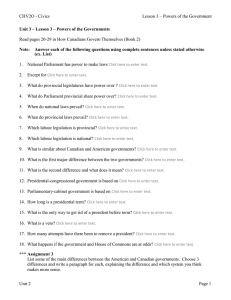

about canada Dispute resolution

advertisement