicles are produced in states producing just 33% of overall manufacturing, whereas in Europe 62% is produced by countries that produce 45% of overall manufacturing. The final two columns of the table reproduce the same argument, but using the top 4 European motor vehicle producers as comparators. These top 4 countries produce over 80% of EU vehicles, and the matching number of US states rises from 10 to 13 over the period. However, the matching US states are again more concentrated in motor vehicles relative to manufacturing as whole, than are the EU countries. 9 Table 6 Eur opean and US motor vehicle pr oduction 1970 1982 Share vehicle Share manuf EU 2 58% 46% US 2 56% EU 4 US 10 1996 Share vehicle Share manuf Share vehicle Share manuf EU 2 59% 44% EU 2 62% 45% 13% US 4 61% 25% US 6 63% 33% 86% 76% EU 4 84% 74% EU 4 82% 65% 87% 56% US 12 84% 61% US 13 82% 61% 5.2 Relative spatial dispersion. The preceding example was based on looking at the share of motor vehicle production in a set of regions (countries or states) relative to these regions production of manufacturing as a whole. We can extend this principle, and construct an index of the location of each industry, relative to the location of manufacturing as a whole (see the appendix for details on how the index of location is constructed; referred to as spatial dispersion index). The ratio of EU to the US values of these indices are presented, for each industry, in table 7. The index we construct is actually one of dispersion, so that if a number in the table is greater than unity, it means that the EU industry is more dispersed than its US counterpart. Looking at table 7 we see that EU industry is relatively more spatially dispersed than its US counterpart in 16 of the 21 industries reported (dropping in the mid 1990s to 15). In two industries the EU is much more dispersed B Tobacco and Textile Mills products. In a few the EU’s high level of dispersion relative to the US has declined somewhat B for example Motor Vehicles and Apparel. In the majority of others the EU pattern was and remains more dispersed than that of the US. While levels of the index appear quite modest, it can be shown that the gap between the EU and the US is generally considerably larger than the changes that have actually taken place in the EU since the early 80s. The analysis suggests then, that if EU patterns of specialisation and relative dispersion are to attain US levels, there is still some way to go. 10 Table 7: EU dispersion relative to US dispersion Industry 413 Lumber and wood products 417 Furniture and fixtures 420 Stone, clay, and glass products 423 Primary metal industries 426 Fabricated metal products 429 Industrial machinery and equipment 432 Electronic and other electric equipment 435 Motor vehicles and equipment 438 Other transportation equipment 441 Instruments and related products 444 Miscellaneous manufacturing industries 453 Food and kindred products 456 Tobacco products 459 Textile mill products 462 Apparel and other textile products 465 Paper and allied products 468 Printing and publishing 471 Chemicals and allied products 474 Petroleum and coal products 477 Rubber and misc. plastics products 480 Leather and leather products Manufacturing sector Average 82/85 1.07 1.06 1.09 1.23 1.04 0.951 0.814 1.44 0.811 0.868 1.04 1.01 2.08 2.14 1.2 1.3 1.02 1.01 0.919 1.03 1.35 1 1.16 88/91 1.11 1.08 1.09 1.2 1.04 0.975 0.843 1.42 0.763 0.835 1.03 1.03 2.27 2.1 1.14 1.29 1.03 1.06 0.885 1.07 1.29 1 1.16 94/97 1.12 1.05 1.07 1.22 1.02 1.03 0.848 1.3 0.797 0.889 0.986 1.01 2.19 2.03 1.04 1.33 0.965 1.07 0.853 1.05 1.24 1 1.14 6. Conclusions. It seems clear from the analysis of this paper that, from the early 1980s onwards, the industrial structures of EU economies have become more dissimilar. This is as would be predicted by trade theory (old and new) during a period of economic integration. The changes are to be welcomed, particularly as the econometric study indicates that the changes are driven – in part at least – by economic fundamentals. Production is moving to draw on input supplies, a set of changes that is likely to bring gains in economic efficiency. Several other characteristics of the change are noteworthy. First, it is slow. Over a fourteen year period, most economies have only seen a few percent of their industrial production