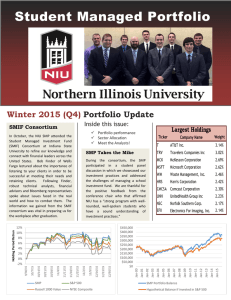

Student Managed Portfolio Fall 2015 (Q3) Portfolio Update Inside this issue:

advertisement

Student Managed Portfolio Fall 2015 (Q3) Portfolio Update Inside this issue: Target Allocations Using historical prices for the GICS sectors and Excel’s Solver to produce the minimum portfolio coefficient of variation (i.e. risk), the SMP determined new target portfolio sector weightings. The outputted weightings were then used in a survival analysis using a MCMC approach. During the upcoming quarters the SMP aims to realign its portfolio from its current allocation to these target allocations. Compared to the S&P 500 allocations, this would result in the SMP overweighting the consumer discretionary, consumer staples, health care, and utilities sectors and under-weighting the financial, industrial, materials, telecommunications sectors. Moving Towards ESG Geometric Av erage Annual Since Quarter 1 Y ear SMP -7.71% -7.45% S&P 500 -6.94% -2.65% NYSE Comp -9.31% -8.44% IW D -8.43% -4.61% Weight T AT&T Inc. 3.14% TRV Travelers Companies Inc 2.90% MCK McKesson Corporation 2.69% CMCSA Comcast Corporation 2.48% WM Waste Management, Inc. 2.46% UNH UnitedHealth Group Inc 2.36% MSFT Microsoft Corporation 2.25% SYNA Synaptics, Incorporated 2.16% EFII Electronics For Imaging, Inc. 2.14% HRS Harris Corporation 2.13% Holding Period Retrun Company Name assets have been reallocated, the SMP may raise the bar and eliminate holdings at high risk for environmental and social criteria. P erformance Metrics Largest Holdings Ticker Summary of historical performance Sector Allocation Meet the Analysts! Over the coming quarters, the SMP is looking towards investing responsibly and sustainably by weeding out the securities at high risk in environmental, social and corporate governance areas. To start, the SMP plans on employing a “3-Strike Rule,” which would eliminate the securities at high risk for all three criteria. Once assets are 5 Y ear 1/2000 9.39% 9.34% 2.89% 10.05% 10.97% 2.06% 5.90% 6.12% 2.58% 11.36% 12.07% 5.67% 3 Y ear 5.0% 3.0% 1.0% -1.0% -3.0% -5.0% -7.0% -9.0% -11.0% -13.0% SMP S&P 500 Russell 1000 Value NYSE Composite Events: Jacob Clark (below left) manned the SMP recruitment table at COB Open House 7/31/15. Guest lecturer Barneto Pascal (below right), incoming Dean at Université de Bordeaux, presented on the intricacies of international accounting systems 7/29/15. Meet the Analysts! Biggest Winners Jacob Clark - Intermediate Analyst Ticker Qtrly Return Jacob is a senior at Northern Illinois University studying Finance. Company Name In addition to being a part of the Student Managed Portfolio, RAI 18.59% Reynolds American, Inc. Jacob serves as President of the Finance Student Advisory Board 16.89% and Vice President of Financial Management Association. This GOOG Google Inc summer he plans to intern at Wintrust in order to further his FNFG First Niagara Financial Group Inc. 8.16% passion for finance. During his free time he enjoys watching WTR Aqua America Inc 8.08% basketball, traveling, and film. SYY 7.92% Thomas Falato - Intermediate Analyst SYSCO Corporation Tom is a senior Finance student at Northern Illinois University. He is involved on campus with the Investment Association, and Biggest Losers also serves as Vice President of Finance for Pi Sigma Epsilon, a Ticker Qtrly Return Company Name nationally recognized business fraternity. In his free time, Tom HUN Huntsman Corporation -56.14% enjoys reading and managing his personal portfolio. After -43.99% graduating in May 2016, he plans to use skills gained throughout ATW Atwood Oceanics, Inc. SID Companhia Siderurgica Nacional (ADR) -41.82% his education to pursue a career as an investment analyst. Jeffrey Fitzgerald - Intermediate Analyst CG The Carlyle Group LP -40.32% While working for his family’s manufacturing business since ESV -36.78% ENSCO PLC high school, senior finance major Jeffrey discovered his passion for investing activities. After graduation, he will an pursue for investing activities. After graduation, he will pursue investment banking internship at Sikich LLP and then hopefully an investment banking internship at Sikich LLPheand obtain a financial management position where canhopefully continue to have a positive impact in the realm of finance. afterwards obtain a financial management position where he continue to have a positi Upcoming Events Portfolio can Subtractions Strayer Education (STRA): Sold all 50 shares on 8/11/2015. 10/12/2015: SMP recruitment table at the NIU Open House. 11/10/2015: Select SMP analysts will present to the NIU Foundation. Natural Resource Partners (NRP): Sold all 204 shares on 8/11/2015. 10/19/2015: SMP recruitment visits to finance core classes. 11/14/2015: SMP recruitment table at the NIU Open House. Intrepid Potash (IPI): Sold all 150 shares on 8/11/2015. 11/4/2015: Guest speaker and NIU Finance Alumni Jeffrey Kilrea, Group Head and Managing Director of CIT Sponsor Finance, will share his experiences in private debt and equity with FINA 445/446. All of the above sales were triggered by the firms’ market capitalizations falling to less than $1 billion. Contact Info Dr. Gina Nicolosi gnicolos@niu.edu (815) 753-6391 http://www.cob.niu.edu/fina/smp.s html