move between sectors. Of course, more activity might be expected to show up if more disaggregate data were available, but nothing in our results suggest that the process is particularly rapid. This is good news, in so far as it suggests that the adjustment costs associated with structural change are likely to be quite low. Second, the process is in the opposite direction from the one we observe in the US. The US saw states becoming increasingly dissimilar from 1860 until around 1940, but a considerable amount of convergence has occurred since. Despite recent work in the area it is still not clear what forces drive these trends for the US. Is the process of growing dissimilarity in the EU likely to continue, or is it reaching some 11 limit? We see no evidence that it is reaching a limit. In so far as any direct comparisons with the US are possible, it is likely that EU industry remains more dispersed than that of the US. The time series record for Europe indicates no evidence of a slow down. And as we have seen, the process is slow; economies are nowhere near pressing against the limits of complete specialization. 12 Refer ences Balassa, Bela (1965): “Trade liberalisation and revealed comparative advantage”, The Manchester School of Economics and Social Studies 33: 99-123 Barro, Robert and Jong-Wha Lee (1993): “International Comparisons of Educational Attainment”, NBER Working Paper no. 4349 Brülhart, Marius and Johan Torstensson (1996): “Regional integration, scale economies and industry location in the European Union”, CEPR Discussion paper no. 1435 CEP II (1997): “Trade patterns inside the single market”, in European Commission: The single market review, subseries IV: Impact on trade and investment Ellison, Glenn and Edward L. Glaeser (1999): “The geographic concentration of industry: Does natural advantage explain agglomeration?”, American Economic Review 89, Papers and Proceedings: 311-316 European Commission (1995): “Fifth survey on state aid in the European Union in the manufacturing and certain other sectors ” Eurostat (1996): Labour costs 1992, Luxembourg - Brussels, 1996 Eurostat (1992): Earnings – Industries and Services 1990, Luxembourg - Brussels, 1992 Haaland, Jan I., Hans J. Kind and Karen Helene Midelfart Knarvik (1999): “What determines the economic geography of Europe?”, CEPR Discussion paper no. 2072 Kim, Sukkoo (1995): “Expansion of markets and the geographic distribution of economic activities: the trends in U.S. regional manufacturing structure, 1860-1987”, Quarterly Journal of Economics 110: 881-908 Krugman, Paul R. (1991): Geography and trade, MIT press, Cambridge, Massachusetts OECD (1994): “Manufacturing Performance: a Scoreboard of Indicators” Pratten, Cliff (1988): “A survey of the economies of scale”, in Commission of the European Communities: Research on the “cost of non-Europe”, vol. 2: Studies on the economics of integration United Nations (1993): “Industrial Statistics Yearbook 1991”, Vol. 1: General Industrial Statistics, UN, New York 1993 13 Appendix Data Our main data source is the OECD STAN database. This provides production data for 13 EU countries and 36 industries, from 1970 to 1997. We combine this with production data for Ireland from the UN UNIDO database, giving us data on a set of 14 EU countries (the EU 15, excluding Luxembourg). The comparison of the economic geography of Europe with that of the US, draws on US State level data for manufacturing employment, 1970-97. The US regional data on manufacturing employment have been kindly provided by Gordon Hanson. Measures of specialization The basic unit of analysis is the activity level (measured, when using the production data, by k the gross value of output) of industry k in country i at time t, which we shall denote xi (t) . We usually want to work with this expressed as a share, either of activity in the country, or k k total EU activity in the industry. We call these shares vi (t) and si (t) respectively. Thus vi (t) xi (t) / Mk xi (t), k k si (t) xi (t) / Mi xi (t) k k k k k Thus vi (t) is the share of sector k in the total activity of country i, which forms the basis of k our analysis of countries in Section 2. si (t) is the share of country i in the total activity of industry k, which is the basis of the industry analysis of Sections 3 and 4. Ki(t) Mk abs vi (t) v̄i (t) k k We call this the Krugman specialisation index, or K-spec (see Krugman, 1991). It takes value zero if country i has an identical industrial structure to the rest of the EU, and takes maximum value two if it has no industries in common with the rest of the EU. Spatial separation index The concentration index employed so far provides information about the extent to which each industry is concentrated in a few countries, but does not tell us whether these countries are close together or far apart. Using this measure, two industries may appear equally geographically concentrated, while one is predominantly located in two neighbouring countries, and the other split between Finland and Portugal. Distinguishing such patterns will provide additional insights on the geography of individual industries, about cross industry differences and about the driving forces of economic geography. Hence, as a complement to the traditional concentration indices, we propose an index of spatial separation, that can be thought of as a supra-national index of geographical location. We define the spatial separation of industry k, (SP k) as follows: SP k C Mi Mj (s i sj δij) k 14 k k where δij is a measure of the distance between i and j, si is the share of industry k in location k i, and C is a constant. For a given location i, Mj (s j δij) is the average distance to other production in industry k. The first summation adds this over all locations i, weighted by their k k k share in the industry, si . The interpretation of Mi Mj (si s j δij) is therefore a production weighted sum of all the bilateral distances between locations. The measure is zero if all production occurs in a single place, and increases the more spatially separated is production. Gini coefficient of concentration To measure the degree of concentration, we use the Gini coefficient of concentration. If all countries have the same amount of manufacturing this measure is zero; if all manufacturing is in a single economy it would take value 1.The Gini coefficient of concentration measures the k dispersion of a distribution of absolute production shares, si (t) , across countries for a given k industry. The Lorenz curve associated with the coefficient has cumulated si on the vertical (as before), cumulated number of locations on the horizontal (each interval with the same k width, 1/N). Locations are ranked by si (the gradient of the Lorenz curve). 15 Table A1: Gini Coefficient of Concentration NO NAME ISIC 70/73 82/85 88/91 94/97 1 Food 3110 0.503 0.471 0.464 0.46 2 Beverages 3130 0.647 0.592 0.576 0.557 3 Tobacco 3140 0.662 0.622 0.624 0.592 4 Textiles 3210 0.554 0.561 0.589 0.566 5 Wearing Apparel 3220 0.575 0.587 0.61 0.613 6 Leather&Products 3230 0.547 0.62 0.668 0.685 7 Footwear 3240 0.594 0.641 0.672 0.669 8 Wood Products 3310 0.533 0.477 0.482 0.498 9 Furniture & Fixtures 3320 0.568 0.584 0.59 0.596 10 Paper & Products 3410 0.504 0.483 0.488 0.479 11 Printing & Publishing 3420 0.539 0.524 0.514 0.515 12 Industrial Chemicals 3510 0.613 0.582 0.571 0.546 13 Pharmaceuticals 3522 0.597 0.572 0.553 0.519 14 Chemical Products nec 3528 0.658 0.615 0.629 0.622 15 Petroleum refineries 3530 0.631 0.541 0.586 0.621 16 Petroleum & Coal Products 3540 0.673 0.7 0.658 0.682 17 Rubber Products 3550 0.619 0.608 0.616 0.624 18 Plastic Products 3560 0.602 0.591 0.598 0.6 19 Pottery & China 3610 0.624 0.699 0.728 0.695 20 Glass & Products 3620 0.616 0.601 0.611 0.569 21 Non-Metallic minerals nec 3690 0.576 0.537 0.532 0.542 22 Iron & Steel 3710 0.625 0.6 0.622 0.611 23 Non-Ferrous Metals 3720 0.581 0.607 0.609 0.623 24 Metal Products 3810 0.576 0.555 0.569 0.567 25 Office & Computing Machinery 3825 0.68 0.634 0.631 0.608 26 Machinery & Equipment nec 3829 0.663 0.609 0.619 0.592 27 Communication equipment 3832 0.654 0.625 0.623 0.589 28 Electrical Apparatus nec 3839 0.668 0.64 0.655 0.645 29 Shipbuilding & Repairing 3841 0.467 0.452 0.457 0.445 30 Railroad Equipment 3842 0.639 0.618 0.559 0.591 31 Motor Vehicles 3843 0.694 0.689 0.686 0.703 32 Motorcycles & Bicycles 3844 0.642 0.689 0.64 0.671 33 Aircraft 3845 0.677 0.704 0.704 0.693 34 Transport Equipment nes 3849 0.551 0.567 0.582 0.628 35 Professional Instruments 3850 0.665 0.634 0.636 0.597 36 Other Manufacturing 3900 Unweighted Average 16 0.577 0.567 0.572 0.552 0.605 0.594 0.598 0.593